If you’re looking for ways to raise capital for a business or startup, here’s a complete list of options:

|

|

|

Each fundraising path has pros and cons and requires thorough research before picking the best ones for your business.

After reading this blog, you’ll be well-equipped to pinpoint the suitable approaches and strategically work them into your product roadmap.

Ready to unveil the mystery of how to raise money for a business? Let’s roll.

Top Takeaways:

- Fundraising for a small business is a full-time job; make no mistake about that. Even if you can’t stomach the challenges of fund-seeking, someone on the team will have to make it their day-to-day. Hiring a dedicated fundraiser at later stages is also an option.

- It’s a sound idea for a tech startup to partner with an agency that has versatile talent across design, product development, strategy, and growth hacking disciplines.

- Check out Topflight’s vision of fundraising services.

Table of Contents:

- Funding Stages on Your Way to Raise Money for a Business

- Fundraising Paths for Startups

- Tips on How to Raise Money for a Startup

- Pitfalls to Avoid When Fundraising for Your Business

- How Topflight Can Help?

Funding Stages on Your Way to Raise Money for a Business

Startups need cash to grow. Founders (usually with a technical background) rarely get a fortune’s smile and manage to bootstrap their businesses all the way to sustainable profits.

No cash means no product. No product means no business. No business means no point. Sounds like a catch-22, right?

That’s why it’s the founder’s destiny to deal with fundraising as long as their companies function.

The startup community singles out 5 main fundraising stages:

- pre-seed

- seed

- Series A

- Series B

- Series C+

Let’s talk about how raising funding for a business differs depending on its stage.

Pre-seed

The pre-seed round is characterized by the lack of a product. All we have at this point is an idea and a few thousand dollars in a savings account. How do we start to wrap this idea into reality?

Founder’s goals: The first thing to do is to turn our research into a slim pitchbook. This will buy you some time from non-stop communications and show that you mean business.

The second thing founders can tackle at the pre-seed stage is building a rapid prototype. That’s an interactive graphical representation of the software that will power their new business, validated with feedback from real users.

Average size: from $40K to $1M; the first sizeable amount raised that converts into artifacts (see below).

Investors: family and friends, angel investors, accelerators, hackathons.

Artifacts: well-packaged research in the form of a pitchbook and a prototype.

Typical mistakes:

- skip the pre-seed phase chasing bigger rounds from the get-go

- no idea about the burn rate (how far the raised amount gets you)

- rushing investors to make a decision within a short time frame

- inconclusive pitch (Does it call for questions? Do you have the answers?)

- giving up too much equity for more funding

Tips: try a no-code approach to quickly put together a proof of concept or even an MVP (if the funding is adequate) to bring some traction metrics to the next round. A no-code requires considerably less (capital-intensive) programming and suits startup founders whose apps don’t need a unique UX/UI.

Seed

Okay, so we’ve raised some modest amounts already and are now ready for the big game with hiring and serious product development. Seed rounds happen for start-ups that can prove some product-market fit and want to go to market.

Founder’s goals: for many founders pursuing fundraising for a business startup, the seed round becomes the first serious round to test their product-market fit assumptions.

Various traction metrics (e.g., budget and time economy to get a job done) will show how well the software meets customer needs. Fortunately, we don’t need a rich feature set to prove a business idea. Still, the one or two critical features we choose to include must perform flawlessly.

Average size: $1.5M — $3M.

Investors: angel investors, venture capital funds, startup accelerators, crowdfunding.

Artifacts: minimum viable product

Typical mistakes:

- avoid pivoting even if the market commands to update a product-market fit

- try to outmaneuver competing investors

- choose an investor solely based on the check size and forgo their industry expertise, networking potential, and overall business acumen

- no solid plan to 10x in five to seven years (as expected by most VCs)

- a pitchbook not reflecting discoveries post the pre-seed stage

Tips: if you started with no code, reassess your expectations: how many customers can the software handle without degrading the user experience?

Series A

As the time comes for a Series A round, your start-up should have already established a firm product-market fit and consistent revenue. You’re long past the product launch phase. Now you’re ready to try out new sales channels and invest in marketing initiatives.

Founder’s goals: growing the revenue stream (whether measured in ARPA or ARR) and crystallizing the ideal customer profile becomes critical at this founding stage.

By this time, you should have built the core of the team, including critical hires in the marketing and development departments. Another capital infusion should help you prop up effective marketing and sales channels, pushing the numbers up on those spreadsheets.

Average size: $3M — $15M.

Investors: VCs

Artifacts: full-fledged software product that’s being iterated further to increase ARPU (average revenue per user).

Typical mistakes:

- obscure long-term growth prospective

- poor research of investors (a company’s profile matches a VC’s portfolio, conflict of interest, etc.) because it’s your third round

- getting exasperated too early (be ready for at least a six-month run)

- avoiding professional advice from a VC’s marketing and sales experts

Tips: to raise funds for your startup faster, every dollar you get must reflect growth projections. A backup plan that allows you to reach the targets without costly software modifications helps, too.

Also Read: App Development Costs: A Complete Breakdown

Series B

Since the previous round already provided the funds to secure and grow revenue, founders now need to raise money for a startup to scale this rapid growth further.

Founder’s goals: exponential growth. Now is the time for expensive hires, including executives that may be gatekeeping the entries to new market verticals.

The software remains mainly in maintenance mode, with no active development of new features.

Average size: $10M — $30M.

Investors: late-stage VCs, sometimes tier-1 investors like private equity firms or hedge funds.

Artifacts: same as in Series A, but with a rapidly growing customer base.

Typical mistakes:

- founders latching onto too much equity

- realistic evaluation of reached milestones and progress is missing

- bombarding investors with too many details and reports

- no data room with due diligence questionnaire and other supporting documents.

- keeping the company’s executives away from direct communication with investors.

Tips: if you’ve gone that far, you can give better advice because you know it’s all about presenting your product. The rest is a matter of time.

Series C+

C+ and all consecutive rounds aren’t much different from B, except it’s no longer about business fundraising as the company is fully operational and turns a profit.

Founder’s goals: strategic acquisitions and expansion into new markets.

Average size: $50M.

Investors: private equity firms, hedge funds, late-stage VCs.

As you can see, fundraising is a never-ending chase from establishing a product-market fit to getting traction to generating revenue to sustaining healthy growth. Founders raise money to start a business and continue trumping the investment treadmill to fuel further growth.

Funding Paths for Startups

If you want to raise funds for a business start up, you need to know about the upsides and shortcomings that accompany various fundraising options.

Family and friends

Friends and family members will probably be the first people you ask about investing in your start-up. They will hardly put the first million in (the pre-seed target is $40K to $1M). However, even a meager $50K-$100K investment can set you on your path to a prototype and proof of concept/MVP (depending on the scope).

Pros:

- relatively easy to raise (no unique assets like a pitchbook required)

- enough to fund the first development phase

- they may become your first customers or test users

- possible to negotiate no-equity investing options

Cons:

- may negatively impact your relationships with the kin

- relatives and friends may misrepresent your target audience and steer your away from the original concept with early feedback

- not enough for funding beyond the pre-seed stage

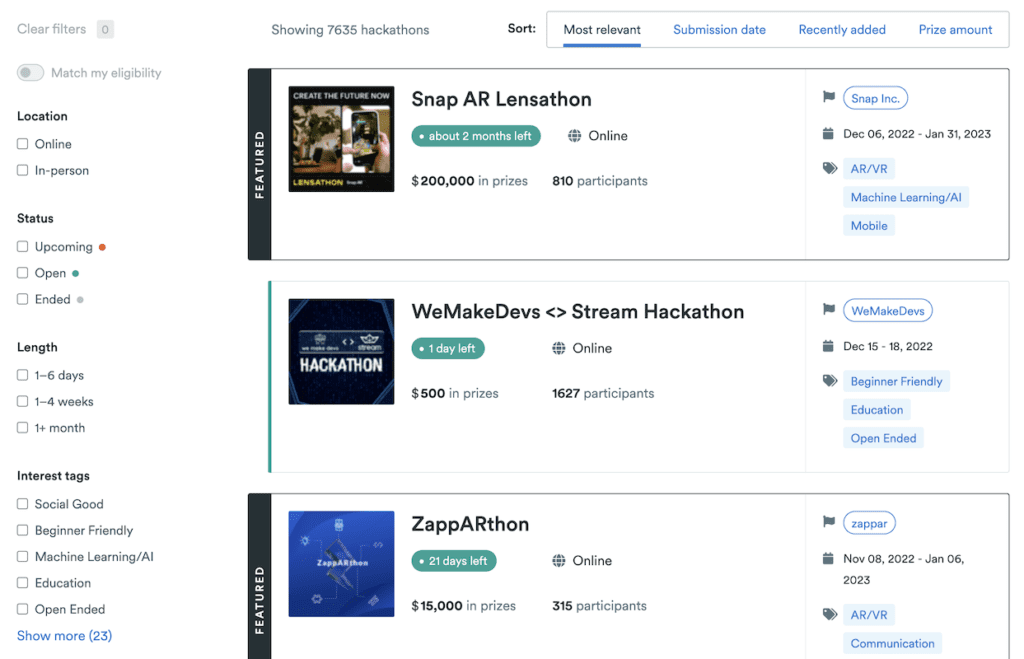

Hackathon prizes

Hackathons are perfect for raising funds for a business when your goal is to create a prototype or even a proof of concept (using a no-code approach). Some hackathons let you win up to $40,000. And even though the competition is fierce and you do need to come with a team, the reward is well worth it.

List of ongoing hackathons as seen on Devpost (all rights belong to Devpost, Inc.)

Pros:

- whatever your team manages to deliver can form a solid basis for further product development

- no need to give away equity

- typically no obligations on how you spend the prize money

- great for finding tech co-founders and networking opportunities in general

Cons:

- need a well-knit team to win

- may have to build something different from your original idea

- going through a series of hackathons can turn out exhausting and discouraging

Angel investors

Securing a deal with an angel investor (aka angel funder) is a dream come true for any founder. That’s because even though you’re just raising capital for a small business, with angel investors, your business gets more than money. Angels’ connections, expertise, and business acumen elevate your chances of success by a lot, to say the least.

Pros:

- perfect route for seed rounds

- get new connections, niche expertise, and proven business advice

- fast decision-making: less due diligence and other legalities

- usually less aggressive demands and no interference with your day-to-day

Cons:

- smaller amounts compared to VCs and other institutional investors

- it takes a sizeable personal network to get in front of a decent angel investor

- requires building a rapport

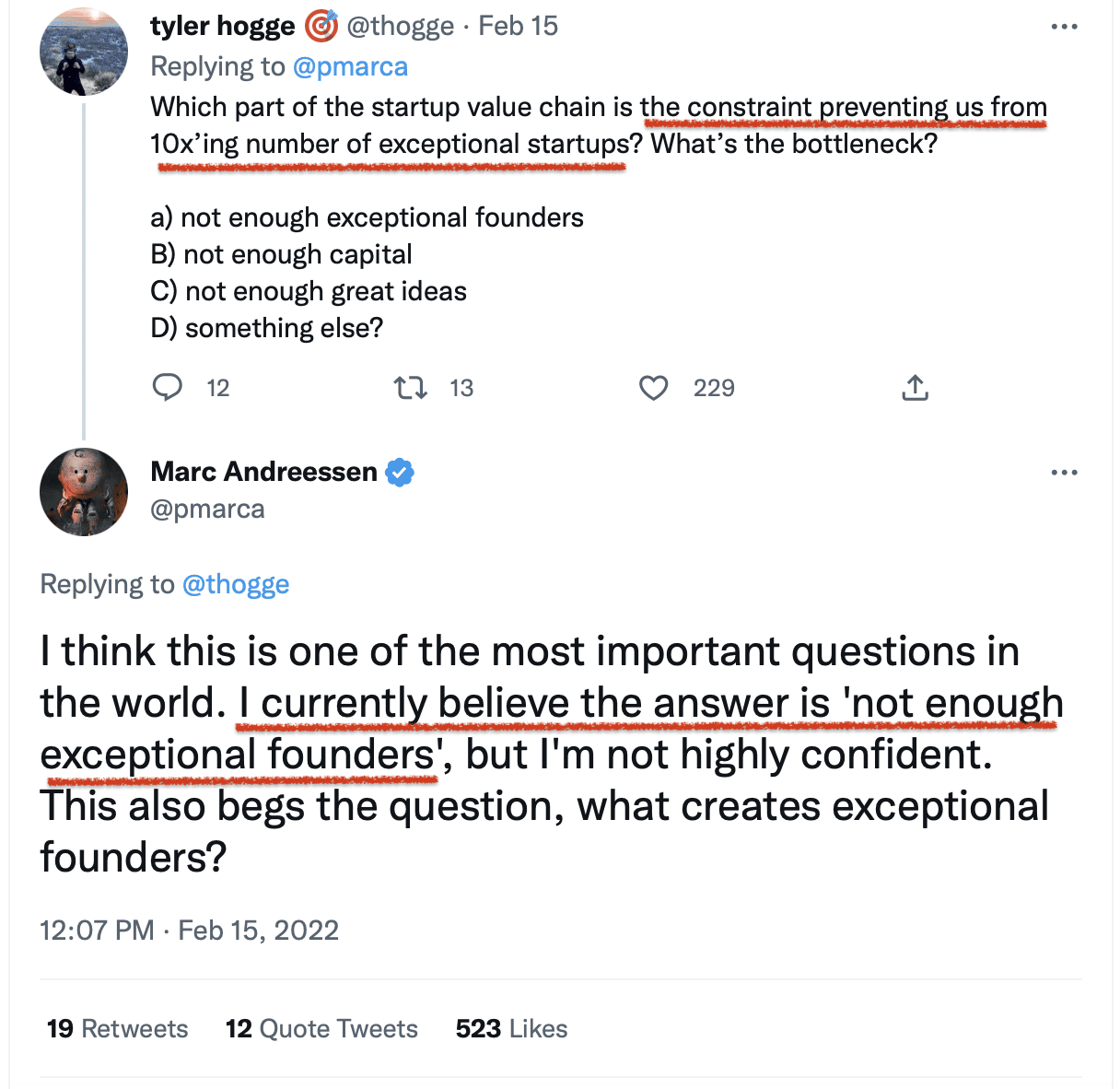

Startup accelerators

Accelerators and incubators are yet another straightforward route to raise funding for startups. Perfect for the pre-seed round, business incubators offer startups the necessary infrastructure for building an MVP without funding (read no equity lost), while accelerators act as funding partners and prime the pump for startups (in exchange for equity), readying for a seed round.

Pros:

- huge networking opportunities

- mentorship is part and parcel of this investment venue

- strengthen a startup’s reputation before a seed round

Cons:

- hard to get into (e.g., Y Combinator funded only 2.4% of companies for its winter 2022 batch)

- varying expertise level (new accelerators and incubators open all the time)

Family offices

Partnering with a family office is like working with a combination of VC and angel investors. Imagine striking a deal with a fund that manages investments for highly affluent individuals. This opens a lucrative perspective for seed or even Series A rounds.

Pros:

- more substantial amounts than with private angel investors

- industry- and/or niche-specific expertise and networking

- more or less the same flexibility as when dealing with angels

Cons:

- no insights for prepping a startup for large institutional rounds

- harder to expand into VC funding later or because of a conflict of interest

- hit-and-miss experiences because of unstructured processes

Venture capital funds

VCs are the prime source of funding for businesses, regardless of where on the fundraising journey they happen to be. Many venture capital funds engage at the seed phase and remain active throughout later rounds, including Series C+. And just like other investment options, VCs have advantages and disadvantages.

Pros:

- “unlimited” funding when partnering with a perfectly matching VC

- practical guidance and an extensive network of high-value connections

- easier follow-on investment rounds

Cons:

- aggressive terms (equity, ROI, exit, etc.)

- decision-making is longer than with previous options (stricter due diligence)

Equity crowdfunding

Equity crowdfunding is a relatively new concept. Getting funded by strangers certainly demands a more thorough preparation than raising pre-seed money with friends and family, but the bottom line is that this approach works.

Platforms like Indiegogo or Crowdfunder allow retail investors to chip in for a tiny fraction of equity in a startup.

Pros:

- hybrid investing models allowing retail investors to participate in VC- or angel-led rounds

- founders get to dictate their terms

- typically as fast as angel pre-seed rounds

Cons:

- startups don’t get expertise and connections in exchange for equity

- investment amount has recently increased from $1M to $5M, but there’s a 12-month timeframe limit

- too many eye-balls on a business idea may lead to plagiarism

Bank loans

Yep, the least favorable option for financing a new business. No one likes business loans, but some founders still choose traditional business loans or even take out a mortgage against property or other assets. Let’s say it’s much prettier when you deal with a bank’s investing department at one of the Series C+ rounds. Till then, a bank loan sounds too dangerous.

Pros:

- startup founders retain full business ownership

- start earning a history of responsible credit

- helps protect founders’ savings (at least temporarily)

Cons:

- can be hard to qualify for

- can ruin your personal credit score

- typically requires monthly payments and includes interest

Government grants and SBA loans

Even though government grants don’t require repayment, unlike business loans from the U.S. Small Business Administration, both investing options suffer from the same flaw — red tape.

Pros:

- No repayments for grants and lower rates and fees for SBA loans

- SBA loans come with counseling and education

Cons:

- highly competitive and hard to comply with

- grant money covers only a part of your business’s costs (up to 50%)

- companies need to adhere to an agenda(s) (e.g., consider the environmental impact of a startup), which can be good or bad depending on how far away that takes you from the original idea

Private equity firms and hedge funds

The big guns with immense investing resources get into play closer to Series C. When you’re ready to play their game, you’ll already have a team of corporate lawyers. And it will take you a few years to get there, meaning the rules might differ.

Hopefully, one of these routes works out for your when you begin to raise capital to start a business. Scratch that. One thing or another will eventually work out because I know entrepreneurs. They are the beasts of maverick intelligence and courage, and they can devise a brand-new investing strategy.

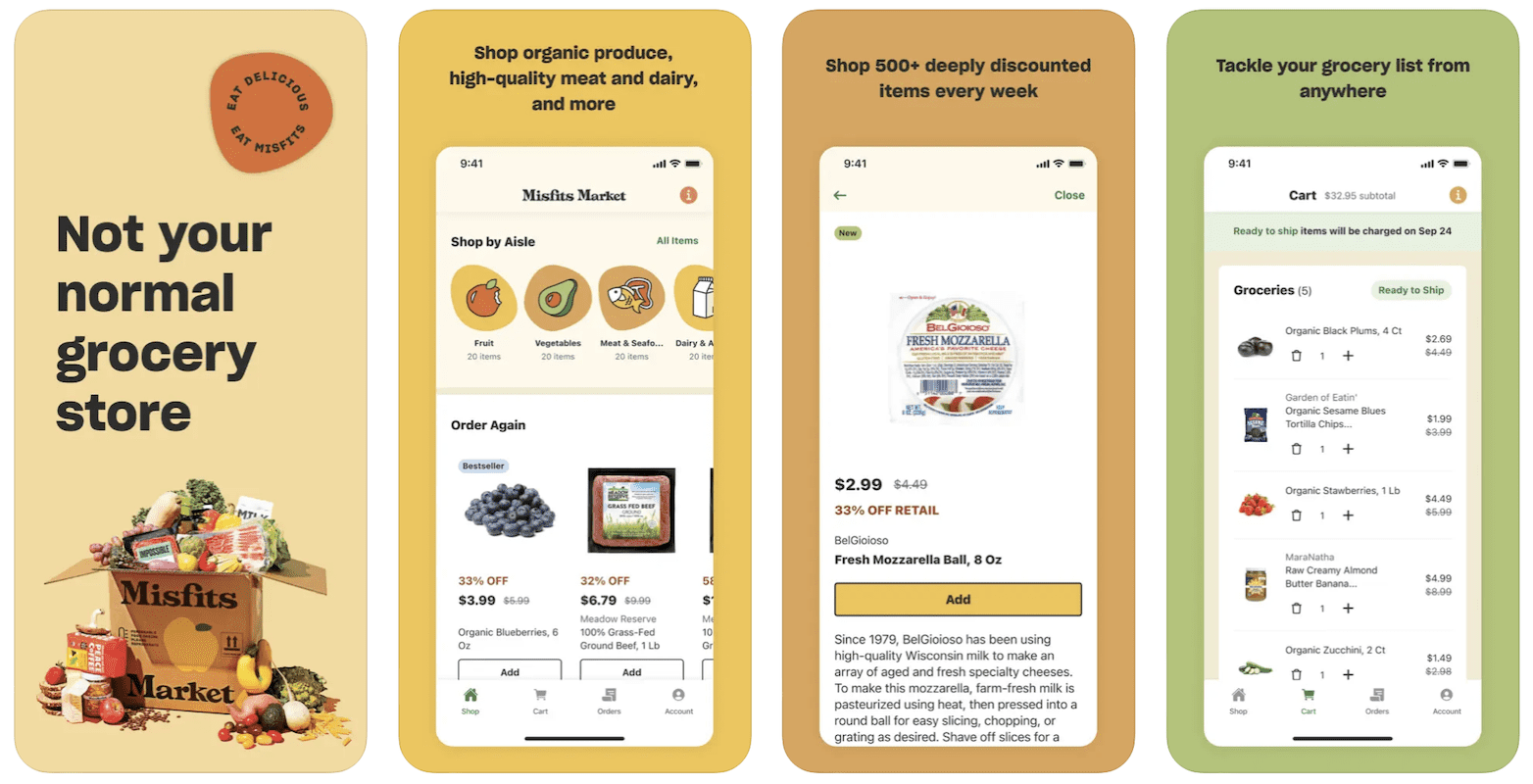

Have you heard about Misfits Market? It’s an Uber for “ugly” veggies and fruits that raised $526M between 2018 and 2021 and recently got acquired by Imperfect Foods (Sept 2022). MM’s founder had been maxing out five credit cards from different banks before landing his first fundraising deal.

While I don’t suggest that’s how anyone should fundraise for a startup, note this founder’s audacity and ingenuity.

Bootstrapping

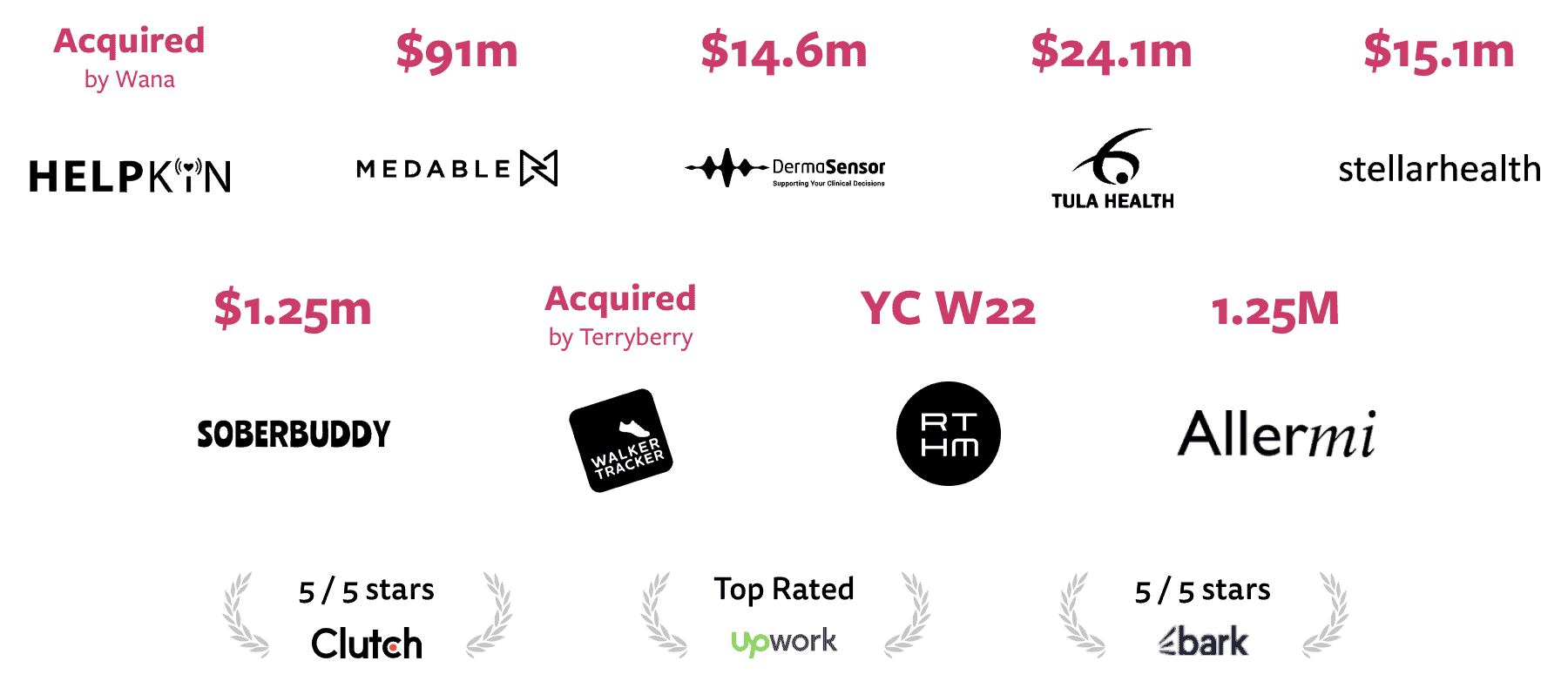

Every founder knows about this “fundraising” option, but few manage to master it. Topflight has been lucky to partner with companies whose founders bootstrapped their startups the whole way to successful acquisitions. Here’s how that works narrated by the founder of Walker Tracker.

What it feels like when you’ve done it

Tips on How to Raise Money for a Startup

Let’s talk about a few tips that may come in handy when you raise a startup capital.

Pitch deck

- Always start with a pitch deck — it’s easy to share, and you never know in whose email it may end up. For founders with a bare idea and no business plan, we recommend starting with a pre-flight workshop.

- Limit the deck to 10-15 slides; show, not tell.

- The pitch needs to have a concise narrative.

- Work through an elevator pitch based on your deck.

Also Read: How to Build Your Fintech Startup

Focus on equity

- You can’t avoid equity pools for key personnel and giving shares to investors; therefore, ensure you have a long-term plan for your equity share.

- A good rule of thumb is to arrive at 10% of ownership by the time you exit.

Fundraising is a long-term game

- If you’re not comfortable hustling up new rounds, this needs to be someone you trust 100%.

- 5-6 months till zero cash day implies you’re already circling in on the next round.

- Keep operations at a low scale while chasing another round, as that always takes longer than you expect.

- Know precisely how much you need to fund the next growth chapter. Avoid getting greedy when investors offer more (taking on an offer from someone with relevant expertise and connections, who will be more hands-on, is preferable to opting for a bigger check).

Investor relations

- Practice your pitch on investors you don’t have to win over.

- If you’re dealing with VCs or similar entities, are you addressing all decision-makers? Is everybody on board? Are you proactively addressing everybody’s concerns?

- Pre-qualify your investors like they vet you.

- Come prepared: all critical aspects of due diligence must be covered in your supporting documents from the data room.

Valuation

- Valuation doesn’t necessarily define your success as a founder.

- Regardless of your valuation methods (book value, multiple of earnings, etc.), always keep human assets front and center; it’s people who make startups succeed.

Also Read: Custom Mobile App Development Guide

Pitfalls to Avoid When Fundraising for Your Business

Finally, what dangers do you need to sidestep to fundraise for a business successfully?

Signaling risk

The conventional wisdom of seasoned entrepreneurs says, “Don’t take investments from Series A funds at the seed stage for the risk of them not following on with the next round.” The signaling risk occurs when other investors see this and pass on your startup. I’d say, if you have a team and know exactly how much you need to show growing traction, follow your guts and take no more than you need.

Growth and efficiency

If you’re chasing growth at all costs in the current economy without optimizing the cash burn rate and planning for a sustainable 2-year runway ahead, investors may take a pass this time.

Burning bridges

The startup community is relatively small, and all your relationships with colleagues, ex-bosses, investors, and other players matter more than you can expect.

Outrunning competition

Have a solid plan on how exactly you will outsmart the competition. Building something faster in the world of no-code and off-the-shelf app components is no longer enough.

One-man show

If you don’t involve other vital team members in the fundraising race sparingly, you may create a repelling image of a bossy absolutist.

Neglect the “fundraising tech”

Working with platforms like Gust, Crunchbase, WeFunder, and Pitch Investors Live can help you hone your pitching skills and shorten your research phase when you’re just getting started with fundraising.

Be an active listener when negotiating

Many founders become so overwhelmed when they get in front of an investor that they forget to listen and may put themselves in a weaker position.

You need to know what they are looking for, too. Yes, everybody in investing looks to make money, but what is this particular investor’s path?

Showing up too early

Some VCs only consider you once and will need substantial progress in key metrics for re-evaluation. Therefore, it helps to get outside confirmation that you’re in the right spot before you ask for a meeting.

Fail to follow up at least three times

That’s basically a refrain in all fundraising blogs I’ve seen. As a former salesman, I advise you to follow up as long as you need, but only if you have things to show.

Hiding weaknesses

Investors will seek out everything they need to know before making a decision. Knowing how to play around with your weak spots instead of hiding them will save both parties a lot of time.

How Topflight Can Help?

Topflight is happy to be a development partner for companies that continue boosting their key metrics, raising millions of dollars, or going through successful acquisitions.

Long story short, the core of the team are ex-founders who made it their purpose to help companies that add value and have a max impact on people’s lives. That’s why we mainly focus on developing healthcare, fintech, and lifestyle solutions.

Here’s our take on fundraising for founders looking for the most impact and best path to massive scale. We are happy to discuss how Topflight can help raise funds for your startup.

Frequently Asked Questions

What makes a decent pre-seed round?

That largely depends on the type of software that makes the backbone of your business. Sometimes you’re lucky enough to get away with a $60K investment and build a no-code prototype. Other times, you feel bootstrapped with a $500K lump investment.

Besides having a prototype, POC, MVP, etc - what is a good indication my startup needs another fundraising round?

You should always be conscious about your burn rate. What is your zero cash day? How long will existing funds last till there’s nothing to throw in the payroll? If it’s less than 5-6 months, you should be already speaking with investors.

How long does it take to close an early round?

The pre-seed and seed rounds go faster. Usually, it takes up to 6 months before the money hits the bank. And as for decision-making, early investors can flip during the first meeting.

What are essential concepts for founders during fundraising?

Dilution and equity: how much of the company do you get to keep? It’s ok to hold 10-15 percent of the business towards B and C+ rounds. However, you should be super careful about giving up too much equity during the early rounds.

What should be my priority when I start to raise capital for a startup?

Networking. Personal connections and warm introductions to as many relevant parties as possible are critical during the first funding stages. No one but founders can get the investment ball rolling. So start networking now.