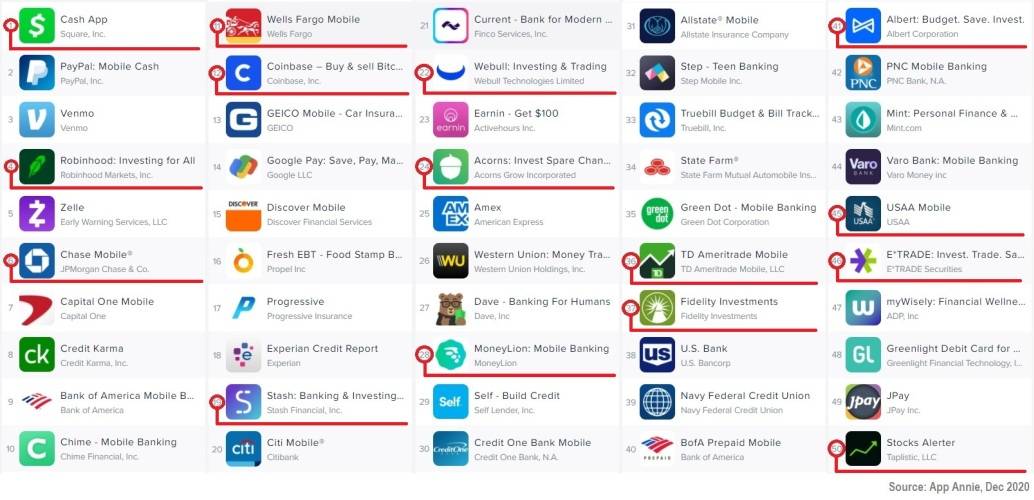

I’ve just dropped by App Annie to check on the top finance apps in the App Store. Guess what? 30% are mobile trading and investment apps.

Most of these apps focus solely on investing, while others represent mobile banking apps and offer investing as an add-on feature.

Still, one third seems like a reasonable incentive to invest in stock trading app development. What do you think? Hopefully, you agree and wouldn’t mind getting a second opinion on things you need to consider when building an investment platform.

Top Takeaways:

- Stock trading app development starts with creating an investment platform — a back-end system working with stock exchanges and other services to populate a mobile investing app with data.

- How to create a stock market app as fast as possible? Use trading APIs by Yahoo Finance, Zirra, or similar stock metrics providers.

- Stress testing can’t be overestimated during trading platform development if you want to create an app like Robinhood because a surge of new users can bring trading to a screeching halt.

- Stock Trading Apps Market Overview

- Why Should You Invest in Stock Trading Application Development?

- Types of Stock Trading Software

- Top 3 Most Successful Stock Trading Apps

- How do Stock Trading Apps Work?

- Stock Trading and Investment App Features

- Regulatory Compliance for Stock Trading Platforms and Applications

- Start a Trading Platform in 5 Easy Steps

- How Much Does Stock Trading Application Development Cost?

- How to Monetize a Stock Trading App?

- Our Experience in Trading Software Development

Stock Trading Apps Market Overview

Trading apps have been on the rise lately. People feel an opportunity to get rich using the market volatility in these rollercoaster times with helicopter money. So if you create an investment app, you’ll equip them with an ideal tool. Yes, a mobile investment app is a no-brainer by all means.

Can we find other signs of the growing popularity of stock trading software?

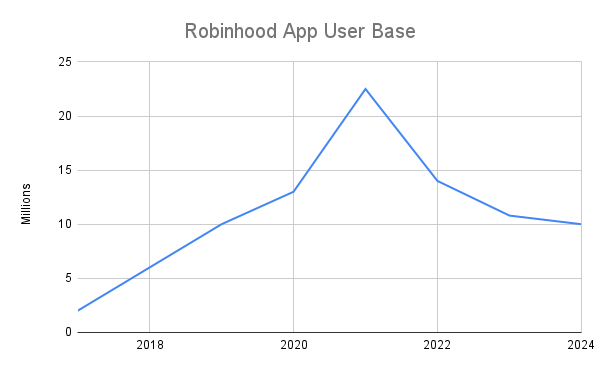

Rapidly growing user base

Here’s a good one: since 2017, the Robinhood app — one of the most popular commission-free trading apps — has been growing by 4 million users each year between 2017 and 2020, reaching 13 million active users. Then the number surged to 22.5 million in 2021 and bounced back to 14 million in 2022, further decreasing in 2023 to 11 million.

As of February 2024, more than 10 million user keep trading in the Robinhood application. More importantly: assets under the platform’s management soared past the $100 billion mark, nearing the heights seen during Robinhood’s peak in meme stock trading. So, the reverse trend after the long bear market is obvious – so the user base of stock trading applications is expected to explode again. Probably, a good time for trading platform software development.

A few other facts of the rising demand for trading apps:

A few other facts of the rising demand for trading apps:

- Predictions indicate that the worldwide online trading market is expected to expand at a compound annual growth rate (CAGR) of 6.4%, reaching an anticipated value of $13.3 billion by 2026, up from approximately $10.21 billion in 2022.

- As of 2023, the stock market saw participation from 61% of adults.

- Today in 2024, automation accounts for over 80% of stock market transactions (that’s why it makes sense to consider AI options for stock market software development).

Leading mobile banking apps adding investment options

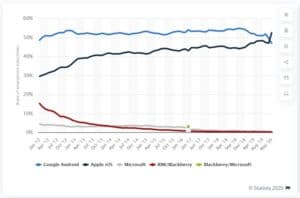

Even by the looks of the App Annie charts, it’s evident that traditional banks with state-of-the-art developed mobile banking apps are slowly adding online investment features into their mobile apps:

- either directly as Wells Fargo Mobile or Chase Mobile

- or via stand-alone apps, e.g., Bank of America – MyMerril App

If this fact alone doesn’t make you want to start your own trading platform, let’s go a little deeper.

Also Read: Gamification in Banking: Tips, Best Practices and More

Why Should You Invest in Stock Trading Application Development?

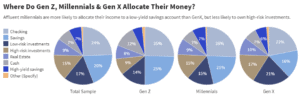

Investopedia has recently surveyed 1,405 millennials and their Gen X and Gen Z counterparts. The survey revealed these exciting stats:

Only 23% to 38% of their money is invested, and almost half of their income stays in checking and savings accounts. Do you see the potential here?

Types of Stock Trading Software

If you want to make a stock trading app, there are different options available. Let’s skim through the most apparent variants you’re likely to face when deciding to create a trading platform.

Trading software by platform

Depending on your target audience’s preferences, you can create a trading app for web and mobile platforms; or else, desktop software is an option. The mobile trading app may look and feel differently on smartphones, tablets, and smartwatches.

Some of the serious market players cover as many platforms as possible. Take the Fidelity trading app, for example. It’s not just an app for iPhone and Android phones. The company has significantly invested in trading application development, and its customers can also access their products on:

- Apple TV and Apple Watch

- iPad and Kindle Fire

- Google Assistant and Amazon Alexa

- mobile web

I’m not saying you should cover all platforms when you develop a trading app, but be cognizant of your target audience’s preferences.

Mobile investing applications

Mobile apps have become the preferred platform for individual investors because of the convenience and accessibility they offer. They provide real-time data and an intuitive user interface that allows investors to manage their investments on the go.

They typically feature push notifications for instant updates about market volatility, a customizable dashboard for tracking favored stocks, and even educational content for novice investors. Examples of these are Robinhood, E*Trade, and Fidelity’s mobile app, which provide a great deal of functionality, allowing individual investors to buy and sell stocks, monitor their portfolio, and conduct research, all from their smartphones.

Web platforms for pro traders

Web platforms, on the other hand, offer a more robust range of features and tools ideal for both individual and professional traders. These platforms usually have more complex charting tools, the ability to handle larger volumes of data, and often include features such as real-time news streams and technical analysis tools.

Examples include TD Ameritrade’s web platform and E*Trade’s web application. These platforms are easily accessible from any computer with an internet connection, making them highly versatile.

Desktop-based investing software for pro traders

Desktop applications are the platform of choice for professional traders and investors. These programs provide the most comprehensive set of trading tools and capabilities, including sophisticated charting and analysis tools, automated trading systems, and advanced order types.

They often offer subscription-based services, providing premium data and features for serious traders. An example of this kind of platform is the Bloomberg Terminal, which provides a plethora of data, news, and analytical tools that professional traders use for decision-making. This platform is also known for its messaging network, allowing for communication between Bloomberg users.

Also Read: Smart Watch Wearable App Development Guide

Day trading vs. investing

Another prominent trait of such applications is that some are more suited for day trading while others are more optimized for long-term investing.

Some trading apps like M1 Finance don’t allow users to trade the same stock more than once per day, making day trading with such solutions in effect non-existent. Instead, users may pick such apps for investing.

Other apps like TD Ameritrade or E*Trade are ideal for day trading while also combining the features you’d expect from user-friendly apps focused on long-term investments. So be mindful of your customer’s needs when you make a stock app, e.g., consider adding commission-free trading or short-term e-trade options for precious metals.

Educated vs. novice investors

Finally, some mobile electronic trading platforms are best suited for novice users. Here I’m talking about apps like Acorns, Stash, or Robinhood. On the other spectrum, there are more advanced platforms like Ameritrade and Power E*TRADE that will take some time to learn your way around.

Things you’d expect from the trading apps aimed at newcomers include lots of educational materials and primitive robo advisors. In contrast, professional investment apps focus on offering advanced options like custom and four-legged spreads. Make sure you account for that when you build a stock app.

Key Elements of Cutting-Edge Pro Investing Applications

- Advanced charting and analysis tools: These allow users to visualize data in a way that can aid in making informed investment decisions.

- Automated trading systems: These platforms often have algorithms in place that can execute trades based on user-defined criteria.

- Advanced order types: This could include limit orders, stop orders, and trailing stop orders.

- Subscription-based services: Many professional platforms offer premium features and data to users for a monthly or yearly fee.

- Real-time news streams: Keeping users updated with real-time market news and updates.

- Technical analysis tools: These are used to predict future price movements based on historical data.

Exciting Features of Lite Investing Applications

- Intuitive user interface: These apps are designed with simplicity in mind to cater to users who may not have a deep knowledge of trading.

- Educational content: They often feature guides and tutorials to help novice users learn about investing.

- Push notifications: Users can receive instant updates about market volatility and changes in their stocks.

- Customizable dashboard: Allows users to keep track of their preferred stocks.

- Robo advisors: These automated advisors provide investment advice based on the user’s financial goals and risk tolerance.

- Commission-free trading: Some of these apps offer free trades to attract new investors.

Top 3 Most Successful Stock Trading Apps

I think a great exercise on your way to online trading solution development is to check up on the leading apps in this segment. We might as well discover a few things worth borrowing and adjusting for our own mobile investment solution.

Robinhood

Founded: 2013

Description: Robinhood is one of the most popular fintech apps of the decade. The app has drawn a lot of attention since its very early days, when they piled up a million users on their waitlist, to the present days when they are well over 13 million users. I suggest that you draw inspiration specifically from Robinhood’s ease of use when you start to create your own trading platform.

Highlights: Robinhood was the first app to introduce commission-free trading. As a result, many of their competitors, including Schwab Mobile and E*Trade, followed suit and canceled or reduced their trading fees.

Pros:

- fractional shares

- intuitive user interface

- trading cryptocurrency

Cons:

- No support for retirement accounts

- no investing in funds or bonds

- subpar customer support

Acorns

Founded: 2012

Description: Acorns takes a different take on investing while still targeting novice traders and investors, optimizing their flow of funds. This trading app offers portfolio management based on the user’s age, risk tolerance, income, etc. And the best part is the investing business model works on autopilot: every time users make a purchase, Acorns sends the change to their investing account. Here’s more on Acorns vs Robinhood vs Stash.

Highlights: The app helps users create a strong habit of regular investments, focusing on long-term savings. They also partner with companies like Lyft and Airbnb to offer the cashback that automatically gets reinvested.

Pros:

- support for Roth and traditional IRAs

- only $5 to start investing

- automatic investing

Cons:

- no tax strategy

- not a huge portfolio mix

- monthly portfolio management fee

TD Ameritrade

Founded: 1975

Description: Ameritrade has been on the market for over 4 decades and, therefore, represents one of the most established trading platforms. The company has several mobile trading apps and personal assistant-leveraging tools that make it easier for both novice and experienced traders to follow the market. If you’re looking for a prime example of a professional trading platform, this is it.

Highlights: Ameritrade is available on as many platforms and mobile devices as one could hope for, including two separate mobile trading applications, a smartwatch app, besides a desktop and a web application.

Pros:

- free market research

- great customer support

- traditional stocks and mutual funds

- thinkorswim app for advanced traders

Cons:

- high margin rates

- high options commissions

Related: Other Fintech App Development Guides:

- How to launch a neobank

- How to develop a loan app

- How to build a personal finance app

- Developing and Deploying: Smart Contracts on Ethereum

- Crypto Token Development

- Crypto Exchange Platform Development

How do Stock Trading Apps Work?

In today’s fast-paced financial markets, stock trading apps have become indispensable tools for investors and traders. These apps streamline the process of buying and selling stocks, making it accessible to anyone with a smartphone.

But how exactly do these platforms function? Let’s delve into the mechanics of how to develop trading apps that empower users to analyze market trends and make nimble investment decisions.

- User Registration and Verification: Users must sign up and verify their identity to ensure a secure trading environment.

- Real-Time Market Data: Access to up-to-the-minute market data enables users to analyze current trends and make informed decisions.

- Trading Features: Users can place buy or sell orders, which the app processes by connecting to stock exchanges.

- Portfolio Management: The app allows users to track their investments and view their portfolio’s performance over time.

- Educational Resources: Many apps include tutorials and resources to help users understand trading concepts and strategies.

- Notifications and Alerts: Customizable alerts keep users informed about significant market movements or changes in their portfolio.

By streamlining these functions, stock trading apps democratize access to the financial markets, allowing more people to participate in trading activities.

Stock Trading and Investment App Features

What key features do customers expect from a decent trading app? There obviously needs to be something unique for them to switch gears or start their investment journey with your solution. Still, what bare minimum do you need to foresee while developing a trading platform to spark their interest?

Authorization

To invest, you’ve got to let users in, right? The simplest thing to do is enable whatever bio authentication is supported by the smartphones you’re targeting: Fade ID, Touch ID, or their counterparts on Android phones. In addition, you must add two-factor authentication (via a phone number, email address, or an auth app) for enhanced security and better user data protection.

On the other hand, you’d also like to gather some user data to create their personal profile in the back end. That’s something that can help you devise the most efficient tactics for making them invest more, on a more regular basis, etc. One thing to do so is by analyzing their social profiles and allowing them to log in using their Facebook or other social media accounts.

Plaid API Integration

A crucial part of the onboarding process in an investment app is adding users’ bank accounts. You can do that by integrating with the Plaid API. The tool has already become a virtual means for securely connecting bank accounts with fintech apps. I’d go so far as to say that you can’t build an investment platform working with fiat money without Plaid or direct bank integrations.

Profile

The user profile is where we can always sweep all the secondary stuff that doesn’t have to be front and center all the time:

- trading history

- settings and subscriptions (if any)

- help

Homescreen

Users need some sort of a home screen or a dashboard where they see the amount of money they’ve invested and whether their investments are growing or not.

That’s also where we can show them the stocks and other securities they own and their buying power, i.e., a money account to purchase stocks.

Robo-advisor

The simplest roboadvisors are simply surveys that use basic algorithms to identify the user’s investing profile and suggest the corresponding investment options. Some trading apps go as far as adding human advisors, but a mini robo-advisor will absolutely do at the start.

Also Read: Robo-Advisor Development Guide

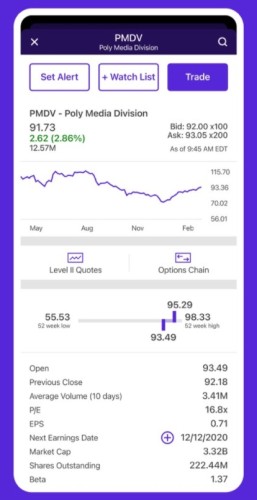

Trading

The focal point of any investment application is the ability to easily sell or buy a stock or other financial instruments. Users expect to see a line or candlestick chart for a given stock, read about the company, and see any additional relevant info. For example, in Robinhood, they show:

- other stocks people often buy

- company details

- earnings

- analyst ratings

- news & research reports

That’s also where users might want to add a stop-loss price to automatically sell a stock when it reaches a certain price.

Adding fees on trading transactions in the back end is how many investment applications make money. However, that’s not mandatory. You could also explore other monetization models, e.g., getting compensation from market-maker partners.

Newsfeed and social feed

The newsfeed is where users digest market news relevant to their stock choices. In addition, we can add a social feed with other users’ comments, investment portfolios, etc., effectively turning our trading app into a social investing experience. That’s how you can make a trading platform most engaging for newcomers.

Search and filters

Users need a robust and at the same time streamlined search tool for stocks and options. A decent search feature will take into account that the user may be looking for a stock by a company name, not necessarily by their symbol: Apple for AAPL.

Favorites and stock discovery pane

One other major section to foresee when we create a stock market application is analytics and grouping of stocks based on what’s trending, what’s most stable, etc. Users can easily add a stock to favorites and review it later.

Notifications

Most often, push notifications in trading apps have to deal with tracking stock prices or fire off when a buy/sell order has been completed.

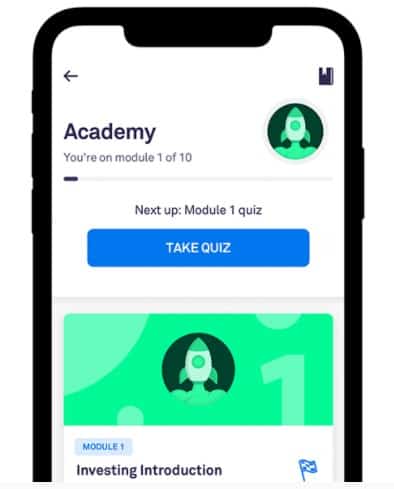

Trading 101

Many modern investment apps choose to include educational resources right into the app. Newcomers may watch videos, read blogs, and even evaluate their learning with quizzes.

Also Read: How to develop a blockchain app

How to Create an Educational App

Extra nice-to-haves

Most of the trading apps didn’t have these features upon their initial launch, but you may still consider adding:

- fractional shares

- dividend reinvestment

- retirement account

- limit/stop/trailing stop orders

- widgets for the home screen

Hopefully, this list of features will help you hit the ground running as you start a trading platform.

Regulatory Compliance for Stock Trading Platforms and Applications

To market an investment or trading mobile app, a company needs to register as a broker-dealer. Naturally, this comes with red tape related to regulatory compliance. If you are planning to allow your app users to invest in and trade stocks, you have to consider:

- Know Your Customer (KYC)

- Anti-Money Laundering (AML)

- Customer Identification Programs (CIP)

Broker-dealers working on custom trading software development are regulated by the U.S. Securities and Exchange Commission (SEC) and self-regulatory organizations, such as FINRA (Financial Industry Regulatory Authority).

Other self-regulated organizations include:

- MSRB (Municipal Securities Rulemaking Board)

- CBOE (Chicago Board Options Exchange)

- NFA (National Futures Association)

So if these acronyms are not scary enough (although regardless of this fact, we recommend you get a lawyer before you get the ball rolling), let’s see what legal steps you’ll be taking to start your own trading platform. You’ll need to:

- Register with the SEC

- Become a member of FINRA

- Become a member of Securities Investor Protection Corporation (SIPC)

- Comply with a state’s stockbroker regulations

That’s just the tip of the iceberg. As you can see, there’s plenty of paperwork to take care of before you build a trading platform, or build any fintech app for that matter, and it becomes a reality for your customers.

Related: How to build a fintech app in record time

Fortunately, these regulations-related matters can go in parallel with stock market app development.

Develop a Trading Platform in 5 Easy Steps

Here’s a good reason why I’ve been calling the same thing an APP and a PLATFORM: you can’t make a trading app that exists on its own, without a platform behind it. The platform makes the app run and provides business owners with levers to manage the core features and contents of a trading mobile application on Android and iOS. Therefore, we’ll need to create an investment platform, then make a stock market app and connect both during product development.

Ok, ready to create a stock trading app?

Step 1: Platform vs. Mobile App

In this case, a platform is a piece of software running on the back end, aggregating stock market data along with user transactions and everything else that happens in the stock app.

Theoretically, you could build a stock trading app working directly with stock market data via APIs, but that’s akin to going into this with blinders on.

- You will have to code the logic each time you need to cover a new platform (iOS, Android, iPadOS, etc.)

- Every time there’s an update, you’ll need to spend the same amount of time to update each platform

- Testing a live environment will be a nightmare

So if you want to create an investing app, you should know that you’ll be working on an investing platform in effect.

Related: Mobile or Web App: How to pick the right one?

Speaking of the platforms, iOS and Android seem like a no-brainer. Both platforms pretty much own the U.S. smartphone market:

This is precisely why joining forces with trading platform developers who boast expertise across various the iOS and Android mobile platforms isn’t just smart—it’s essential.

Step 2: Mobile-First Approach in Design

Since you’re building a mobile trading solution, it’s vital to wield the mobile-first design approach. This means the app’s UX/UI should address typical mobile user needs, e.g., micro-interactions, glimpse views, limited screen space, instead of trying to fit numerous features often found in web-based stock trading applications.

Even if your goal is to create an online trading platform and then adjust it for mobile, it’s crucial to keep the mobile-first design perspective in view.

We also always recommend doing a rapid prototype and then running a user testing session to discover how well the product serves its user. It’s often during rapid prototyping, which includes user testing when we discover UX/UI design gems that help to turn a mobile app into a 5-star experience.

For instance, do you know how many investing apps support the landscape mode for charts? And that’s just one example of using the right technology as a step towards a more engaging user experience.

Remember, there are people out there for whom your trading platform is just a market graph app. Therefore, you need to adjust the design and tech to work well for their purposes.

Related: The Complete UI/UX Guide to Designing a Winning App

Step 3: Technical aspects: APIs, SDKs

The next big thing when you make trading software is to hook the app with a stock market data feed to get real-time stock quotes, indices, commodities, currencies, etc. The stock market application development process can be pretty convoluted, but here are a few things to consider.

Some of the most popular stock market APIs include:

Some APIs excel at serving constantly updating trading data, real-time alerts, while others focus on crypto, exchange rates, and historical data. Here’s a decent list of trading APIs.

Some APIs, such as Finbox or Tradier, besides providing stock market feed, offer stock metrics and research functionality. Others, e.g., Alpaca, help trading startups by taking care of the banking (investment accounts) and regulatory complexity.

Choosing Trading APIs

Our development team (including Android and iOS developers) looked into the following APIs when doing technical analysis for investment software development:

- APEX Clearing

- Alpaca

- Interactive Brokers

- DriveWealth

Each of these companies offers comprehensive documentation and consulting services on implementing their trading APIs into mobile and web solutions. You can expect to have such features as fractional trading, pre-market & after-hours trading, portfolio management, margin trading, advanced orders, tax reporting, and much more. Some, like Apex and Alpaca, even offer crypto trading options. That’s becoming a trend lately in trading system development platform.

Another upside to using one of these trading APIs is they all provide:

- real-time market data

- secure multi-factor authentication

- support for business accounts

It goes without saying that trading APIs integration takes place during automated stock trading software development. And by the way, there are no constraints on a programming language you want to use to create a trading application: Swift, Kotlin, React Native, Flutter. It’s totally up to you and your business analyst.

Related: HIPAA Compliant video conferencing: SDKs and APIs you need

Choosing the right tech stack to build a winning app

Step 4: Testing

It’s really hard to underestimate the testing stage when you’re custom developing an app like Robinhood. Did you hear about those Robinhood outages throughout 2020? One of the main reasons was their back end (aka server infrastructure, aka platform) wasn’t ready for a flood of new users.

Financial technology doesn’t tolerate bugs because people can lose money. For instance, Robinhood had to compensate out of their own pocket to make peace with customers.

Therefore, testing an app for UX and algorithm issues is one thing; and stress testing to identify the number of transactions your trading system can process per second is quite another.

To ensure the trades are error-free, you and your QA engineers can use special tools like Sailfish, specifically designed for exchange, MTF, and broker systems testing.

Related: QA Testing: The Complete Breakdown

Step 5: Maintenance

Final rounds of testing are always followed by a release, which is pretty basic compared to what you’ve already done. Apps are uploaded to the mobile stores (Google Play and/or the App Store) and hooked with the production server environment.

That’s when the (hopefully) everlasting phase of stock trading application development takes place. From that moment onwards, you’ll need to keep your app up-to-date, for different reasons:

- to weed out bugs caused by updates in third-party APIs

- to beef up the app with new features

- to support the latest features of new mobile OS versions

It should be noted that you should always have a test sandbox environment for testing purposes and a separate production environment when you build a brokerage app.

In this scenario, all new features and fixes make it to the app’s users only after thorough testing, without affecting real money.

One word of advice is to check with your development company if they have established DevOps procedures. This helps with bringing the changes to users quicker and more consistently. Your project manager should keep you up-to-date on investment platform development progress throughout the project.

User engagement / competition tracking

Maintenance also involves tracking how users interact with your trading application. By using automated platforms like Google Analytics or Mixpanel, we can discover if customers have any issues navigating our software, or if they need additional features to get more value out of the trading software.

Besides user engagement tracking, we shoul also make use of ASO and competition monitoring. Fortunately, we can use dedicated platforms for this too. For example, data.ai allows us to monitor how well the application performs in the App Store and Google Play and what our competitors are doing to outperform. This ASO practice goes well beyond working with keywords. Get in touch if you need help with that.

This pretty much wraps up how you can build your own trading platform.

How Much Does Stock Trading Application Development Cost?

We can develop trading software on a lean budget of around $69,000 and then continue building it into a full-featured product, staying somewhere within the $199,000 region.

Related: Hiring the right developers to build a winning app

We know that you need to get buy-in from investors before you go and build a stock trading platform. So we suggest doing a rapid prototype first. The initial cost is very flexible and is around $15,000-$20,000. You get an interactive clickthrough prototype that you can take to investors, already knowing what kind of user traction they can expect based on user testing.

This is the secret sauce we used to help startups raise $165 million to date. It not only helps validate your idea from real users, but also helps reduce investment app development costs in the long run. We’ll be happy to share the knowledge with you, especially if your app idea is genuinely innovative.

To give you a better idea of a min budget that will get Topflight engaged into buidling a delightful PoC or MVP experience for mobile trading software, this starts at $60,000 – $80,000. I also encourage you to talk to our bot (bottom right corner) for more info on pricing of our agile design and development services.

How to Monetize a Stock Trading App?

Monetizing a stock trading app is crucial for its sustainability and growth. With the right strategies, these apps can generate substantial revenue while providing valuable services to users. Let’s explore some effective monetization methods that can transform your app into a profitable venture.

Subscription Model

- Offer basic features for free and premium features under subscription plans.

- Implement tiered subscription levels to cater to different user needs and budgets.

In-App Purchases

- Enable users to buy advanced trading tools or unlock additional features.

- Offer access to exclusive market research reports or advanced analytics.

Advertising

- Integrate targeted advertising tailored to the interests of the financial community.

- Partner with financial institutions or fintech companies for sponsored content.

Custom Trading Platform Development

- Develop bespoke trading platforms for institutional clients or niche markets.

- Generate revenue through development fees and ongoing support services.

Create Trading Software Tools

- Design specialized trading algorithms or risk management tools for advanced traders.

- Offer these solutions on a subscription basis or through one-time licensing fees.

By implementing these monetization strategies, your stock trading app can not only serve your users but also become a significant source of revenue. Whether it’s through custom trading platform development or creating exclusive trading software, there’s a wealth of opportunities to explore in the fintech space.

Our Experience in Trading Software Development

We’re just wrapping up the development of an investing and wealth management application for a major brand that is on its way to democratize retail investing for a huge market. While the project is under NDA as the team puts final touches, and I can’t disclose any details at the moment, I can assure you the app includes a well-balanced mix of the features we discussed in this blog and some of the client’s know-how, which we framed together into a solid tech and UX/UI framework.

Update as of July, 2023: We can finally lift the NDA curtain and reveal the investing app we’ve been working on. Check out this video:

And read up on the project in this case study.

If you’re into crypto, you can read about a decentralized exchange we built for a metaverse game in this case study.

Book a call with our experts to learn more about rapid prototyping and how it can help you succeed.

Related Articles:

- How to Create a Fintech Startup

- Crypto Trading App Development Guide

- How to Build a Crypto Trading Bot

- Crypto Wallet App Development

- DeFI App Development Guide

- How to Build a Cryptocurrency Exchange

[This blog was originally published in December 2020, and has been updated for more recent information]

Frequently Asked Questions

How long does it take to create a stock trading platform?

Between 6 and 9 months.

Where do I get live data from a stock exchange for my trading app?

You can use special stock APIs like Yahoo Finance or Alpha Vantage.

What size of a team do I need to create a trading software?

While you can start with just a couple developers: one handling the back-end and the other working on the mobile app, to develop a full-blown app you’ll need a bigger team with UX, QA, and DevOps talent besides full-stack developers.

What is the most essential part of developing an investment app?

Ideally, you will have several development environments. The first one is a live production environment — the app your users download from the App Store and Google Play, and the back end powering the whole magic. The second is a test environment that replicates the live one but doesn’t deal with real money. Finally, there’s also a development environment where you build a trading app test version and run early QA.

What is the most obvious thing most trading app developers miss when they make automated trading software?

It’s funny how most of these apps don’t support the landscape mode.