Are you a crypto enthusiast tired of this slowly dragging bear market, just like me? Well, if there’s one good thing about bear markets (besides accumulating, of course) is they allow some time to build things. They give us space to create and test new crypto apps — for example, a crypto exchange — before they come to a screeching halt during the next bull run (hello, Ethereum fees!).

If you’re wondering about the cost to start a crypto exchange from scratch, look no further: $150,000-$200,000 to put out an MVP and around $400,000 — $600,000 for a turn-key solution. Let’s dive into the nitty-gritty of where these numbers come from and how we can trim them down.

Top Takeaways:

- Choice of Development Model: The choice of development model significantly impacts the cost. DEX cloning offers a cost-efficient option; white label solutions provide a manageable alternative while building a CEX from scratch is a costly endeavor requiring a large team and investment.

- Focus on MVP Features: Prioritize the Minimum Viable Product (MVP) features to control costs and expedite the release. Key features include crypto wallet integrations, a trading engine, external APIs, an admin panel, user-facing features, and localization for accessibility.

- Consider Non-Development Costs: Apart from development expenses, non-development costs contribute to the overall launch price. These include server maintenance and hosting costs, hardware expenses for cold wallets, customer care, ongoing security improvements, legal counsel, bank transfer fees, and liquidity providers’ fees.

Table of Contents:

- Crypto Exchange Development Costs at a Glance

- Types of Crypto Exchange Platforms

- What Factors Affect The Cost Of Developing a Cryptocurrency Exchange?

- How Does the Choice of Development Model Impact the Cost of Building the Crypto Exchange?

- Importance of MVP Features Estimations to Make the Development of Crypto Exchange Cost-Effective

- Determine Additional Features Estimation

- How Much Does it Cost to Build a Cryptocurrency Exchange?

- What Non-Development Costs Affect the Launch Price of a Cryptocurrency Exchange?

- Why Choose Topflight as Your App Design Partner

Crypto Exchange Development Costs at a Glance

Understanding how much it costs to build a crypto exchange can help you budget effectively and prioritize the features that matter most. Below, we break down the estimated costs and development time for key components of a crypto exchange.

| Feature/Component | Estimated Cost ($) | Development Time |

|---|---|---|

| User Authentication (KYC) | $5,000 – $10,000 | 2 – 4 weeks |

| Wallet Integration | $10,000 – $15,000 | 3 – 5 weeks |

| Trading Engine | $20,000 – $50,000 | 6 – 12 weeks |

| Liquidity Integration | $15,000 – $30,000 | 4 – 8 weeks |

| Security Features (2FA, Encryption) | $10,000 – $20,000 | 3 – 6 weeks |

| Admin Panel & Analytics | $8,000 – $12,000 | 3 – 5 weeks |

| Mobile App Development | $25,000 – $50,000 | 8 – 12 weeks |

| Total Average Costs | $93,000 – $187,000 | 24 – 40 Weeks |

The cost to develop a crypto exchange ranges from $93,000 to $187,000 and typically takes 24 to 40 weeks, depending on the features and complexity of the platform.

Types of Crypto Exchange Platforms

In 2023, after a few bull runs and bear-market stagnations, everybody seems to know the main types of crypto exchanges:

- centralized cryptocurrency exchanges (aka CEXs)

- decentralized cryptocurrency exchanges (aka DEXs)

- hybrid exchanges that borrow from DEXs and CEXs

The canonical example of a CEX is the wildly popular Coinbase:

- trades happen off-chain, using exchange-hosted user accounts

- users’ assets are custodied by the platform

- the exchange is owned by a centralized legal entity (a company of a group of companies)

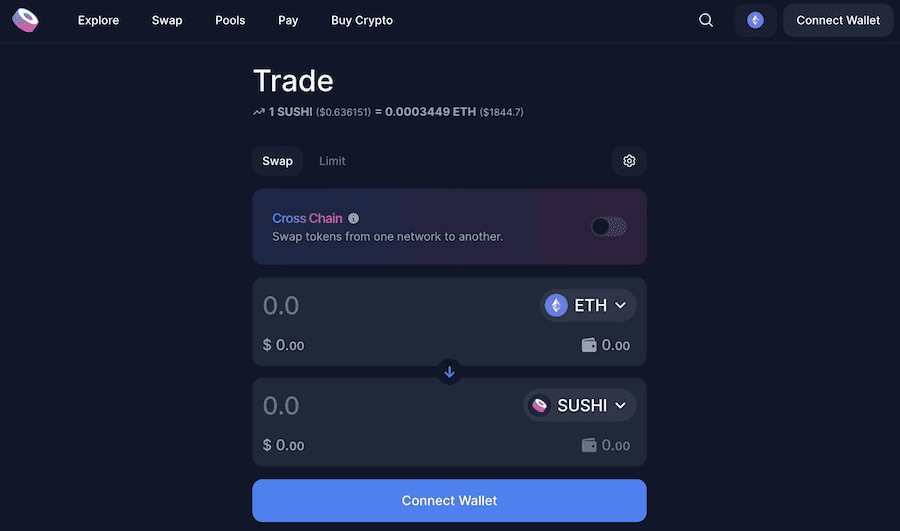

As for DEXs, the most-known decentralized crypto exchange is UniSwap:

- the dex is governed by users through a DAO (decentralized autonomous organization)

- users have sole custody of their assets

- all trades happen directly on the blockchain

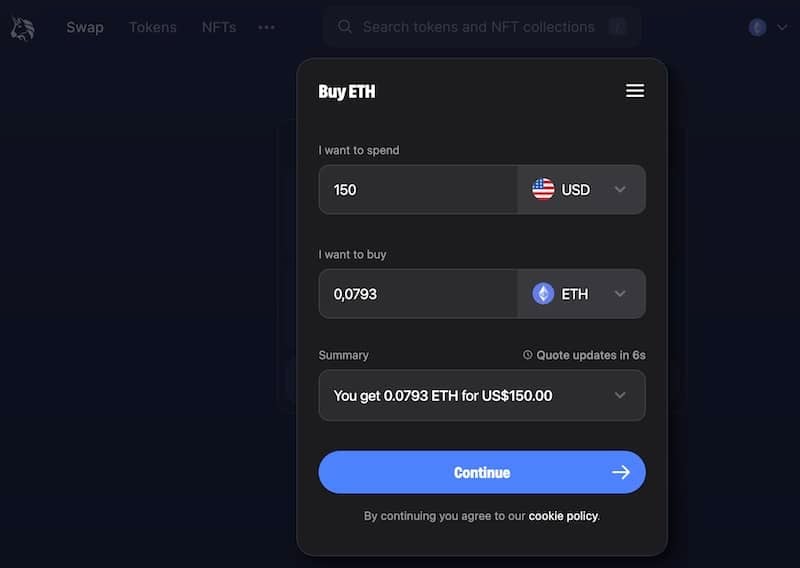

One other striking difference between DEXs and CEX used to be the availability of fiat on/off-ramps with the latter. However, many DEXs today integrate with crypto-fiat onramp services like MoonPay that allow one to purchase crypto, for example, right on UniSwap.

CEXs are still champions when it comes to crypto-fiat off-ramp, though.

An exchange that combines features of a CEX (ownership) and a DEX (self-custody of funds) is a hybrid crypto exchange model. An example would be the Eidoo platform: owned by a company, but users operate via non-custodial wallets.

An interesting variation of a hybrid model is a P2P crypto exchange where users connect via a centralized platform, e.g., LocalCoinSwap, with escrow functions to trade peer-to-peer. Note that many CEXs have the p2p-trading functionality as part of their suite.

Related: A Complete Guide to Building a Crypto Exchnage

What Factors Affect The Cost Of Developing a Cryptocurrency Exchange?

Make no mistake, developing a crypto exchange like Coinbase, i.e., a CEX, from the ground up costs millions of dollars. Even keeping it running is expensive: Coinbase has 1,419 employees occupied in engineering (with hefty hourly rates, e.g., $70 per hour), which easily translates into a millions-worth monthly payroll. [skip to the next section to learn how to lower this cost to develop a cryptocurrency exchange]

However, CEXs like Coinbase have been in the making for years (since 2012) and, at some point, have become profitable. So, what do founders seeking to repeat Coinbase’s success need to take into account when considering the crypto exchange development cost?

CEX or DEX?

Building a CEX will always cost more because of liquidity provision. The company building a CEX must either partner with a liquidity-providing partner or put in massive amounts of cash for liquidity provision to enable any trading on the platform.

By the way, all exchanges become liquidity providers sooner or later.

Read more about how to create a trading platform for traditional stock trading applications in our dedicated blog.

How many features?

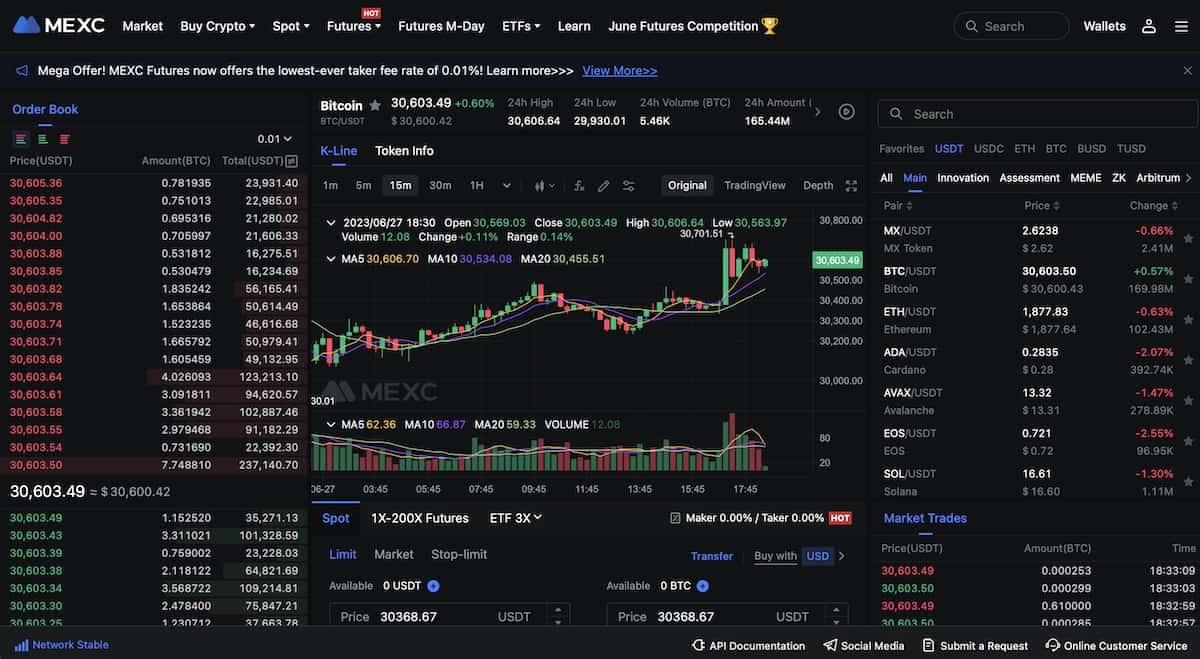

Take a look at the MEXC crypto exchange:

Looks scary, right? How many features can you spot at a glance?

- order book

- wallet

- chart

- trade history

- five ways to buy crypto

- spot/futures/ETFs trading

- profile with dozens of options

The more features you envision for your crypto exchange, the more investment will be necessary as a result. And that’s no surprise, right? Every feature must be designed, developed, tested, integrated, and maintained. That’s a lot of work and time.

Team size

Depending on your ambitions, you might need at least 10-12 people to make sufficient progress with building a crypto exchange.

This includes a product manager, a project manager, developers, designers, QA engineers, and DevOps specialists. The bigger the team, the higher the cost. However, there’s little sense in attacking such an endeavor with fewer people. It will take forever to make and keep up with the market needs.

Which blockchain to support?

Will the DEX or CEX operate on Ethereum, Polygon, Arbitrum, or another popular blockchain? If you choose to operate solely on EVM-compatible networks, then the cost to build a crypto exchange will remain more manageable.

At the same time, startups may choose to launch on a single blockchain, like Polygon, and expand to other chains with time.

However, other blockchains use other programming languages, which means more development and, accordingly, higher expenses.

Another point to consider is whether you want your exchange to be cross-platform, e.g., to allow users to swap Bitcoin for Ethereum-based tokens. This doesn’t imply that it must work on every blockchain which tokens it supports. But you must connect with cross-chain bridges and build a cross-chain router. Put simply, a cross-chain exchange requires more effort than an exchange working on a single chain.

Which platforms to support?

Will you start with a web app? It makes all the sense since you can make it accessible in mobile browsers and think about dedicated mobile apps later on.

Will you add native mobile apps or limit customers to using a mobile web version?

Note that even though major-league DEXs tend to start with a web version that also works on mobile, they eventually provide their customers with downloadable mobile apps (available through the App Store and Google Play). Even if those are the same mobile web experiences simply wrapped into native mobile shells.

Again, even if you just consider a simple platform, you can choose to provide customers with light or pro user experiences. Some apps, like Binance, keep both UIs in the same mobile app and allow users to switch between them. Others, like Kraken, release separate apps for pros and first-time traders.

The bottom line is the more platforms you support, the higher the cost will be. It’s only natural to start with a desktop web version of an exchange that scales well on mobiles.

Integration costs

CEXs and DEXs don’t exist in a vacuum. They need other services to integrate with:

- custody/liquidity service providers

- fiat on/off-ramp service providers

- crypto wallets

- KYC

By the way, some DEXs, e.g., UniSwap, decided in favor of their own dedicated crypto wallets — but even with that, they provide an option to connect to a non-custodial crypto wallet.

APIs

APIs are like veins in a crypto exchange mechanism. They connect different parts of the exchange by syncing data and sending commands back and forth. Those are internal APIs, and you can’t do without them. It’s just part of what back-end developers will work on.

You could also choose to deploy external APIs so that customers can pull their assets data into external crypto portfolio apps and other services. Of course, these external APIs have less priority because they don’t directly impact an exchange’s core functionality.

Server and hardware costs

CEXs need servers, period. And DEXs need servers, too: to host their front-ends, APIs, etc. And as we all know, there’s no such thing as free servers that can handle millions of users.

In addition, CEXs need lots of hardware, such as cold storage arrays, to securely hold customers’ funds.

Security

Security has become paramount in the crypto space after the recent events with FTX, Celsius, and other calamities, including monthly reports on stolen user funds from different web3 platforms. At least, all the friends I onboard first ask about proper ways to protect their funds.

So, we all know about the typical drill for user-facing security, right? This includes:

- multi-factor authentication

- bio-authentication

- alerts

- account freezing

- withdrawal limits

But you wouldn’t believe how much real security remains behind the scenes. Figuring out all the possible ways to neglect hacker attacks costs a lot of money:

- SQL injection blocking

- anti-DDoS

- SSRF protection

- data encryption

A lot goes into making an exchange as secure as possible. And that accordingly absolutely drives up the cost of creating a cryptocurrency exchange. However, that’s not something we can bypass. Better invest in security than get hacked and expose customers.

How Does the Choice of Development Model Impact the Cost of Building the Crypto Exchange?

When considering the cost of building a cryptocurrency exchange, we need to account for the preferred development model:

- from scratch (aka money-draining endeavor)

- white label (moderate amount of effort)

- open-source dex cloning (most efficient, but only for DEXs)

Depending on our choice, the cost to make a cryptocurrency exchange will range from very expensive (building a CEX from scratch will cost an arm and a leg) to medium (white label) to cost-efficient.

DEX cloning

Cloning a DEX may take less than a week or two, depending on your developers’ experience, especially if you choose a ready-made script from third-party providers. They can quickly clone almost any famous DEX (like PancakeSwap, UniSwap, or ParaSwap) on the most popular chains, and that’s much cheaper than the creation of a DEX from scratch.

This approximate $10,000 price tag doesn’t include the cost to design a crypto exchange. That’s purely the cost to launch a cryptocurrency exchange that is an empty clone of a DEX. You get a bare copy of a popular exchange under a new name… and then what? Why will millions of users suddenly rush to this new place to trade their crypto assets?

This approximate $10,000 price tag doesn’t include the cost to design a crypto exchange. That’s purely the cost to launch a cryptocurrency exchange that is an empty clone of a DEX. You get a bare copy of a popular exchange under a new name… and then what? Why will millions of users suddenly rush to this new place to trade their crypto assets?

You still need to think about the following:

- new UI/UX (read: a dedicated design stage) optimized for your target audience

- tokenomics: liquidity pools and farms, a DAO token, etc.

- set up: auto-routing, limit orders, and all the fancy features you can think of — to attract more customers.

These steps imply additional customization and development (including design services) that’s inevitable if you want to get some traction. By the way, the redesign itself, like refurbishing design elements and working on wireframes, icons, and prototypes, is the least of your worries. Their price impact is insignificant compared to development costs.

White label

The white label development model offers a balance between customization and cost-effectiveness. While it involves a higher cost compared to cloning, it provides a manageable solution for both DEXs and CEXs.

With a white label exchange, you can leverage existing infrastructure and technology, reducing development time and costs. However, it’s important to note that there are associated training costs, as someone within your team will need to learn how to effectively administer and operate the thing. This additional training ensures that you can fully utilize the features and functionalities of the white-label solution to meet your specific requirements.

CEX from scratch

Building a cryptocurrency exchange from scratch is a highly complex and resource-intensive endeavor. It requires assembling a sizeable cross-functional team of developers, designers, security experts, and more.

The development process involves creating a robust and secure infrastructure, implementing advanced trading features, integrating payment gateways, and ensuring compliance with regulatory frameworks.

Due to the extensive scope and technical challenges involved, the cost of building a CEX from scratch starts at around $400,000 and can increase significantly based on customization requirements and scalability needs.

Importance of MVP Features Estimations to Make the Development of Crypto Exchange Cost-Effective

When developing a crypto exchange, it’s crucial to accurately prioritize and estimate the Minimum Viable Product (MVP) features. There’s no need to hammer onto the endless list of features and delay the release.

Instead of waiting to release a fully-featured exchange, focusing on the key functionalities can help save costs and expedite the development process. The MVP should include features that ensure maximum traction and provide essential functionality to users. These features may include:

- Crypto wallet integrations: Seamless integration with popular cryptocurrency wallets enables users to securely store and manage their digital assets.

- Trading engine: A robust and efficient trading engine that allows users to execute buy and sell orders with speed and reliability.

- APIs for external integrations: Integration with essential external services such as on/off-ramp solutions for easy fiat-to-crypto conversions, KYC/AML providers for regulatory compliance, and other third-party services to enhance the user experience.

- Admin panel for managing the exchange: A comprehensive admin panel that enables efficient management of user accounts, trading pairs, liquidity, and other vital aspects of the exchange.

- User-facing features: Engaging user interfaces, charts, transaction history, order books, and other elements that enhance the trading experience and provide transparency.

- Localizations: Making the exchange accessible to a broader user base by supporting multiple languages and catering to users worldwide.

For a comprehensive look at how to create your own token, check out our detailed guide.

Additionally, it’s essential to consider the cross-platform nature of the MVP. Building a cryptocurrency exchange website compatible with mobile platforms ensures accessibility and convenience for users across different devices.

By focusing on the core functionalities of the MVP, you can reduce development costs, shorten the time to market, and gather valuable feedback from early adopters. This iterative approach allows for cost-effective development while maintaining the potential for future enhancements and feature expansions.

Determine Additional Features Estimation

When your product gets initial traction, it’s a good time to invest in more advanced features to enhance the user experience, attract a larger user base, and differentiate your exchange from competitors.

Of course, that will also continue to increase the cryptocurrency exchange development cost, but you’ll be making some revenue on fees and ads by then. Let’s explore some additional features to consider:

Fraud detection

Implementing robust fraud detection mechanisms and security measures to protect users from fraudulent activities and ensure a secure trading environment.

Messaging

Enabling direct communication and interaction between traders, fostering a sense of community, and facilitating trade negotiations. Especially if we’re building a peer-to-peer (P2P) crypto exchange platform.

Trader profiles

Creating trader profiles that display important details such as trading history, reputation scores, and verification levels. This allows users to evaluate the credibility and reliability of counterparties.

Escrow

Introducing an escrow service to hold funds during P2P trades provides an additional layer of security and builds trust between buyers and sellers.

Crypto wallet

Enabling users to seamlessly send and receive cryptocurrencies from their exchange wallets, offering convenience and flexibility for managing their digital assets.

Also Read: Crypto Wallet Development Guide

Staking

Introducing staking capabilities that allow users to earn rewards by staking their cryptocurrencies, providing an incentive for holding and supporting the exchange’s native token or other supported assets.

Support

Offering a responsive customer support system to address user queries, provide assistance, and resolve issues promptly, enhancing user satisfaction and trust.

Margin trading

Implementing margin trading functionality that enables users to trade with borrowed funds, expanding trading opportunities and potentially increasing trading volumes.

Different order types

Providing a variety of order types, such as limit orders, market orders, and stop orders, allowing users to execute trades based on their specific preferences and trading strategies.

Advanced security features

Implementing advanced security measures, including multi-factor authentication, cold storage for funds, encryption protocols, and regular security audits, to protect user assets and enhance platform security.

These additional features (along with crypto derivatives, launchpads, spot trading, etc.) contribute to the crypto exchange’s overall functionality, user engagement, and competitiveness. However, it’s essential to prioritize these features based on user demand, market trends, and budget constraints.

Remember, the cost of developing these additional features will depend on the exchange app’s complexity, integration requirements, and development resources. Evaluating each feature’s potential value and impact will help make informed decisions while balancing the cost-effectiveness of the development process.

How Much Does it Cost to Build a Cryptocurrency Exchange?

The cost of building a cryptocurrency exchange can vary depending on various factors and the scale of the project. Generally, the cost range falls between $200,000 and $600,000.

Also Read: App Development Costs: The Complete Breakdown

However, it’s important to note that this estimate can vary based on specific requirements and the desired level of customization.

Setting up a DEX clone can be a viable choice for those looking for a more cost-effective option. Cloning a DEX with a few noteworthy differentiating features can be accomplished within a budget of approximately $60,000 — $80,000. This allows you to leverage existing infrastructure and functionality while adding your unique touch to stand out. A 1-to-1 clone is but a trifle — within $10,000.

If you opt for a white-label solution, where you customize an existing exchange software, the cost may be higher than DEX cloning but still more manageable than building from scratch. This approach allows flexibility and customization while leveraging existing infrastructure, reducing development time and costs.

Disclaimer

When determining the budget for building a cryptocurrency exchange, it’s crucial to consider factors such as development complexity, desired features and functionalities, security requirements, scalability needs, and ongoing maintenance and support.

Working with an experienced development team or an app design partner like Topflight can provide valuable insights and guidance in estimating and managing the cost of building a cryptocurrency exchange.

Remember, these cost estimates are rough guidelines and can vary based on individual project requirements. Conducting a thorough analysis and consulting with professionals will help you calculate an accurate final cost for your cryptocurrency exchange development project.

What Non-Development Costs Affect the Launch Price of a Cryptocurrency Exchange?

Launching a cryptocurrency exchange involves development costs and various non-development expenses that should be considered. So, when pondering on the cost to start a crypto currency exchange, please view the following items that can significantly impact the overall launch price of the exchange.

Server maintenance costs

This includes hosting fees and regular server maintenance to ensure optimal performance and availability of the exchange platform.

Hardware costs

Cryptocurrency cold wallets and on-premise servers may be necessary for storing and securing user funds. These hardware investments contribute to the overall launch price.

Customer care

Providing quality customer support is crucial for user satisfaction and retention. Costs associated with customer care, including hiring support staff and implementing communication channels, should be factored in.

Ongoing security improvements

Ensuring the security of the exchange is an ongoing process. Regular security testing, audits, and simulated attacks are necessary to identify vulnerabilities and enhance the platform’s security.

Legal counsel

Engaging legal professionals to navigate the complex regulatory landscape surrounding cryptocurrencies and exchanges is essential. Legal advice and compliance-related expenses should be considered in the overall launch price.

Bank transfer fees

Integrating traditional banking services into the exchange infrastructure may incur fees for bank transfers, payment gateways, or fiat currency conversion. These costs vary based on the specific requirements and partnerships of the exchange.

Liquidity providers’ fees

Partnering with liquidity providers may be necessary to ensure sufficient liquidity on the exchange. These providers may charge fees for their services, impacting the launch price.

By accounting for these non-development costs, you can have a more accurate estimation of the total investment required to launch and operate a cryptocurrency exchange. It’s crucial to carefully plan and budget for these expenses to ensure a smooth and successful launch while providing a secure and user-friendly trading experience.

Why Choose Topflight as Your App Design Partner

Topflight is the trusted choice for developing DeFi ecosystems and blockchain applications. Our work with Citizen Finance exemplifies our expertise in creating cross-chain DeFi apps, NFT marketplaces, and decentralized crypto exchanges. We designed a GameFi economy where players can earn, trade, stake, and lend in-game tokenized assets.

We prioritize cost-effective and efficient transactions by leveraging chains like Polygon and Binance Smart Chain, driving adoption and user engagement. With our agile development approach, transparent project management, and robust quality assurance processes, we ensure faster time-to-market while meeting your business’s ROI goals.

Read more in the case study: Citizen Finance: DeFi Apps EcoSystem for a Metaverse GameDeFi, Fintech.

If you want to learn more about the cost to set up a crypto exchange and need help with bringing to life your vision, get in touch.

Frequently Asked Questions

How much does it cost to build a cryptocurrency exchange?

The cost can range from $200,000 to $600,000, depending on the scale of the project. DEX cloning can be done for around $80,000-$100,000 with notable differentiating features.

What factors influence the cost of developing a cryptocurrency exchange?

Factors include the development model chosen (from scratch, white label, or DEX cloning), the number of features desired, team size, blockchain and platform support, integration costs, server and hardware expenses, and security measures

What is the recommended approach for cost-effective development?

Prioritize the Minimum Viable Product (MVP) features, choose a suitable development model, and consider the scalability needs of the exchange. This allows for a more focused and efficient development process.

Are there ongoing costs associated with running a crypto exchange?

Yes, ongoing costs include server maintenance, hardware upgrades, customer support, continuous security improvements, legal counsel, bank transfer fees, and fees charged by liquidity providers.

How can I reduce development costs without compromising quality?

Consider utilizing ready-made solutions like white-label platforms, carefully evaluate and prioritize features, collaborate with external service providers for integration needs, and optimize team size and resource allocation.