What are the two prominent use cases for crypto? Holding and trading, right? When we build a defi lending platform, we simply bring these two together.

To be more precise, defi lending apps, also known as decentralized money markets, bring together lenders and borrowers. The former lend crypto assets to realize yields over time, and the latter borrow to chase quick gains stipulated by crypto volatility.

If you’d like to learn how to launch a defi lending/borrowing platform, look no further. We’ve got the scoop.

Top Takeaways:

- Building a defi lending site followed by native mobile apps once you get real traction is a very sound strategy, provided that the site appropriately scales for the web and mobile platforms.

- The three things that will demand your utmost attention during defi lending platform development include design, tokenomics, and smart contracts.

- Keep in mind the powers of the agile methodology, crucial to the project’s success: flexibility, transparency, speed.

Table of Contents:

- Lending/Borrowing Apps in Decentralized Finance Market

- Why You Should Use a DeFi Technology for Your Lending Platform

- Must-Have Features for DeFi Lending and Borrowing Platform

- 5 Steps to Create a DeFi Lending Platform

- DeFi Lending/Borrowing Platform Development Costs

Lending/Borrowing Apps in Decentralized Finance Market

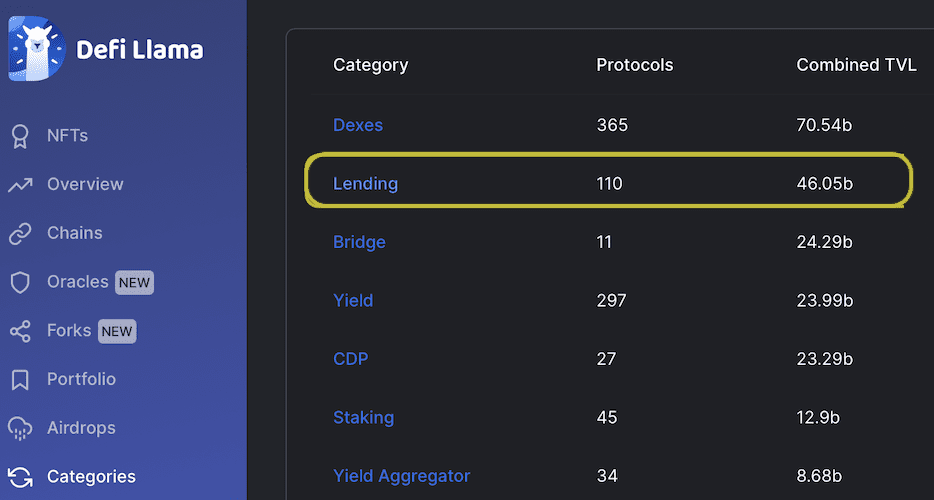

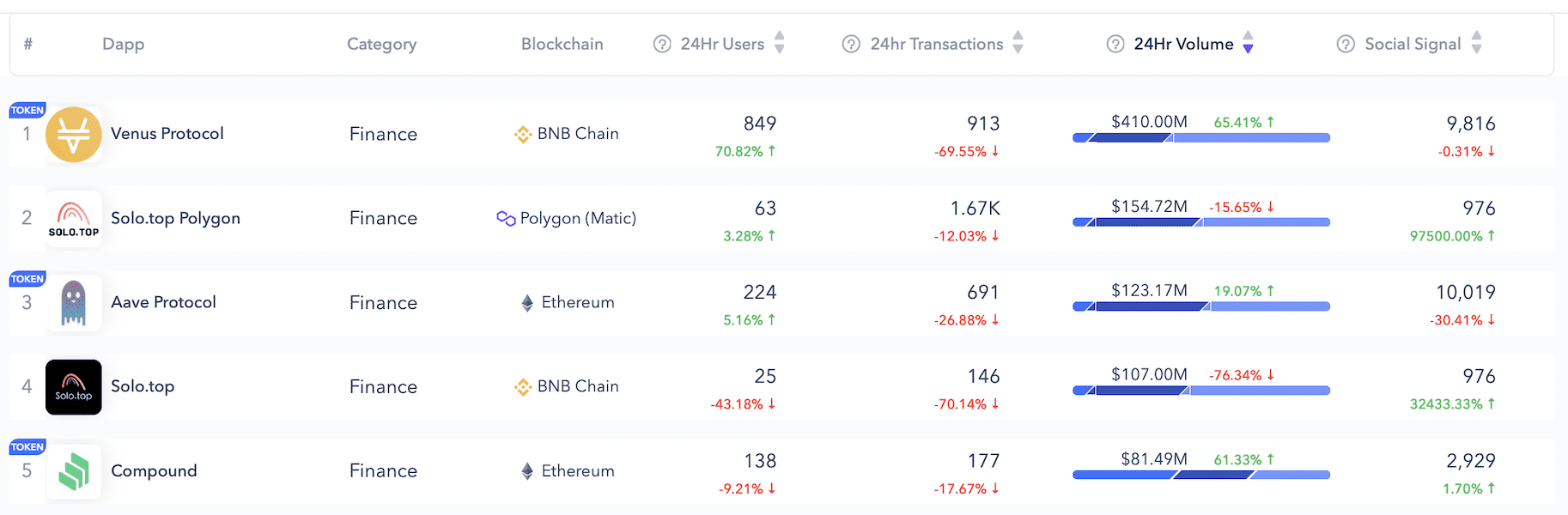

Defi lending solutions are among the leading decentralized apps, rivaled only by exchanges:

The total value locked (TVL) at $46 billion is no joke, right? Come to think of that second position; it’s pretty obvious. How do many of us end up in crypto? That has to be through crypto exchanges because they are easier to onboard and have a user-friendly UI.

The total value locked (TVL) at $46 billion is no joke, right? Come to think of that second position; it’s pretty obvious. How do many of us end up in crypto? That has to be through crypto exchanges because they are easier to onboard and have a user-friendly UI.

Related: How to Build a Crypto Exchange

And what’s the next big thing after trading? That has to be savings, like in traditional finance, right? As soon as people start trading, they realize it’s risky. And the last thing they want for their crypto leftovers is to sit dormant in wallets. Crypto sleeps even less than money; therefore, it’s always ready to make more money.

Lending/borrowing apps on blockchain offer up to 20% APY yields, which sounds nonsensical compared to what you get at a bank, but OKish to someone who’s witnessed crypto volatility for a while.

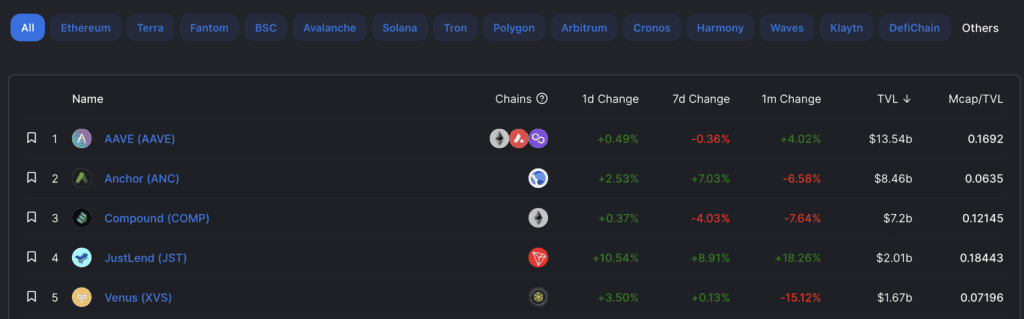

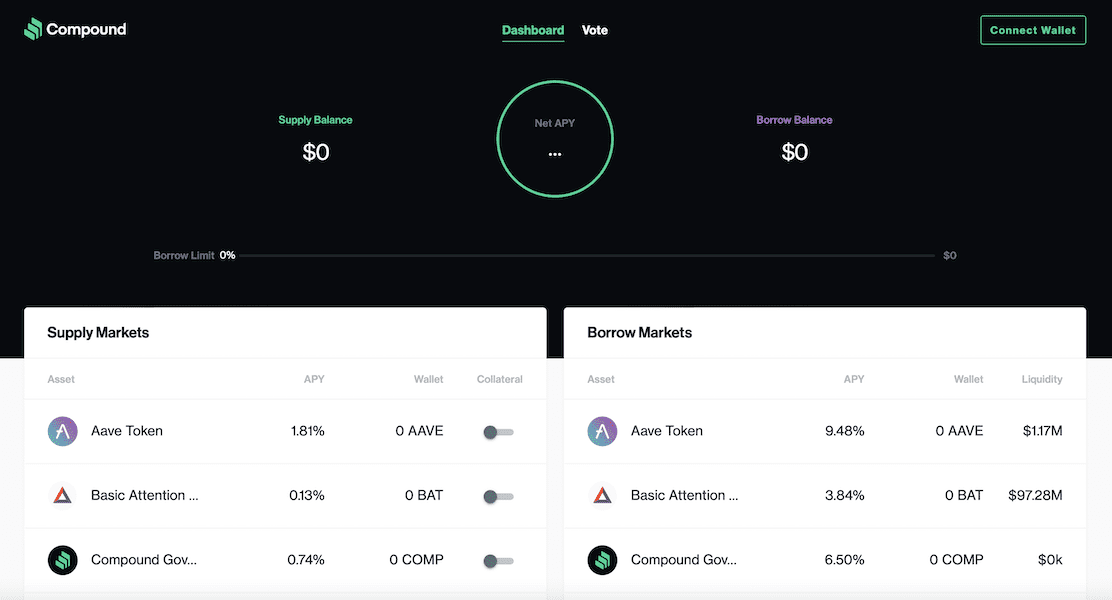

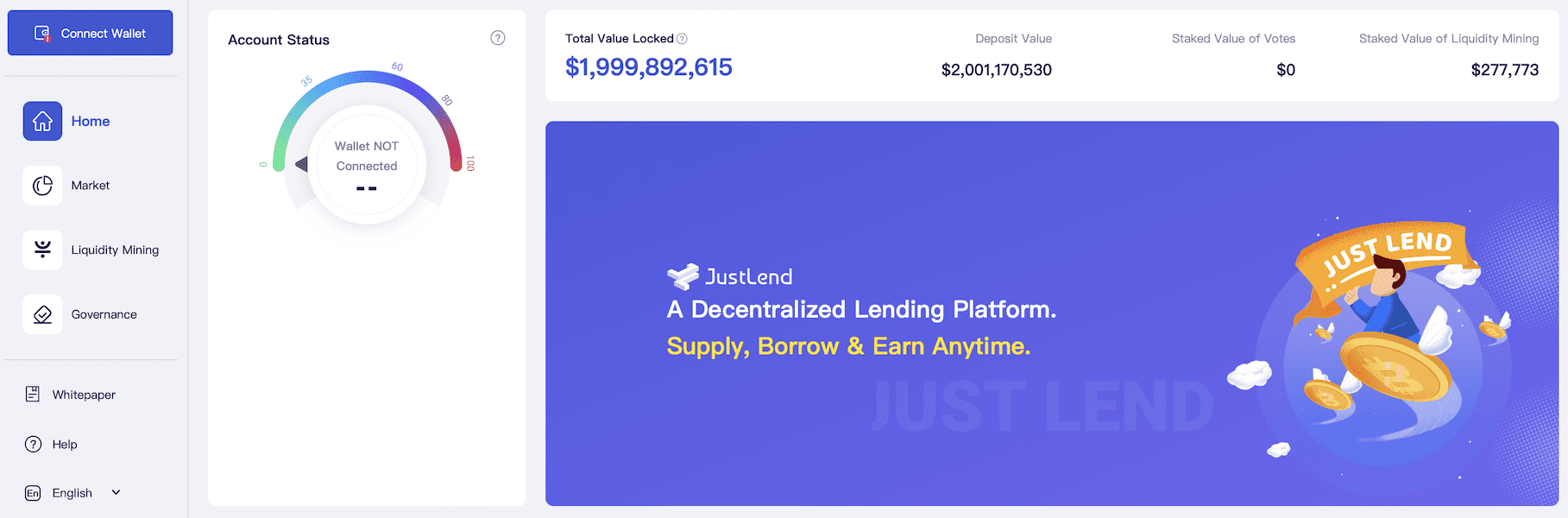

The top lending market money protocols include Aave, Compound, and Anchor.

We can see more defi lending apps appearing across all major blockchains:

We can see more defi lending apps appearing across all major blockchains:

- Ethereum

- Polygon

- Terra

- Binance Smart Chain

- Fantom

- Avalanche

- Solana

These financial services also make it to the top 5 best ranking defi apps:

Why You Should Use a DeFi Technology for Your Lending Platform

Let’s look at the benefits of defi lending software. First of all, like all applications running on blockchain technology, defi apps inherit intrinsic advantages of distributed ledgers:

- transparency of transactions

- immutable data

- complete ownership and control over crypto assets by users

- no intermediaries

All of that allows users owning crypto to take out loans bypassing KYC (a must in traditional financial institutions) much faster and more securely. They can then use borrowed funds freely across any digital or physical borders (typical features of defi apps).

Related: Fintech App Development Services

That said, let’s also debunk some of the myths typically associated with defi lending and borrowing platforms.

- More secure than bank loans

If someone screws you over with a bank loan, chances are you’ll be able to settle that with your bank in your favor. However, in the case of a defi lending app with its non-custodial nature of operations, security is mainly in the hands of users.

I should mention that such platforms do provide enough security mechanisms to protect from hacks. So the user often becomes a weak link in this equation.

- More accessible to the underbanked

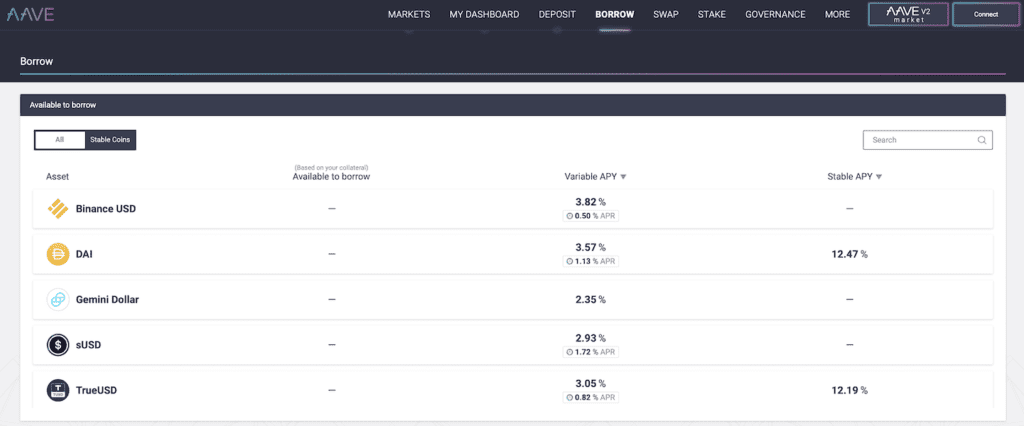

How many underbanked with zero credit history who own crypto do you know? The often-quoted premise is all you need to borrow on, say, Aave (one of the most popular defi protocols) is internet access. How about collateral? People need to deposit their crypto to get a loan, and they have to deposit more than they take out.

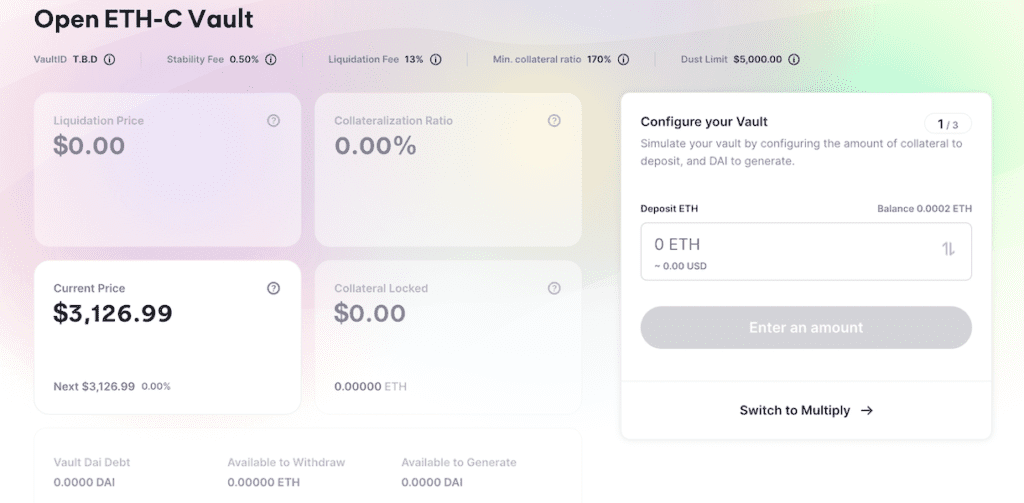

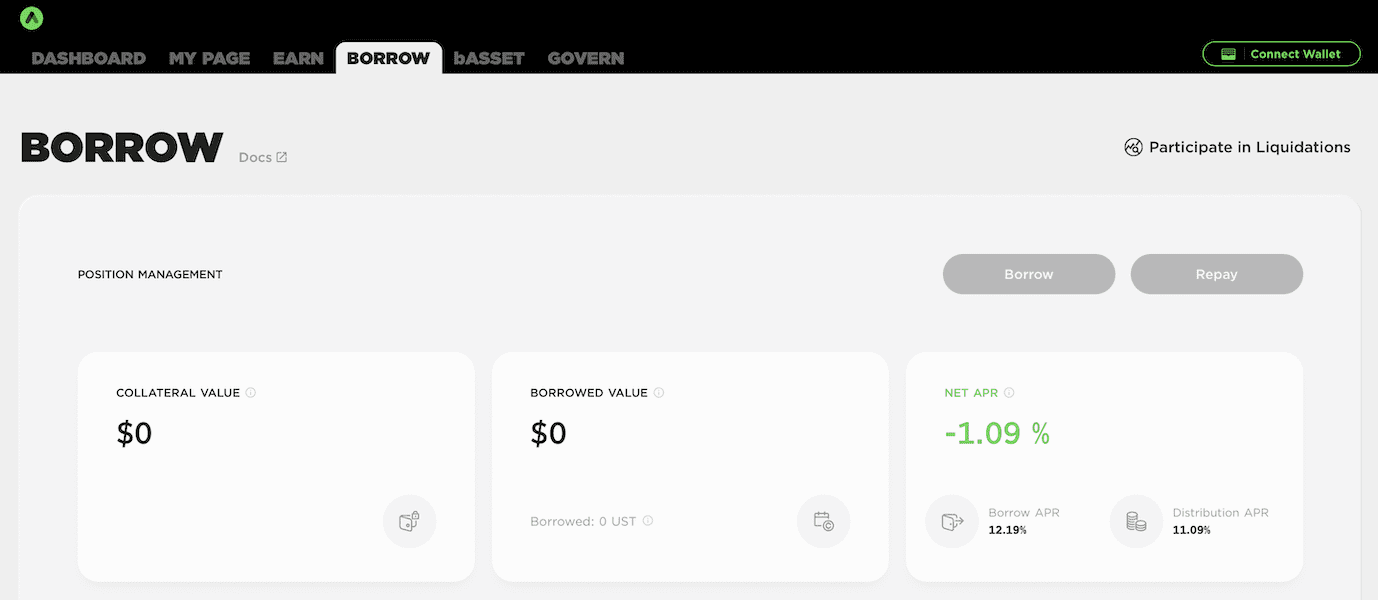

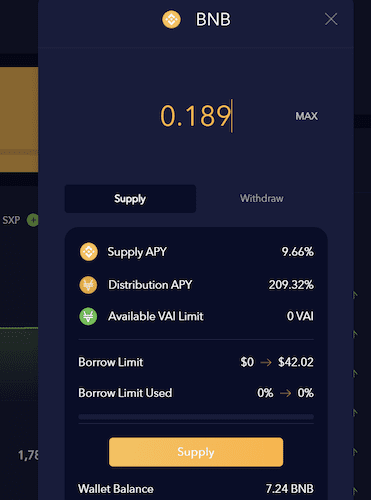

How about owning crypto in the first place or making sense in such interfaces? I’m not a complete newbie, but that’s way too much contextual help and info on a single screen. Does the image below look like a simple borrow screen? And that’s from Maker DAO’s Oasis app, the #1 lending protocol (TVL $16.67 billion).

That’s precisely why today’s defi lending protocols target savvy crypto enthusiasts. Some believe that it’s about time in the market. Therefore, they join to earn interest long-term by making their digital assets available for loans. In fact, passive income is the sole reason for the user to become a lender.

That’s precisely why today’s defi lending protocols target savvy crypto enthusiasts. Some believe that it’s about time in the market. Therefore, they join to earn interest long-term by making their digital assets available for loans. In fact, passive income is the sole reason for the user to become a lender.

Others believe they can time the market and take out loans for margin trading or other crypto shenanigans. None of them are underbanked.

- It’s peer-to-peer lending

No, it’s not. It’s peer-to-contract. Aave used to be p2p in the very early days. However, they quickly discovered that it takes too long to match lenders with borrowers and moved to pool-based lending. People deposit to different crypto asset pools, and borrowers take out defi loans from these pools. No actual p2p matching is happening.

Related: How to build a DeFi Exchange Platform

Also Read: How to Build a Loan App

Although, I should add that the same Aave has introduced an option for p2p lending/borrowing for prominent players: deals are negotiated off-chain and then executed via Aave’s defi lending protocol.

Must-Have Features for DeFi Lending and Borrowing Platform

Let’s go over a few key features you simply can’t miss if you want to make a defi lending and borrowing website.

Fiat on-ramp

That sounds counterintuitive because customers would need to go through a KYC procedure, losing their anonymity as a result. But at the same time, being able to onboard crypto newbies at once, right on the platform, regardless of whether they hold any crypto or not, is priceless.

Some of the popular third-party APIs we can use for crypto onramps include Wyre and MoonPay.

Crypto wallet

We’d either need to support multiple wallets or provide a branded wallet with additional value to the defi platform’s customers.

Lending/borrowing

Borrowing and lending options should balance supported crypto assets, the collateral ratio, stable/variable interest rates paid on deposited liquidity, and the supply/demand ratio. After all, customers join the platform to lend and borrow.

Flash loans

Flash loans pioneered by Aave allow customers to take out loans with zero collateral almost instantly to run transactions automated by smart contracts. Users can swap collateral, pay back loans with collateral, and execute arbitrage transactions with flash loans.

Governance

Our defi borrowing protocol may work with unique governance tokens, which provide voting rights on future updates to the platform.

We may also consider some advanced options like staking, yield swaps, credit delegation, among others.

We may also consider some advanced options like staking, yield swaps, credit delegation, among others.

5 Steps to Create a DeFi Lending Platform

Ok, what practical steps do we take to create a defi lending platform? Quite simple, like with building a house or painting a wall: we strategize, execute, and then refine/maintain. The specifics of the defi lending platform development are a little more interesting. So let’s dive in.

Step #1: Strategize

As with any software, first, we need to decide who we’re building for. Who’s our target audience? What are their needs? The more we know about our users, the better traction our lending app will enjoy.

There’s definitely a lot to discover during this step. For example, what platforms our customers will use to interact with our solution: web vs. mobile. Chances are we’ll be sticking with the web because:

- web can cover both desktop and mobile use cases while saving budget

- it’s faster to iterate and release updates for a web app than two mobile apps

Related: Mobile vs Web: Choosing the best option for your application

Going mobile-first when building a defi borrowing platform may worsen adoption and require extra development efforts, e.g., creating a dedicated built-in crypto wallet.

Related: How to Create a Fintech App

How to Develop a DeFi Staking Platform

Among other things we’ll need to take into account as we get ready to make a defi lending platform:

Among other things we’ll need to take into account as we get ready to make a defi lending platform:

- tokenomics, i.e., rates, fees, and all other rules for the platform

- selection of a blockchain/s and the rest of the tech frameworks

- prioritization of features according to ROI expectations

Step #2: Design

The next step is UX/UI. How do we design a defi lending platform? We use the knowledge about our target audience to craft compelling sketches that eventually turn into high-fidelity wireframes — screens of the lending application.

Related: UI/UX tips to designing a successful application in 2022

Here’s a little twist, though, you may already know from our previous blogs. To guarantee better traction, we compile these screens into a clickable prototype. As soon as it’s ready, we can take it to users and gather their feedback on improving the UX/UI to make it more intuitive.

One thing to consider when you build a defi lending site is scalability. The UI must remain flexible enough to host more features that will be added to the app over time. For example, the Aave lending platform had to redo their entire UX when upgrading their protocol to version 2 to accommodate a score of new features.

We should also account for mobile platforms like iOS and Android when designing a lending application.

The final touch of the design phase is verifying the UX/UI with dapp developers to ensure it’s technically feasible and won’t require extra effort.

Step #3: Develop and test

Finally, coding begins. At this point, you already have verified designs, tokenomics model, and everything else necessary to develop a defi lending platform. By the way, that rapid prototyping we did during the design step has already saved you thousands and thousands of dollars.

Agile

Agile has championed all other software development models. So you’re more than likely to end up working with an agile team. Just make sure they put their money where their mouth is:

- Team leaders keep in touch regularly

- You get full visibility into who’s doing what at any moment

- You get updated early versions of the app every two weeks

- Team challenges some of your assumptions when they see a better way

- You feel like you hired a full-stack team with all the required expertise, and you don’t have to put them all on full-time payroll.

Again, agile is crucial, especially with crypto and blockchain-related projects where so many things come into existence every month. You will definitely appreciate the flexibility and transparency this methodology brings along.

Related: Agile App Development Guide: Everything You Need to Know

Smart contracts + tokenomics

Self-executing smart contracts will be the real engine of your defi lending platform. You basically can’t create defi a lending protocol without them since they contain all tokenomics logic:

- fixed or fluctuating rate

- combined or isolated pools

- crypto acceptable as collateral

- partial liquidation rules

- fees

- gas expenditure optimization

Obviously, that is the tip of the iceberg, but it should give you some direction. You can check for more details on how to create a blockchain app here.

Related: Smart Contract Development Guide

Crypto wallets

Another vital aspect to consider is which crypto wallets our lending services platform will support: the more, the better. However, we should stick to our audience’s preferences.

The bare minimum would be MetaMask, CoinBase Wallet, and Ledger or Trezor. As you understand, our choice will largely depend on what blockchain we run on and whom we target.

We can also choose to make a crypto wallet that’s unique to our lending platform.

Oracles

When you set up a defi lending platform, you need a reliable source of crypto prices since collateral will always fluctuate with crypto prices. We can employ oracles for that purpose, for example, Chainlink Data Feeds, which are also used by such lending protocols as Aave and Cream.

Testing

Finally, you’d want to test all developed functionality. An ideal approach is to start testing as soon as a couple of significant blocks of the crypto lending app have been written. From that point on, testing goes side by side with development.

Related: Mobile App Testing Guide: Everything You Need to Know

Because of their immutable nature, blockchain apps running on smart contracts are nearly impossible to augment once you release them. That’s why it makes sense to test using test networks fully simulating the actual network you target.

Step #4: Deploy

Deploying a defi lending/borrowing application is arguably the most straightforward step in the whole process. The blockchain development team will deploy smart contracts to the chain and switch the front end (web or mobile apps) to a production environment — and it’s live!

Step #5: Maintain

Maintaining a defi lending protocol implies releasing updates with new features and fixing lingering issues. However, if the front end can be easily updated with no issues, how do we update immutable smart contracts?

One way is to use a particular smart contract that supports admin keys and can be updated to work with newly released upgraded smart contracts.

One way is to use a particular smart contract that supports admin keys and can be updated to work with newly released upgraded smart contracts.

Another approach is to leave version one as is and ship new releases as new versions of protocols. In fact, this second option is a standard narrative for major defi apps that want to avoid adding backdoors to smart contracts.

You can find more details in our blog about how to build a dApp.

DeFi Lending/Borrowing Platform Development Costs

The cost of defi lending platform development starts at around $120,000. The total budget will naturally depend on the number of core features and integrations. Fortunately, if you go agile, your ROI goals will be aligned with the feature set.

Related: App Development Costs Guide

How to build a DeFi App: Everything You Need to Know

How to Develop a DeFi Staking Platform

How to Develop a DeFi Exchange Platform

If you’re planning to make a defi lending platform, get in touch with our experts today.

Frequently Asked Questions

Can I optimize the development budget by starting with a single mobile app for iOS?

Not much. The back-end (smart contracts) will still take the bulk of the budget and can’t be avoided.

What tech stack should I use?

This totally depends on the blockchain network you’re going to support. I advise you to rely on your development company’s expertise to choose relevant frameworks and languages.

What are monetization options for a defi lending app?

Fees on transactions and the economic power of a platform’s native token.

What's the biggest issue with existing defi lending and borrowing platforms?

Usually, they are designed by developers who lack UX/UI expertise.

How long does it take to start a defi lending platform?

At least 6-8 months to launch a rough-and-ready MVP.