One thing that catches my eye every time I watch fintech founders sharing their success stories is they rarely talk about app development per se. I mean, these can be one-two hour interviews, and they never even touch on any of the specifics of their fintech app development.

To me, that’s a clear indication that starting a fintech company doesn’t equal developing a fintech app. There must be way more than meets the eye. What contributes to building a fintech startup amassing millions of customers besides finance software development? Let’s find out together.

Top Takeaways:

- To run a fintech company successfully, you must create a viable business model backed by secure software and strong mutually beneficial partnerships.

- Even though you can’t create a fintech startup without developing a modern mobile and/or web application, your priority should be creating partnerships enabling new or democratizing existing financial routines for customers and businesses.

- If you have a sound business plan and funding to cover proof of concept development, check out the Topflight Fund to learn how we can help you make your idea a reality.

Table of Contents:

- 5 Things to Consider Before Starting a Fintech Company

- Step-by-step Guide on How to Start a Fintech Company

- Examples of Successful Fintech Startups

- Pitfalls to Avoid When Building a Fintech Startup

- How Can Topflight Help?

Things to Consider Before Starting a Fintech Company

Without further ado, let’s jump right into it. What do you need to take into consideration before you start a fintech startup? Based on my experience of working with app founders, there are a few things.

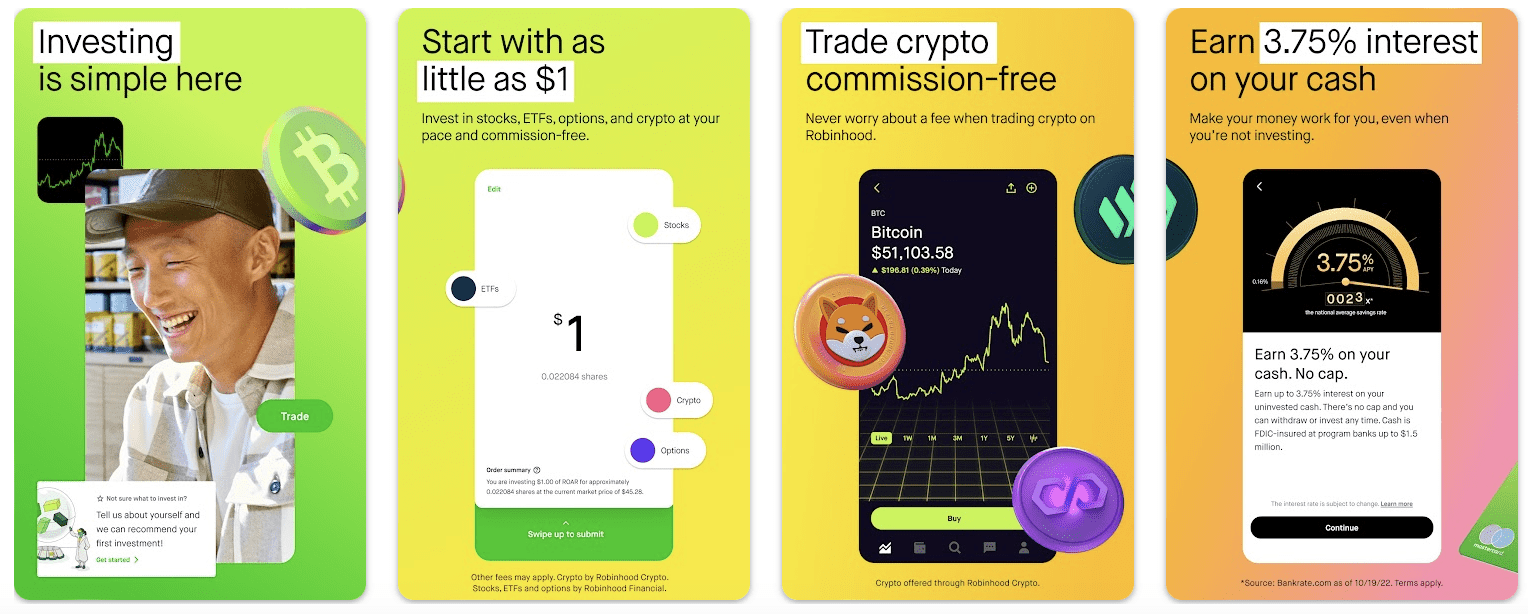

Image credit: Google Play, Robinhood

Don’t start by building an app

After spending 17 years in the app development business, I often find myself answering friends’ and peers’ questions about their app ideas. After hearing out, I first ask them whether they have done anything to validate their vision.

The last time I had this kind of conversation was with a gal who wanted to build an app for medicine delivery. I immediately pulled out my iPhone and asked if she wanted to run against these thriving apps already on the App Store?

She said her app would enable a uniquely convenient workflow between pharmacies and medical suppliers. I shot back, stressing the importance of having relevant, trustworthy connections, and advised her to fulfill a single order using just a messenger, email, or whatever combination of existing software to see how it works out.

All I’m trying to say here is that developing an app is an extremely expensive way to find out if you’ll have any customers at all. There are plenty of ready-made solutions and workarounds to validate your idea first before you set up a fintech company. However, such attempts are useless without the prerequisites we’ll discuss in the next section.

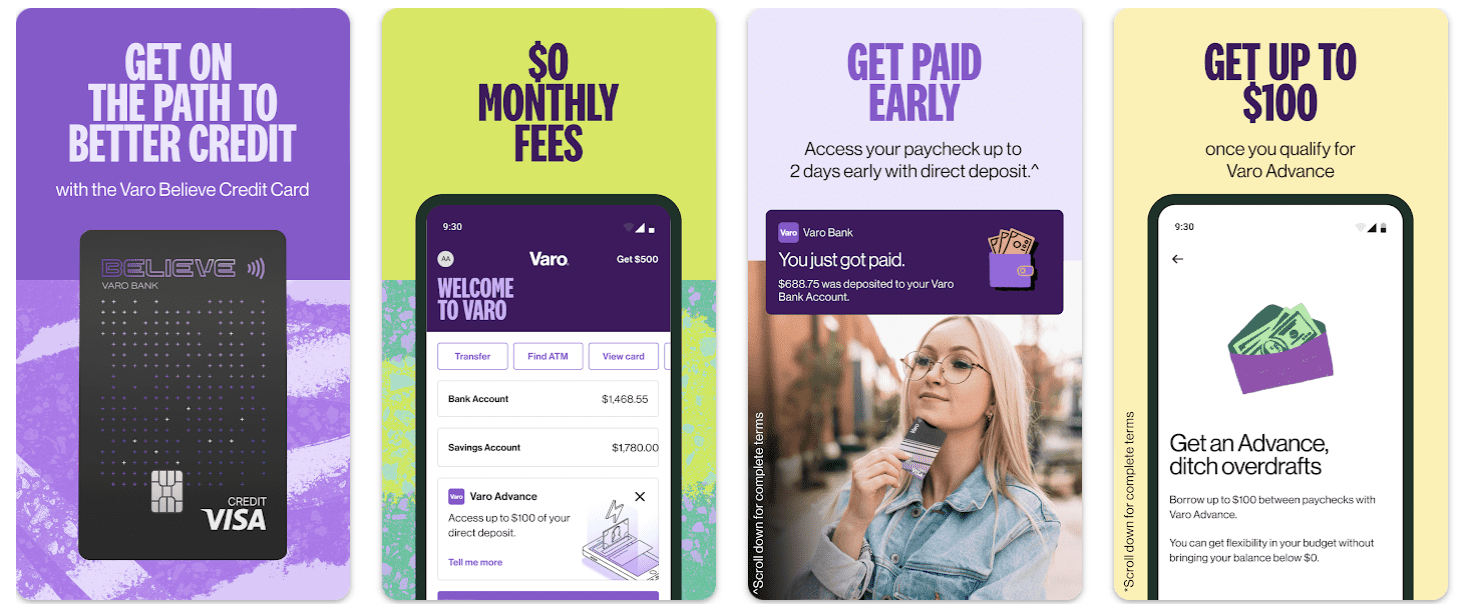

Image credit: Google Play, Varo Bank

Own the expertise

Most successful fintech companies are founded by people who spent some time in the fintech industry and observed genuine inefficiencies or problems that can be solved by software. For example, investing app Robinhood started after its founders spent over five years working on trading software.

Build a network

Startups don’t exist in a vacuum. They need investors, customers, and employees, right? As a founder, you’ll need to pull all these people together like a magnet. And this means you’ll have to network a lot, starting with your closest circle of friends and colleagues.

For example, Transferwise (rebranded to Wise) — an $11B-valued money remittance service — started as five people on a Skype chat, helping each other with faster and cheaper cross-border money transfers (using their local bank accounts in UK and Estonia).

Therefore, if you plan to make a fintech startup, you should be already actively networking and looking for investors, partners, future hires, advisors, etc. — even before you start building anything.

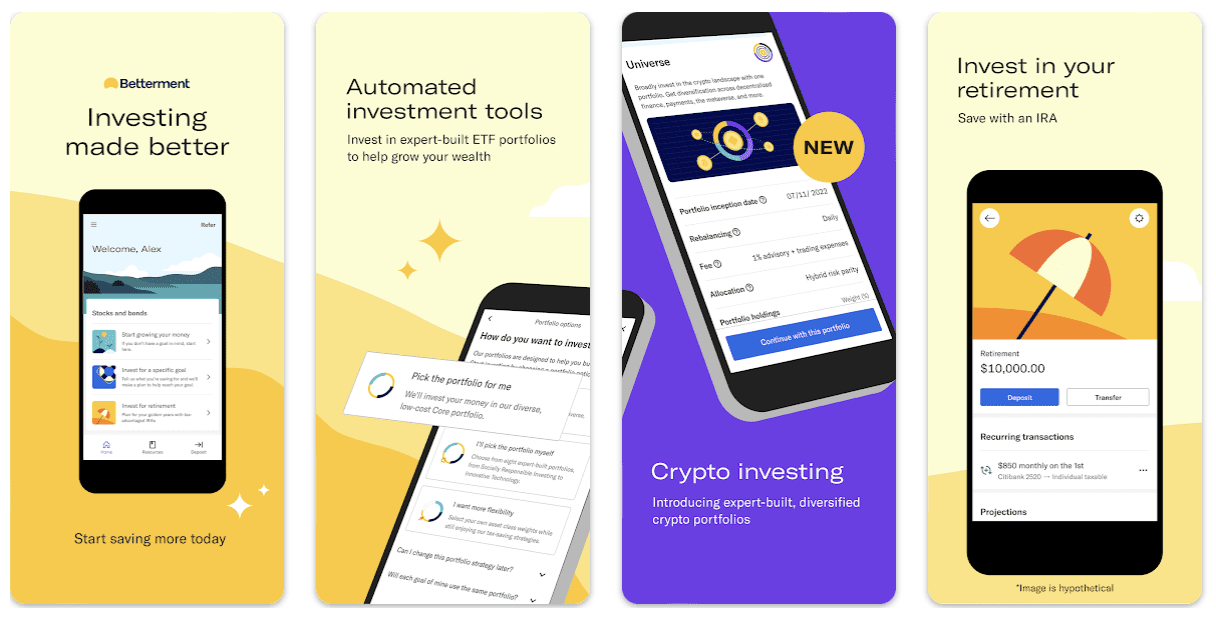

Image credit: Google Play, Betterment

No tech co-founder is still a go

Having a tech co-founder is still pretty much the status quo, even though you can find design and development agencies fully vested in your idea. I bet some fintech founders would parry, “Who on earth would start a fintech company without a tech co-founder? Are you out of your mind?”

You’re good to go as long as you partner with the right company that can cover all your product development and beyond (strategy, marketing) needs. I speak from our experience at Topflight.

Patience and persistence

It’s a truism, but I must mention that only patient hustlers win. Even our founder, in one of the recent interviews, admits that persistence is everything in the startup land:

I would say my biggest personal achievement is just persisting. To have not quit after the insane growing pains, including very talented people leaving the company or facing legal issues that drained me. So, doggedly chasing growth 6 years later. I would say that’s my biggest achievement, and the same probably goes for any company that survives the test of time.

Joe Tuan, Topflight’s founder

Bite-size takeaways

To sum it up, here are the things you need to consider before starting a fintech company:

- be an expert in a specific financial niche

- network with the right people

- find a way to validate your idea without building an app

- start small: serve an adequate hyper-local market

- find a competent, reliable partner

- stay vigilant

Step-by-Step Guide on How to Start a Fintech Company

Let’s go through all the steps you need to take to launch a fintech startup.

Step #1: Have an idea

It all starts with an idea. You keep thinking about this and can’t stop envisioning how everything would be much simpler, faster, cheaper, and more convenient if such a solution existed.

In the modern world of fintech, this idea can belong to:

- crypto

- fiat

- combination of crypto/fiat

Also Read: How to Build a Crypto Wallet

Furthermore, you may look to address enterprise or consumer needs, making your fintech solution respectively b2b or b2c software.

There are quite a few areas to select from, and even though I fully realize that your idea comes from your personal experience, let’s list a few popular finance domains:

- money transfers

- investment software

- trading software

- lending solutions

- neobanking

- billing

- accounting

- digital payments

- personal finance management

- Insurance

Related: How to Build a Financial App for Budget Planning

Step #2: Back your idea

An idea is something, but now you have to back your assumptions with research. You need to prove that the problem is real and your solution successfully solves it for consumers.

The research will ideally cover the following:

- deep understanding of the target audience and their needs

- competitive analysis

- binding regulations

- available technologies

Getting to know your target audience up and close can be the most simple and, at the same time, intimidating task. Sometimes founders assume that since they’ve been in the customer’s shoes, they know what everybody wants. Wrong; surveys can help.

The competitive research part is often the most fun part. If you want to set up a fintech startup that works off a mobile app, the research would require analyzing available apps.

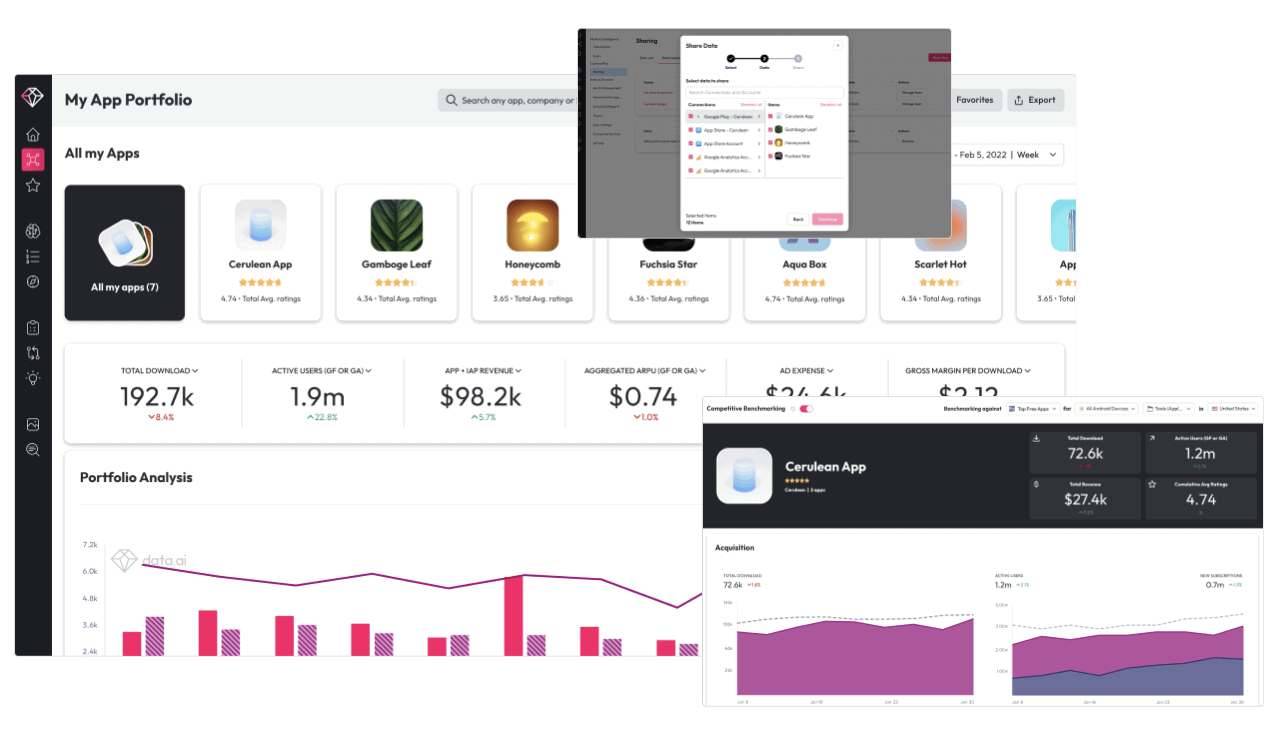

Image credit: data.ai

Your advantage is using analytics platforms like data.ai or sensor tower to uncover the nitty-gritty stats behind successful startups in your niche — down to their tech stack.

For example, if you want to create a neobank, you must know such apps as Chime, Current, Varo, and Dave inside out.

The regulations are the hardest nut to crack in the finance domain. Besides ubiquitous anti-money laundering (AML) and KYC (Know Your Customer) regulations, there are also standards like PCI DSS. Companies must ensure operational compliance on the federal and state level, taking into account regulatory requirements by:

- SEC

- FINRA

- CFBP and many other acronyms

The best thing you can do as a founder, unless you have a solid regulatory background, is to partner up with experts or find middleware that takes care of compliance and general data protection regulations under the hood.

Finally, exploring available financial technology options, you should look for off-the-shelf solutions that will help you shortcut the development of a prototype (more on that later). And, of course, you must ensure that the tech (e.g., artificial intelligence and machine learning) that makes your solution possible exists at all.

Bite-size takeaway

You may need to pivot from your original idea based on what you discover during this step about:

- customers and their genuine needs

- regulatory framework

- tech limitations

- competitive analysis

Step #3: Find funding

Funding is when you meet the harsh reality. Will people who already made a ton of money actually believe in you, your team, and your future solution?

Of course, it’s nice when you can rely on self-funding or raise enough through crowdfunding. Still, that way or another, funding will become the epicenter of all your networking efforts.

You may be interested in how to raise money for your business.

And it’s going to be a challenge despite all the available options:

- VC (venture capital) funding

- crowdfunding

- traditional (painful) bank loans

- angel investors

- business accelerators/ incubators

- government grants and subsidies

- family and friends

During this process, you also need to answer how much control over the company you’re willing to give up, which partner helps you create missing relationships, whether equity will be an option for your employees, etc.

It’s worth noting that the funding step will probably extend and intermingle with the following steps because you will need readily available resources even after launching an MVP. Because that’s the quick answer to rapid scaling and growing your user base if you think strategically.

Step #4: Validate your idea with a prototype

At this point, you have a little cash and a well-researched plan to start a fintech business. Now you’re ready to validate this concept by making it a reality.

You may choose one of the following options on this path:

- wireframing

Involves drawing sketches of an app’s main screens. Helps to visualize what customers will interact with once the software is ready.

- rapid prototyping

Same as wireframing, except you end up with a clickable prototype, and the screens have a high polish. A prototype means you can jump between screens and see how they change based on user input (even though it’s just a simulation) — it’s a better representation of the envisioned product. You can share it with test users to gather feedback and improve the UX/UI.

At Topflight, we prefer to start with rapid prototyping to avoid wasting resources during the coding stage and to ensure we’re building a solution with a product-market fit.

- no-code proof of concept development

Finally, no-code development is another option involving creating a “real” app using drag-and-drop UI building blocks. The limitation here is that blocks have minimal customization, and you typically end up with something that looks very generic.

Usually, fintech founders partner at this stage with a design & development agency or work with a freelancer to get professional results. The prototype will continue serving as a fundraising tool and has to professionally portray the app’s potential. And what’s even more important is that the prototype, at least to a certain degree, validates your software’s product-market fit.

Step #5: Prove your idea is viable with a proof of concept

The next step on your journey to starting a fintech firm is to release something more tangible — a proof of concept that customers can use in real life and get the results they want. It’s time to develop a fintech app.

Your three options here will be:

- no-code development

- low-code development

- custom development

Also Read: A Complete Guide to No-Code Development

As you already guess, the level of customization increases gradually between these approaches, with virtually no customization in a no-code case, slight customization with low-code, and unlimited customization with the third variant.

The idea is to focus on one or two main features — whatever your team can put together within three months. That’s an ideal time frame for creating an engaging user experience wrapped around a focal feature.

A proof of concept aims to further iterate on the product-market fit by analyzing customer feedback and choosing the next features promising the max ROI upon delivery.

It’s worth noting that PoCs are not usually meant for a public release. Instead, you give it to the most loyal customers or release it to a hyper-local market.

NB, you’ll need assistance from a fintech app development partner if you choose a low-code or custom development scenario.

Step #6: Build an MVP

Eventually, your proof of concept will reach a state when you feel comfortable releasing it into the wild. Therefore building a minimum viable product is essentially iterating on a PoC until it has enough features to guarantee mass traction with users.

Beware that you should raise some money by this point because you’ll need to run a marketing campaign at this point besides spending resources on polishing the product.

There’s one thing you absolutely can’t ignore while scrambling pieces of an MVP together. And that’s integrations with an analytics engine that lets you gauge user behavior and app performance.

You’ll be tracking quite a few metrics post-launch to ensure you’ve got the proper fintech company setup, for example:

- users reaching their in-app goals

- bugs and issues (sometimes crashes)

- slow-downs

- conversions

Findings from these analytics services will form the basis for new updates and optimizing your CI/CD infrastructure. Not to bother you with details, you’ll be able to set up the most cost-efficient and 99%-uptime cloud infra.

Step #7: Iterate and be ready to pivot

If you’ve been paying attention to the previous steps, you already know that you’ve been iterating your fintech app since step #5. The drill is to keep tabs on the app’s performance, optimize the monetization strategy, and iterate until you hit a wall. At that point, you pivot.

You also need to double down on building partnerships that broaden your horizon and let you reach more customers.

Examples of Successful Fintech Startups

If you want to build a fintech company that’s set to generate mass adoption, the following startups can definitely teach you how to do this.

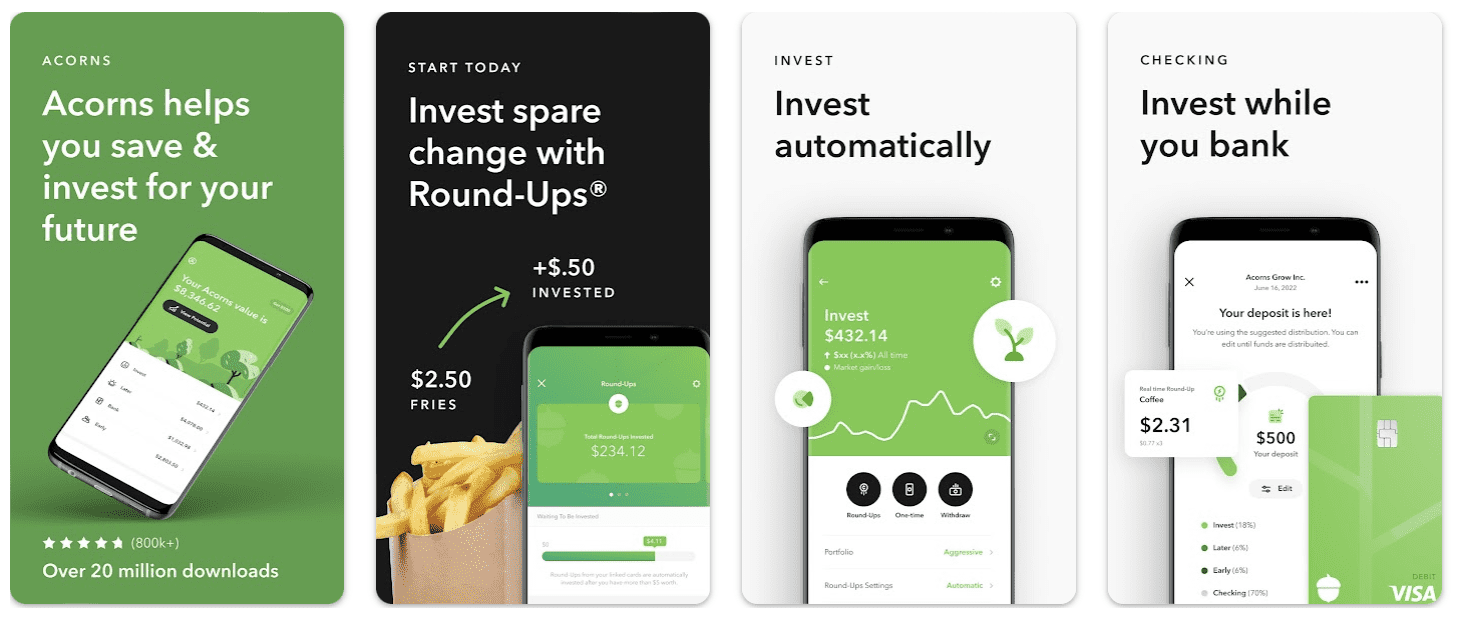

Acorns

Founded: 2012

Headquarters: Irvine, CA

Valuation: ~ $2 billion

Image credit: Google Play, Acorns

Solution: Acorns is an investment app that automatically rounds up purchases and uses the saved change for investing on a robo-advisor-managed platform. The app also supports a cash-back rewards program and provides personalized financial goals and a checking account with credit cards.

Related: How to Make a Trading and Investment App

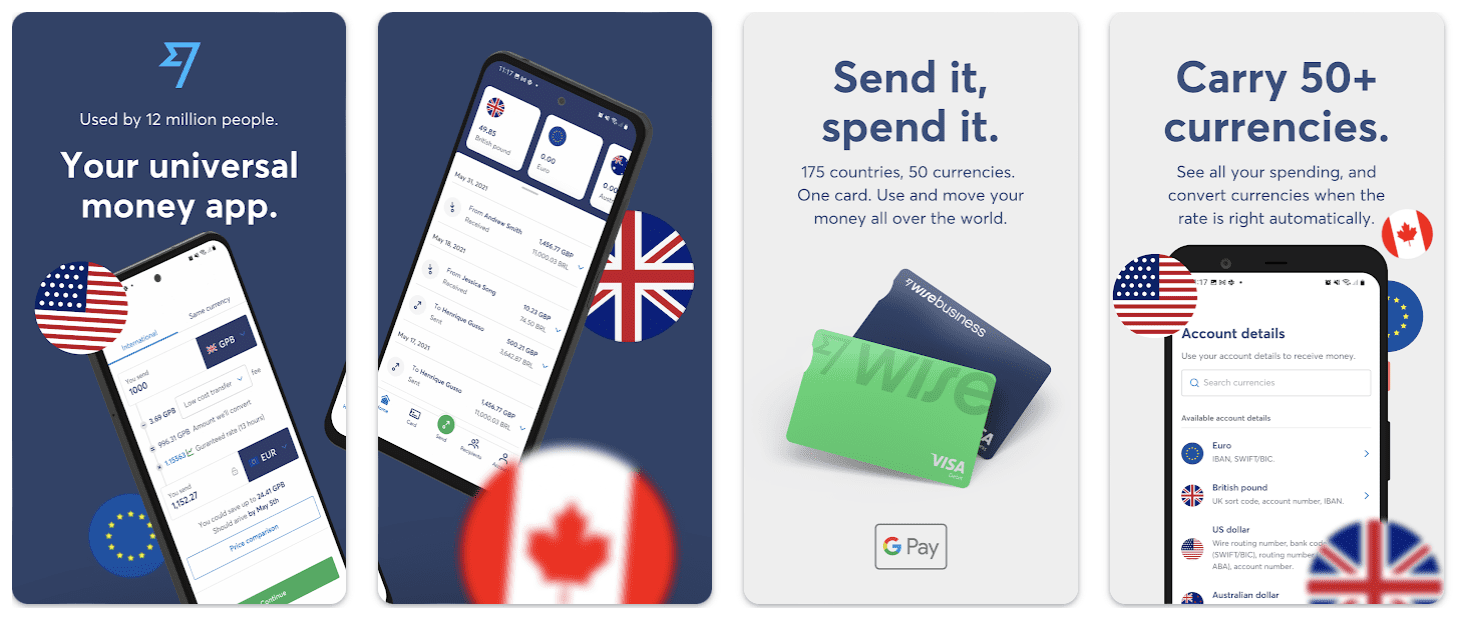

Wise (formerly Transferwise)

Founded: 2011

Headquarters: London, UK

Valuation: $4.1 billion

Image credit: Google Play, Wise

Solution: Wise (ex Transferwise) is a financial app for international money transfers offering the best exchange rates on the market. The company doesn’t add any markup to interbank exchange rates and boasts the lowest fees for financial transactions on the fintech market.

Plaid

Founded: 2013

Headquarters: San Francisco, CA

Valuation: $13.4 billion

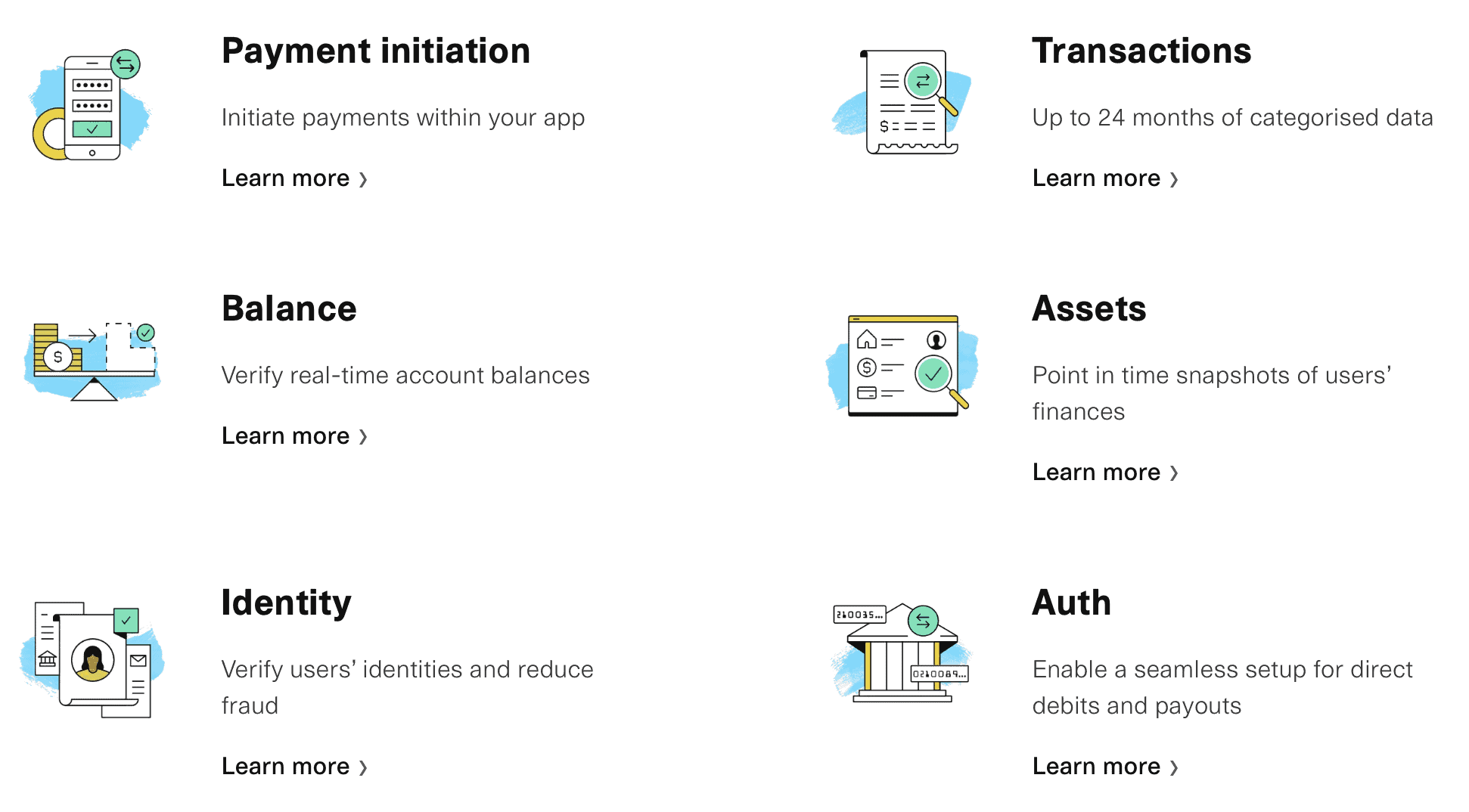

Image credit: Plaid

Solution: Plaid does not target end users directly, instead providing fintech companies with middleware required to securely connect customers’ financial accounts and share their data with their software. Plaid solves the challenge of streamlining and formatting financial data sets handled differently in different financial institutions.

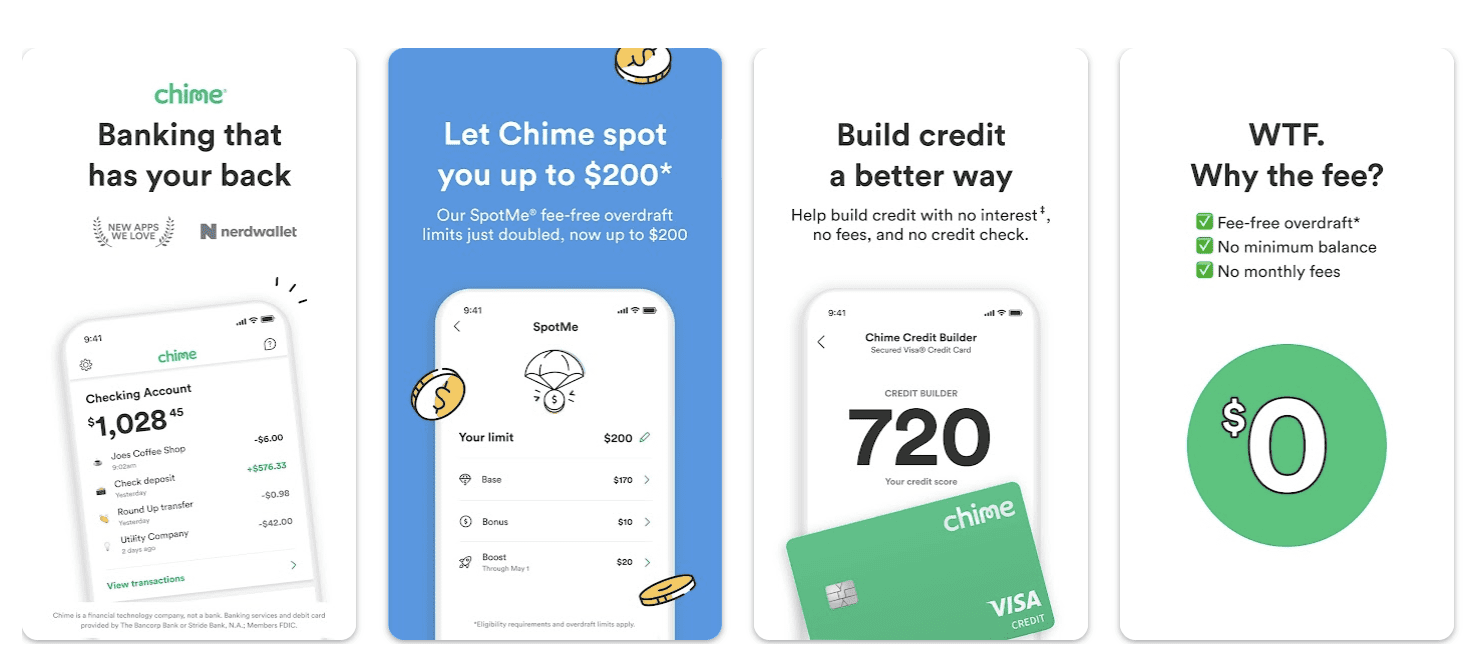

Chime

Founded: 2012

Headquarters: San Francisco, CA

Valuation: $25 billion

Image credit: Google Play, Chime

Solution: Chime is a neobanking application that covers virtually all retail banking needs (mobile banking at its best). The app comes with an impressive list of features, including up to $200 overdraft, early paycheck, credit builder, money transfers, etc. — and all of that with zero fees. The app’s banking services are provided by traditional banks: The Bancorp Bank and Stride Bank.

Related: How to Create a Banking App

How to Build Money Transfer App

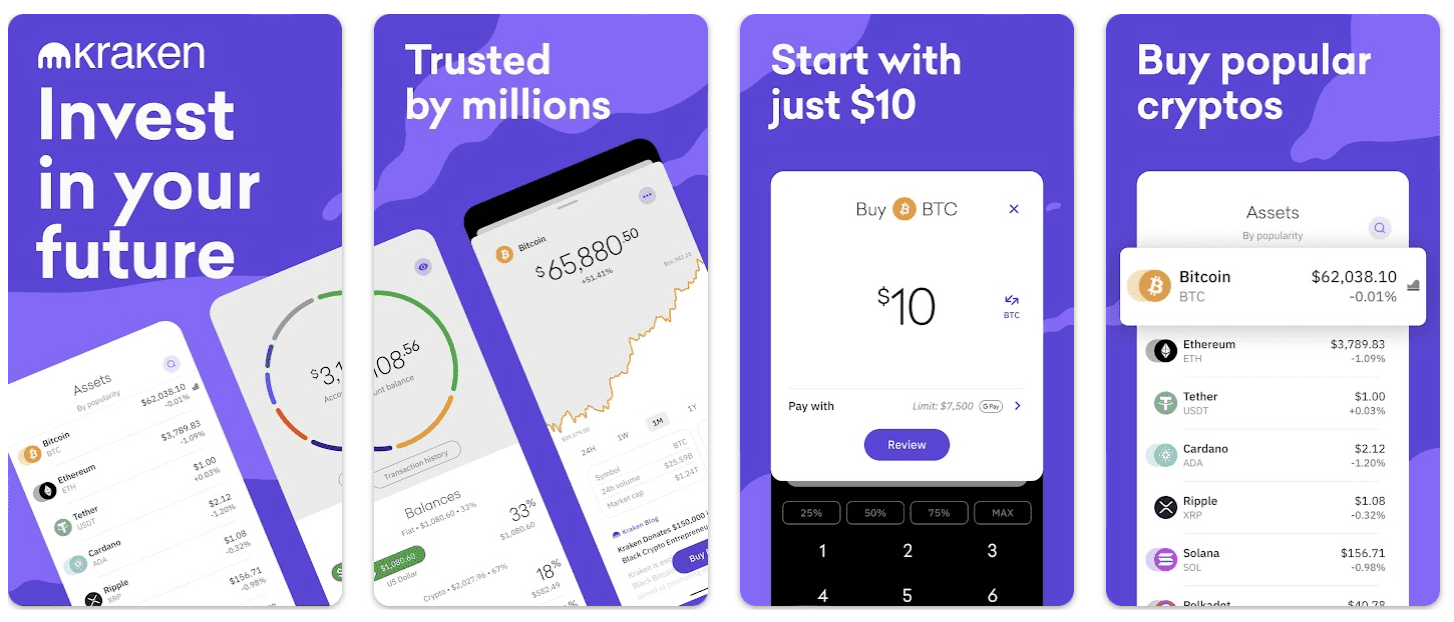

Kraken

Founded: 2011

Headquarters: San Francisco, CA

Valuation: ~ $11 billion

Image credit: Google Play, Kraken

Solution: Kraken is a centralized crypto exchange platform known for its high security standards — not a single hack during its ten-year history. Besides typical crypto-fiat trading features, the Kraken trading app also provides some advanced functionality, e.g., margin trading, staking, advanced trading orders, multiple charting options, etc.

Toast

Founded: 2011

Headquarters: Boston, MA

Valuation: $33 billion

Image credit: Toast

Solution: Toast is a powerful combination of cash register hardware and point-of-sale software for restaurant businesses. The solution works on all possible devices and supports customer loyalty programs, food delivery, scheduling and payroll, in-depth reports, and integrations with third-party software providers.

Pitfalls to Avoid When Building a Fintech Startup

To create a fintech company that scales and stands the test of time, you need to sidestep these calamities.

No unique selling proposition

Traction-generating fintech apps always offer some unique benefits to customers. Whether it’s about cheaper fees, more convenience, faster service provisioning, or some other advantages — you can’t just copy someone’s model without improving it sufficiently.

No partnerships

Your customers already use a lot of financial services. Therefore, your software will need to integrate with various financial and other services to provide users with a seamless experience. And the whole thing hinges on building partnerships with other companies.

Your ability to build effective partnerships with other market players will also affect how well your product will be promoted through third-party services.

No customer feedback in the product roadmap

Some companies choose to decide how their financial products should evolve without taking into consideration customer feedback. However, successful fintech startups, in hindsight, attest that the most impactful changes are always driven by user feedback.

For example, for Robinhood (a stock trading app), this involved starting a fintech firm for social networking around investing and then switching to an investment app.

Monetization is delayed too much

Working on a monetization strategy from day one is uber-important. You’ll hear about this a lot of questions from investors. Having different models that can be tested once a proof of concept launches always helps.

Also Read: A Complete Guide to Monetization Strategies

No customer acquisition strategy

This one goes hand in hand with identifying a monetization strategy early on. Like any other business, you start your own fintech company to be profitable. And finding the most cost-effective way to onboard new users is critical to this success.

So researching the cost of advertising on different platforms while the solution is still being developed goes a long way.

App components developed from scratch

You should absolutely take advantage of ready-made and proven technologies available on the market. For example, there’s no need to create a custom integration with a bank account if you can use the Plaid service instead.

Using its APIs, you can connect to virtually any bank account and securely sync financial information. This principle applies not only to financial APIs and well-recommended libraries but also to other app components, e.g., a mobile chat module or a card scanner.

Raising capital too early or too late

The problem with raising too early is you have to give up part of the control over the company to investors. And if you raise too late, you may be late to market, competing with several other companies offering similar fintech services.

Regulation oversight

Ideally, you partner with a lawyer at the research step because financial regulations can make or break the whole affair. Taking into account federal and state laws, filing for required licenses, etc. — all of that can be pretty intimidating.

Cybersecurity and data privacy

Cybersecurity and data privacy

Most security concerns will have to be addressed on the compliance path. However, you should also consider the specifics of the mobile and web platforms your software will support to ensure top-notch security.

How Can Topflight Help?

We’ve been very fortunate to work with innovative companies that have raised over $188m using MVPs and proof of concepts we built. If you’re serious about leaving a mark in the finance industry, you can count on us as your trusted partner for creating top-notch fintech products.

The thing is, running a business itself (networking, partnerships, operations, etc.) is already stressful enough. Throw in product development hurdles, and you’ve got yourself a hectic life. Having a competent team of ex-founders, who cover the full spectrum of product development tasks, definitely helps:

- Strategy

- Product management

- Development

- Design

- Quality Assurance

- DevOps

The best part is working with this top 3% vetted talent saves you a lot of money. Did you know that a single app development hire can cost anywhere between $30,000 – $50,000? That’s almost the cost of a PoC that requires more talent (besides app developers) than a single coder.

To find out how we can help you build a fintech startup, check out our Topflight Fund. Our experts will be happy to learn about your idea and discuss the best approach if you book a call here.

Frequently Asked Questions

What is the most typical mistake by fintech founders?

Starting with app development, skipping the research and prototyping phases.

What's the biggest misconception about starting a fintech startup?

The idea of running a business without a tech co-founder may sound scary to many entrepreneurs. Yet, low-code solutions and the availability of turnkey development teams that supply all required talent makes this a moot point.

What tools can you recommend for competitive research?

Data.ai and Sensor Tower offer various analytics granting insights into what monetization strategies, technologies, and marketing tactics work best for your competitors.

How long does it take to open a fintech company?

Going live with an MVP can take between 6 and 9 months, depending on the scope.

What's the biggest challenge to start up a fintech company?

Regulations that enforce implementation of robust security infrastructure.

Cybersecurity and data privacy

Cybersecurity and data privacy