When everyone and their mom rushes to become a crypto trader, the plans to create a cryptocurrency bot start to sound very pragmatic. In this blog, we’ll discuss how to build a crypto bot and avoid all the major pitfalls in the process.

Read on to find out the steps and best practices for building successful automated crypto trading software.

Top Takeaways:

- When building a crypto bot for trading, we need to develop at least three applications that will sync data and integrate with each other: front end apps for customers (web/mobile), a back-end with trading algorithms and business logic, and a web portal for managing the bot.

- What many business owners looking to make a crypto trading bot don’t realize is that they will eventually end up with a marketplace offering different types of bots. Such a trading platform has way greater potential than creating a single crypto bot.

- The process of crypto trading bot development will run much faster if you use an open-source CCTX library. The library takes care of connecting and trading with popular cryptocurrency exchanges.

Table of Contents:

- Crypto Trading Bots Overview

- Top 3 Crypto Bots

- Different Crypto Bots Strategies

- Cryptocurrency Bot Must-Have Features

- How Does a Cryptocurrency Trading Bot Make Money?

- Tech Stack for Crypto Trading Bot Development

- Build a Crypto Bot in 5 Steps

- How Much Does it Cost to Create a Cryptocurrency Trading Bot?

Crypto Trading Bots Overview

It’s no secret that most trades in the stock market are carried out automatically. The crypto market simply follows suit. As you know, the bullish season of 2021 attracted many crypto newbies, who think they are late to the game and jump to any means promising faster wealth generation.

And even though bots for trading crypto are more about persistence, many novice traders see them as the source of mad gains while savvy traders hope to get some of their life back. Hence, the rising popularity of trading bots.

Bot flavors

If you were to pick a robot for trading crypto right now, you might be overwhelmed by available choices. Most often quoted types of bot include:

Arbitrage bots — they make money for customers trading across multiple exchanges, taking advantage of price discrepancies.

Trend-following bots — rely on the quantitative technical analysis of indicators for deciding when to buy and sell (include DCA and GRID bots), playing on market fluctuations.

Portfolio automation — these robots manage specific percentage of coins in the portfolio, e.g., 50% altcoins and 50% bitcoin.

If we look deeper, we can also notice these types of trading bots:

- multiple/single pair trading bots

- bots working with CEXs or DEXs

- open-source and fully custom robots

- AI / simple algorithm-driven bots

From the business owner’s perspective, it makes less sense to make a crypto trading bot of one specific type. Instead, we see more and more platforms accumulating and offering different bots, targeting different user groups.

Related: How to create a crypto exchange

Advantages

What are the benefits of automatic crypto trading tools?

Crypto never sleeps is more accurate than “money never sleeps” because stock markets close for the night and holidays. Contrary to that, crypto bots run day and night even during holidays — a toll order for persevering traders.

Bots don’t trade on a whim. Emotions are not part of their logic, and therefore don’t affect sudden profits or (more often) losses so common for humans.

Automated trading is fast. Think of all the data sources software can consume simultaneously at a steady pace compared to human abilities. Now add to the equation cheap and powerful computing power and the fact that bots don’t need to fiddle with a user interface to execute trades.

Backtests and paper trading enable quick simulations unachievable in manual trading conditions. As a result, bots enter the real market with optimal, verified trading strategies.

After all, having an army of autonomous crypto traders, raking in passive income day and night and never asking for any compensation, must feel nice, right?

Workflow

The essence of every crypto robot is its algorithm describing a trading strategy of a mix thereof. We’ll discuss a few popular strategies in a bit, but first let’s understand how these bots operate.

Crypto trading bots need to accomplish three things:

- Analyze incoming and historical market data

- Assess risks (in other words, predict price movements short and long term)

- Execute trades accordingly using crypto exchange APIs

Obviously, that’s an extremely high-level overview of how crypto bots work. An easy way to imagine that is to think of setting an endless chain of limit buy and sell orders.

Risks

As is always the case in crypto, mad gains come side by side with possible fiascos. But that’s part of the ground rules, right? After all, past performance is not indicative of future results, as investors say, and crypto is not an exception here.

At the same time, crypto bots can leverage multiple data sources and rely on ultra fast trades to squeeze out sizable gains.

Related: How to create a trading and investing platform

Top 3 Crypto Bots

To make sure our cryptocurrency bot development efforts are not wasted, let’s review some of the well-known crypto trading robots.

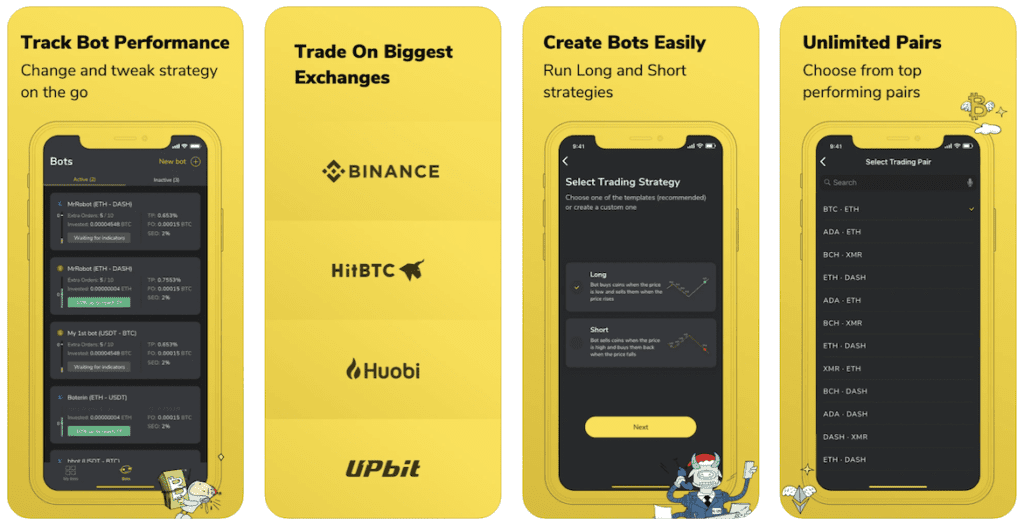

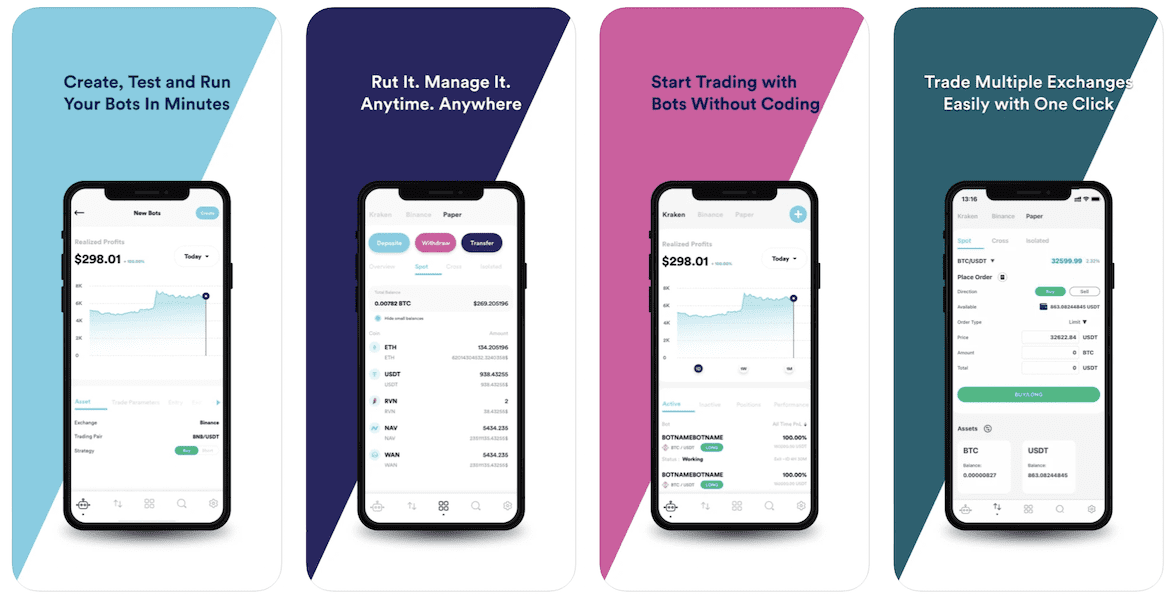

TradeSanta

TradeSanta automates trading on the four biggest crypto exchanges: UPbit, Binance, Huobi, and HitBTC. Santa bots execute user-specified algorithms and place new orders 24/7.

Key Features:

Key Features:

- long/short templates or creating a custom bot from scratch

- detailed bot performance tracking

- stop loss, Bollinger, MACD, RSI, etc.

- Trading View signals integration

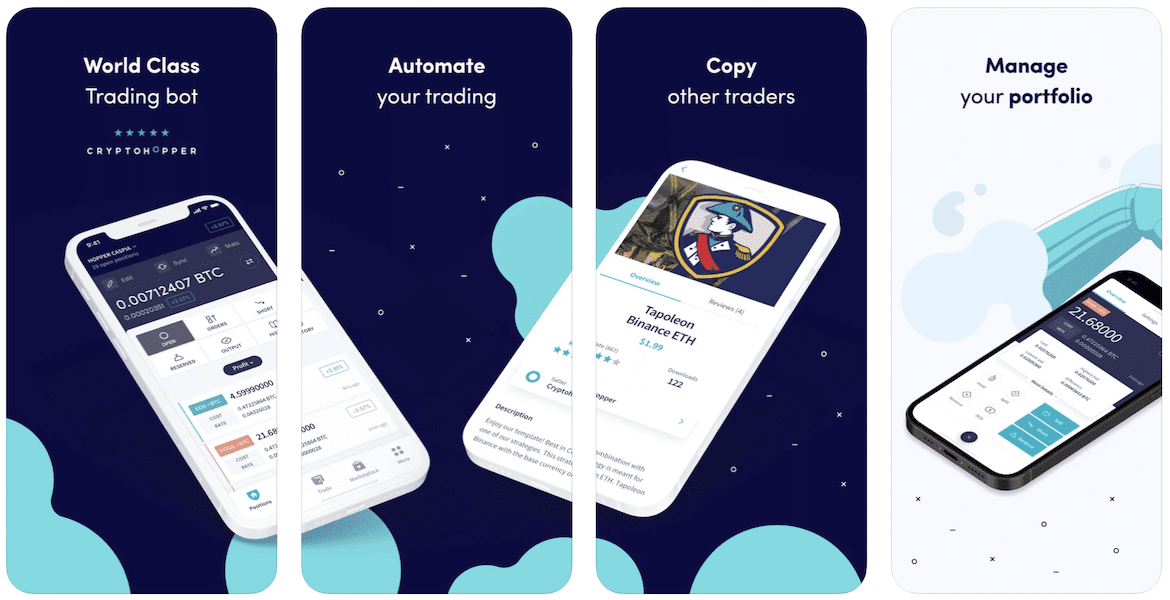

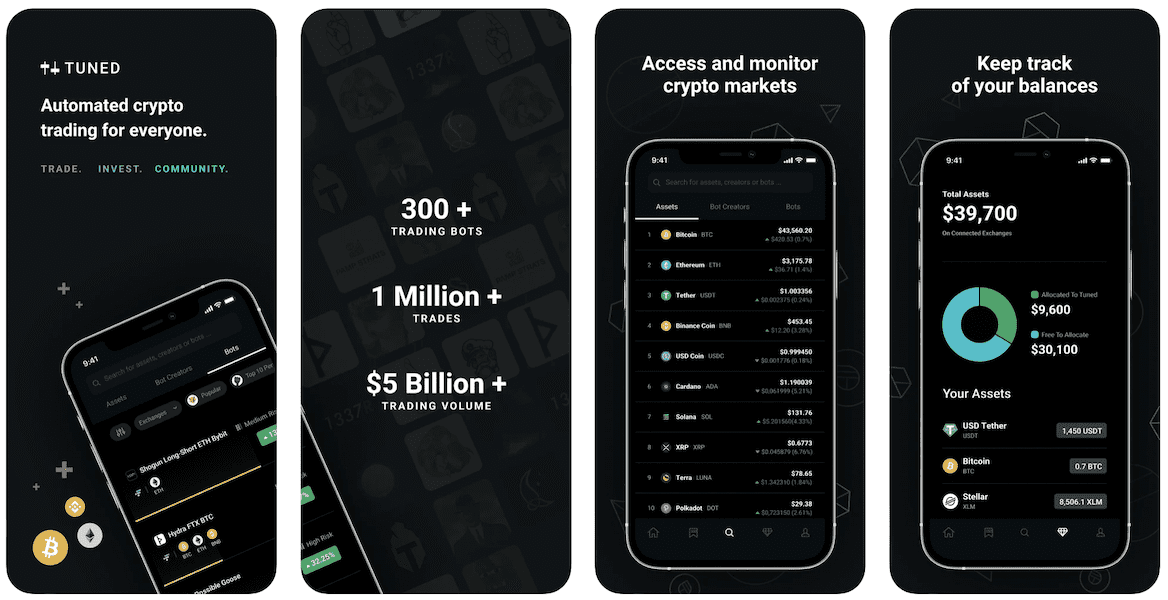

Cryptohopper

Cryptohopper is one of the most popular crypto trading bots on the market. The solution supports 10 exchanges and offers an extensive collection of bots created by users.

Key Features:

Key Features:

- copycat (aka social trading) and manual trading

- crypto portfolio management

- configurable AI strategies

- trailing stop-loss and other advanced tools

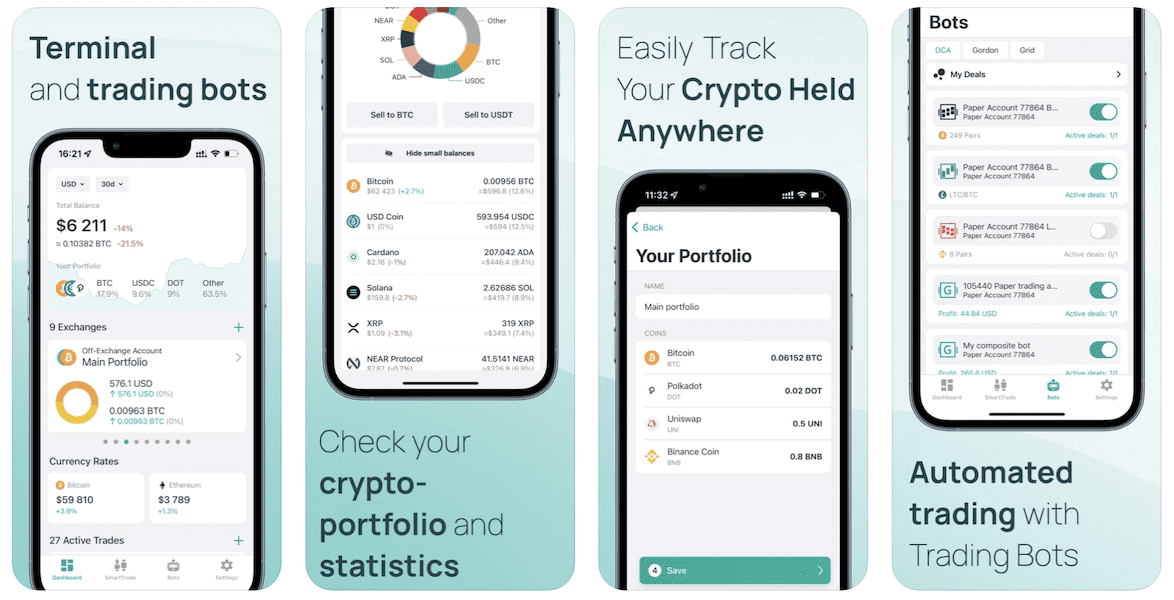

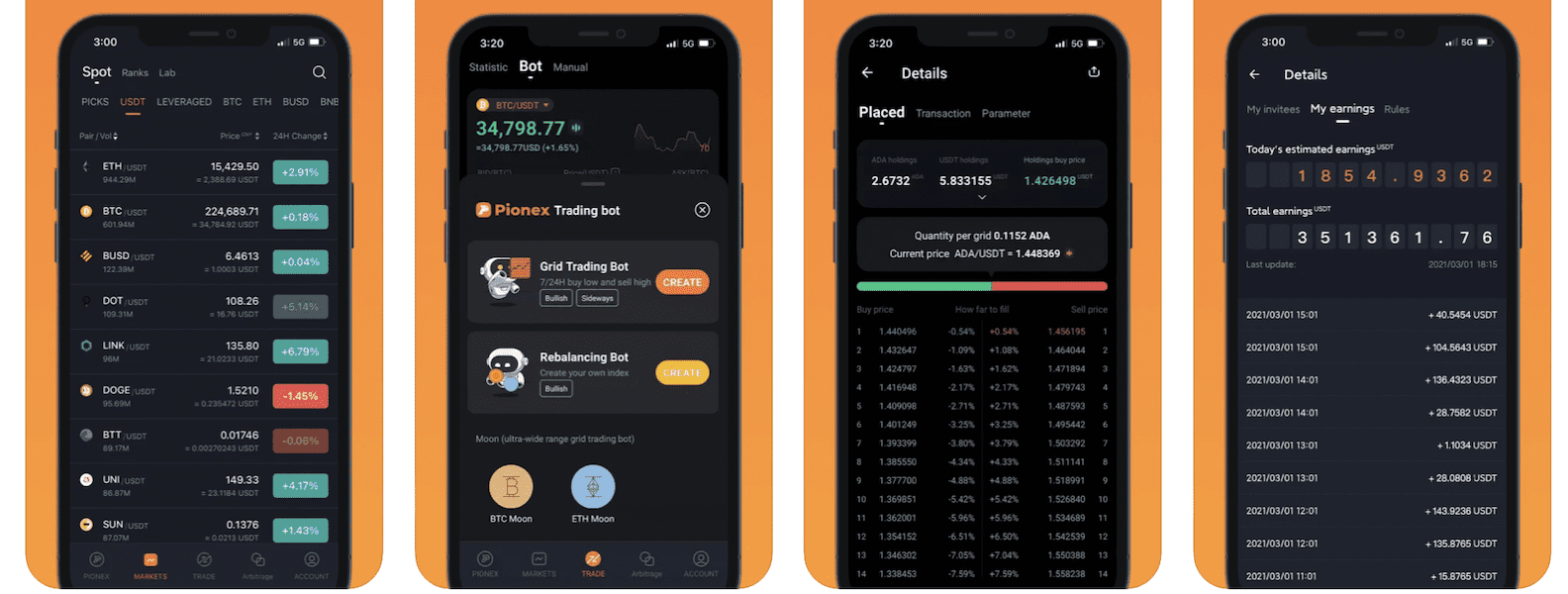

3commas

3Commas is an all-in-one crypto trading terminal allowing customers to place orders on several crypto exchanges in one window. Their bots work with 18 exchanges.

Key Features:

Key Features:

- three customizable template strategies

- paper trading

- intuitive dashboard for controlling bots

- detailed portfolio overview

Different Crypto Bots Strategies

We also need to cover trading strategies as we plan to build a crypto trading bot. What are the most typical trading strategies found in automated trading?

Trend following

This strategy implies identifying an asset’s direction and entering long or short positions depending on whether its price is trending upward or downward 24 hours a day. Crypto buying usually implies securing long positions and selling — short ones.

Arbitrage

An arbitrage crypto bot capitalizes on the asset’s price discrepancy across multiple crypto exchanges. Buying at lower and selling at higher prices seem like a no-brainer; yet, there’s more to it. For example, we need to take into account the fees, especially if we deal with DEXs on different networks.

Related: How to create a defi cryptocurrency exchange platform

Market making

The market making strategy involves making a fast profit by reselling an asset with a slightly fluctuating price. It’s a typical approach for scalping bots looking for quick and relatively small gains.

There are many other algorithmic trading strategies, of course, like mean reversion, momentum trading, or naive bayes, and our bot doesn’t have to stick with one necessarily.

Cryptocurrency Bot Must-Have Features

You can’t create a cryptocurrency trading bot and expect any real traction without including these must-have features.

Connecting crypto exchange accounts

Customers need a way to provide APIs from their exchange accounts. Each API is individual for every user and for every crypto exchange and represents a long sequence of random characters. QR codes seem to be an acceptable solution for adding this option.

Dashboard

How does the user assess a bot’s performance? Of course, by reviewing their balance and profit dynamics in a dashboard. We can also include here crypto prices and other relevant info, for example, trending news.

Trading rules

It’s impossible to build a bitcoin trading bot and not give the user some levers to set up its behavior. Every single autonomous crypto trading tool of the dozen I’ve reviewed offers at least a couple of parameters to tinker with.

Schedule

Users will appreciate an option to turn off the bot during preset intervals, e.g., when massive market moves are expected due to new legislation or when they can’t check in every now and then.

History of transactions

Being able to review the list of all trades and their outcomes provides a certain level of comfort to users. They can check on completed trades and see if some fine-tuning is in order.

Paper trading

Allowing customers to simulate trades in a live environment is priceless as they can get confidence from their bot’s performance without risking any money.

Backtesting

The backtest feature is essential as it ensures the bot works as intended, using the historical data for completing test trades.

Notifications

Notifications are a must practically for any modern application. Users need to get updates about major trading events to keep an eye on their bots.

Security

FaceID and TouchID are the minimal security options we should foresee in our app, and two-factor authentication is a must for web-based solutions.

Trading signals

Advanced cryptocurrency trading robots may offer a set of trading signals that should be taken into account by the bot when making trades.

Marketplace

To build a cryptocurrency trading bot platform with a truly high potential, we may also want to include a marketplace of bot templates with different trading strategies. That way, both position and speculative traders will have plenty of choice.

How Does a Cryptocurrency Trading Bot Make Money?

The ideal scenario is to offer a couple of subscription tiers, with the price increasing towards more aggressive (and therefore frequent) trading. Other approaches I noticed include taking a small percentage of the realized profit or partnerships with select exchanges to share revenue from each executed trade.

Needless to say, advertising and a fixed price would not be the best monetization options for a trading bot. Ads will ruin the entire user experience, and the fixed-price approach would cause issues with upgrades.

Tech Stack for Crypto Trading Bot Development

When talking about the technical aspects of cryptocurrency bot development, we need to separate customer-facing apps and the backbone. The backbone part is the server-side with all business logic, running in the cloud and usually containing AI algorithms.

It’s no surprise that we need different tech stacks to create these separate parts when we make a cryptocurrency trading bot.

For trading algorithms, we should pick something fundamental like C++ — to make sure algos run as fast as possible and remain stable at the same time. In case there will be AI involved, we’ll have to stick with Python, the programming language of choice for any machine learning-related projects, including crypto bots.

If our bot will work with DEXs, we’ll need some blockchain expertise on the team. Ideally, someone with experience in Solidity and other blockchain technologies like Hardhat and web3.js.

As for customer-facing software, we’re absolutely free to choose any modern technologies like React/Node + React Native or Flutter.

We might also make use of ccxt — a popular crypto trading library. It’s open source and works with JavaScript and Python, allowing trading-bot developers to bootstrap connections to popular exchanges like Kraken, Binance, etc.

Build a Crypto Bot in 5 Steps

Before you go and build your own crypto trading bot, you need to realize that what you want to create is more like a marketplace or constructor. No, really. What’s the point of creating a crypto bot and selling it if you can run it yourself, generating wealth non-stop?

I bet you’d rather set up a platform with bot templates where customers can customize their robot or create it completely from scratch by following a wizard. Let’s look at the steps that take you there.

I bet you’d rather set up a platform with bot templates where customers can customize their robot or create it completely from scratch by following a wizard. Let’s look at the steps that take you there.

Related: How to build a crypto trading app

Step #1: Discovery

We start by defining an ICP (ideal customer profile). Fortunately, for crypto projects, there are just two primary targets: novice and pro traders.

Therefore, we only need to decide which group of users our crypto bot will serve. Based on that, we can prioritize features picking those with immediate impact on our ROI goals.

Another important decision we’ll need to make is about the bot’s nature, or its trading strategies, to be more precise. The essence of any crypto trading bot is trading algorithms.

Will our software work purely off mathematical equations, or will it also feature AI components? Do we need natural language processing capabilities to comb through incoming data?

Deliverables:

- prioritized list of features

- high-level strategic roadmap

- business model overview

Step #2: Design

The next step is to prepare the user interface and work through the user experience of the product. We start by jotting down user journeys, trying to predict the minimal number of steps the user should take to achieve the desired goals.

These user journeys are then transformed into low-fidelity wireframes and then into high-fidelity app screens. The design team then puts these screens in a prototyping tool like InVision and creates an interactive prototype — an on-screen app mimicking a live application.

These user journeys are then transformed into low-fidelity wireframes and then into high-fidelity app screens. The design team then puts these screens in a prototyping tool like InVision and creates an interactive prototype — an on-screen app mimicking a live application.

The purpose of this prototype is to verify the ease of use and feature completeness as we test the prototype with actual customers. Their feedback is then used to improve the app’s UI/UX. If we were to do the same, but rely on coding instead of design, such experiments would cost us a fortune.

As for prototyping, that costs a fraction of the development budget, but at the same time guarantees we’ll push software with an optimal product-market fit.

Related: UI/UX tips when designing an application

One thing to note while creating a crypto trading bot is if you choose to appeal to both novice and pro customers, you’ll face a tough challenge. Because that would entail a seamless combination of two UI/UX sets in a single app.

I should also remind you that advice from programmers is also highly recommended at this stage. They need to check that the design is feasible for the target platforms and doesn’t break conventions.

Deliverables:

Deliverables:

- high-fidelity screens

- marked-up design assets, ready for development hand-off

- Interactive prototype

Step #3: Development

Once the design has been verified and is ready for development, we can proceed to coding. When we make a cryptocurrency bot, in reality, we need to code quite a few things:

- front end for consumers

These include web and/or mobile apps that customers use to set up and manage automated trading. The must-have features we outlined earlier find their place in this software.

- back-end with trading algorithms

This is also where we keep the database and all other relevant business logic besides the algorithms. Ideally, this software runs in the cloud and syncs with front end consumer-focused applications.

- admin portal

An admin portal is required for managing different bot parameters in consumer apps. This way, our non-techy employees can control various bot characteristics.

Let’s review some of the critical development aspects as we build a trading bot for crypto.

Agile team

We’ve discovered that the agile software development method works best, especially for crypto-related projects. This space is all about constant change, with new tools and protocols springing to life all the time. Making use of these technologies is essential for outperforming the competition. How does agile fit in?

Agile means we can make product changes to achieve a better product-market fit when we see new opportunities or when early feedback suggests we should augment some functionality.

An agile team works in sprints, defining the tasks for every two weeks and then adjusting the next sprint based on the results of previous sprints. Of course, this style of work implies close collaboration between all team members and the client. So keeping open lines of communication at all times is critical.

Related: Agile App Development: Key to building a winning app

As a bonus, our partners get complete visibility in the development process and have clear expectations in regards to the next version of software. Working with an agile team, they get all the perks of running an internal team without the overhead headache.

Trading strategy

Crypto trading strategy is the core of our bot. Do we want to make a bitcoin trading bot or make it support altcoins and alternative tokens too?

There are quite a few things we need to decide about the trading algos, for example:

- Which coins/tokens should we support?

- Will the bot trade a single pair or cryptocurrencies?

- What trading signals should we take into account?

- Do we need any additional data sources?

- Will the bot include any AI/ML processing?

Besides that, we need to consider if we want multiple trading strategies to work in parallel to improve trading accuracy of the bot. For example, Trality allows its users to create multiple trading strategies and combine them in a single bot.

Backtesting and paper trading assume we will need to keep large amounts of the cryptocurrency market data for all supported crypto assets. Otherwise, our customers won’t be able to test their bots without risking losing their funds.

Exchanges APIs

When we make a crypto bot, we need to provide it with APIs from crypto exchanges. Every user has their own unique API controlling trades on a particular account. However, all the APIs from a specific crypto exchange conform to a predefined set of rules.

So our software needs to parse all the APIs from the exchanges it supports. Please note that the more exchanges we support, the more effort will be required to roll out our solution.

Security

Security is of utmost importance not only because we need to protect user data but also because the bot has access to the user account on a crypto exchange. Therefore, strong security mechanisms should be implemented:

- data encryption in transit and at rest

- https, ssl, tls

- automatic session expiry

- bio authentication

- two-factor authentication

In addition, it’s recommended to run periodic security audits to find out potential vulnerabilities.

Best practices

Let me share some best practices that will make your crypto bot stand out from the crowd.

- use Apple ID for super seamless onboarding

Users are literally one tap away from immersing themselves in your app when you use Apple ID or Facebook in the sign-up process.

- provide a demo exchange account

For many users, adding their crypto exchange API is a massive blocker. Allowing them to paper-trade using your demo account seems like a good idea to keep them exploring the software.

- add a wizard and bot templates

Hand-holding can’t be overestimated — walking new users through the bot creation process, providing tips and explanations is absolutely critical for creating a sticky user experience.

- integrate with a messenger apps for notifications

Customers will have to deal with enormous amounts of notifications, which can become quite a burden for your servers too. If you set up the bot to deliver all notifications via a messenger app instead of relying on push notifications, your customers will have an easier way to manage them.

- include benchmarks to compare bot performance

Once the bot has run for a while, it may be a good idea to compare its performance with benchmark bots to see how well it delivers.

Step #4: Testing

Testing a crypto trading bot is not trivial. First, because no one likes to lose their funds while running QA rounds. Second, because a bot working with a decentralized crypto exchange needs special attention.

The first issue is easy to overcome with simulations, trading crypto in a live environment without using actual money. And in case of DEX integration, we’ll have to run QA tasks on a test blockchain and then inevitably follow-up with micro trades on an actual DEX.

Related: Mobile App User testing: Steps, Best Practices, Tools and More

Then, of course, all usability, functionality, and usability tests still need to take place with the front end software as well as stress testing for the back end.

Step #5: Deployment and maintenance

Deployment implies moving the server-based software to a live production environment in the cloud, which has been already stress-tested. As for mobile apps, they are uploaded to Google Play and the App Store.

Maintenance means keeping the software up-to-date. As time goes on, we’ll need to add new features, fix issues, comply with the latest OS updates, etc. The other side of maintenance is analyzing user behavior and identifying new strategies for improving the UI/UX, etc.

How Much Does it Cost to Create a Cryptocurrency Trading Bot?

Making a crypto trading bot requires a sizable budget of $200K. Please note that we’re talking about building a cryptocurrency trading bot as a platform that allows customers to create their own bots by applying sophisticated trading strategies.

Based on your choice of devices to support and advanced features, the cost will vary; however, the $200K budget should help you get the MVP version out of the door.

Based on your choice of devices to support and advanced features, the cost will vary; however, the $200K budget should help you get the MVP version out of the door.

Related: App Development Costs: Everything You Need to Know

If you want to create a crypto bot and have more questions, please reach out to our experts to get advice and a sneak peek at how we’d handle that.

Related:

- How to Make a DeFi Lending Platform

- How to Build a DeFi App

- How to Build a Market ready Fintech App

- How to Make a Blockchain payment system

- How to Develop a DeFi Staking Platform

- How to build a DeFi Exchange Platform

- How to Create a Crypto Token

- How to Start a DAO

Frequently Asked Questions

What platform should I choose to create a crypto trading bot?

Totally depends on your target audience, but the web is always a safe bet, since the core of your product — algorithmic trading — will run in the cloud.

Can you make your own crypto trading bot like Cryptohopper?

Yes, some apps allow customers to create completely custom robots from scratch.

Can I code a crypto trading bot for smartphones using a cross-platform framework like React Native?

Yes, the tech stack of the customer-facing app doesn’t matter much. So you can pick Flutter, React Native, or go native with Swift/Kotlin for iOS and Android accordingly.

Do you have any ideas for making my app special?

TradeSanta did a great job onboarding novice users with their solution.

How long does it take to make a trading bot like crypto?

That may take well between 6 and 9 months per platform.