If you want to build your own defi exchange similar to UniSwap, get your spot in the line: SushiSwap already copied UniSwap in 2020. The defi space is filled with SakeSwaps, KwikSwaps, PanCakeSwaps, and all other imaginable flavors of crypto swaps — developed from scratch or forked from existing projects.

So, how do you create a defi exchange that’s unique and appealing to customers? What steps should you take, and what challenges should you expect? All of that and more in this blog, dedicated to crypto entrepreneurs.

Top Takeaways:

- Only one percent of the world’s population uses crypto. That’s why creating your own decentralized exchange (defi) system can turn you into a millionaire, given the dex gains enough traction.

- When you build a dex, remember to protect it with proper licensing. The software can be open source and ready for public audits, yet not allowed in commercial applications.

- The real challenge with starting a defi exchange is creating a beautiful tokenomics drawing in enough people to participate in liquidity pools, making trading more appealing.

Table of Contents:

- DeFi Exchange Brief Overview

- Why Create Your Own DeFi Crypto Exchange?

- Challenges of Developing a DeFi-based Cryptocurrency Exchange Platform

- Steps of DeFi Exchange Development

- How Much Does it Cost to Launch Your DeFi Exchange?

- Our Experience in DeFi Development

DeFi Exchange Brief Overview

DeFi = decentralized finance (independent financial services)

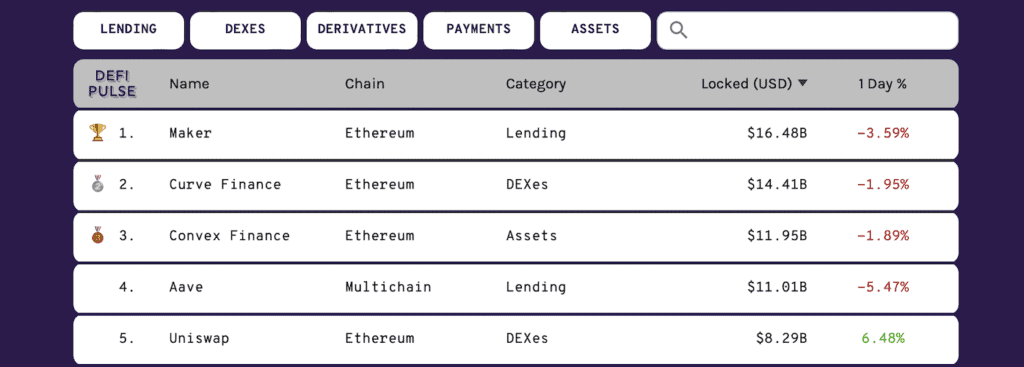

If you want to create your own defi crypto exchange, you’ll be nolens volens competing against other DEXes. Therefore, it makes a lot of sense to review major defi exchanges to see what’s trending and understand how you can make your own DEX stand out.

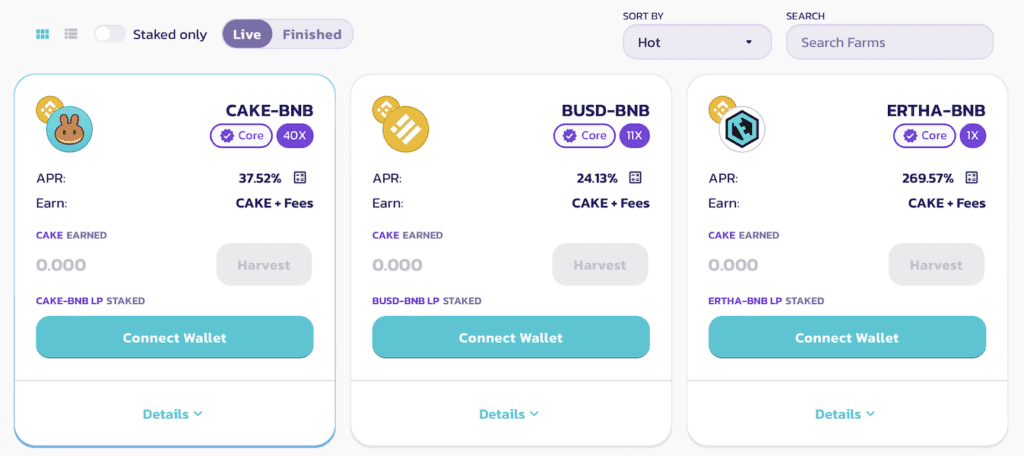

If we look at such popular DEXes as UniSwap and PanCakeSwap, we’d have to admit they are gradually becoming all-inclusive defi platforms. Apart from trading per se, users can also:

If we look at such popular DEXes as UniSwap and PanCakeSwap, we’d have to admit they are gradually becoming all-inclusive defi platforms. Apart from trading per se, users can also:

- stake crypto assets

- participate in yield farming

- earn bonus coins

- lend, etc.

Some DEXes even include launchpads — crowdsourcing platforms for funding new apps integrated with the platform’s defi ecosystem.

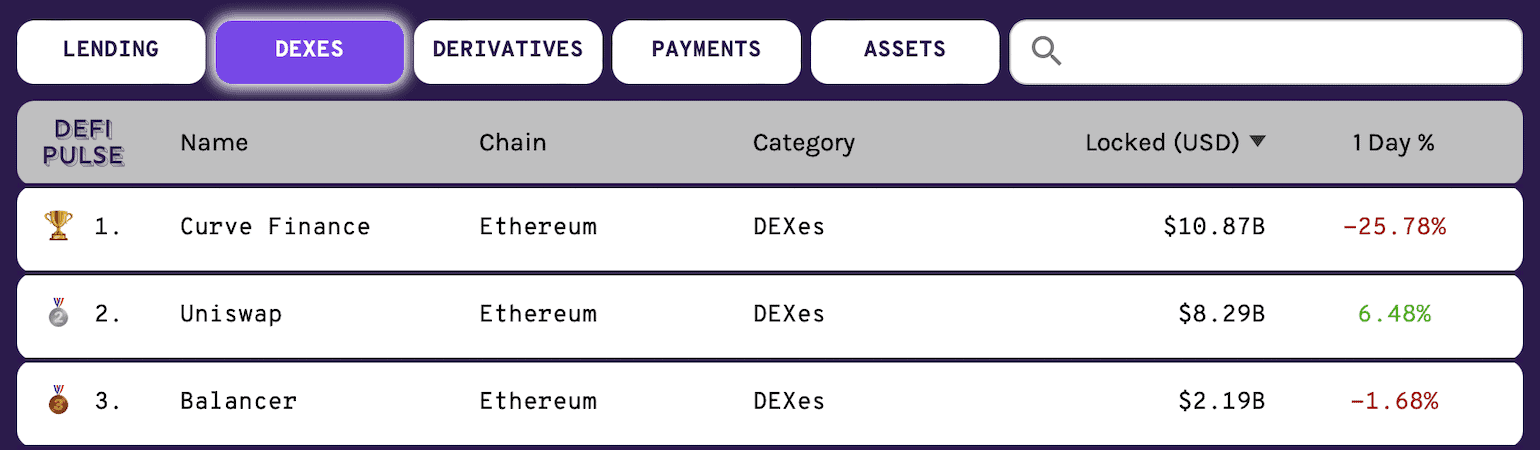

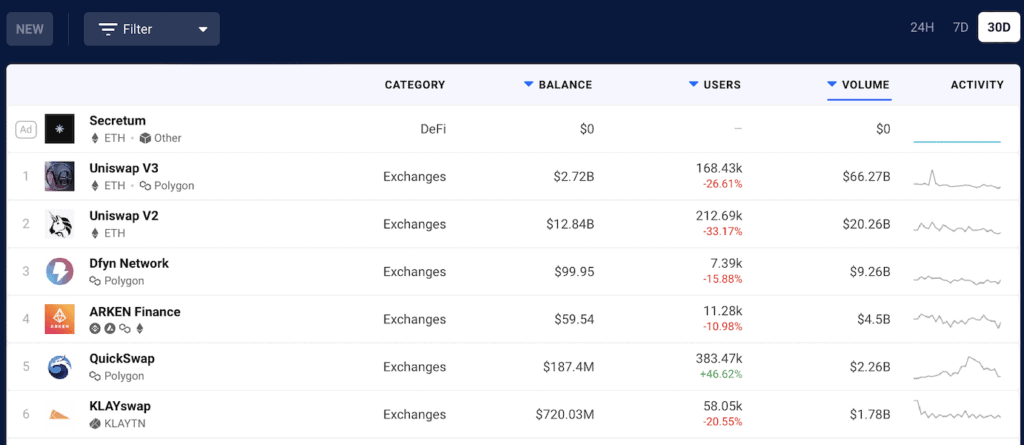

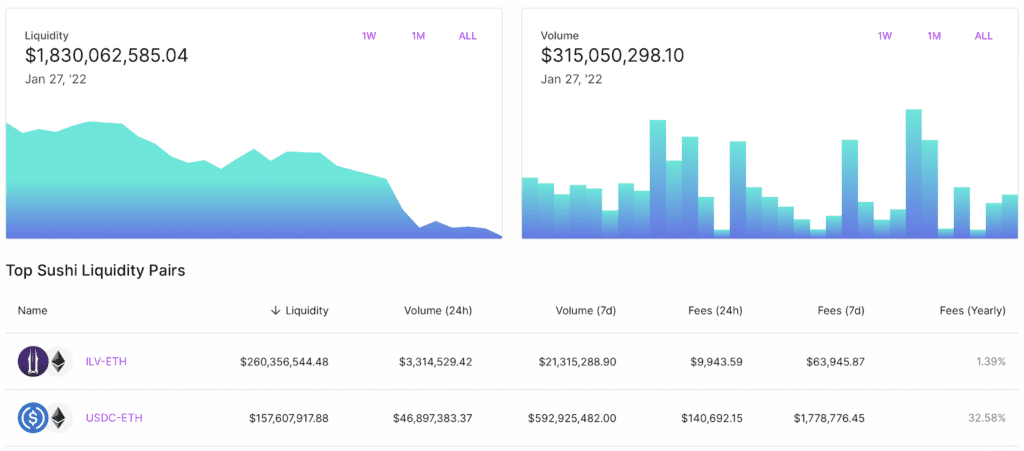

So what are some popular DEXes besides UniSwap? The DappRadar rankings feature these top contenders: Dfyn Network, QuickSwap, and KLAYswap. What’s so special about them?

Dfyn Network

Dfyn is a multi-chain exchange currently residing on the Polygon blockchain and interacting with the rest of chains for creating cross-chain liquidity via Router Protocol. They also use layer 2 blockchain solutions to make faster trades with extremely low fees.

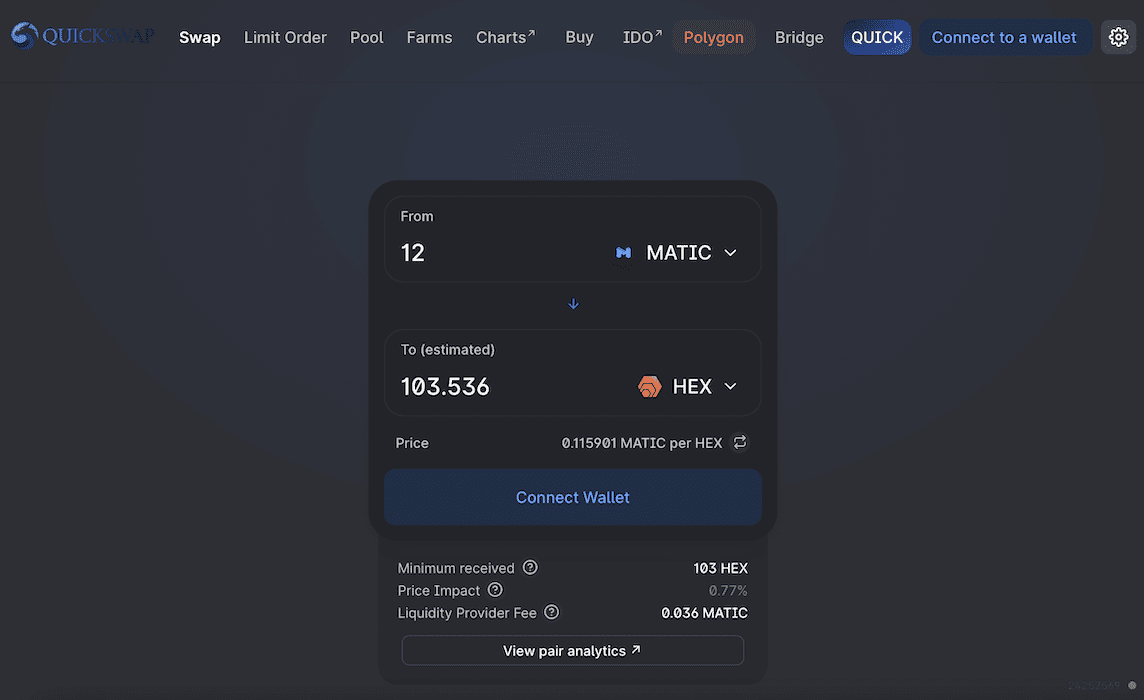

QuickSwap

QuickSwap uses layer 2 by Polygon to speed up transactions and lower trading commissions, focusing exclusively on ERC-20 tokens — tokens living on the Ethereum blockchain.

Also Read: Trading and Investment App Development Guide

KLAYswap

This DEX allows anyone to become a liquidity provider, even by depositing just one type of crypto asset. As you probably know, on other crypto exchanges liquidity providers are supposed to provide at least a pair of crypto assets to start earning interest on fees.

YourSwap?

As you can see, each DEX offers some unique functionality, and there are even more offering practically the same features. So the question comes to mind, “How do you position your DEX in this competitive market?” However, this brings us closer to another topic I want to discuss with you in a bit.

By the way, before we jump to the next section: out of the top 100 defi apps, according to DeFi Pulse, 22% are DEXes.

The rest are defi lending (28%), assets (26%), derivatives (19%), and payments (5%) dapps. Take the stats as you will; to me, that indicates there’s still room for competition in the DEX space.

The rest are defi lending (28%), assets (26%), derivatives (19%), and payments (5%) dapps. Take the stats as you will; to me, that indicates there’s still room for competition in the DEX space.

Why Create Your Own DeFi Crypto Exchange?

So the biggest question is, why would you create your own defi protocol when there are plenty of other DEXes out there already? Why not develop a centralized crypto exchange and harvest trading fees, for example?

There are several reasons why customers may find DEXes more superior than CEXes.

My keys, my coins

Users maintain custody of their own funds without having to trust an intermediary. DEXes work with non-custodial, fully decentralized cryptocurrency wallets, which means only customers control their private keys to digital assets.

I preserve my anonymity

DEXes require zero KYC while onboarding. The usual cycle is connecting a noncustodial crypto wallet, and off you go. As a result, DEX users enjoy anonymity. Today, anyone can buy crypto, siphon it through anonymization services like TornadoCash and remain fully anonymous while trading.

Related: Fintech App Development

DEX is safe and transparent

All trades happen on a blockchain; therefore, everyone can review trades if they need.

In addition, DEXes often don’t have any admin keys, meaning they operate independently. And no one can make any changes. If code is good, no hacks for a lifetime, aka optimal security.

As a bonus, DEXes, unlike CEXes, have higher chances of withstanding Big Brother’s regulatory scrutiny.

Direct access to rare coins/tokens

Customers often prefer decentralized platforms simply because they can’t find defi tokens of their choice on well-known exchanges like CoinBase or Binance. As a matter of fact, any DEX user with substantial funds can create virtually any trading pair they need.

It’s dirt cheap (most often)

The trading fees are typically lower compared to what we pay over at centralized exchanges.

To be fair, let’s also go through some of the cons of starting a defi exchange because it’s not all rainbows and unicorns:

How do I buy this?

The biggest hurdle is fiat on-ramp. In theory, newbies would bring their own crypto wallet like MetaMask and use its built-in options for purchasing crypto via services like Wyre or Transak. In practice, many newbies are at a loss when it comes to initial fiat/crypto conversion: usually, DEXes do not provide such an option.

You can read up on creating a payment gateway for cryptocurrency in a separate blog.

Can someone help me?

No centralization also means no official support.

Throw in bad actors like scammers impersonating support staff all the time, and you have no less than a nightmare for any novice crypto trader.

Do they have a guide or something?

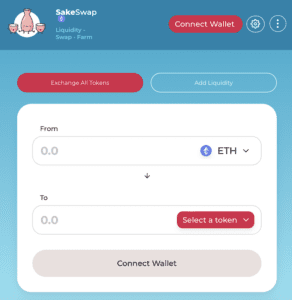

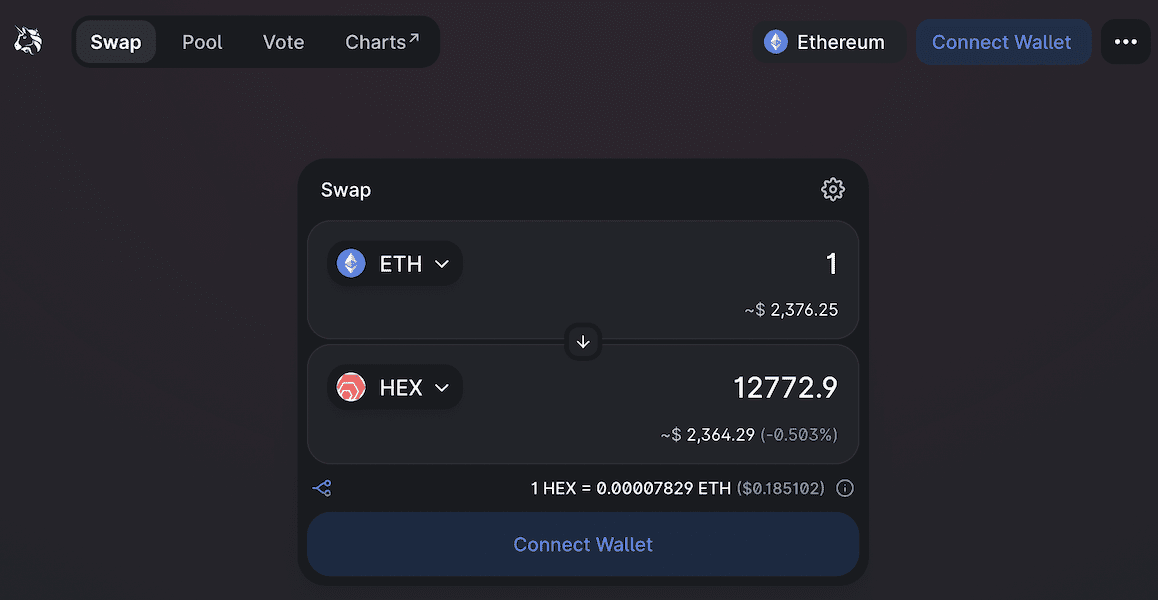

You’d often read about DEXes having complicated UX/UI. I wonder if people writing those blogs ever used a DEX themselves. Let’s take a look at the UniSwap interface. Can it get any simpler? Also, can we make better use of space when displaying this on a desktop browser?

All the same, buyers and sellers will need to click around and learn the ins and outs of the DEX. For example, I haven’t seen a DEX that successfully conveyed the slippage narrative.

All the same, buyers and sellers will need to click around and learn the ins and outs of the DEX. For example, I haven’t seen a DEX that successfully conveyed the slippage narrative.

How long do I wait for a trade to happen?

Depending on the chain, trades on a DEX may take a while. The speed is mostly okay, especially when the network is not congested. All I’m saying is trades are not instantaneous like on CEXes.

So why build a defi cryptocurrency exchange platform?

In practice, DEX founders become millionaires fairly quickly. Mainly because they get large amounts of a DEX token for free before it starts accumulating any financial value. Or they become prominent liquidity providers.

Challenges of Developing a DeFi-based Cryptocurrency Exchange Platform

Before we proceed to discuss how to launch your defi exchange, let’s run over the challenges you’re likely to face.

Liquidity pools

Liquidity pools are crucial to any DEX’s operations. The idea is anyone can come to a decentralized crypto exchange and lock their tokens to allow other market players to trade using this liquidity. In exchange, liquidity providers get a fraction of all fees from the corresponding trades on a pro-rata basis.

Plus, they are rewarded with an additional token (like UNI), unique to the DEX they use.

Plus, they are rewarded with an additional token (like UNI), unique to the DEX they use.

The big question is how you’re going to attract new users if they already can participate on all other decentralized exchange platforms. If you think about it, this totally depends on the tokenomics of your DEX:

- Will your DEX token be inflationary or deflationary?

- Can customers stake this token to generate interest?

- Do you want to accept tokens from other DEXes for staking?

In other words, if people come to DEXes for money, the onboarding of new customers will hinge on how well you can organize the economic mechanics of your DEX.

UX/UI challenge

As already mentioned, I find the UX/UI of most decentralized platforms relatively straightforward, despite what many blogs claim. At the same time, many of them willy-nilly piggyback on the UniSwap interface. Wouldn’t it be nice to offer a brand-new interface on a new dex platform?

Related: Mobile App Design Guide: Designing a Winning App

Build it, and copycats will come

It’s all about the open-source nature of DEXes and any dapp for that matter. On the one hand, you need to provide access to source code to prove the product is secure (public audit); on the other – this makes the product vulnerable.

For example, SushiSwap copied UniSwap v2 and keeps evolving. On top of that, they lured Uni’s customers by allowing them to stake the UNI token, which ended up by transferring part of UniSwap’s liquidity to SushiSwap.

For example, SushiSwap copied UniSwap v2 and keeps evolving. On top of that, they lured Uni’s customers by allowing them to stake the UNI token, which ended up by transferring part of UniSwap’s liquidity to SushiSwap.

To protect itself, UniSwap v3 was released under a “non-compete” license that prevents commercial use of their code within 2 years since launch. You should do the same.

How do I make money, again?

I bet you thought about that for a while: “How do I monetize my DEX?” And of course, the simple answer is by distributing the DEX’s token to yourself before it costs anything. A SushiSwap’s developer sold a stack of his SUSHI tokens for $14m at one point.

Again, tokenomics is your everything. The payback should come back via crypto. Could you lend out staked assets, for example?

If no one owns the DEX, how will it evolve?

Governance tokens — users with a governance token (on some exchanges, it’s the same unique token for liquidity providers) can suggest improvements and vote as they like, but the largest group of holders decides what will happen with the exchange.

Steps of DeFi Exchange Development

In reality, defi exchange platform development is not much different from when you develop a crypto exchange with a focus on centralization. You still need to go through all major steps typical for any software development project.

What are these?

- Discovery

- Prototyping

- Development

- QA

- Maintenance

One thing different (and that’s a biggie) is that all back end (databases, business logic, APIs, etc.) will live in smart contracts that will operate on a blockchain network instead of a cloud service like AWS or Google Cloud.

So instead of going through all these steps in detail, which you can peek at in our blog on how to create a private blockchain on Ethereum, I suggest we focus on the areas that will need your utmost attention during defi exchange development.

Agile: climbing a spiral staircase

The steps I’ve just mentioned don’t exactly follow one after another, one by one. At least most of them. While it makes sense that the discovery phase should precede everything else, all other steps can happen simultaneously, almost.

That’s the power of agile: while developers build what has been already designed, designers can work on future features, QA engineers test what has been already developed.

Related: Agile App Development: Everything You Need to Know

All these steps go in parallel, driving the DEX product closer to a perfect product-market fit — where it gets the maximum traction and ROI KPIs.

Another advantage of agile is that we can quickly adapt to new blockchain technologies that appear every day. This makes navigating the crypto-tech minefield much easier.

Product questions to ask

As you plan to develop a defi based cryptocurrency exchange platform, you and your dapp developers will need to find answers to lots of questions. Most of these concerns should be tackled during the discovery step; some will reveal unexpected options during implementation.

That’s precisely what happened with us during one of the recent defi projects. We had already built a crypto investing mobile app when we discovered better technology, exposing even better crypto gains. As a result, we continue refining the app, making it ready to work with more than one protocol.

Also Read: MVP App Development: The Ultimate Guide

In most cases, tokenomics innovation is something that you bring to the table, and your development team is responsible for validating your idea from a technological standpoint. If you’re lucky, the development services team will come up with alternatives that can significantly improve your “pumpamentals.”

Ok, so questions do you typically ask when creating your own decentralized exchange (defi) system?

Which blockchain to support?

One perspective is to choose an optimal blockchain from the point of view of its customer base, speed of transactions, fees, and competitors. And the other aspect of this question is what chains or protocols you need to support to allow trading their coins/tokens on your DEX. You can find more info on how to make a crypto token in one of our previous blogs.

One of the options is to work with layer 2 development solutions like Polygon — add-on chains with faster and cheaper transactions that integrate with the main chain, say Ethereum, and periodically register their transactions there.

One of the options is to work with layer 2 development solutions like Polygon — add-on chains with faster and cheaper transactions that integrate with the main chain, say Ethereum, and periodically register their transactions there.

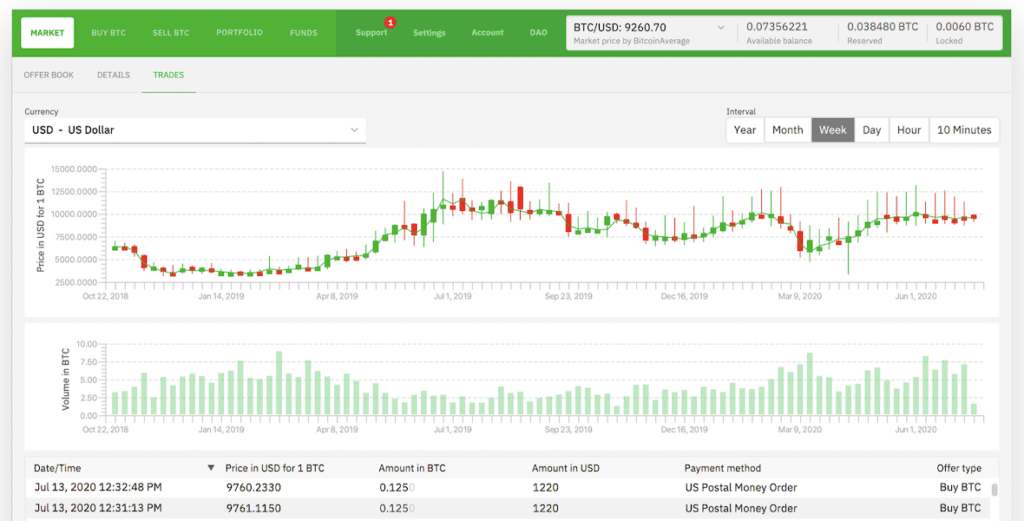

What platform will our target audience prefer?

Will it be a web/mobile app or a desktop peer-to-peer application? It goes without saying that ideally, we’d like to support all of these platforms. However, developing a DEX MVP will require focusing on a particular platform.

How will my automated market maker work?

As you probably know, AMM is essentially a smart contract holding liquidity that DEX customers trade against. Will your AMM allow only two tokens per contract (read liquidity pool) or several different tokens?

We talked about how to create and deploy a smart contract on Ethereum in a separate blog.

Do I need to supply my own non-custodial crypto wallet?

Yes, if it offers extra functionality combined with your DEX’s options. Besides, you should offer seamless integration with as many third-party non-custodial crypto wallets as possible. Here’s a decent roundup on how to make a crypto wallet.

Maintenance is a little different

When you release web 2.0 or mobile software, we recommend setting up the processes and infrastructure to ensure continuous development. You need this to keep iterating on the product, adjusting it to market reality.

With truly decentralized applications, such as DEXes, you can’t really do a lot of updates. At least not in the same way as you would with regular software. I suggest we look at trailblazers like UniSwap and adopt their practice of releasing new versions that work in parallel to previous releases.

As you understand, what’s deployed to a blockchain remains the same (90% of cases); however, nothing prevents us from releasing a modified copy. Of course, such an approach drastically limits the number of updates we can release. So we better make every single update count.

How Much Does it Cost to Launch Your DeFi Exchange?

The cost of building a defi exchange should start out at around $320,000 — for a built-from-scratch decentralized exchange. Forking Uni will cost less, of course, but you still need to account for customizations.

Related: App Development Costs: The Complete Breakdown

Guide to the Cost of Developing a Cryptocurrency Exchange

Our Experience in DeFi Development

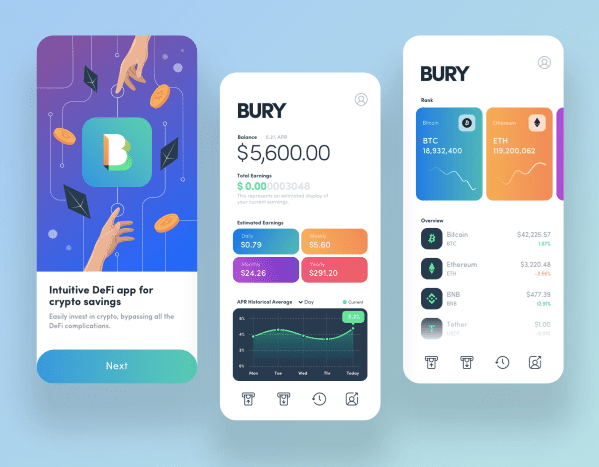

Bury Finance is a crypto-based defi application for smartphones that allows people to open a crypto savings account without dealing with all the crypto hassle. You can check out the case study here. The app looks user-friendly and intuitive, but we’re dealing with plenty of crypto/blockchain technologies and protocols on the inside.

Related:

- How to Make a DeFi Lending Platform

- How to Build a DeFi App

- How to Build a Market ready Fintech App

- How to Make a Blockchain App

- How to Develop a DeFi Staking Platform

- How to build a DApp

- How to Create a Crypto Trading App

- How to Start a DAO

Note: This blog was originally published on 2/9/2022, and has been updated for accuracy.

Frequently Asked Questions

What is the main difference between DEX and CEX?

Anonymity vs. KYC and full control of your funds vs. custody by an intermediary.

If my decentralized crypto exchange runs on Ethereum, does that mean the trading pair will be limited to ERC-20 tokens?

No, you can integrate with other chains too.

What are some popular DEX features?

Staking, participating in yield farming, earning bonus coins, crypto loans.

How do you test a defi DEX?

On test networks. Every blockchain main-net has a least one (or usually) a couple of test nets.

How long will it take to create a defi exchange?

Around 9 months, give or take a couple months, for a minimal viable product (MVP).