If you want to develop a cryptocurrency exchange, the timing couldn’t be better with all the crypto craze:

- the leading crypto, BTC, has reached all-time highs twice in 2024

- Bitcoin ETFs have finally received the green light and are now being traded on Wall Street

- Ethereum ETFs are coming

- social media trends and overall market sentiment turn increasingly positive

When your revenue is transaction fees from investors trading volatile cryptos, even a bear market doesn’t look too gloomy, and if it’s bull time (and BTC and ETH popularity is on the rise), you’re golden. No wonder most top-ranking decentralized apps on dapp-ranking sites are crypto exchanges.

This blog is a head start for business owners on how to build a cryptocurrency exchange platform and make a splash in the crypto space.

Top Takeaways:

- You can build a centralized or decentralized cryptoasset exchange. The former is hosted on a central server (like any traditional software), and the latter works directly on a blockchain (like any dApp). Look for their pros and cons in the blog.

- Cryptocurrency exchange development involves creating a multi-layered solution that includes many components, e.g., a web interface for users, a dashboard for exchange administrators, a mobile app, a trading engine, and many other features we cover here. Use ready-made tools to shortcut through all of that.

- Starting a CEX (centralized cryptocurrency exchange) lifts any barriers to adding whatever functionality you envision. With DEXs (decentralized exchanges), your options are narrower due to natural blockchain technology limitations.

Table of Contents:

- Benefits of Starting a Crypto Exchange

- Types of Crypto Exchange Platforms

- Key Features of a Cryptocurrency Exchange

- Advanced Features of a Crypto Exchange

- Architecture of a Cryptocurrency Exchange

- Make Your Own Cryptocurrency Exchange in 5 Steps

- Maintenance and Customer Support

- Community Building and Network Effect

- Pitfalls to Avoid During Crypto Exchange Development

- Monetization Strategies for Crypto Exchanges

- Cost to Build a Cryptocurrency Exchange

Benefits of Starting a Crypto Exchange

Crypto is turning into a colossal asset magnet as more and more people have to face inflation. And how do you on-ramp in crypto with fiat? That’s right, a cryptocurrency exchange is one of the most accessible routes.

In fact, crypto exchanges are the front runners of the decentralized finance revolution, bringing in more users than any other blockchain apps. That’s because exchanges usually include a crypto wallet for buying crypto with a fiat currency.

Now, the question arises – how are these exchanges built? The answer lies in cryptocurrency exchange platform development. It’s the process through which these user-friendly online platforms are created, ensuring secure and efficient trading experiences for users worldwide.

If you start an exchange for cryptocurrency, you’re likely to:

If you start an exchange for cryptocurrency, you’re likely to:

- get more customers than other decentralized apps

- make profits on commissions regardless of whether the market is going up or down

- branch out into offering other crypto-based services, e.g., payments

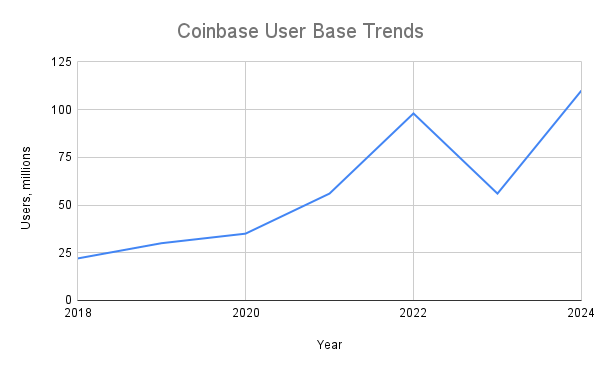

Coinbase continues to stand out as a premier centralized crypto exchange, demonstrating remarkable adaptability and growth. As of Q4 2023, Coinbase reported generating an impressive $953.8 million in revenue. Looking ahead to the first quarter of 2024, it’s estimated that their subscription and services revenue could fall within the range of $410-480 million.

This platform isn’t just a hub for retail and institutional investors; it’s also a vital resource for merchants and blockchain developers seeking to navigate the complexities of the crypto market. With its broad spectrum of services and robust financial performance, Coinbase exemplifies how centralized crypto exchanges can thrive by diversifying revenue streams and continuously innovating to meet the evolving needs of the market. So, opening a cryptocurrency exchange is definitely no brainer.

Types of Crypto Exchange Platforms

What kind of cryptoasset exchange do you want to make? Do you want to set up a bitcoin exchange or create a trading place for altcoins? There are just two options:

- Centralized crypto exchange (managed privately) — CEX

- Decentralized cryptoasset exchange (no central ownership) — DEX

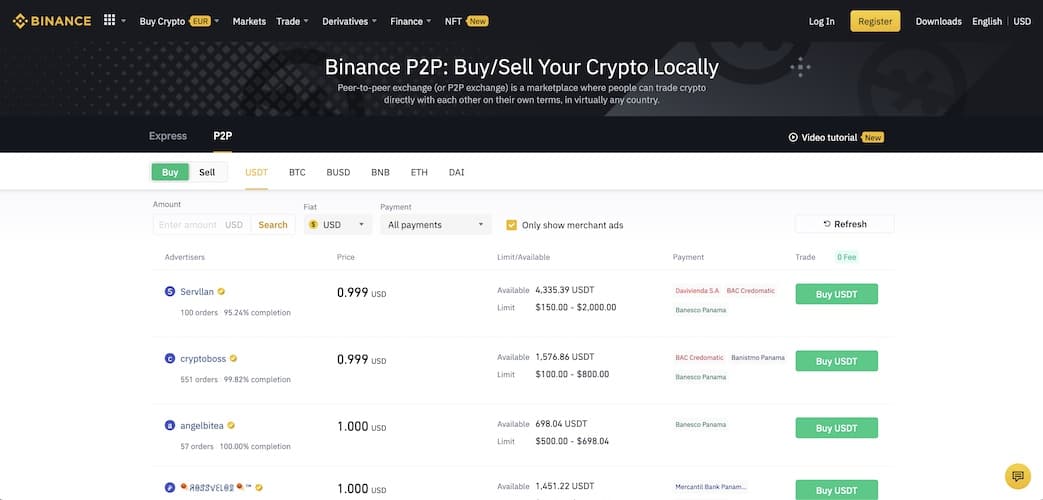

You’ll sometimes hear something about a hybrid option or a peer-2-peer crypto exchange. Well, the hybrid one doesn’t really exist. There’s either an entity controlling an exchange, or it’s managed by smart contracts (decentralized blockchain software). And a p2p exchange can be interpreted as a DEX or a particular use case within centralized exchanges. For example, Binance allows users to trade crypto p2p through an escrow account, which is a niche use case within an overall centrally owned cryptocurrency exchange.

If you’re looking to start a cryptocurrency exchange, it’s essential to understand these different types and their unique features. Your choice between a CEX and a DEX will determine your platform’s operation style, technological needs, and regulatory considerations.

Related: P2P payment app development: The Complete Guide

CEX vs. DEX

What are the main differences between centralized and decentralized crypto exchanges? You better learn the difference before you open a cryptocurrency exchange.

The most prominent contrast lies in how clients view them. With CEX, you trust a third party running an exchange to protect your funds. In contrast, trading on DEX, you bear full responsibility for your crypto. “Not your keys, not your coins” is mainly about this fundamental difference of CEXs and DEXs.

That’s the major difference, but there are many others. Why don’t we sum up these other discrepancies in a table?

| Criteria | CEX | DEX |

| Where do transactions happen? | On centralized servers | On a blockchain network |

| Who has ultimate control over traded crypto? | Company | Customer |

| Where onboarding is simpler? | Anyone can onboard quickly. Includes a crypto wallet. | Used mainly by advanced crypto enthusiasts. Requires a crypto wallet. |

| Can customers on-ramp with fiat? | Yes | Usually no |

| Are transaction fees high or low? | Fees vary for different users and types of operations. | Fees are generally lower compared to CEX. |

| Can users maintain anonymity? | Onboarding includes thorough KYC/AML procedures. | Yes, customers can remain anonymous. |

| UI/UX user-friendliness | Intuitive graphical interface and tutorials. | Users are on their own; a steep learning curve. |

| Which exchange is more secure? | Provides less security due to a single point of failure. | More secure; everything happens on a chain. |

| Where do transactions take place faster? | Faster transactions | Slower transaction |

| Where can users expect to find more liquidity? | CEXs provide more liquidity | DEXs provide less liquidity |

| What’s the trading pairs availability? | CEXs generally have fewer pairs. However, users can buy crypto with fiat money. | DEXs often include rare coins and tokens, not found in CEX; but no fiat. |

| What is the revenue model? | Transaction fees, subscriptions, add-on services for institutional investors and merchants; listing fees; trading its own token; ads. | Transaction fees, trading its own crypto token, ads. |

| What is the biggest barrier to customer adoption? | CEXs are notorious for locking trading activity upon major market events, locking out retail investors. | A steep learning curve, complex UI. Not too many people know about DEXs. |

| Is there any customer support? | Support is available, even though slow at times. | Users are on their own and at the mercy of the community. |

| What is the most significant appeal for the customer? | Clean user interface; “everybody is trading there.” | “My keys, my coins”; plus lower fees. |

As you can see, the choice between a CEX and a DEX has significant implications, especially if you’re planning to build a crypto exchange targeting a specific audience. This decision will determine the kind of user experience you offer, the security measures you need to implement, and the regulatory landscape you’ll navigate. So, before you take the leap, make sure you understand these differences thoroughly.

You should also know that CEXs often have to mimic trades with fake bot accounts to display their platform as a lively, viable solution with lots of liquidity. People are slowly becoming more aware of this fact. So you could probably base your marketing strategy on 100% transparency when planning to make your own cryptocurrency exchange.

Considering many retail investors don’t know much about DEXs and look for simple ways to trade crypto, you’re most likely to start an exchange for cryptocurrency that’s centrally owned. Simply because you’re likely to onboard more users with less friction this way.

And if you decide to make a DEX, you’ll need to create a blockchain application and deploy it to a chain network.

Read More About Our Fintech App Development Services

Key Features of a Cryptocurrency Exchange

When you start your own bitcoin exchange or any other crypto exchange for that matter, you need to include some typical features customers expect to find in such a product.

Onboarding

First of all, a customer needs to register. Unfortunately, you can’t get by with just a social login option. You will need to take the user through a thorough KYC (Know Your Customer) process and collect their ID and other personal information required by AML regulations.

An alternative is to let them in immediately with zero input required (maybe only an email address) and initialize the KYC process when the user attempts to complete a trade.

This onboarding process is a critical component when you set up a crypto exchange. It’s not just about making the platform easy to use, but also ensuring it complies with regulatory standards. So, remember, a smooth, intuitive, and compliant onboarding process is key to attracting and retaining users on your crypto exchange.

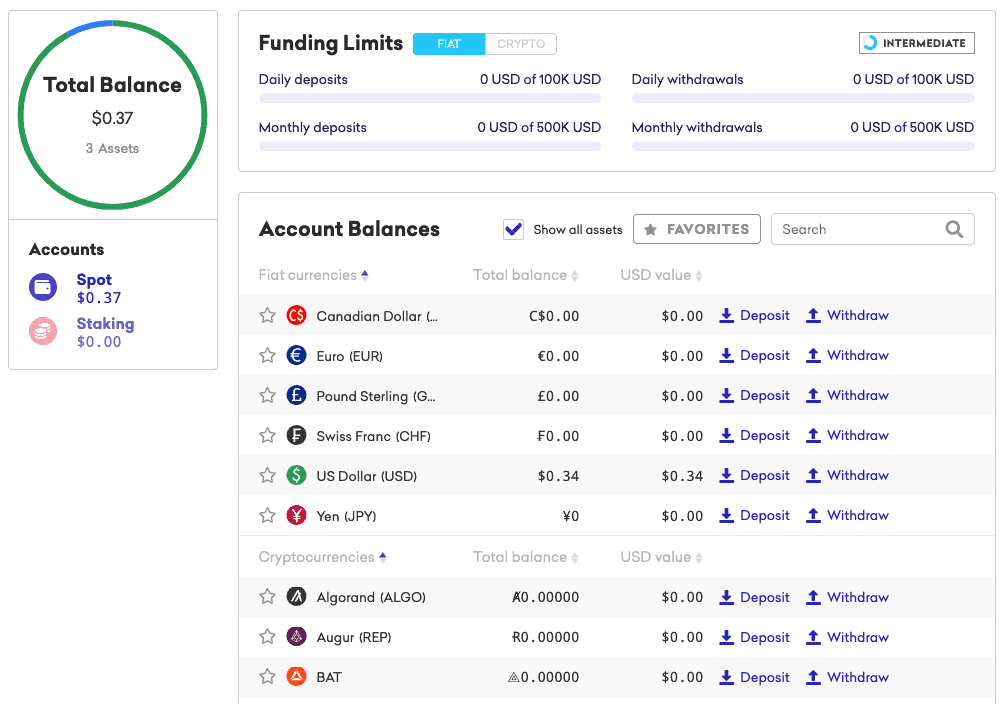

Crypto wallet

If you are working on a centralized cryptoasset exchange, you’ll need to create a crypto wallet for users to hold their coins and tokens. They will use the wallet to receive and transfer crypto to/from their account balances.

The challenge here is that different tokens will require separate wallets (or addresses), and you will need to be very explicit about which address to use for which altcoin or cryptocurrency.

Crypto wallets can come in two forms: custodial, where the service provider holds the private keys on your behalf, or non-custodial, where clients maintain control over their own private keys.

Alternatively, you can open a Bitcoin exchange without any wallets – just abstract away this complexity from customers (you will still have BTC address under the surface, but clients won’t need to interact with them directly). Instead, users will work with an account balance and deposit/withdraw from/to their bank accounts.

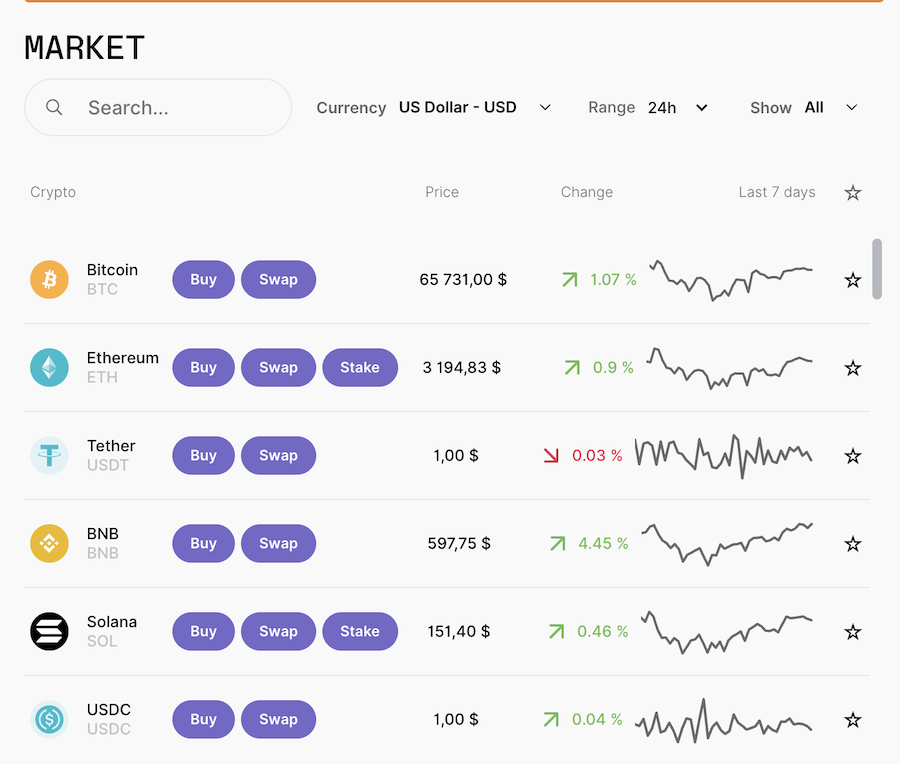

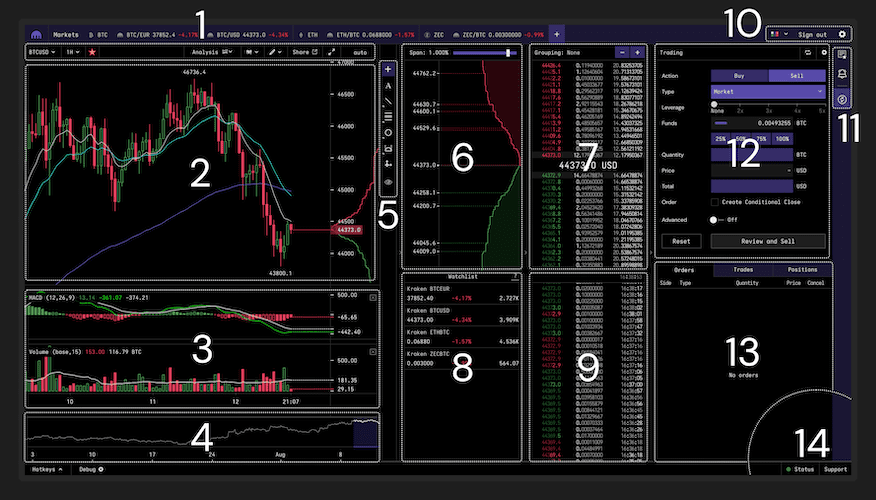

Charts

Users will spend most of their time in your app looking up crypto prices, trends, exchange rates, and other charts that are usually included in the main dashboard.

Related: Dashboard Web App Development

Order book

An order book shows current buy and sell orders (aka bids and asks) from buyers and sellers who buy or sell crypto. That’s where we can also see the market size (overall supply and demand) for every given price point.

I wouldn’t say that’s a super helpful feature for novice users. I remember I got scared away the first time I saw that chart in Kraken’s old interface. Still, many users need to learn their way through order books and the buy/sell process to become successful crypto traders.

So, if you’re looking to make a crypto exchange, incorporating an order book is a crucial aspect. While it might seem intimidating to some, it offers transparency and a real-time view of market activity. So, when building your platform, consider how to present this information in a user-friendly way to cater to both beginners and seasoned traders.

Transaction history

Plain and simple — a list of all transactions, possibly broken down by the actual amount and applicable fees.

Portfolio analytics

People love these pie charts showing how much crypto they have, which asset has appreciated in value the most, and all other analytics you can offer. Therefore, starting a cryptocurrency exchange without at least some basic portfolio tracking is useless.

Notifications

These are typical for practically any modern web and mobile apps. If something requires user action, there needs to be a visual clue constantly nagging users to take a look.

The usual scenario for notifications when you make a bitcoin exchange website is to nudge users to turn on more security features or unlock new account tiers by providing more info for verification.

Advanced security features

And last but not least, no cryptocurrency exchange can exist without advanced security options. This is particularly crucial when you aim to create your own crypto exchange. That should go way beyond enabling bio and two-factor authentication.

As you probably heard, Coinbase got serious issues with their multi-factor authentication, which got hacked through for 6,000 users. So, if you’re venturing into building your own platform, investing in top-notch security measures is a must to safeguard your users’ crypto assets and maintain their trust.

Advanced Features of a Crypto Exchange

Now let’s go over some more sophisticated options you may want to include to develop a crypto exchange that really rises above the competition.

Crypto staking

Like a bank deposit, staking crypto allows you to lock a certain amount of coins and start earning interest. The rates are nowhere near as lucrative as with other DeFi options. Still, it’s a great alternative that gives users peace of mind when they aren’t actively trading.

Related: Building a DeFi Staking Platform: Complete Guide

Cold wallets integration

Tech-savvy users would appreciate an option to connect their hot crypto wallets with hardware wallets that aren’t connected to the internet. Thus, they are more secure for storing large lumps of crypto.

As a crypto exchange owner, you should know that regardless of whether you provide this option to investors or not, it’s not really an option for you — it’s a must. Particularly if you’re aiming to make a cryptocurrency exchange running on centralized servers, the integration of cold wallets is a non-negotiable aspect.

All staked and dormant cryptos or other digital currencies on your exchange will be sitting in cold crypto wallets, inaccessible to hackers even if they manage to breach through your front-line defenses.

Credit card integration

Leading crypto exchanges like CoinBase and Crypto.com offer their customers credit cards to pay for their everyday expenses with a digital currency of their choice. As part of the deal, users get crypto cashback and other perks.

P2P crypto trading

Your exchange can also assume escrow responsibilities and intermediate direct crypto trading between users around the world (they agree on pricing terms by themselves). If you think about it, the option makes sense for rare digital assets that users may hold in their private wallets. Your role will be to freeze funds until both parties acknowledge the exchange and provide a platform with user ratings, reviews, etc. Many high-quality exchanges offer this functionality to customers with substantial trading experience.

KYT

KYT stands for Know Your (cryptocurrency) Transaction and represents the next level of KYC best practices required from companies dealing with crypto.

KYT procedures include analysis of all transactions and risk assessment of their involvement with money laundering or other criminal activities as per FATF and 5AMLD regulations.

Tradable exchange token

You can also issue your own token and incentivize users to purchase and trade it by offering lower fees or other options when they hold your crypto token on their accounts. Here are our recommendations on how you can create a crypto token.

Advanced trading options

Don’t forget about savvy investors who will be looking for all the tools they commonly find in traditional investment instruments, e.g., margin trading, limit orders, stop-loss orders, all the chart projecting tools, trading volume, etc.

Consider adding these advanced features to attract experienced traders and set your platform apart in the competitive crypto exchange market as you’re planning to start a bitcoin exchange.

Related: Trading and Investing App Development Guide

You may also consider adding a separate platform for launching vetted crypto projects through IEO (Initial Exchange Offering) and a yield farming solution for extended crypto staking. The former add-on offers your users early access to promising tokens. The yield farming platform may serve as a liquidity provider.

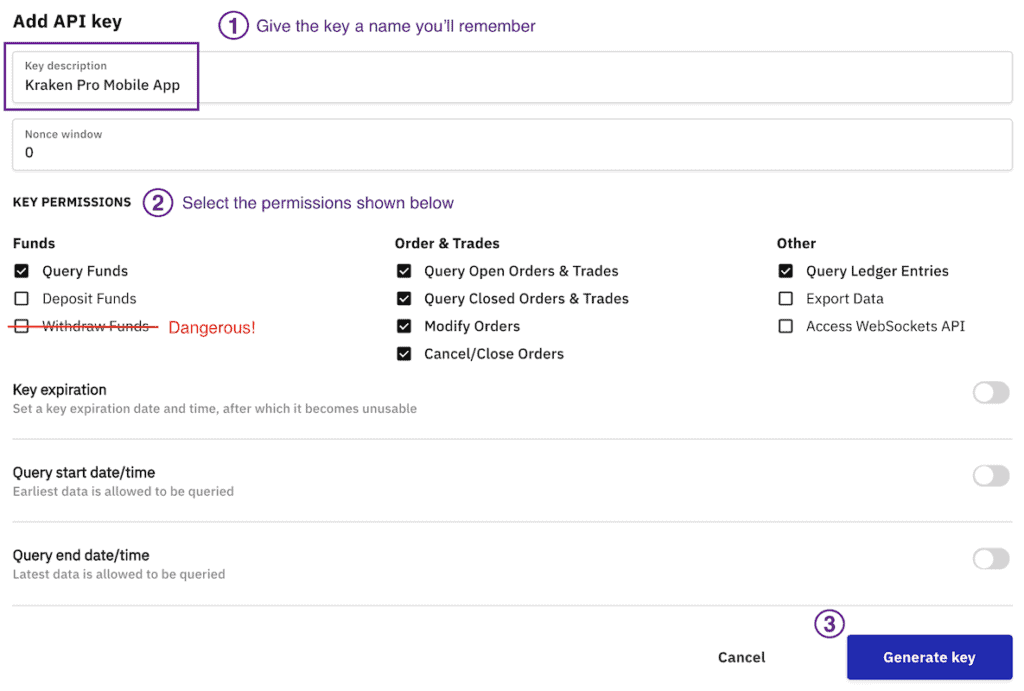

APIs

Having an API tied to the user’s account gives your crypto exchange a second life outside its own boundaries. Using the API, your customers can make use of other crypto-focused applications by feeding them portfolio data and all additional information the API can relay. Remember about these when creating a cryptocurrency exchange – pro traders will thank you for the ability to branch out into other solutions using your product as the main hub.

Social elements

Think about throwing in some engaging features based on socializing. Users would love to compete in different leagues to win bonuses and perks. For example, there can be a hall for top all-time high callers who get the exchange token for making accurate price predictions.

Also read: How to build a DeFi based crypto exchange

Besides, there’s no better and safer way to brag about mad gains than an anonymous platform on a crypto exchange.

Architecture of a Cryptocurrency Exchange

Of course, you can’t start your own cryptocurrency exchange without thinking through its architecture. To an average business owner, software architecture may sound too technical and intimidating. At the same time, without going into depth, the subject is not much scarier than, say, thinking about the architecture of your house.

It’s not scary, I promise

In practice, sketching the architecture of a cryptoasset exchange will be the responsibility of your crypto exchange developers, but you’ll find they base their assumptions on simple things like:

- do you want a CEX or DEX?

- how many users do you expect to serve concurrently?

- how quickly should they be able to transact?

- what should the uptime be?

- how much processing will the exchange host behind the scenes?

- what front ends do you envision (web/mobile/desktop/etc.)?

As you help answer these questions, the crypto exchange development team starts to juggle various building blocks of your product, orchestrating them into a solid, robust cryptocurrency trading platform.

Whether you make your own crypto exchange as CEX or DEX, you’ll need to stick with a microservice architecture. Your crypto is a complex product (although it may look straightforward and intuitive to your customers) consisting of multiple elements.

Related: DeFi App Development: Everything You Need to Know

When you build each element independently and then interconnect them, you can easily update each block without adjusting the other parts in the future. It’s a crucial part of crypto exchange setup. For those curious about similar development processes in fintech, learn how to create mobile banking applications for a comprehensive understanding.

Moreso, different developers can work on separate chunks of the exchange simultaneously, which guarantees faster time to market.

Also Read: Gamification in Banking: Examples, Benefits and Use Cases

Bird’s-eye view of crypto exchange architecture

What building blocks do you need to assemble to build your own bitcoin exchange?

- Trading engine

The heart and soul of your product. That’s where all trading logic resides. Typically, this block would also include an order-matching engine that matches sellers’ asks with buyers’ bids.

- Multi-cryptocurrency wallet generator

Every customer gets a wallet, remember? You need a mechanism for doing that automatically.

In fact, every customer receives multiple wallets (for different crypto), and they are all in concert with your internal wallets for the most efficient funds movement.

In fact, every customer receives multiple wallets (for different crypto), and they are all in concert with your internal wallets for the most efficient funds movement.

- Admin dashboard

An admin panel is a place for your operators to manage the platform, typically role-based and protected with hardware security keys.

- Authentication server

A server for KYCing and authenticating your customers.

- Front ends: mobile/web

The eye candy for the customer.

- API layer

As you already know, APIs serve to connect building blocks together as you proceed to create your own Bitcoin exchange. They also help to connect your exchange with third-party solutions. And believe me, there are quite a few things to link to: liquidity providers, payment gateways, various blockchain explorers, trading bots, analytics, logging, etc.

This connectivity is particularly crucial when you aim to build a cryptocurrency exchange website, as it ensures seamless integration and functionality, enhancing your platform’s overall user experience

Read our Guide to Creating a Payment Gateway for Cryptocurrency

As you can see, it’s not that complicated, but bear in mind that I’m giving you a high-level overview of an exchange’s architecture here.

Make Your Own Cryptocurrency Exchange in 5 Steps

Ok, it’s high time we discuss how to create a crypto exchange platform. What are the software development steps you need to take to launch such a product?

Step 1: Build from scratch or pick an off-the-shelf solution

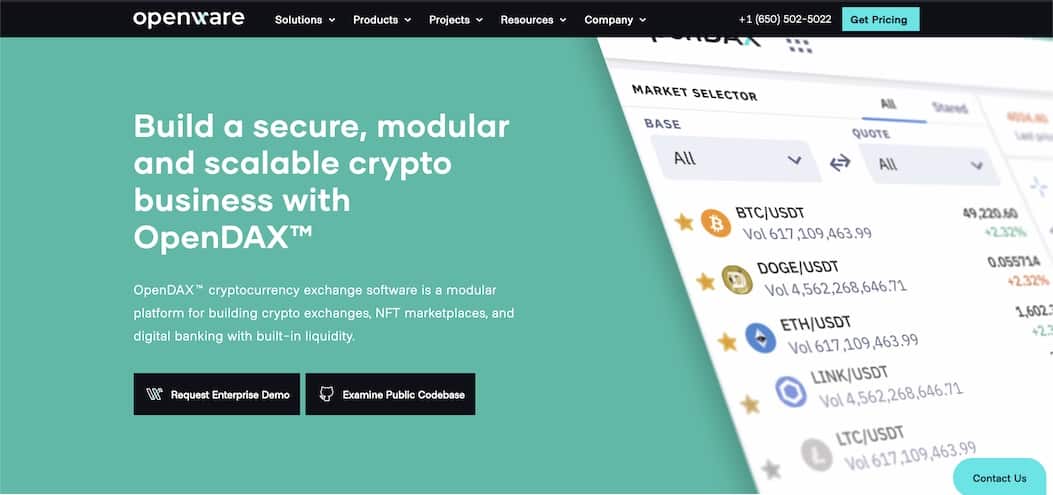

The first question you’ll need to ask yourself is whether you want to build your own crypto exchange website or stick with a ready-made solution. The market has a few white label options like OpenDAX cryptocurrency exchange software or Alphapoint, but as you’d expect, they come with their own pros and cons.

Pros:

- Faster time to market

- Mild customization

That’s about it, for real. You get the rest of the advantages like scalability, infinite customization, and unique features, among others, with a custom-built exchange. Now to the cons of licensing an off-the-shelf platform setup.

Cons:

- Stock, non-upgradable functionality (unable/hard to add unique features to your cryptocurrency exchange setup)

- Time for your team to get acquainted with code (or you’re stuck with the team that made the canned solution)

- Full security audit from a third party is required (to make sure existing code is 100% safe)

- High upfront costs upon opening the exchange

Building your own crypto exchange, you can be sure it’s safe and secure. Plus, you literally watch how your investment turns into a workable product that you can start testing.

Related: Custom build vs Off-the-shelf: Pros and Cons

Anyways, if you choose to go with an off-the-shelf option, consider this step as a final one. If you need a custom-built exchange, please follow along to build your own cryptocurrency exchange.

Step 2: Investigate legalities and create partnerships

Making sure your CEX operates according to local legislation is critical, whereas a DEX doesn’t necessarily have to comply as it runs on a blockchain, and governments have little control over that yet. This is particularly important when you set up a cryptocurrency exchange that’s fully decentralized.

[Update, as of April, 2024: the SEC has started investigation into UniSwap, the largest DEX out there; so, no guarantees even when you work on a decentralized product and especially when setting up a bitcoin exchange.]

Anyways, you’ll need a lawyer experienced in crypto to make sure your product is fully compliant with AML/KYC and other local regulations.

As for partnerships, you will need to partner with companies offering fiat-crypto on-ramp solutions, payment gateways, and crypto liquidity provisioning. That may involve partnering with banks, credit unions, other crypto exchanges, and other financial institutions.

Also Read: How to start your fintech startup

Step 3: Create and verify UX/UI

Back to the actual product. Since we want to create a cryptocurrency exchange website or mobile app that is super engaging and easy to use, we need to spend enough time on its design.

The typical routine here is to:

- think through your visual brand

- create a prototype

- test the prototype with users

- update the UX/UI according to the feedback

- verify design feasibility with blockchain developers

- hand-off the UX/UI to a development team

And the result of this step is the version of user design that’s likely to get higher traction with clients.

Step 4: Develop the front ends and back end

Nothing interesting here, just developers putting code together for your platform’s back-end and front ends.

Programming only gets exciting when you start receiving the first builds that you can play with. It’s crucial that as you venture into CEX/DEX development, you won’t miss this step and begin providing feedback because it’s easier to fix things in the making than when the whole thing is ready.

Programming only gets exciting when you start receiving the first builds that you can play with. It’s crucial that as you venture into CEX/DEX development, you won’t miss this step and begin providing feedback because it’s easier to fix things in the making than when the whole thing is ready.

Please note that you will need two teams of developers when you create a bitcoin exchange site:

- traditional app developers

- blockchain developers

Related: Choosing a tech stack for your application

Step 5: Run QA and release

Once your crypto exchange site (or/and a mobile app) has been developed, as you are taking strides to start your own crypto exchange, it’s time to test it thoroughly, imitating massive user inflow, and then release it.

Two things to keep in mind here:

- testing really starts during development, and this QA step is like a single major effort to verify everything works as designed

- release and deployment include setting up DevOps processes so that you can continually improve a working product without interruptions for users

This step ensures that your solution won’t go offline because that’s not an option for such businesses.

That’s a very high-level overview of the crypto exchange development process, and you should expect deviations depending on your product requirements.

Related: The Complete Guide to QA: Tips, Steps, Guidelines

Also Read: How to Guide on ASO for Mobile Apps

Maintenance and Customer Support

In the fast-paced world of crypto exchanges, maintenance and customer support are crucial for ensuring smooth operations and building user trust. However, recent statistics reveal that even major players in the industry still have significant room for improvement. Keep that in mind to build your Bitcoin exchange software as a pleasant user experience.

Maintenance

Regular maintenance is paramount for any crypto exchange. This involves routine checks and updates to ensure the system runs optimally, including server maintenance, software updates, security enhancements, and bug fixes. The platform must be able to handle high transaction volumes without crashing or slowing down, which requires regular performance testing and capacity planning. Keeping up with the latest advancements in crypto technology is also essential to stay competitive.

Customer Support

Providing top-notch customer support is a key aspect of running a successful crypto exchange. Users should be able to easily get help when they encounter issues or have questions. This requires a knowledgeable support team that can respond promptly to customer inquiries. Multiple channels for support, such as email, live chat, and phone support, cater to different user preferences. A comprehensive FAQ section and user guides on your platform assist users in navigating your exchange.

However, data from the Annual Global Crypto Customer Support Report by ACX reveals some concerning trends:

- Over half of crypto exchanges (63.2%) were unable to deliver a first response time under 5 minutes.

- The typical first response time for the scrutinized crypto exchanges was notably high at 143 minutes.

- A significant portion of crypto exchanges (27%) fell short in providing the necessary level of knowledge on crypto products while addressing customer support inquiries.

These statistics underscore the importance of investing in customer support. By improving customer service, crypto exchanges can increase user satisfaction, promote customer retention, and ultimately drive their platform’s long-term success.

Community Building and Network Effect

In the dynamic world of cryptocurrency exchanges, two vital ingredients can significantly boost your platform’s growth and sustainability: community building and the network effect. To create your own cryptocurrency exchange that scales fast, you need to consider both factors. Let’s unpack them:

Community Building

In the crypto universe, a robust community is like a secret weapon. It’s all about rallying a group of engaged users who not only contribute to your platform’s growth but also help spread the word about your exchange. Here’s a few things to keep in mind as you’re making a crypto exchange:

- Engaging Content

Keeping your users in the loop with regular updates about new features, security measures, and market trends can spark engagement and keep them hooked.

- Social Media Integration

Make it easy for users to share their crypto victories on social media with handy share buttons and automatic posts. It’s a great way to draw more eyes to your platform.

- Community Events

Webinars, AMAs, and other events can provide invaluable learning opportunities for users. Plus, they’re a fantastic way to build a sense of camaraderie among your user base.

- Rewards System

A little incentive never hurt anyone! Rewarding active participation can encourage users to stay engaged and contribute more to the community.

Keep those tacticts in mind even as you only start a crypto exchange business.

Network Effect

The network effect is like magic. As more people join your exchange, the liquidity increases, making your platform even more appealing to potential users. Here are some features that can amplify this effect:

- Referral Programs

Encourage your users to bring their friends aboard by offering referral incentives. It’s a win-win situation that helps expand your user base.

- Diverse Range of Cryptocurrencies

By offering a wide variety of cryptocurrencies, you can attract a broader user base, each adding unique value to the platform.

- Scalable Infrastructure

As your user base grows, so should your platform. Ensuring your infrastructure can handle an increase in users is key to maintaining performance and satisfaction.

- Ease of Use

A smooth, user-friendly interface can make your platform inviting to new users, encouraging them to join and stick around.

As you can see, community building and harnessing the network effect are crucial strategies for developing a successful crypto exchange. By focusing on these areas, you create a platform that attracts users and keeps them coming back for more.

Pitfalls to Avoid During Crypto Exchange Development

You may hit a brick wall a few times while building a CEX or DEX, and we’ll be happy if these ramblings below will help you navigate towards a successful product faster.

UX/UI issues

Every product has its target audience, right? But what do you do when your target audience is highly versatile? Today, it seems, everybody is willing to take part in the crypto hype. It seems like every Tom, Dick, and Harry is itching to open a crypto exchange these days!

Every product has its target audience, right? But what do you do when your target audience is highly versatile? Today, it seems, everybody is willing to take part in the crypto hype. It seems like every Tom, Dick, and Harry is itching to open a crypto exchange these days!

So you can either pick a specific demographic and work on growing this audience together with other market players.

Or you can appeal to as wide a group as possible and find a way to include advanced features for more crypto-savvy users. Think the Robinhood app that can also turn into Interactive Brokers on crypto steroids upon request. A crypto exchange business can take many forms.

By the way, large players like Binance have successfully adopted this paradigm and allow their customers to seamlessly switch between a pro and simple version of the app. Be sure to consider this option when you start to build a crypto trading platform.

Related: UI/UX tips to designing a successful application

Building the right development team

Just a heads-up about putting together a team for creating a cryptoasset exchange.

Blockchain developers with hands-on experience are in high demand these days. Now think that you need them to work fruitfully with skillful UX/UI designers, QA engineers, other app developers, and project managers.

Some of these roles will be involved only part-time, but everybody still needs to work as a team.

Related: How to hire the right developer: Comprehensive Guide

Mobile vs. web

Where do you expect to onboard more users? Will you start with a mobile or web app, or do you want to release both simultaneously? If you go with a mobile app first — does it mean you need to adjust the mobile-first design to the web app later on, or vice versa? We provide answers in a separate blog: Mobile-First Web Design.

Here, I’ll just note that your mobile app and the browser-based exchange need to resonate with each other. It’s not like you build a web app and then optimize the UI for the mobile. Ideally, you work on both simultaneously (even if one is slated for later development).

Related: Mobile Web vs Mobile App?

Security is your everything

That doesn’t exactly happen left and right, but quite a few crypto exchanges do get hacked now and then. Therefore, you can hardly overperform on this front: take every measure you and your team are aware of:

- use machine learning/artificial intelligence to detect fraudulent transactions

- lock-down immediate fund movements before withdrawals

- require more proactive actions from users based on how much money they invest/trade

- use bio authentication

- use 2-factor authentication that’s hard to hack (read: not via text messages)

- implement multi-signature crypto wallets

Believe it or not, this list barely scratches the surface of what really goes into securing a crypto currency exchange (including compliance, too). We’ll be happy to share more if you want to learn how to start a crypto exchange. Yeah, building a cryptocurrency exchange is no small feat.

Believe it or not, this list barely scratches the surface of what really goes into securing a crypto currency exchange (including compliance, too). We’ll be happy to share more if you want to learn how to start a crypto exchange. Yeah, building a cryptocurrency exchange is no small feat.

Risk management in cryptocurrency exchange business

Running a crypto exchange is like playing 3D chess while juggling flaming swords. But don’t worry, we’ve got your back. Let’s break it down:

- Understanding the Risks

The crypto world can be as turbulent as a roller coaster ride. From market volatility to regulatory uncertainties, you’ve got to keep your eyes open. Stay updated on trends, conduct regular audits, and be prepared for the unexpected.

- Safety Measures

In this business, safety isn’t just a priority, it’s the priority. Consider using AI to detect fraudulent transactions, require proactive actions from users based on their trades, and don’t forget about multi-signature crypto wallets.

- Educate Your Users

Knowledge is power. Empower your users with webinars and educational content about risk management. An informed user is a safer user!

- Diversification

Putting all eggs in one basket? Not a great idea. Encourage your users to diversify their portfolio to spread the risk and minimize potential losses.

- Regular Updates and Communication

Keep your users in the loop. Any changes in the market or on your platform that could impact their trading activities should be communicated promptly.

Using these best practices you can create a bitcoin platform for trading that genuinely stands out in this increasingly crowded space.

Monetization Strategies for Crypto Exchanges

Developing a crypto exchange is not just about immediate profits, but also about creating a sustainable platform that can generate long-term value for its users and stakeholders.

Transaction Fees: This is the most common monetization strategy for crypto exchanges. Every time a user trades cryptocurrency, the platform charges a small commission. The key to success with this model is volume; the more trades executed on your platform, the more revenue you’ll generate.

Listing Fees: New cryptocurrencies are being created all the time, and their creators want to get them listed on exchanges to increase their visibility. As an exchange, you can charge a fee for this service. This not only generates revenue but also helps ensure that only serious and credible cryptocurrencies make it onto your platform.

Premium Services: Offering additional services like advanced trading tools, priority customer support, and increased withdrawal limits can attract more seasoned traders who are willing to pay for these benefits.

Staking: Some exchanges allow users to earn interest on their crypto holdings through staking, where a user’s cryptocurrency is used to secure the network and validate transactions. In return, users receive a share of the transaction fees or newly minted coins. Exchanges can take a small percentage of these rewards as a fee.

Margin Trading: This is a service that allows traders to leverage their positions, meaning they can trade more cryptocurrency than they actually hold. Exchanges can charge higher fees for this service due to the increased risk and potential reward.

Selling Ads: Crypto exchanges attract a high volume of traffic, making them an attractive platform for advertisers. Selling ad space on your platform can be a significant source of revenue. However, it’s important to manage this carefully to ensure ads are relevant and do not detract from the proper user experience.

Remember, the goal is not just to make money, but to provide value to your users. A happy user base can lead to higher transaction volumes, positive word of mouth, and ultimately, a successful, long-term business.

Cost to Build a Cryptocurrency Exchange

The cost of developing a cryptocurrency exchange, as always, depends on lots and lots of things:

- are you building a DEX or CEX?

- will you need a mobile app?

- do you want to use an open-source trading engine?

And a myriad of other factors. I’d say the cost to create a minimum marketable version of a CEX would gravitate around a $300,000-400,000 investment.

Related: App Development Costs: The Complete Guide

Topflight Expertise in Crypto Exchange Development

At Topflight, we pride ourselves on our deep understanding and extensive experience in the development of cutting-edge crypto exchanges. Our portfolio showcases a diverse range of projects that underline our capability to navigate the complexities of the crypto world, delivering solutions that are not only innovative but also robust and user-friendly.

Spotlight DEX Project

Discover the groundbreaking CitizenFinance project: a DeFi Ecosystem Tailored for a Metaverse Game. This pioneering initiative by Topflight has redefined the gaming landscape, blending the thrill of play-to-earn metaverse gaming with the innovative world of decentralized finance (DeFi). Here’s how we’ve made an impact:

- Cross-Chain Ecosystem: Developed a comprehensive ecosystem of decentralized apps, facilitating seamless gameplay and financial transactions across multiple blockchain networks, including Polygon and BSC.

- NFT Collectibles: Enabled players to truly own their in-game assets. From skins to weapons, every item is tokenized as an NFT, ensuring players have full control over their digital treasures.

- Decentralized Crypto Exchange (DEX): At the heart of the GameFi economy, our DEX allows players to trade, stake, and lend their in-game crypto and NFT assets, fostering a dynamic and self-sustaining economy within Metalands.

- Multi-chain DEX integration

- NFT/crypto staking capabilities

- Yield farming in liquidity pools

- Comprehensive lending/borrowing protocols

- Dynamic price charts for informed trading decisions

- NFT Marketplace: A vibrant marketplace where players can trade in-game collectibles, stake them, or use them as collateral. Future updates include a dedicated online image editor for creating and selling custom skins as NFTs.

- Supports popular wallets like Trust Wallet, MetaMask, and MathWallet

- Offers fixed price and auction sales

- Ensures seamless experience on both mobile and desktop

- Innovative DeFi Challenges Tackled: We addressed key issues head-on, such as transaction costs and speeds, by:

- Deploying smart contracts on newer, more efficient chains

- Bundling transactions to minimize fees

- Automating staking with Chainlink Keepers

- Facilitating cross-chain token transfers with bridges

- Handling complex crypto calculations with BigNumber.js

Topflight’s Crypto Development Services

Rapid Prototyping & Agile Development: Our approach is centered around rapid prototyping and agile development methodologies. This enables us to quickly adapt to changes in the crypto landscape, ensuring that our clients’ platforms are always at the forefront of technology.

Healthcare and Fintech Integration: We specialize in integrating crypto exchange functionalities within the healthcare and fintech sectors, offering services like telemedicine, telepharmacy, and fintech solutions. This unique blend of expertise allows us to create exchanges that cater to specific industry needs, enhancing user engagement and compliance.

Comprehensive Tech Stack: Leveraging a comprehensive tech stack, including Solidity, Truffle, Node.js, React.js, and more, we ensure that our crypto exchange platforms are built on a foundation of security, efficiency, and scalability.

Security First: Recognizing the paramount importance of security in the crypto space, we employ bank-grade encryption, multi-signature wallets, and two-factor authentication to safeguard users’ assets and data.

End-to-End Solutions: From ideation to launch, Topflight provides end-to-end development services. Our team’s expertise in project management, QA testing, and continuous development environments guarantees that each crypto exchange is tailored to meet and exceed our clients’ expectations.

Through a combination of technical prowess, agile methodologies, and a keen understanding of the crypto market, Topflight delivers crypto exchange development services that are unmatched in quality and innovation.

You can schedule a free consultation with our experts to learn more if you’re thinking about starting a crypto exchange.

Related:

- How to Make a DeFi Lending Platform

- How to Build a Smart Contract

- How to Build a Market ready Fintech App

- How to Make a Private Blockchain

- How to Start a DAO

- How to Develop a Crypto Trading App

- How to Create a Crypto Bot

- How to Build a DApp

[This blog was originally published in November 2021 and has been reoptimized for more accurate data]

Frequently Asked Questions

Why start your own crypto exchange?

Starting your own crypto exchange opens the door to tapping into the booming cryptocurrency market. It offers a unique opportunity to innovate, providing secure and efficient trading solutions while potentially generating significant revenue as you connect buyers and sellers in this dynamic digital economy.

What is a white label crypto exchange?

A White Label Crypto Exchange is a ready-made software solution that allows you to launch your own cryptocurrency exchange quickly and with lower upfront costs. It’s fully customizable, enabling you to brand and tailor the platform to meet specific market needs while ensuring a seamless user experience.

Can I have a fiat-crypto on-ramp in decentralized cryptoasset exchange?

Yes. You can integrate with a payment gateway of your choice, like MoonPay or Mercury.

What's the biggest bottleneck to onboarding users to a crypto exchange?

Having enough liquidity and showing active trading/investing activity on the platform. Some exchange businesses solve that issue by integrating with other exchanges and market makers for liquidity and using bots to emulate transactions.

You didn't mention anything about tech stack. Any recommendations?

Stick with whatever technologies the team you trust is experienced in. There are many variants and no universal stack that will work for every project in this industry.

Do I have to comply with any regulations if I build a DEX?

No, but it’s recommended to err on the right side and include easy controls for switching the solution off for different geographies if you hear such official requests. Users will be able to circumvent that by using VPN anyways.

How long does it take to build a cryptocurrency exchange?

6 to 9 months for a deployable MVP.