Have you ever tried expense tracking apps like Mint or Monefy? If you have, I bet you noticed a thing or two you’d like to move around. How about we dream up a perfect personal finance app?

What would be the steps to build it? Which budgeting app trends should we account for? Where are competitors heading and what does a killer feature set look like?

I’m thinking of a budget app that recommends saving strategies based on user spending habits. To spice things up, let’s also have the app connect to marketplaces and show users items they can save for. What do you think? Is it worthwhile to build a budget app like that?

Table of contents:

- What is a Personal Finance App?

- Personal Finance App Market

- Types of finance apps

- Top 5 Budget Apps for Personal Finances

- Essential Features for a Budget App

- Choosing the Right Tech Stack

- 5 Steps to Make a Financial App for Budget Planning in Retrospective

- Step 5: Add the app to app stores and maintain it

- Step 4: Test vigorously

- Step 3: Enforce security

- Step 2: Build an MVP

- Step 1: Design and verify a prototype

What is a Personal Finance App?

I’m sure you already know that, but let’s jot down the definition here anyway:

A personal finance app is a mobile app that helps us take care of, well, our personal finances: budgeting, saving, investing, and the rest of the fun stuff we get to do with money.

In this blog, we are going to talk specifically about budget planning apps. Those keeping track of our expenses and making recommendations about improving our financial well-being.

Personal Finance App Market

As with any new product, it makes all the sense in the world to probe the market before creating a finance app. So what’s happening in the market?

Competition

First of all, let’s look at who our competitors are. If we scan recent reports on the personal finance apps market, we’ll quickly identify this pack of leading products:

Mint, Personal Capital, GoodBudget, Spendee, Wally, You Need a Budget, Acorns, WalletHub, Toshl Finance, Money Smart, Money Lover, Expensify, Easy Money, Bill Assistant, Account Tracker, Level Money, Expense Manager, Qapital.

Going after a younger audience

Almost 25% of the US population is under 19. So many budgeting apps seem to be going after this lucrative target audience. It’s no surprise, therefore, there are more startups like BusyKid or Plan’it Prom coming to the market, who make a finance app for zoomers.

The premise here is that teens and children will build up their trust in a brand and transition into lifetime subscribers of a company’s financial services as they transition into adulthood.

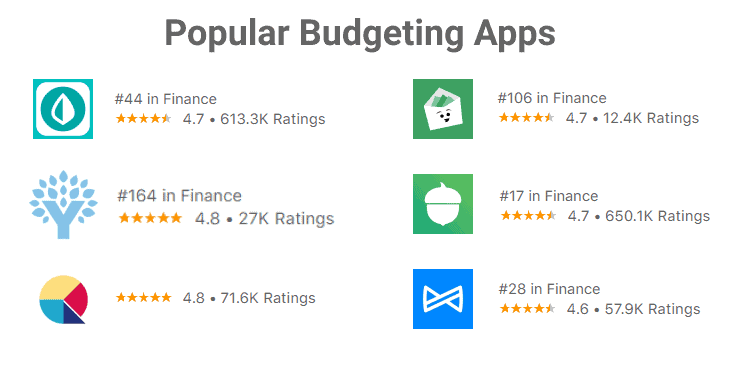

COVID-19 effect

COVID-19 absolutely smashed fintech funding in the first quarter of 2020. Still, as the pandemic unfurled, the second quarter saw a 17% growth in funding. With today’s unstable economy, you’d think budgeting apps should have all the chances of becoming a necessary tool for many households. Unfortunately, according to SensorTower’s report The State of Fintech Apps, these solutions dropped in downloads by 32%.

Read Also: How to Make a Fintech App

However, that’s likely to change as we’re approaching the season of New Year’s resolutions. Plus, the saving rate has skyrocketed due to the pandemic to 33%, and more people are going to explore options for mindful money management.

Traditional banks fighting back

Another notable trend is how traditional banks are trying to compete in the personal finance management areas by adding budgeting options into their mobile apps. Practically every major bank has some sort of tracking expenses with the automatic categorization of transactions and other similar features.

We can view this as another evidence in favor of developing such a solution — our exit strategy may be selling our app to a bank that’s playing a catch-up game.

Crypto

Cryptocurrencies are also making their way into budgeting solutions. Apps like Mint and Spendee allow users to connect their crypto wallets and track the Bitcoin balance. Other applications like OSOM use AI algorithms to automatically manage their users’ crypto-based portfolios.

I’d say that creating a budget app without support for crypto these days may be very short-sighted.

Related: Smart Contract App Development: The Ultimate Guide

Related: Crypto Trading App Development: Everything You Need to Know, Crypto Wallet App Development

Improving customers’ financial literacy

If we look carefully, we’ll notice that most budgeting solutions add educational content to help their customers make smarter financial decisions. In fact, you can see that happening across the whole spectrum of personal finance apps, e.g., in Plinqit, targeting children and in Acorns, focusing on grown-ups.

Key stats on personal finance apps market

- Total transaction value in the personal finance segment is projected to reach a little over $700,000 million in 2020

- Finance applications generated 24 billion downloads in Q2 2020

- $343 million is the projected size of the personal finance software market in the US by 2026

- 53% of users surveyed by Business Insider budget using their mobile banking app

Types of Finance Apps

Before we create a budgeting app, we also need to understand two major types of financial applications in this category.

Run-of-the-mill budgeting tools

Dumbed-down money management tools focus solely on showing users their earnings and expenses. They are rather effective if we need to monitor the cash flow or run a basic bill tracker, but barely classify as a budget planner or a holistic money management app.

Even if they pull data from other financial services or payment systems and don’t require manual entry of transactions, such personal spending trackers usually fail to change users’ financial habits.

Personal expense tracker apps

This financial planner software leverages machine learning to not only tame the money flow but also provide savings tips. Take an app like Mint for example. Its users can manage money, order a credit card, and enjoy smart savings in this gamified money app.

That’s because such applications use AI algorithms to predict the future state of finances based on people’s behavior. In addition, this software offers customized tips for augmenting users’ money habits.

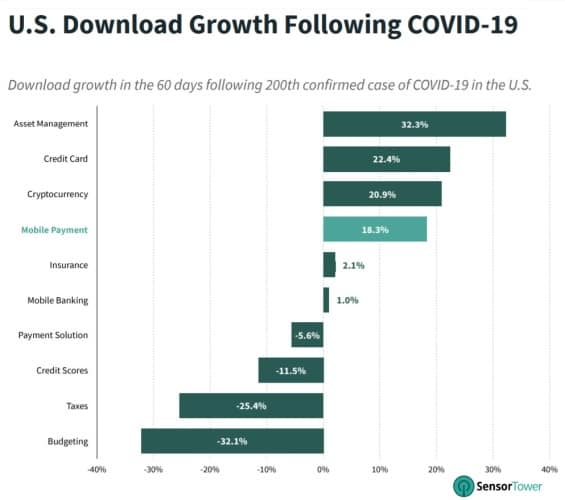

Top 5 Budget Apps for Personal Finances

While reviewing the personal finance software market and considering best budgeting apps, let’s also see what we can borrow from the front runners. If you check the top 50 apps in Finance on the App Store, you’ll see these five mixed in among major mobile banking apps.

To create your own finance app, you’ll need to borrow and creatively reassess a few ideas from these front-runners.

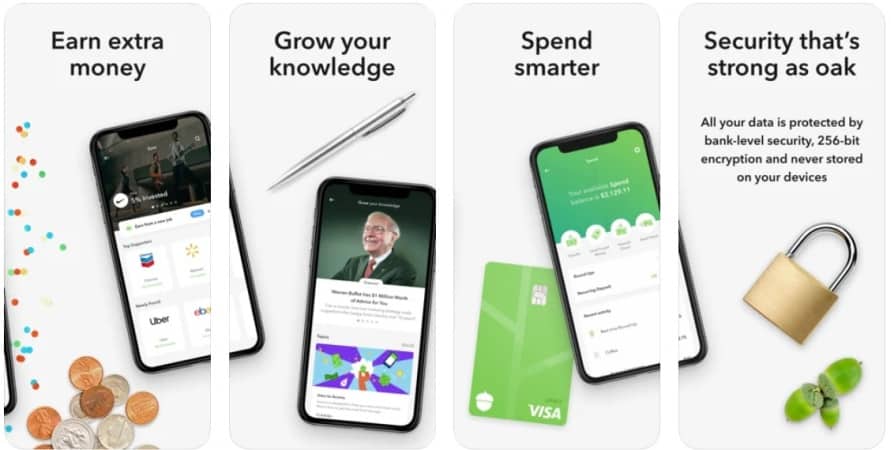

1. Acorns

![]()

Acorns is praised for democratizing investing. The program rounds up each expense to the nearest dollar and invests the spare change. Because the amount is often insignificant, users barely notice the difference. Hence, the app’s general appeal — painless saving.

iOS: https://apps.apple.com/us/app/acorns-invest-spare-change/id883324671

Android: https://play.google.com/store/apps/details?id=com.acorns.android&hl=en&gl=US

Highlights:

- education section with the basics of investing, FAQ, and a glossary

- round-up multiplier that allows users to ramp up their investment tempo by up to 10x

- reward bonuses that are automatically invested when buying from Acorns’ partners

Monetization

Acorns offers paid subscriptions and gets referral bonuses from purchases that app users make from its partners.

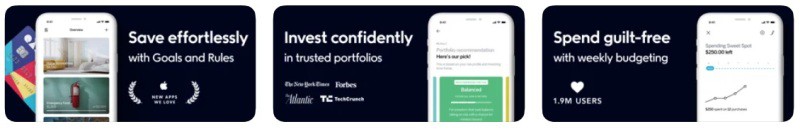

2. Qapital

![]()

Qapital is all about helping users save money, not that much for the sake of saving, but for helping them reach their goals. They can even work towards shared goals together.

Like other apps in this category, Qapital also offers investing options where users can enter an amount and investment period, and the product will automatically invest and diversify users’ funds.

iOS: https://apps.apple.com/us/app/qapital-find-money-happiness/id969977669

Android: https://play.google.com/store/apps/details?id=com.qapital&hl=en&gl=US

Highlights:

- Personalized and shared goals

- Checking account without regular bank fees

- Spending tracker that advises on how to save more

Monetization

Qapital makes money through transactional fees.

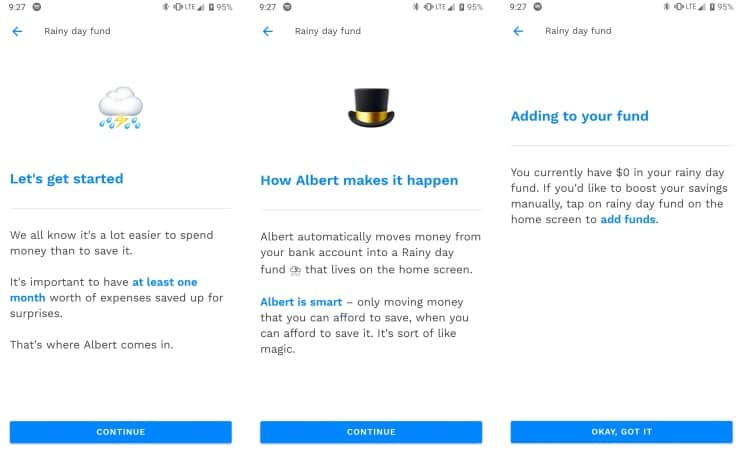

3. Albert

![]()

Albert is a personal finance app with automatic budgeting, savings, guided investing, and more. Practically all of Albert’s features are available for free, but the premium service starts at $4 per month.

iOS: https://apps.apple.com/us/app/albert-banking-on-you/id1057771088

Android: https://play.google.com/store/apps/details?id=com.meetalbert&hl=en&gl=US

Highlights:

- commission-free investments

- human-assisted financial advice

- Savings optimized to reach predefined goals

Monetization

Albert earns from referral fees, partnering with a few lending and insurance service providers. Plus, they offer a subscription for human-assisted guidance.

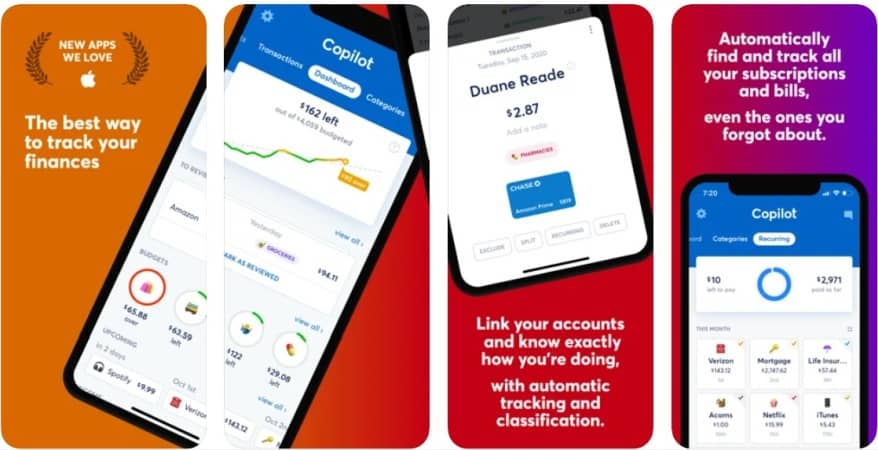

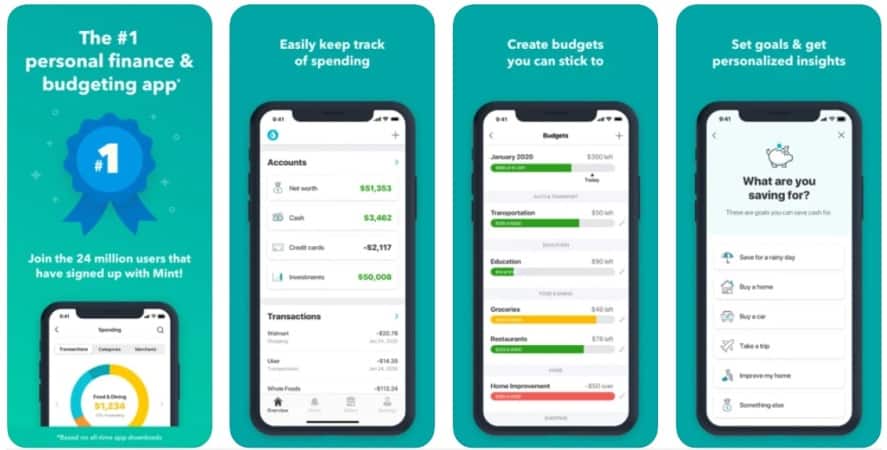

4. Mint

![]()

Mint is a venerable veteran in personal finance apps. What started as a simple expense tracker with categorization has evolved into an AI-enabled financial advisory platform that spans across web and mobile platforms. I believe Mint is a classic example of how to create a budget app and grow into a lucrative acquisition target.

iOS: https://apps.apple.com/us/app/mint-budget-planner-tracker/id300238550

Android: https://play.google.com/store/apps/details?id=com.mint&hl=en&gl=US

Highlights:

Highlights:

- aggregates your bank accounts for a single budget view

- monitors users’ credit scores

- allows to set goals and track investments

Monetization

Subscription for user credit monitoring and referral fees. Mint also monetizes aggregate consumer data.

5. You Need a Budget (YNAB)

YNAB is a classic example of budgeting software that has grown into a cult with an impressive Facebook, YouTube, and Reddit following. What may look like a simple budget management app is, in fact, an entry point for a massive educational platform teaching you how to be smart with your money.

iOS: https://apps.apple.com/us/app/ynab-you-need-a-budget/id1010865877

Android: https://play.google.com/store/apps/details?id=com.youneedabudget.evergreen.app&hl=en&gl=US

Highlights:

- focuses exclusively on budgeting

- ability to track shared budgets with partners

- goal tracking and reports

Monetization

Subscription.

Essential Features for a Budget App

Great! Now that we’ve reviewed a few successful budgeting applications, we can easily discern the features that customers are likely to expect from such solutions. Let’s go through these features one by one and decide if they make sense as we go about making a budget app.

Registration and onboarding

If you think of it, a budget planning app requires quite a few bits of data to register a new user. That includes:

- email and password

- bank account credentials

- basic demographic information

To simplify onboarding, let’s include social media login options via Facebook and Google. Plus, we can postpone gathering demographic details until the user has fully onboarded and feels comfortable sharing it.

Later on, this data will help us customize the app appropriately, based on individual user profiles.

Fetching transactions from bank accounts

I don’t know about you, but I could never force myself to enter expenses manually in one of the early-days budget tracking apps. Fortunately, today we do not need to worry about that when building personal finance software.

Our personal finance app will connect to users’ bank accounts using secure APIs, e.g., Plaid, and automatically fetch all transactions. And for the edge cases, when users pay cash, we should envision a couple of options for quick and easy data entry:

- voice input, e.g., “Hey Siri, please mark in MoneyWise minus $5 for coffee.”

- home screen widget

- image recognition for receipt scanning

Expenses categorization

Once we have user transactions in the application, we’ll need to tag them appropriately. In fact, being able to tell what exactly they are spending their money on is a killer feature for many customers.

So we should let them add custom categories and change the default list of categories. Plus, if we go with the AI and machine learning capabilities, we should make the budget app recognize typical expenses and categorize them accordingly.

A successful personal finance app is built on a foundation of custom mobile software that ensures security and usability.

Budgeting

Budgeting is all about giving each dollar a job. As the financial guru, Dave Ramsey puts it, “You’ve got to tell your money what to do or it will leave.” So we should definitely provide a budgeting option for our customers to plan their spending.

One thing we could do differently while creating a personal finance app is to let people set their budget for a week, two weeks, or a month. And they should be able to set the start and end dates for each budgeting period.

Goals setting

Now we’re getting closer to the juicy parts of our solution. After all, its purpose is to help customers realize their financial goals. Naturally, there should be an option to add these goals to the app.

If you remember, we’ve decided to build a financial app advising customers on products that they can set as their goals. To provide this feature, we’ll need to integrate with specific marketplace APIs like Amazon’s Selling Partner API.

Budget forecasting and analytics

That’s where our AI and ML algorithms really kick in. Based on user spending trends, this technology can automatically determine the likely budget in the near and distant future.

In addition, we should also provide feedback on how users can improve their financial well-being by showing them different ways to save, invest, and cut unnecessary expenses.

Related: Machine Learning App Development Guide for Entrepreneurs

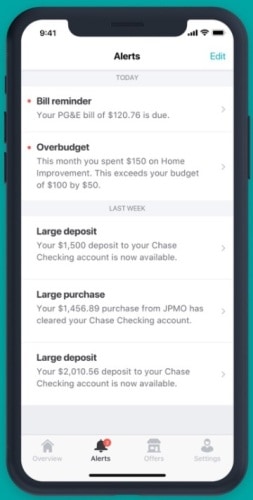

Notifications

Well, of course, we’d want to keep our customers on top of what’s happening with their finances. So, we’d notify them about new transactions, products, goal milestones, etc.

It’s a good idea to split notifications into different groups so that users can turn off notifications that might duplicate messages from their mobile banking apps.

Check out our guide about creating a banking app.

Add-on features

That’s where we really need to get creative and create a financial app with a feature set that will make our solution stand out. Do we want to include in the budget software such options as:

- investing

- scheduled payments

- social competitions

Or maybe we want to allow our customers to access their credit score reports through the app?

We might also consider adding a currency converter and all sorts of calculators: for taxes, credits, etc.

Related: How To Build A Loan Calculator Using Machine Learning

Another fancy feature we might add is support for the voice interface. Wouldn’t it be nice if our users could ask their smart speaker or phone about their current balance and the amount they have till the next paycheck comes in?

For our app, I think I’d also like to implement an AI algorithm that analyzes user spending habits and offers advice on how to save more. Let’s say the machine combs through the user’s recent transactions and finds out she has been spending $5 on a latte every day.

The app would then search for other coffee options in the nearby area and advise the user to switch to a $4 coffee, teasing with a product that the user can afford if she decides to save $1 on each latte.

Choosing the Right Tech Stack

Startups typically opt for cross-platform mobile development frameworks to expedite time to market. At Topflight, we prefer React Native and Flutter. These tools treat our partners’ development budgets gently, even if they don’t need to release to iPhones and Android phones simultaneously.

However, one thing to keep in mind is if you plan on adding advanced options, like ML image or text recognition, you will need Swift and Kotlin experts. So double-check that your mobile engineers are proficient in these technologies, besides RN and Flutter.

To clarify, while the general business logic can still be engineered using the cross-platform frameworks, AI parts of code will be written in Swift (iOS) and Kotlin/Java (Android) and then stitched together with Flutter/React Native code.

The server-side and web software can be built using absolutely any modern tech stack, e.g., MERN, MEAN, or even good old LAMP. We prefer MERN, making the best use of React and Node.js, opting for a microservice architecture.

Also Read: How to Choose the Right Tech Stack

5 Steps to Make a Financial App for Budget Planning in Retrospective

We develop a budget app so that customers can install it from app stores. Let’s track the application’s life cycle backward from when a user has discovered it in Google Play.

Let’s say our custom developed mobile app is in a mobile store, a curious user has found it and is hovering the finger over the Get button. What steps do we take to get here? In other words, “How to make a budget app if we’re going backward?”

Step 5: Add the app to app stores and maintain it

If you’ve never experienced it, app store submission may sound like fun. Well, the reality is that many app owners have to settle quite a few things before their product gets accepted by Apple and Google.

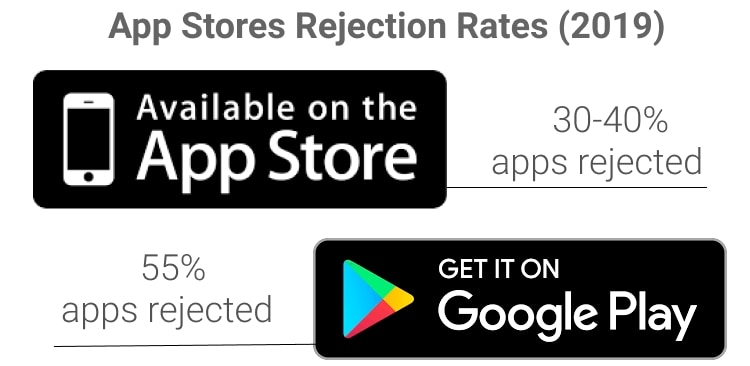

For example, in 2019, Google rejected close to 55% of the submitted apps. For Apple, that number was around 30-40% of applications, which means this step is something everyone should take seriously as they create a finance app.

Of course, that doesn’t mean our app will invariably have a hard time getting into the mobile stores. That only means we need to get familiar with the companies’ app review guidelines.

As for maintenance, we should have proper processes and software setup to ship new versions at regular intervals. In software development circles, we call it DevOps. What this term describes is special servers and practices that help app developers and QA engineers automatically churn out new app versions, verify them, and push them to app stores.

This practice will help us keep the app updated with the latest iOS features and fix issues that sometimes sneak into the app store.

Related: The Ultimate Guide to App Monetization

Step 4: Test vigorously

What do you do before you upload an application to an app store? That’s right, you put it through a proper QA cycle.

I admit, testing is the least exciting part when you develop a personal finance app, but it’s our QA effort that results in a flawless mobile experience for our customers. The final testing that we run before we publish our app should include all sorts of tests: from load balancing and unit tests to edge case testing.

However, it’s important to remember that we should start QA procedures after the very first development iteration. Initiating testing early on in the development process, we guarantee faster final testing.

Related: QA Testing: Best Practices, Steps, Tools, and more

Some of the tools helping us get better QA results include Sentry — a full-stack bug monitoring platform. Sentry identifies and diagnoses errors in code and provides better visibility into probable causes of errors. It’s a perfect tool for personal finance management app development.

Step 3: Enforce security

Even though technically speaking, security is architected and implemented during the development stage, I still want to single it out as a separate step of its own.

There’s no denying that security is paramount in personal finance management apps. We want our customers to feel at ease adding their financial data to the application. Therefore, we need to follow specific guidelines:

- implement bank-grade data encryption

- use secure connections and protocols like HTTPS and SSL

- add two-factor authentication and bio authentication (TouchID and FaceID)

- cut off inactive sessions

- mask data to protect from peeping eyes

- comply with the ISO 27001 information security standard

We should also thoroughly research any third-party library that we decide to use for our app because it may contain vulnerabilities or even backdoors for attackers. Another layer of protection might be a web portal where users can unlink their device from our service and flush their data if they’ve lost their phone or wish to execute their right to be forgotten as per GDPR.

Step 2: Build an MVP

Another step back, and we enter the coding stage. Mobile developers are putting app features together, one by one. Back-end engineers are building the server component for syncing user data and providing web access to the app. Please note that a budget web app is essential these days to develop a financial app capable of generating real traction.

We should carefully consider our tech stack before starting development, though. I’m opting for React Native and Node.js with the premise of reusing code for the web version of the product. We’ll run all AI operations in the back end, so there’s no need for us to stick with native mobile app development tools.

To ramp up the tempo, we’ll use a few well-recommended libraries:

- Firebase or AWS for the back end

- Plaid for connecting to bank accounts

- Yodlee for account verification, data aggregation, and multi-factor authentication

Other than that, budget app development, in its essence, is the translation of a UX/UI prototype into a working solution. So what do we do prior to that?

Related: How to Build a Minimum Viable Product: Everything You Need to Know

Step 1: Design and verify a prototype

That’s right, we are designing and verifying the prototype! Today, users quickly get bored with mobile apps that fail to excite them. So maybe drawing a ubiquitous expense donut is not the brightest idea.

Instead, we should probably think about adding some gamification elements. Something that will keep users coming back to the application. On the UI side, that also means enhancing design with micro animations and offering comprehensive graph-based reports that users can customize by period, category, etc.

Related: Mobile App Design Guidelines

I can’t stress enough how verification is an essential part of prototyping our solution both to create a killer product and optimize costs and how long it takes to develop the app. We need to launch something that’s best positioned to capture users’ attention and keep the churn rate at the minimum. So to achieve that, we should thoroughly test a clickable prototype with test users.

Otherwise, we might flush a ton of money on something we think is outstanding but that customers don’t want to or don’t understand how to use. Prototyping, on the opposite, is the most cost-efficient step in the whole app development process.

Cost of Building a Finance App

What are we looking to spend when building a mobile budget management app? Based on the past fintech apps developed, it would cost around $40,000 – $50,000 to make a personal finance app in its initial MVP iteration.

However, since we’re envisioning a machine learning component, our app’s price tag will probably pop to $70,000 — $80,000. That includes:

- iPhone and Android applications

- visual design

- back end with sync

If you decide to cover more platforms, such as having a standalone web app, a tablet, or a smartwatch app, the cost of personal finance app development will increase.

Related: Understanding App Development Costs

Our Experience in Personal Finance App Development

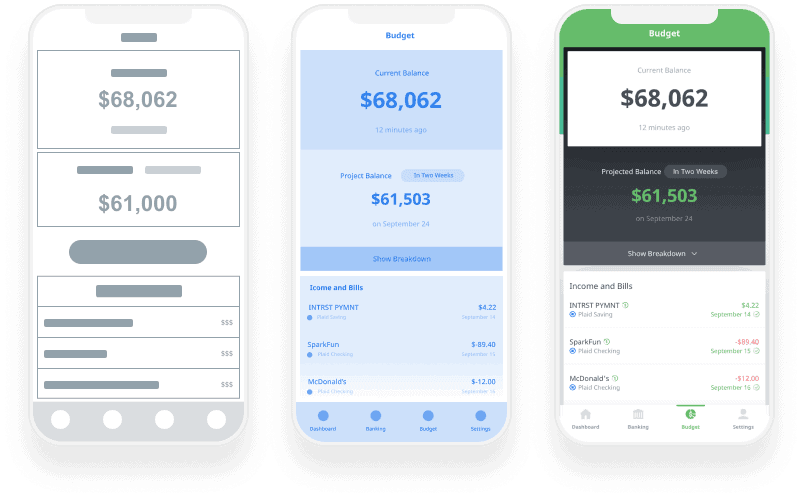

One of the recent exciting apps for budgeting we built was Sherpa.

It’s a smart-budgeting app that analyses user spendings and projects their future budget accordingly. Some of the highlights of this project include:

- Enhanced security: Touch & Face ID, 256-bit encryption, SSL.

- Subscription outside of Apple’s ecosystem

- Stripe payments integration

One thing that makes Sherpa unique is that besides being budget software, it’s also an on-demand marketplace that brings together app users and financial advisors. The user can authorize an advisor to access their budget and spending reports and get professional advice on their finances. Read the case study here.

If you want to create your own budget app and need advice, let’s talk!

Related:

- How to Build a P2P money transfer lending application

- A Guide to Gamification in Banking

- How to Create a Fintech Startup

- How to Build a Neobank

- DeFi Staking Platform Development

[This blog was originally published in October 2020, and has been updated for relevance]

Frequently Asked Questions

How long does it take to build personal finance applications?

2-3 months.

Do I have to apply ML to automatically tag expenses? I'm worries about development costs.

No. You can absolutely do with “normal” algorithms that are not AI-based.

Do you know how to make a financial app that works cross-platform?

Yes, you can use one of the cross-platform frameworks like React Native.

What's the most common mistake startups make when they start a finance app?

Skipping the prototyping phase and going straight into development may cost too much in the end. We recommend verifying your app with real users using a prototype.

How to build a personal finance app:from scratch or using off-the-shelf libraries?

In many cases, it’s a much safer approach to create a financial app from scratch, relying only on well researched and established solutions like Plaid, Yodlee, and some others.

Will I have to change tech stack if I start with developing a budget application for iOS and Android using React Native and later decide that I also need an Apple Watch solution?

Yes. You can’t build Apple Watch software using React Native. Therefore, you’d have to pick Swift. To learn more about these technologies’ pros and cons, we recommend reading our article discussing how to choose between Swift and React Native.

Highlights

Highlights