If you are wondering how to create a crypto token — whether to boost your DeFi app, raise money for app development, or chase other goals — look no further. I’ll explain how you can create your own crypto token, even if you don’t know much about blockchain technology.

Yes, those headline-making crypto coins like Dogecoin ($0.25) and tokens like Aave ($299) started with an idea, “Why don’t I make a crypto token? It’s gonna be fun!”

While some crypto investors would probably argue about the fun part, we still live in a brave new world of cryptocurrencies and decentralized finance. So why miss the opportunity?

Top Takeaways:

- You can create either a crypto coin or a token. There can be only one coin per blockchain, and you make it when building a new blockchain. Tokens are plenty, and they are easier to develop.

- Any crypto token is essentially a smart contract living on a blockchain. So you need to implement a smart contract according to certain token standards, which depend on a blockchain if you want to make a token.

- The most common use case for creating a crypto token is to incentivize users to participate in your DeFi or another decentralized app more actively.

Table of Contents:

- Coin vs. Token Primer

- Key Features of a Token

- Common Misconceptions about Crypto Tokens

- Use Cases for Creating a Crypto Token

- Ready-made autions to Create Your Own Token

- How to Create a Crypto Token in 4 Steps

- How Much Does It Cost to Make Your Own Cryptocurrency Token

- Is it Legal to Create a Crypto Token?

- How Topflight Apps Can Help in Creating a Crypto Token

Coin vs. Token Primer

Let’s get you up to speed on what crypto tokens really are. In the intro, I’ve mentioned Dogecoin and Aave. The former is a coin, and the latter is a token. What’s the difference, and why does it matter?

| Quick reminder: a blockchain is like a public, shared spreadsheet that keeps a transparent record of all transactions happening on the chain and validates them by having its participants solve complex math equations. |

A crypto coin is, so to speak, the main currency on a blockchain. For example, Ether (ETH) is the underlying currency on the most popular blockchain called Ethereum. Every blockchain needs a crypto coin acting as money to fund transactions and any other interactions with a blockchain.

| Quick reminder: a DeFi app is any software running on a blockchain that empowers users with financial features without having central ownership. Hence, decentralized finance. |

In addition to having coins, some advanced blockchains, such as Ethereum or Binance Chain, also support cryptotokens. These tokens can be issued by anybody according to a blockchain’s standards. When you lend, exchange, send or perform any other actions with a cryptotoken, you pay for it using the blockchain coin.

To this extent, the main differences between crypto coins and tokens come down to this:

| Crypto Coin vs. Crypto Token | ||

| Crypto Coins | Crypto Tokens | |

| Purpose | Fund any operations on a blockchain | Bear their own value and specific utilities tied to a project on a blockchain hosting them |

| Quantity | Only one per blockchain | Multiple tokens can exist side by side on the same blockchain |

| Price | Traditionally higher compared to tokens | Lower than the price of a blockchain’s coins |

| DeFi participation | required for the correct functioning of any decentralized finance application; can be swapped, sent, received, traded, etc. | can be exchanged, traded, etc. like coins, may be required for specific DeFi applications |

| Examples | Bitcoin, Ether, ADA | BAT, Aave, UNI |

As you can see, coins and cryptotokens differ significantly, and there’s a higher chance you’ll be interested in developing a cryptocurrency token.

| Quick reminder: an altcoin is a simple term to call any cryptocurrency, whether a coin or cryptotoken, other than Bitcoin. |

With the knowledge gained here, you might be inspired to create your own token, and understanding the nuances of token creation is a crucial first step.

Key Features of a Token

So, we’ve established that anyone can create their own crypto token, virtually on any blockchain, except for the bitcoin blockchain that only supports its works using Bitcoin — the crypto king of all digital coins. Alas, you can’t create a bitcoin token, but stick around for a workaround. I’ll share it later.

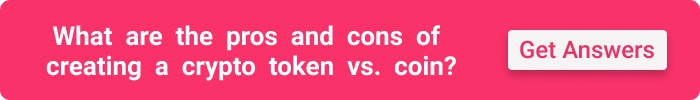

As a result, we now have somewhere between 6,000 and 9,000 cryptotokens. One popular crypto tracking resource counts a little over 13,000 tokens.

Tokens exist to transfer value around specific blockchain projects that gave them birth. For example, BAT (or basic attention token) is a crypto token that anyone can earn by browsing the web through the Brave browser and then spend it by tipping creators or exchange it for fiat money or other cryptotokens.

By the way, don’t be discouraged by the sheer number of these crypto tokens/currencies. You’d be surprised, but the success of your own crypto absolutely depends on how you will engage the crypto community. For example, 2024 bull (or pre-bull, Spring) is all about wild meme-coins that have seemingly no value or utility. Some seemingly random coins make some crazy X’s, and in the background a well-oiled social-media mechanism of crypto fans and influencers keeps humming.

What features, or rather properties, do these tokens have that you need to be aware of?

Blockchain-specific

First of all, you can create a new crypto token for different blockchains. At first sight, there seem to be quite a few chains to choose from. At the beginning of 2021, there were around 30 blockchains on the market.

Each one has specific rules and standards for developing crypto tokens. Furthermore, cryptotokens may have different features depending on where they put their roots. How do you pick a blockchain that will be home to your token?

| Quick fact: despite their growing numbers, crypto tokens are still youngsters in the world of technology. Google “1 BAT to USD”, and you won’t get an auto-prompt like you would, say, for “1 euro to USD”. Google won’t bother to add this feature until enough people start searching. To be fair, bitcoin (BTC) and ether (ETH) auto-prompts already work. [NB: as of Feb 2023, Google has already caught up on BAT/USD; try “1 SOL to USD” instead.] |

If I decide to create my own crypto token, it’s crucial to understand the technical intricacies involved, particularly the different blockchain standards and protocols that will shape your token’s properties and functionalities.

Fortunately, to a business owner like you, the question of which blockchain to choose is not so intimidating. You go to where you get mass adoption, right? In this sense, the whole blockchain ecosystem, particularly crypto tokens, is still nascent.

Visit a chain explorer site like Blockchair. You’ll quickly discover that Ethereum currently trumps all other blockchains, both in terms of total and per-second transactions. On top of that, the Ethereum chain has approximately the same amount of active wallets as Bitcoin.

Visit a chain explorer site like Blockchair. You’ll quickly discover that Ethereum currently trumps all other blockchains, both in terms of total and per-second transactions. On top of that, the Ethereum chain has approximately the same amount of active wallets as Bitcoin.

That’s the reason why most crypto tokens (aka ERC-20 tokens) live on Ethereum. That’s where many successful coins started too. For example, the Binance Coin (BNB) was first developed as a crypto token on Ethereum and then migrated to its own chain, where it became a crypto coin — the queen of the Binance chain.

The chances are, you’ll want to build your own token on Ethereum, too, simply because the chain has already onboarded a lot of users.

Related: How to develop a cryptocurrency wallet

Different species

The second thing you need to know about tokens is that they, too, can be different. Generally speaking, there are three big cohorts of crypto tokens:

- payment

- security

- utility

Payment tokens are the simplest form of cryptotokens. As the name suggests, they exist solely to allow users to transact without offering extra functions.

You’d think that security tokens are used for enhancing the security of a blockchain app (at least that’s what I thought when I first discovered them). However, these cryptotokens fall more into the group of financial instruments. Any token that’s considered an investment tool can be regarded as a security token. Users can often stake them, which means they freeze a certain amount of their holdings to accrue interest.

Utility tokens are probably the most intriguing type of crypto tokens. They usually serve the specific purpose of a decentralized app (aka dApp), e.g., providing customers with access to dApp features.

For instance, Helium — the decentralized IoT network — requires users to purchase its HNT coin in addition to buying and setting up a wireless hardware station to start mining Helium blocks.

For instance, Helium — the decentralized IoT network — requires users to purchase its HNT coin in addition to buying and setting up a wireless hardware station to start mining Helium blocks.

Tokens may also differentiate themselves by the development standards, which guide their inherent features. Take Ethereum — they have ERC-20 as the golden standard of a cryptotoken, which defines a token’s parameters and how it operates. Apart from ERC-20, there are other formats available for development.

One popular crypto token type these days is non-fungible tokens or NFT. Non-fungible stands for one-of-a-kind, meaning you can’t exchange an NFT for the same thing because each non-fungible token is unique.

When you decide to create your own cryptocurrency token, you’ll need to select the right blockchain and adhere to its specific standards. Websites like EtherScan (for Ethereum) or Solscan (for Solana) can help you track and manage your token’s transactions.

| Quick fact: think about NFTs as digital images that have one owner, and the ownership is transparently tracked via blockchain technology. |

At the elementary level, NFTs are digital art tokens with verified and public proof of ownership. That can be an animated image with cats belonging solely to you, a collectible item, an access key, a lottery ticket, etc. If you were to develop an NFT, you’d have to comply with the ERC-721 standard.

Volatile

Volatile

Another aspect of any cryptotoken is its price volatility: it can go up and down by 50% or more percent in a matter of days. One exception is stable coins like USDC or USDT; however, you need to back stable coins with the corresponding amount of fiat money to keep the price at the same level.

What volatility means to you as a business owner is that your business model relying on the price of a token will largely depend on the market. If people can freely buy and exchange your cryptotoken for other assets, they will, which has little to do with the overall support for your product.

So it may be worthwhile to think hard about tying your cryptotoken features as close to the functioning of your digital product as possible.

Anonymous

Finally, crypto tokens provide anonymity to transactions. At the same time, any transaction is available for anyone on blockchain explorer sites like EtherScan. So if someone knows your wallet address, they can see all your transactions.

Related: How to make an e-wallet application

Common Misconceptions about Crypto Tokens

Let’s also quickly review a couple of myths about crypto tokens that you should take into consideration if you want to create a blockchain token (also applies for general fintech app development).

Super secure

Crypto tokens live on blockchain networks and, therefore, should be super safe, right? Wrong. The two most common attack vectors are:

- off-chain software that allows users to interact with a token (prone to hack attacks)

- newbie crypto wallet owners (extremely prone to scams)

Blockchains also can be hacked. That’s why when developing a crypto token, you should double down on securing the infrastructure (servers and software) that it runs on and interacts with.

It’s true that once a cryptotoken is on a blockchain, no one can change it because it’s encrypted, but the frontends and backends that it interacts with still need to be protected.

Also, if you decide to implement quasi-decentralized architecture with admin keys that allow the owner to change parameters and even replace a smart contract, that add yet another attack vector. This defi app will be only as secure as your keys. One way to improve the security is to use multi-signature (like in Gnosis Safe) technology so that several team members need to confirm critical transactions.

Anonymous

I’ve already mentioned that anyone who knows your public crypto wallet address can quickly look up all your transactions. Just bear that in mind and educate your users.

No transaction fees

Ok, so Ethereum is the most popular blockchain right now, and people pay gargantuan fees, e.g., between $100 and $500, to do basic transactions. That’s because Ethereum has issues with scaling (they are working on it with Ethereum 2.0). Still, the fact remains: a cryptotoken does not guarantee zero or minimum transaction fees.

That all depends on the blockchain you choose to work with: its validators and the number of queued transactions. You could also spin up your own blockchain to allow your customers to transact for free.

Immediate transactions

Again, transactions on Ethereum may take a couple of hours. That’s not days like in the case of international bank transfers, but that’s not immediate either. Sometimes, a transaction may not come through, and you still need to pay the fee.

When it comes to creating crypto token, understanding the nuances of tokenization and distribution is crucial. Tokenization involves converting assets into digital tokens on a blockchain, and their distribution must be managed carefully to ensure security and efficiency.

Those are the main things I wanted to highlight. Fortunately, you can make some of these issues work for your project (transparency is not necessarily a bad thing) and improve other aspects of your crypto token to make it more viable.

Use Cases for Creating a Crypto Token

Why would you want to make a cryptocurrency token?

Raise capital

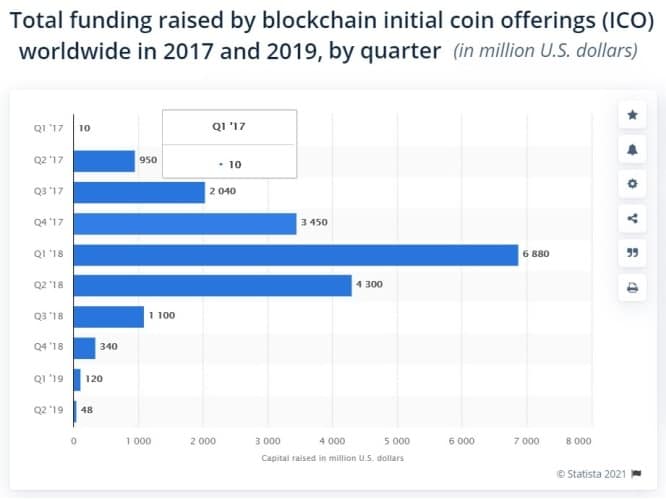

Companies raise a lot of money using initial coin offerings (ICO) or simply speaking by selling promise coins. The count is in the billions of dollars — all raised to enable businesses to develop their products.

Today, the crypto industry prefers to speak about airdrops, which essentially is the same thing where companies promise to distribute a certain amount of coins or cryptotokens in exchange for donations.

While the ICO craze may not be as vibrant today, standout successes like World Coin, which raised $240 million, Arbitrum with $123.7 million, and SUI garnering $52 million in 2023, show that significant opportunities still exist for innovative projects.

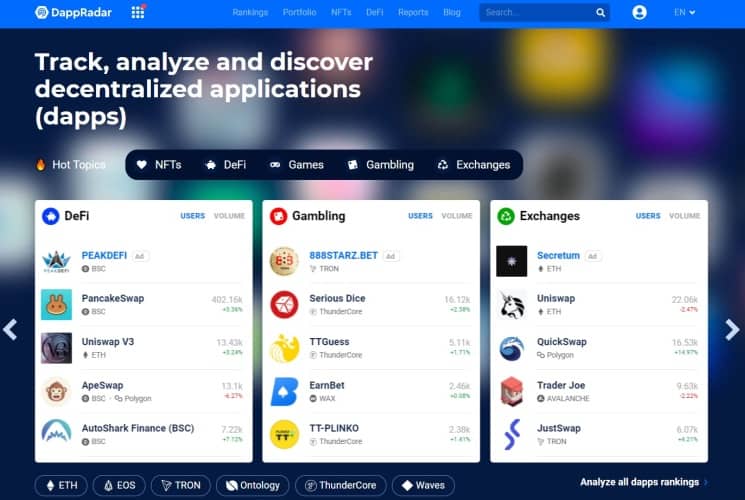

Drive adoption of your dApp

That’s the most common actual use case for creating a crypto token, which takes a lot of tech acumen. Let’s say you have a dApp, for example, a decentralized exchange (DEX), which perfectly qualifies as a DeFi product. And you want to create a token to promote this product and engage more users.

UniSwap, the largest DEX at the moment working on the Ethereum blockchain, did this very thing. They released a UNI cryptotoken for trading it on both centralized (CoinBase) and decentralized exchanges. However, UNI has no relation to how UniSwap functions. Therefore, it’s a purely speculative asset (frankly, much like any crypto). The sad truth is that people come in crypto for mad economic gains; some of them, who are a bit smarter, look for ways to invest (or stake) long-term.

Also read our guide on how to create a crypto exchange.

Therefore, it’s tough to tie a token function to a DeFi or any other type of dApp. And not only tie but also make it essential to the whole dApp functioning. The truth be told, if you look at any cryptotoken at all, you’ll see that it’s a highly speculative digital asset with some “utility” slapped onto it. The real utility tokens are like gems, e.g., BAT, which pays users for their attention.

If you can crack this problem, consider yourself a successful founder because everything else is just a matter of putting together a technological puzzle.

When creating your own crypto token, it’s important to consider how it will integrate as a native asset within your ecosystem. A well-designed native token can enhance user engagement and facilitate seamless transactions across your platform.

Support a cause

Here’s a Bx token that connects corporates and farmers in an effort to optimize carbon emissions. The company behind Bx offers software that helps farmers grow optimally and keep more carbon in soils, while enterprises invest in climate-smart practices to obtain digitized carbon efficiency data on a blockchain.

Does it make any sense to you? Anyhow, that’s a cause, and the company is using a digital token to get more support.

Build a blockchain

Finally, when you build a blockchain, you can’t get away without developing a coin. As we’ve already discussed, the coin will be used as the main currency used to perform any transactions on the chain.

Developing a blockchain (or copying and modifying an existing blockchain) is outside the scope of this blog (more on how you create a blockchain application). So let’s continue focusing on how you can develop a cryptocurrency token.

Ready-made Solutions to Create Your Own Token Coin

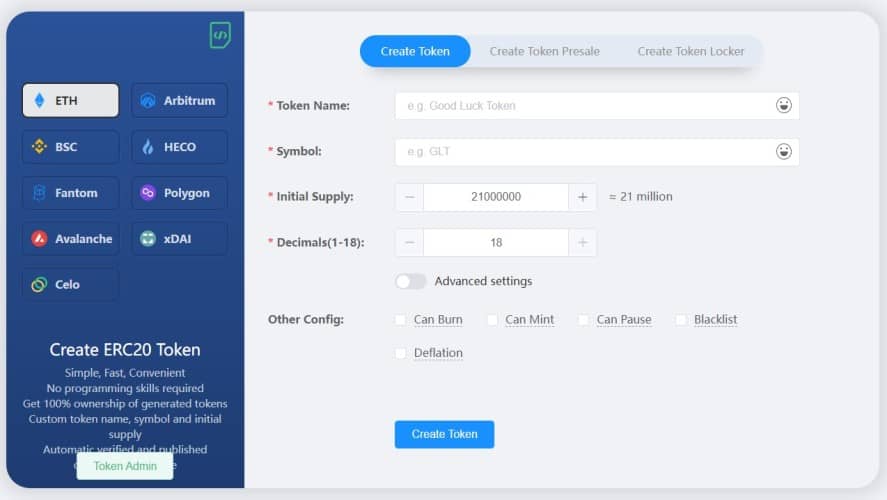

The easiest route to create your own cryptocurrency token is by using dedicated DIY platforms. If we have SaaS platforms to create web and mobile apps from scratch, using a drag-and-drop UI, why can’t there be tools for creating tokens?

And you are right! Such tools do exist.

If all you need is a cryptotoken to raise funds, you can choose between multiple options:

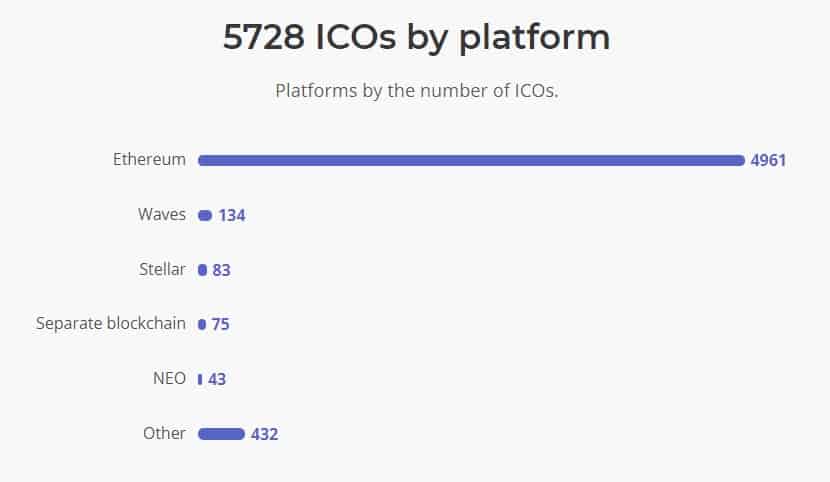

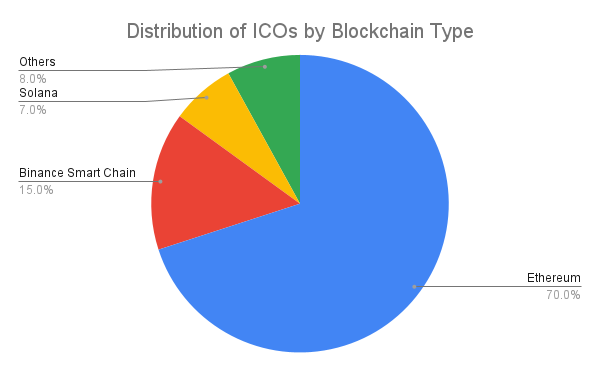

My guess is you’ll be working on an ERC-20 token — the one that can take advantage of the developed Ethereum blockchain ecosystem. In fact, most ICOs run there:

Wondering which blockchain platforms are leading the way in ICOs? Let’s break it down based on the latest data for 2024:

- Ethereum (ETH): Why does Ethereum still host approximately 70% of all ICOs? The answer lies in its mature ecosystem, extensive developer tools, and widespread adoption. It’s no surprise Ethereum remains the dominant player.

- Binance Smart Chain (BSC): With around 15% of ICOs, BSC is a significant contender. Its appeal? Lower transaction fees and a rapidly growing ecosystem. Could this be the platform for your next big project?

- Solana (SOL): Solana is quickly catching up, hosting about 7% of ICOs. Its high transaction speed and low fees make it an attractive option for many developers.

After choosing a platform, you still need to decide on the fundamental properties of your cryptotoken, like whether you want to be able to:

- burn

- mint

- create roles to manage the cryptotoken

- assign ownership, etc.

For those looking for more control and unique functionalities, creating a custom crypto token can be the perfect solution. These platforms allow for highly customized options, enabling you to tailor your token’s behavior and governance to suit your specific needs.

You do all of that without writing a single line of code, only selecting different options and providing minimum input where required. An ideal scenario for quickly creating a token for ICO.

How to Create a Crypto Token in 4 Steps

Now, if you want to create a cryptocurrency token with some advanced functionality closely tied to a dApp ecosystem, you will need a professional team of blockchain developers.

Step 1: Define your token properties

First of all, you need to decide what your cryptotoken will do. If it’s a typical ERC-20 token meant to attract investors, it will have the inherent properties of the ERC-20 standard. You’ll be able to specify:

- total token supply

- token’s name, symbol, and number of decimals

- and a couple of auxiliary functions to check balances on addresses, enable and verify transactions

If it’s an NFT, it will have slightly different parameters, e.g., to specify owners of non-fungible cryptotokens.

As I’ve mentioned, there are plenty of tools to create these rather simplistic tokens. However, if you need to make your own crypto token that is more advanced, seek professional assistance from a development team.

Step 2: Develop a smart contract

Why smart contracts all of a sudden? Long story short, any cryptotoken is governed by a smart contract, which is a piece of software running on a blockchain. So to make your own token, you need to code a smart contract.

By the way, Ethereum was the first blockchain to introduce smart contracts. That’s probably the main reason why the majority of all cryptotokens are developed and deployed on Ethereum.

Make no mistake, even when you use token-generating sites to build a token for ICO — they still write and deploy contracts to blockchain in the background for you.

Ok, so what do we know about smart contracts? They run on a blockchain and power DeFi and other decentralized apps, allowing users to interact via transactions.

Related: Smart Contract App Development: The Complete Guide

These smart contracts can be very smart, much more advanced than ICO contracts. Therefore, you get to make a token with more advanced functionality. Some of the things you might consider when assigning a team of cryptocurrency developers on a project include:

- Do I want a 100% immutable contract, or would I like to keep an option to change it quickly later on?

This is pretty serious stuff. Crypto enthusiasts love fully decentralized dApps (and coins) that don’t have admin keys providing backdoor access to the contract. After all, the central premise of blockchain technology is decentralization. However, suppose you are thinking about developing a token for a closed community, such as serving a group of clinics. In that case, such a solution is well justified.

- Do I want my cryptotoken to provide some additional features like staking?

Some crypto tokens have peculiar logic when users stake them. For example, the contract can burn all staked tokens, effectively removing them from the existing liquidity pool, and mint new coins plus the interest after the stake has finished.

When considering how to create a token, it’s crucial to design your smart contract with user consent in mind. This involves coding the contract to require explicit consent from participants before any transaction is executed, thereby enhancing security and trust. Additionally, think about how the contract will store metadata related to each transaction, which can provide valuable insights and improve transparency.

There are many other advanced features to consider, like creating a payable token that can simplify paying for services and managing subscriptions.

- Will my cryptotoken need to have an ownership attribute?

That’s more about NFTs, where an ownership property allows one to determine the unique owner of a digital asset.

- Do I need any token recovery functionality?

Blockchains are a wild west today. People can discover the address of your smart contract and send their crypto (which the contract doesn’t necessarily support) to it by mistake. These funds are usually gone forever. However, you might want to design a workaround in your smart contract to avoid such accidents.

There are many other questions to answer while working on a crypto token smart contract. The main thing is to think through its logic — how do you want it to behave, what will it do to attract more customers into your dApp ecosystem? People will probably ignore another rando speculative asset that doesn’t stimulate them to use your software.

Step 3: Run QA on a test chain

When creating a vanilla smart contract for a crypto token, keep in mind that it will be quite a hassle to replace it in case there’s a bug. Therefore run multiple tests on a test blockchain like Rinkeby or Ropsten.

Your developers may also make use of such tools as SafeMath — a Solidity library protecting your contract’s code from calculation mistakes. It’s one way to avoid “mapping address uint256” errors for sure.

Your developers may also make use of such tools as SafeMath — a Solidity library protecting your contract’s code from calculation mistakes. It’s one way to avoid “mapping address uint256” errors for sure.

Related: Mobile App QA Guide: Tools, Process, Best Practices

Step 4: Deploy to blockchain

Deploying a smart contract is pretty simple. Depending on a tool your developers are working with, they’ll just need to send a transaction with compiled contract code without specifying a receiver. It’s just a matter of a few clicks, really, and something not to worry about.

In any case, ensure that the contract functions perform flawlessly on a test net (user can send and receive cryptotokens, the contract executes the rest of its features, etc.) before deploying it to the mainnet (Ethereum). Before you launch a crypto token on the mainnet, it’s essential to ensure that every function of your smart contract has been meticulously tested and validated.

(Secret) Step 5: Create token tracking software

Dashboards… Everybody loves them. I know I do: checking how my crypto portfolio fares in the bear and bull market, charting red and green lines, is quite an experience (I hope you didn’t invest what you couldn’t lose).

I bet you wonder, “Why develop a crypto portfolio software for a single token?” And if it’s a single token with a very simple functionality (no staking, etc.), I’m totally with you. There’s no reason to build yet another application for tracking your token or coin performance.

However, if the token provides more functionality, e.g. staking or voting (DAO), it becomes necessary to track too many metrics to predict its price fluctuations. For example:

- accrued interest

- number of stakes / unique staking addresses

- transactions of whales invested in your token

- number of daily transactions

I will give you an example. I’m invested in HEX, and I can stake it to earn 100% decentralized interest. There are quite a few web and mobile applications that track a lot of metrics besides the interest. Besides calculations of possible penalties for early end-staking, total value locked, average stake duration, and APY, the HEX community also tracks other altcoins built on top of the HEX ecosystem: ICSA, HDRN, MAX, etc.

![]() As you must be aware, usually crypto developers create such portfolio tracking software driven by their own enthusiasm. However, that’s a niche that you can own, too.

As you must be aware, usually crypto developers create such portfolio tracking software driven by their own enthusiasm. However, that’s a niche that you can own, too.

How Much Does It Cost to Make Your Own Cryptocurrency Token

One thing to remember with developing a crypto token is that you are not just making a lone icon and a symbol, which is pretty simple. You’re making a decentralized application based on financial design mechanics, and the cryptotoken serves as a gas you fill your car with to get to a specific place. Just like that, the token will help your customers securely navigate your DeFi app.

The cost of developing a medium-level dApp powered by a cryptotoken is around $160,000, while an MVP is attainable starting at $40,000. As you can see, the cost varies greatly depending on the required features. When you decide to launch your own crypto token, it’s crucial to budget for not just the development but also ongoing maintenance and security audits to ensure its reliability and trustworthiness.

Read our Guide on Building dApps

Also read: Custom Mobile App Development: The Complete Guide

Is it Legal to Create a Crypto Token?

Creating your own crypto token can be an exciting venture, but the legal landscape surrounding it is complex and varies by country. Here are some key points to consider:

Regulatory Compliance: Different countries have different regulations regarding the creation and distribution of crypto tokens. In the U.S., for example, the Securities and Exchange Commission (SEC) may classify certain tokens as securities, subjecting them to specific regulations. Always consult with a legal expert to ensure compliance.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements: Many jurisdictions require stringent AML and KYC procedures to prevent illicit activities. This involves verifying the identities of your users and monitoring transactions.

Tax Implications: Creating and trading crypto tokens can have significant tax consequences. Make sure you understand the tax obligations in your jurisdiction, including reporting requirements and potential liabilities.

Consumer Protection Laws: Protecting your users from fraud and ensuring transparency in your project’s operations is crucial. Non-compliance with consumer protection laws can lead to severe penalties.

Intellectual Property Rights: Ensure that your token does not infringe on existing intellectual property rights. This includes trademarks, patents, and copyrights.

Navigating the legal intricacies of launching a crypto token requires careful planning and professional advice. Always stay updated with the latest legal developments to avoid potential pitfalls.

How Topflight Apps Can Help in Creating a Crypto Token

At Topflight Apps, we’ve successfully launched several crypto projects and continue to push the boundaries of DeFi and blockchain technology. Here are some highlights from our recent case studies:

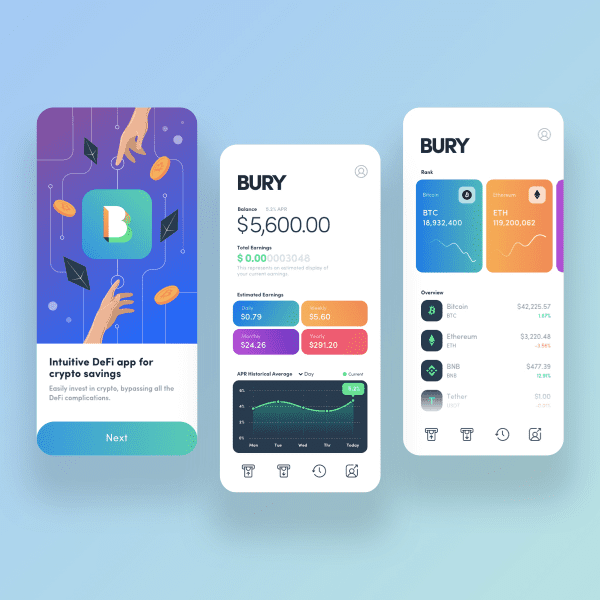

Bury Finance: DeFi Savings Made Simple

Secure and User-Friendly: Implemented 256-bit encryption, multi-signature wallets, and two-factor authentication for robust security.

High Yield: Achieved a stable 7% APY, paid out monthly, by leveraging advanced crypto technologies.

Streamlined Onboarding: Integrated with Plaid and Wyre for seamless fiat-crypto on/off-ramp and KYC compliance.

Citizen Finance: DeFi Ecosystem for a Metaverse Game

Cross-Chain Integration: Developed a multi-chain DEX on Polygon and Binance Smart Chain.

Fully Decentralized: Enabled 100% user-owned in-game NFT collectibles and comprehensive staking and lending protocols.

Innovative Features: Incorporated yield farming, dynamic price charts, and cross-chain token transfers.

Toolbox: Empowering a DIY Community with a Crypto Ecosystem

Tailored Ecosystem: Created a unique cryptocurrency ecosystem specifically for the DIY community.

Community Engagement: Leveraged the ethos of Toolbox LLC’s popular YouTube channel with over 150,000 subscribers.

Seamless Collaboration: Successfully aligned with the client’s vision through shared passion and deep industry knowledge.

We continue to work on exciting DeFi projects and are constantly exploring intersections like DeFi and healthcare. Our ongoing initiatives include applying crypto in move-to-earn and other wellness-related projects, as well as finding ways to democratize EHR platforms and medical research through blockchain and cryptocurrency.

We’d be happy to discuss your dApp idea and advise on cryptotoken development. Schedule a call here.

Related:

- How to Make a DeFi Lending Platform

- How to Build a DeFi App

- How to Build a Market ready Fintech App

- How to Make a Blockchain payment system

- How to Develop a DeFi Staking Platform

- How to build a DeFi Exchange Platform

- How to Create a Cryptocurrency trading bot

- How to Start a DAO

[This blog was originally published in October 2021, but was updated for more recent data]

Frequently Asked Questions

How does a crypto coin differ from a token?

There can be only one coin on any given blockchain, and it works as the main cryptocurrency, meaning users need to spend it to make any transactions. As for cryptotokens, there can be a lot of them; they often serve a particular decentralized app and can also migrate between different blockchains.

What's the difference between developing a crypto coin or a token creation?

When developing a coin, you need to fork (copy) or create a brand new blockchain. And when you build a cryptotoken, you develop a smart contract.

What cryptotoken standard do you recommend?

Ethereum and Solana seem to be the most popular blockchains these days. You can pick any token standard that fits your needs and works on these chains. ERC-20 is the most popular one and works on Ethereum.

Why do I need to create a cryptotoken?

To attract more users to your decentralized application. Hopefully, those will be genuine believers in your product. Whoever joins later, especially if it’s mass adoption, is chasing investment gains.

How long does it take to develop a cryptocurrency token?

Under a month if you need a basic ICO cryptotoken and over three-four months if we are talking about a utility cryptotoken closely connected with a dApp.