For many app founders and entrepreneurs, monetization is the linchpin of their app’s success. You’ve poured your heart, soul, and resources into developing a remarkable mobile app. But now comes the critical question: how do you make it profitable without losing a significant chunk of your revenue to app store commissions?

When you’re in the early stages of your startup, every dollar counts. The ability to maximize revenue streams can mean the difference between scaling your operations and closing up shop. This blog is designed to provide actionable insights into how you can navigate the complex landscape of app store commissions and find the most beneficial monetization strategies for your mobile app.

Top Takeaways:

- Reduce App Store Commissions: There are two main ways to potentially reduce app store commissions:

- If your app earns less than $1 million annually, you can qualify for a 15% commission rate from both Apple and Google.

- Use StoreKit External Purchase Link Entitlement (Apple only): This allows you to link to an external payment page and offer a lower price, but Apple will still take a reduced commission (27% or 12%) for purchases within seven days of following the link. This method also involves a complex application and compliance process.

- Consider Outside-the-App Payment Options: If your app sells physical goods, services consumed outside the app, or offers subscriptions to content accessible on a website, you can potentially avoid app store commissions altogether by using external payment methods.

- Trade-offs of External Payment Methods: While external payment methods can help you avoid app store commissions, they come with drawbacks:

- Users may find it less convenient to pay outside the app.

- You’ll need to handle your own payment processing, tax compliance, and customer support.

- Loss of benefits from in-app purchases: You’ll miss out on features like Apple’s marketing tools, analytics, and all the updates they introduce to billing and payment options regularly.

Table of Contents:

- Understanding App Store Commission Structures

- In-App Purchases (IAP)

- Outside-the-App Payment Options

- What You Miss Out On Without In-App Purchases

- Lower Apple’s Cut to 27 or 12%

- Navigating the Monetization Maze

Understanding App Store Commission Structures

Apple’s App Store charges a standard commission rate of 30% on in-app purchases and subscriptions. This fee structure has been a point of contention among developers, particularly those in the early stages of their startups, where every dollar counts. However, Apple offers a reprieve through its App Store Small Business Program, which allows eligible developers to qualify for a reduced commission rate of 15%.

To be eligible for this program, a developer must have earned no more than $1 million in proceeds during the previous calendar year. This initiative significantly relieves small and new app businesses, allowing them to retain a larger portion of their revenue. The same fee structure applies to all purchases made in Android apps — for apps distributed through Google’s Play Store.

Criteria for Reduced Commission Rates

Understanding the criteria for reduced commission rates is essential for maximizing your revenue. Both Apple and Google have set specific eligibility requirements for their respective programs:

- Developers must earn no more than $1 million in proceeds during the previous calendar year.

- If you exceed the $1 million threshold, the standard 30% rate applies for the remainder of the year.

- Eligibility is reassessed annually, providing an opportunity for continued qualification if your earnings dip below the threshold.

- Developers need to disclose all related developer accounts to assess eligibility for proceeds.

So, the good news is that if you’re just starting, you won’t have to give up 30% of sales to Apple or Google. It’s going to be just 15%. If you aren’t already doing this, enroll here.

In-App Purchases (IAP)

Apple’s App Store commissions and Play Store fees apply only to digital services being sold through mobile apps. However, there are exceptions, particularly when it comes to certain types of in-app purchases.

Understanding these various types of in-app purchases can help you tailor your monetization strategy to maximize revenue while delivering excellent value to your customers.

Types of In-App Purchases

Consumable Content

Consumable content includes items like virtual currency, extra lives, or other resources that users can deplete and repurchase. These are popular in gaming apps where users frequently need to top up their resources to continue playing or enhance their gameplay experience.

Key Features:

- Depletes upon use

- Can be purchased multiple times

- Examples: in-game currency, power-ups, additional lives

Non-Consumable Content

Non-consumable content is a one-time purchase that doesn’t expire. Once a user buys this type of content, they own it permanently. This is ideal for features like removing ads, unlocking a premium version of the app, or access to special content.

Key Features:

- Permanent once purchased

- Cannot be bought more than once

- Examples: ad-free versions, premium features, additional content

Auto-Renewable Subscriptions

Auto-renewable subscriptions allow users to access continuously updated content or services on an ongoing basis. These subscriptions renew automatically at the end of each subscription period unless canceled by the user. This model benefits services offering regularly updated content, such as news apps, streaming services, or fitness programs.

Key Features:

- Renews automatically until canceled

- Provides ongoing access to dynamic content

- Examples: streaming services, news subscriptions, fitness programs

Non-Renewing Subscriptions

Non-renewing subscriptions are similar to auto-renewable subscriptions but do not automatically renew at the end of the subscription period. Users must manually renew their subscription if they want continued access. This model is often used for seasonal or limited-time content.

Key Features:

- Does not renew automatically

- Requires manual renewal

- Examples: seasonal passes, limited-time event access

Benefits of Using In-App Purchases

In-app purchases offer several advantages that can significantly boost your app’s revenue potential:

- Convenience: Users can purchase directly within the app, providing a seamless experience.

- Global Reach: Platforms like Apple’s App Store and Google Play handle worldwide payment processing, supporting over 200 payment methods and simplifying international sales.

- Security: Secure authentication methods such as Face ID, Optic ID, or Touch ID minimize abandoned purchases and enhance user trust.

- Marketing Tools: Access to tools for managing pricing across international markets, with automated systems handling tax compliance and transactional taxes in over 80 regions.

- Customer Loyalty: Features like Family Sharing allow users to share purchased content with family members, increasing user satisfaction and retention.

- Ongoing Upgrades: Getting new updates as Apple refines IAP APIs. For instance, the recent WWDC24 update enables customization of subscription screens and provides win-back offers.

Limitations and Costs Associated with IAP

While in-app purchases provide numerous benefits, they also come with certain limitations and costs that app founders must consider:

- Platform Fees: As already mentioned, standard commission rates of 15%-30% for both Apple and Google Play apply, which can significantly impact your revenue.

- Development Overhead: Implementing and maintaining in-app purchase functionalities requires ongoing development and support efforts.

- Dependency on Platform Policies: Changes to platform policies or commission structures can affect your monetization strategy and overall profitability.

Consider the impact of different in-app purchases on your app’s user experience. How do platform fees affect your current pricing model and profitability? Do you feel your margin is too slim, and you’d rather avoid fees altogether?

According to Statista, revenue from in-app purchases in the United States is projected to reach $41.5 billion in 2024. This underscores the significant potential of in-app purchases as a revenue stream for mobile apps, especially when implemented strategically.

Are you curious about alternative payment methods that could help you avoid hefty platform fees? Let’s explore outside-the-app payment options next.

Outside-the-App Payment Options

When it comes to finding ways to bypass app store commissions, developers can leverage certain scenarios where transactions fall outside the standard digital services sold within mobile apps.

Apple specifically details these exceptions in its App Review Guidelines. Let’s explore these scenarios and the possibilities they offer.

Scenarios for Using External Payments

The primary way to avoid app store commissions is by selling services or physical goods consumed outside the mobile app. In this case, you must not use in-app purchases and should collect payments using credit cards or other traditional methods. This clearly indicates that transactions involving external consumption do not attract the usual 30% or 15% commission fees.

Beyond physical goods and services, there are several other scenarios where external payment methods can be employed to sidestep app store fees:

- Reader Apps: Apps that grant access to previously purchased content or subscriptions, such as books, magazines, or video content, can service this content via the app, of course, and provide a link to the user’s profile on their sites.

You can’t bypass Apple’s fee for in-app purchases. If you don’t use in-app purchases, direct customers to your website to buy books, films, or other products—but avoid doing this for each individual item.

- Multiplatform Services: Apps operating across multiple platforms can allow users to access features or content acquired on other platforms or websites.

Only if the app doesn’t serve as a content storefront and is used primarily for content consumption. Can’t link out to buy stuff from the app directly.

- Enterprise Services: Apps provided directly to organizations for their employees or members can utilize external payment methods.

- Person-to-Person Services: Real-time services like tutoring or medical consultations are eligible for external payments.

Typical scenario for consulting businesses. No fees. The whole payment process takes place inside your app, using your payment gateway of choice.

- Goods and Services Outside of the App: Standard for purchasing physical goods or services used outside the app environment.

Typical scenario for goods and services marketplace apps. No fees. Payments happen inside your app.

- Free Stand-Alone Apps: Companion apps to paid web-based tools can bypass in-app purchases.

Example: GoToMeeting app (customers buy a subscription plan on their site and then just use the app to make/join calls using their existing account (no way to sign up/register in the app). No fees, but no payments either.

- Advertising Management Apps: Apps managing advertising campaigns across different media types can avoid using in-app purchases.

Use your preferred payment gateway to initiate and process payments right inside the app.

Using External Payment Gateways

To facilitate external transactions, you can integrate various payment gateways like Apple Pay, Stripe, Braintree, or Square, among others. Offering multiple payment options not only enhances user experience but also provides flexibility in handling transactions:

- Apple Pay and Google Pay: Seamlessly integrated into your app, allowing users to make quick payments using stored credentials.

- Credit Card Processing: Traditional methods that cater to a broader audience who may prefer direct credit card transactions.

- Venmo and Other Services: Catering to users who prefer alternative payment methods.

These payment processes can be executed within the app itself without incurring the app store commission, provided the services or goods are consumed externally.

Additional Use Cases for External Payment Methods

Hardware-Specific Content

In specific instances where app functionality depends on particular hardware, the app can unlock features without using in-app purchases. For example, an astronomy app that integrates with a telescope could use external payments to unlock advanced features.

Of course, as you understand, the purchase happens outside of the app, too. This means you can’t just link out directly to a payment page to buy a telescope. Instead, the app uses a Bluetooth connection, QR code, or other technologies to pair with the device and unlock some features.

Cryptocurrencies

Cryptocurrency-related functionalities present unique opportunities and restrictions:

- Wallets: Apps facilitating virtual currency storage are allowed if offered by developers registered as organizations. No fees.

- Mining: Cryptocurrency mining within apps is prohibited unless the processing occurs off-device.

- Exchanges: Apps enabling cryptocurrency transactions or transmissions on approved exchanges are permitted. No fees.

- NFTs: Apps can utilize in-app purchases to offer services related to non-fungible tokens. This includes activities such as minting, listing, and transferring these tokens. In-app purchases only. Can’t avoid fees.

- Initial Coin Offerings (ICOs): These must be conducted by established financial institutions and must comply with applicable laws.

It’s important to remember that in all scenarios where you avoid paying fees to Apple or Google, you are not using the In-App Purchase API. Curious about what you might miss out on by opting for external payment methods? Let’s explore that next.

What You Miss Out On Without In-App Purchases

Deciding to forgo in-app purchases (IAP) in favor of external payment methods can help you save on hefty commissions, but it’s essential to weigh this decision against the potential trade-offs. Let’s explore what you might miss out on when opting for external payment methods and why these factors are significant for your app’s success.

Integrated User Experience

Creating a seamless and integrated user experience is crucial for retaining users and ensuring high engagement levels. With IAP, transactions are designed to blend naturally into your app’s interface, providing a smooth and intuitive shopping experience. Users can purchase digital products without feeling like they’ve left your app.

Key Points:

- Transactions mirror your app’s style and design

- Simple, succinct product names and descriptions help users quickly find what they need

- Default confirmation sheets prevent accidental purchases, adding a layer of security and trust

How will an external payment method impact the fluidity of your user experience?

Simplified Payment Processing

In-app purchases leverage the extensive infrastructure of Apple’s App Store and Google Play, simplifying the payment process for both developers and users. These platforms handle global payment processing, tax compliance, and currency conversion, which can be complex and resource-intensive if managed independently.

Key Points:

- Secure authentication methods such as Face ID, Optic ID, or Touch ID minimize abandoned purchases and enhance user trust.

- Automated systems handle tax compliance and transactional taxes in over 80 regions.

- Family Sharing allows users to share purchased content with up to five additional family members.

Are you prepared to handle the complexities of global payment processing and tax compliance on your own?

Access to Apple’s Marketing Tools and Analytics

By using IAP, you gain access to Apple’s powerful marketing tools and analytics, which can help you optimize your sales strategies and track performance. These tools provide valuable insights into user behavior, enabling you to make data-driven decisions.

Key Points:

- Access to tools for managing pricing across international markets

- Near-real-time status updates for refunds, subscription state, and Family Sharing access

- Detailed transaction information in JSON Web Signature (JWS) format for easy parsing and validation

Can you replicate the depth of analytics and marketing support provided by Apple on your own?

Security and Trust Factors

Apple’s and Google’s platforms are trusted by millions of users worldwide, providing a secure environment for transactions. This trust can significantly impact your app’s credibility and user confidence, which are critical for driving conversions.

Key Points:

- Built-in security measures like the default confirmation sheet and secure payment processing

- Family Sharing encourages user loyalty and satisfaction

- Billing Grace Period ensures continuous access to paid content while resolving billing issues

How will you ensure the same or comparable level of user trust and security with external payment methods?

Customer Support and Refund Management

Managing customer support and refunds can be challenging, especially for smaller teams. Apple and Google offer robust mechanisms to handle these aspects, ensuring a smooth experience for users and reducing the burden on your support team.

Key Points:

- Users can request refunds directly within the app using the beginRefundRequest API

- Real-time notifications for refunds and subscription state changes

- The StoreKit framework handles payments and notifies your app, making transactions available on all customer devices

Are you equipped to manage customer support and refunds without the backing of Apple’s or Google’s infrastructure?

Don’t forget to migrate to StoreKit 2, which was introduced during WWDC24, to get all the latest features and future updates for IAP inside your app. Existing implementations will continue to work, but it is safer to switch earlier and get all the coming changes (like re-engaging lapsed subscribers) with less code out of the box.

While bypassing app store commissions through external payment methods can be appealing, it’s essential to consider what you might miss out on. Integrated user experiences, simplified payment processing, access to valuable marketing tools, enhanced security, and robust customer support are significant benefits that come with in-app purchases.

Lower Apple’s Cut to 27 or 12%

There’s still a way to lower Apple’s cut on in-app purchases, even when selling digital goods consumed in the app, by implementing StoreKit External Purchase Link Entitlement. This entitlement allows developers to direct users to an external payment page and offer better pricing options.

However, even with this entitlement, Apple will still take a reduced commission of 27% or 12% (for apps with less than $1 million in sales) if a customer makes a purchase within seven days after following the link.

Apple’s StoreKit External Purchase Link Entitlement

The StoreKit External Purchase Link Entitlement is a result of legal developments, notably the Epic Games v Apple case, which mandated that apps should have the ability to link out to external payment processors. This entitlement is designed to provide developers with more flexibility in managing their app’s monetization strategy.

Eligibility and Application Process

To qualify for the StoreKit External Purchase Link Entitlement, your app must meet specific criteria, ensuring it aligns with Apple’s guidelines:

- Availability: Your app should be listed on the iOS or iPadOS App Store in the US storefront.

- In-App Purchases: The app must offer in-app purchases to users when distributed through the US storefront.

- Program Exclusions: Apps participating in the Video Partner Program or News Partner Program are not eligible.

Steps to Apply:

- Submit an Entitlement Request Form: Only the Account Holder in the Apple Developer Program can submit this form. Details required include your app’s bundle ID, website domain, and payment service provider information.

- Provide App and Website Information: Share your app’s name, description, bundle ID, destination URL, and customer support web page.

- Configure Xcode: Update your Xcode project by modifying the entitlements plist file and Info.plist file to incorporate the entitlement and required metadata.

Compliance and Restrictions

Ensuring compliance with Apple’s guidelines is crucial to avoid app rejection or penalties. Here are key points to keep in mind:

- Static URL Requirement: The URL for the external purchasing page must be fixed and unchanging, without any additional parameters.

- Button Appearance: The link should appear as a plain button, avoiding any fill color, background, or shape around it.

- Icon Placement: A “link out icon” must be positioned to the right of the URL.

- Single Screen Display: The link can only appear on one screen, which should not be an interstitial, modal, or pop-up. It must be placed in a single, dedicated location on that page.

- Modal Warning: Before navigating to the external paywall, a modal warning must inform the user about the redirection.

- Frequent Reporting: You must frequently report sales derived from the external link to Apple using their specific format.

Many Steps for Integration

Implementing the StoreKit External Purchase Link Entitlement involves several detailed steps:

Step#1. Apply for the Entitlement: Complete and submit the entitlement request form, then wait for confirmation from Apple.

Step#2. Configure Your App ID: Update your App ID in Certificates, Identifiers & Profiles to support the entitlement.

Step#3. Update Project Files: Modify the entitlements plist file and Info.plist file in your Xcode project to include the entitlement and necessary metadata.

Step#4. Settle on a Static URL: Ensure the external purchasing page URL is static and adheres to Apple’s guidelines.

Step#5. Style the Button: Follow Apple’s design guidelines precisely to style the button correctly, maintaining a compliant appearance.

Step#6. Use Apple’s Template Copy: Utilize the provided template for the link to ensure consistency and compliance.

Step#7. Place the Link: Ensure the link is situated on a compliant page, adhering to display restrictions set by Apple.

Step#8. Present the Modal Warning: Implement a modal warning to inform users before they navigate to the external paywall, ensuring they understand the redirection.

While the StoreKit External Purchase Link Entitlement can reduce Apple’s commission to 27% or 12% (for apps with less than $1 million in sales), it’s clear that implementing this entitlement is complex and requires meticulous compliance with Apple’s guidelines.

The decision to use this method hinges on your projected sales volume and user behavior. If you anticipate that directing users to an external payment page will significantly increase conversions and overall revenue, this route could be worthwhile.

However, if the anticipated savings do not justify the effort and potential user experience disruptions, it might be more beneficial to stick with in-app purchases. Careful analysis and strategic planning are essential to determine the best approach for your app’s monetization strategy.

Also Read: A Guide to Custom Mobile App Development

Navigating the Monetization Maze with Topflight

Monetizing your mobile app doesn’t have to mean surrendering a significant portion of your revenue to app store commissions. As we’ve explored, qualifying for reduced commission rates can offer significant advantages for startups, providing a more sustainable path to profitability.

We also examined the possibilities of external payment methods, which allow you to bypass commissions entirely for certain transactions. Implementing StoreKit External Purchase Link Entitlement, for instance, can reduce Apple’s commission to 27% and 12% (from 30% and 15% respectively).

However, it’s essential to remember that these external methods come with their own set of challenges. They can impact user experience, introduce additional compliance requirements, and add layers of development complexity. Thus, the decision to implement them should be carefully weighed against the potential benefits.

At Topflight, we pride ourselves on guiding app founders through the complex landscape of app monetization. Our expertise in both healthcare and fintech industries, backed by data-driven approaches and real-world success stories, positions us as the ideal partner for your app development journey. Whether you’re looking to optimize in-app purchases, implement external payment options, or explore innovative monetization strategies, we’re here to help you make informed decisions that drive impactful results.

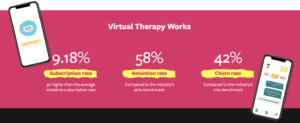

Since our focus is helping companies gain traction, we engage in monetization strategies from the outset. A standout project that showcases our expertise is SoberBuddy, a virtual recovery chatbot. Through our collaboration, we achieved remarkable results:

- Boosted retention by 300%

- Increased average engagement time by 40%

- Elevated the app store rating from 3 to 4.5

- Expanded the user base to over 30,000

Additionally, we cut the cost of user acquisition by 50%, all of which contributed to the app’s explosive growth.

Also Read: App Development Costs: The Complete Breakdown

Ready to take the next step in maximizing your app’s revenue potential? Let’s work together to develop a tailored monetization strategy that aligns with your vision and business objectives.

Frequently Asked Questions

How much can I earn before app store commission increases?

Both Apple and Google charge a 15% commission if your app earns less than $1 million annually. Once you exceed this amount, the standard 30% commission applies. Remember to enroll in their respective programs to qualify for the reduced rate!

What are the different types of in-app purchases I can offer in my app?

There are four main categories: Consumable Content: These are items like extra lives or in-game currency that users can use up and buy again (e.g., power-ups). 2. Non-Consumable Content: These are permanent purchases that users own forever, like ad-free versions or access to special features. 3. Auto-Renewable Subscriptions: These subscriptions provide ongoing access to content and renew automatically unless canceled (e.g., streaming services). 4. Non-Renewing Subscriptions: Similar to auto-renewing subscriptions, but users have to manually renew them for continued access (e.g., seasonal passes).

Are there any advantages to using in-app purchases besides making money?

Yes, in-app purchases offer several benefits beyond revenue. They provide a convenient and secure way for users to pay directly within the app. Plus, you get access to marketing tools and global payment processing handled by the app stores.

Can I avoid app store fees if my app sells physical products delivered outside the app?

Yes! If your app sells physical goods and users complete the purchase and receive the product outside the app environment, you can bypass app store commissions. You can collect payments directly through your website or a chosen payment gateway.

I have a subscription service for meditation classes. Can users pay outside the app to avoid fees?

Absolutely! For services consumed outside the app, like your meditation classes, you can direct users to your website to subscribe. Just avoid repeatedly linking to specific purchasable items within your app.

Can I use a link to an external payment page within my app and still get a reduced commission from Apple?

Yes, but with limitations. Apple’s StoreKit External Purchase Link Entitlement allows you to offer a lower price on an external payment page, but they will still take a commission (27% or 12%, depending on your revenue). The process is complex and requires strict adherence to Apple’s guidelines.