If you want to accept payments in crypto, you need to make a blockchain payment system or integrate with an existing platform.

The internet is chock-full of misconceptions about implementing cryptocurrency payment options, and I’ll be happy to help you cut through the noise and half-truths.

Whether you want to unlock crypto payments for your retail spot, e-commerce, web application, or mobile app — we’ll discuss how you can approach this nascent crypto-fintech space to delight your customers. We’ll also look at some of the best practices for developing blockchain payment solutions.

Top Takeaways:

- The most scalable approach to implementing a crypto payment gateway is integrating with one of the existing providers. Otherwise, you’ll need to develop a whole ecosystem consisting of an on-chain app, a couple of web portals, and a few mobile apps.

- When choosing a cryptocurrency for your payment solution, think about how fast it transacts on the blockchain, how popular it is, and whether there are too many fees involved in the process.

- Cryptocurrency adoption among retail investors and customers is growing. Yet, there are many challenges to using crypto for payments, especially in the retail industry.

Table of Contents:

- Crypto Payments = Financial Freedom?

- Benefits of Developing a Blockchain Payment Solution

- Building a Crypto Payment Solution — Your Options

- Challenges of Implementing Blockchain Payments

- Features of a Crypto Payment Platform

- Popular Crypto Payment Gateways

- Still Want to Create a Crypto Payment Gateway?

- Time for Crypto Payment Processor Development

Crypto Payments = Financial Freedom?

We’re already more or less accustomed to digital payments thanks to mobile banking and services like Apple and Google Pay. And here’s this new craze, called crypto, hitting the scene. Do we really need more in the fintech app development space?

The sole purpose of crypto is to get rid of middlemen. Here’s how Satoshi Nakamoto, the inventor of Bitcoin, framed that in his white paper:

“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

Just a couple of weeks ago, I realized the harsh truth: my money in the bank belongs to them, not me. It’s up to them to decide what I can buy and what I can’t. Long story short, they blocked my debit cards when I tried to purchase some crypto, and I had to pay them a visit to get everything back to working.

Related: How to make a cryptocurrency token

Please bear with me: I’m sharing this for a reason. Just note how cryptocurrencies promise uncompromised freedom with managing your digital currencies. We’ll soon discuss how that translates into user experiences with blockchain payment solutions.

Benefits of Developing a Blockchain Payment Solution

Let’s talk about why someone would pay with crypto after hearing about the two proverbial pizzas bought for 10,000 bitcoin in 2010 — give or take half a billion these days.

Benefits for sellers

First, let’s see how sellers can benefit from accepting payments in cryptocurrencies.

- Reach a new audience on a global scale

Every day, more and more people join the global crypto club. More than 77 million people are using blockchain wallets today, and the number is only growing — at about 10 million per year.

Of course, merchants would love to see this crowd buying their goods or services using cryptocurrencies. Every merchant adding crypto payment methods gets a mass appeal from the crypto community.

- Fraud prevention

Since all financial operations happen on a decentralized network, it’s easy to track each transaction detail. Besides, verification occurs automatically.

Related: How to make your e-wallet app for secure transactions

- 24/7 operations

Crypto, just like money, never sleeps. In fact, you could say that fiat money does sleep when the markets close for the night. Crypto keeps working on weekends and holidays, day and night.

- Complete automation with smart contracts

Smart contracts can completely automate money flows and make the payment process more straightforward and trustworthy.

Related: Smart Contract Development: The Complete Guide

You could argue that the last two points perfectly describe how traditional banking works, and that’s true. Right now, being crypto-friendly for a merchant is like showing their belief in the crypto future of financial services and being there in time. The signs are all over the place, though:

- Google is working on adding bitcoin payments into Google Pay

- Twitter has added integrated bitcoin-based tips for users

- Stripe, a popular payment service provider, is building a dedicated crypto team

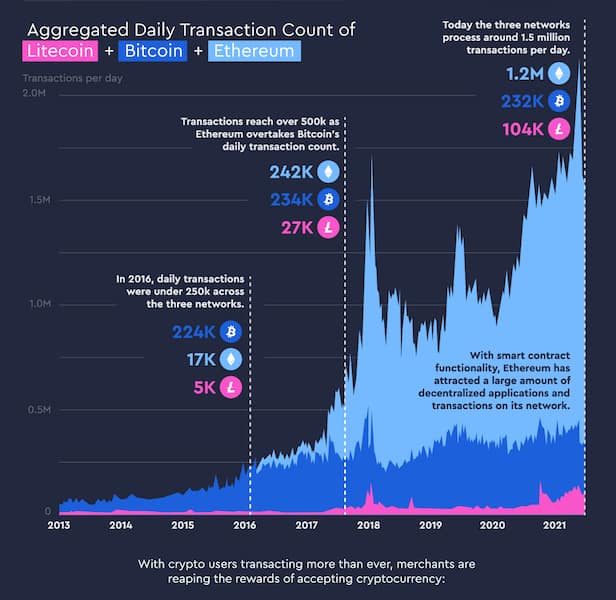

- Bitcoin and Ethereum process around 1.5 million transactions per day

Benefits for buyers

Now let’s see what buyers get when they spend their crypto on actual services or goods.

- Support for the underbanked

First of all, some consumers in developing countries simply don’t have access to banking services but need only a phone or a laptop to get into the blockchain game.

- Transparency

Crypto transactions on blockchains are absolutely transparent because they are stored in a distributed ledger. Therefore, customers can always go and check their transaction details — or can they? We’ll talk about that in more detail in a bit.

- Privacy

Despite all the transparency into transactional activity on the blockchain, it does not contain any personal information besides the public address of a user’s wallet. Therefore, the customer’s digital identity remains anonymous.

- Transborder transactions happen faster

Cross-border payments using traditional financial instruments usually take longer. Usually, the speed of transferring crypto to anywhere in the world is no more than five minutes.

- Trustless

Finally, since transactions are happening on the blockchain, there’s no need for a trusted intermediary. Payments are verified by blockchain participants.

Despite all these benefits, the average Joe comes into crypto first and foremost for trading or investing. Buying, on the other hand, comes as a bonus — an ability to make a blunt statement, “Only I command my money, not Wall Street.”

Building a Crypto Payment Solution — Your Options

Ok, so what are your options if you want to create your own crypto payment solution? Let’s not beat about the bush and lay down all of them:

- develop a cryptocurrency payment solution from scratch

- register a crypto wallet and publish its public address

- create a crypto coin or token

- integrate with an existing blockchain payment solution provider

Make your own blockchain payment solution

First of all, developing a crypto payment solution from scratch doesn’t make sense if you’re only looking to accept payments in cryptocurrencies from your customers. Not only will it take a titanic effort to pull off, but you will also need to develop your own crypto exchange or secure a partnership with other exchanges. Otherwise, how are you going to convert paid crypto into fiat?

Related: How Much Does It Cost to Develop a Crypto Exchange?

If you were to develop a blockchain payment platform and offer it to other merchants as BitPay does, for example, you’d have to create:

- a payment gateway (to reimburse merchants with fiat)

- a crypto exchange or an API to a partner exchange (for crypto-fiat conversion)

- back-end portal for merchants (with orders, reports, etc.)

- internal back-end portal (to execute on your crypto conversion strategy)

- endless plugins for major e-commerce vendors

- multiple front-ends including mobile, POS terminals, and web

- APIs for interconnecting the back end with all front ends

If this prospect of creating a blockchain payment system doesn’t look ominous enough already, secure a million or two in investments because that’s going to be a long road.

Obviously, that’s not something I’d recommend you do unless you’re ready to take on other players in the space.

Get a crypto wallet

That’s arguably the easiest way to bootstrap your business into crypto payments. You don’t even need to create a crypto wallet. In fact, no development is required at all — get an address on a blockchain and put out its public address. As long as your customers know your wallet’s public address, they can pay you with crypto.

Seems easy enough, right? Why aren’t many businesses doing that already? Well, there’s a couple of reasons:

- uncertainty with regulations (Can I accept it in my legislation? How do I pay taxes?)

- manual orders processing

- unavoidable transparency (anyone can look up all transactions associated with your public crypto addresses)

- need to set up a multi-currency wallet to accept as many tokens as possible

You could potentially set up a smart contract to automatically process these transactions, for example, to initiate the conversion of received crypto into a stablecoin and set the rest of the sales workflow in motion.

However, if your business has anything to do with delivery, you’re stuck. People will never disclose their addresses or other personal data on a blockchain. And if you think of a workaround where you handle shipping separately in a more traditional software setting, that’s too much overhead.

Therefore, I’d recommend this option only as a temporary solution when the number of transactions is insignificant and you want to cheer up the crypto crowd.

Therefore, I’d recommend this option only as a temporary solution when the number of transactions is insignificant and you want to cheer up the crypto crowd.

Create a crypto coin or token

Today, anyone can also create their own crypto token or coin and trade their services or products exclusively for this digital asset. In the case of a crypto coin, that would involve the development of a new blockchain — a pretty hefty task to accomplish. It’s one thing to create a blockchain and quite another to onboard enough users to make it viable.

However, creating a crypto token is much easier, e.g., an ERC-20 token on the Ethereum blockchain network. You can read up on how to create a crypto token in a separate blog.

Just remember that once the token is out, you’ll still need to choose one of the options we’ve already discussed to start accepting the token as payment. Therefore, there’s little gain as far as implementing a blockchain payment solution.

If anything, this approach may complicate the payment process for your customers as they’d have to go through additional loops to obtain the token first. Customers would have to buy or swap the token at an exchange, paying transaction fees.

Plus, your token will hardly avoid wild price fluctuations so common in the crypto space. And if it’s going to be a stablecoin pegged to the US dollar, why not use an existing stablecoin like USDC?

This approach may work for some DeFi or other types of decentralized apps, where your token plays an essential role in the functioning of the dApp itself. I would say it’s pretty common if you want to create a blockchain application.

Otherwise, it’s not worth the trouble.

Integrate with an existing blockchain payment solution

Finally, we’re stuck with the only viable option for accepting crypto payments — integration with an existing crypto payment gateway. It’s the approach I recommend you follow through on.

What is a crypto payment gateway? Think of PayPal, Stripe, or any other payment provider. Now imagine integrating their services to allow purchases through these channels. A crypto payment gateway is the same but allows your customers to check out using crypto.

As a matter of fact, PayPal has recently included a crypto checkout option. As you can see, major payment service providers are heading into this space, and that spurs healthy competition.

As often is the case with integrating a payment gateway, you get to choose whether you want:

- a vanilla, out-of-the-box integration experience

Involves setting up a merchant account and then using plug-and-play plugins.

- customizable integration

Implies you and your dev team get to tinker with APIs and change quite a few things around to enable precisely the customer experience you are looking for. We’ll discuss that in more detail shortly, but first, let’s review some of the challenges that blockchain payment solution development poses for merchants.

Challenges of Implementing Blockchain Payments

Remember how I stressed the freedom of managing your finances ushered by crypto? As we’ve just established, to introduce crypto payments for your customers, you need a middleman — a crypto payment gateway provider.

That must be the biggest challenge of implementing a blockchain payment solution. Crypto came about to help us get rid of middlemen. Yet, we need an intermediary to accept crypto payments effectively.

Unfortunately, there are no fully decentralized crypto payment gateways out there right now. However, that may change as the crypto space becomes more regulated and standardized across different chains.

What are some other limitations that you need to consider when developing crypto payment solutions? Well, there are quite a few:

- Customers still need to pay fees, and their amount depends on on-chain activities

For instance, transaction fees on the Ethereum blockchain range from $25 to $125, depending on how many users are currently transacting. Other blockchains offer better fees but have fewer users.

- Transactions are not always quick

Don’t get me wrong: they are still way faster compared to cross-border transactions, but they fall short if you compare them to paying with a credit card.

- Customers bear full responsibility for their funds

It’s elementary to lose all crypto for a newbie customer because it’s an entirely novel use case of digital money. There’s no one taking care of you and your finances like banks or other financial institutions. In crypto, people need to learn a lot of new stuff to protect themselves, and there are hardly any ready-to-go solutions or services. In other words, it’s not entirely safe to transact in crypto.

- Incorrect transactions can be irrevocable

No chargebacks, how about that? Merchants would love that, but how about customers? Crypto sent to a wrong address is gone forever too. You’d need to set up a separate system to manage refunds or do that manually.

- Too slow for face-to-face retail sales

With Apple Pay or similar services, clients can check out in seconds. Opposite to that, crypto payments may take minutes or sometimes hours.

- Need to lock the price for a short period

It’s difficult to display the price in cryptocurrencies because of volatility. And even if you could implement dynamic pricing, you’d have to lock the price for some time to allow the customer to transact.

Gas fees that users have to pay on every blockchain are probably the biggest deal-breaker for non-crypto businesses. However, if you seek to introduce blockchain technology-based payments for a DeFi service, most users are already accustomed to paying fees.

Features of a Crypto Payment Platform

Before creating a payment gateway for cryptocurrency, or rather, integrating with an existing provider, I’d suggest you explore its potential features.

For merchants

First, let’s consider what features you might need as a merchant:

- an online profile with bank account info and other settings

- ability to withdraw funds in fiat and stablecoins

- ability to hold crypto as is (for trading/investment purposes)

- an option to convert other cryptocurrencies into a stablecoin

- support for various e-commerce and CRM platforms

- KYC/AML

- analytics and reports

- transaction history

For consumers

What should a blockchain-based payment solution include to better engage customers?

- split fiat/cryptocurrency payments

- one-click payments for registered clients

- complexity of the KYC procedure

- can I get a crypto card too?

- multilingual support

- two-factor authentication

Popular Crypto Payment Gateways

Ok, so we’ve established that creating a payment gateway for cryptocurrency is an arduous task, and it’s much easier to use an existing provider. What options do you have? Well, there are quite a few players out there. I’ll give you two examples.

BitPay

An established player, operating since the very early days of Bitcoin. They support multiple coins and tokens, including Bitcoin, Bitcoin Cash, Ethereum, Wrapped Bitcoin, Dogecoin, Litecoin, and 5 USD-pegged stablecoins.

The key features include:

- their own crypto wallet and support of dozens of other wallets

- multi-factor security (multi-signature addresses, private key encryption, PINs, and bio authentication)

- well-documented API for custom integrations

- 1% fee on each transaction

- support for multiple front ends (from mobile to web)

- its own crypto credit card (MasterCard partnership)

ForgingBlock

ForgingBlock offers pretty much the same services as BitPay, but at more affordable rates and with more flexibility. The company is relatively new in this area and seeks to attract merchants by giving them more control over their crypto funds.

The key features include:

- their own POS terminal

- flexible APIs

- requires no KYC (p2p transactions)

- non-custodial payment gateway

- multi-blockchain support

Still Want to Create a Crypto Payment Gateway?

What if I haven’t succeeded in proving that blockchain payment processor development is too complex, and you should instead integrate with a third-party crypto payment solution? What if cryptocurrency payment processor development is going to be the core of your business?

First of all, the subject of developing crypto payment solutions goes way beyond the scope of this blog. And second of all, I’d have to reveal some trade secrets. Here’s what we can share here, and for more info, please consider booking a Pre-flight Workshop.

Things to consider when developing cryptocurrency payment solutions

When creating a payment gateway for blockchain, you’ll need to answer quite a few questions. What are these?

#1: What crypto coins and tokens would I like to support?

Depending on the cryptocurrencies you plan to support, you will need to set up your crypto gateway to work with multiple blockchains. That’s required because various crypto coins and tokens operate on different chains.

In essence, you’ll either build a decentralized exchange similar to UniSwap for swapping tokens or connect to it or a centralized exchange. That’s the only way to ensure accepting as many tokens as possible.

An alternative approach is to focus on a few most popular cryptocurrencies and create your own crypto pools where you’ll store all paid crypto.

#2: How do I manage fiat payouts to merchants?

You will still need to convert crypto into fiat for paying merchants. How do you do that?

You’ll need a backend payment processing system with a front end for admins to handle merchant payments to their bank accounts.

That’s where you will also see different reports, mitigate disputes with merchants, etc. So think of it as an internal portal.

#3: Where will my crypto payment solution meet customers?

An average user will have at least two devices they interact with on a daily basis: a smartphone and some variation of a desktop or laptop computer. Will it be enough if your blockchain payment platform works in browsers and as a mobile app? Or would you like to go as far as to support tablets, smartwatches, and other gadgets like smart speakers?

As for merchants, you might want to consider developing a dedicated POS solution and ready-to-go plugins for major e-commerce platforms and CRMs.

#4: Will merchants have control over crypto payment options?

If you want to provide merchants access to crypto funds they receive, consider creating a dedicated admin area. I believe some merchants will really appreciate a way to handle their crypto.

In fact, this may be the sweet spot for innovations. What do crypto payment gateways like BitPay do? They allow merchants to never touch crypto. Instead, they pay them with fiat immediately once a crypto transaction has been confirmed on a chain.

In fact, this may be the sweet spot for innovations. What do crypto payment gateways like BitPay do? They allow merchants to never touch crypto. Instead, they pay them with fiat immediately once a crypto transaction has been confirmed on a chain.

What if merchants could access other popular crypto use case scenarios, like trading, staking, lending, among others?

Read more on how to develop a defi staking platform in a separate blog.

#5: Do I want to solidify my connection with merchant customers?

In some cases, you might want to establish a direct connection with customers and keep them using your services. For example, BitPay offers a crypto wallet with plenty of features that essentially works as a universal wallet for paying with crypto across any merchants that work with BitPay. In addition, customers can buy crypto and gift cards.

Of course, that implies the development of a customer-focused mobile app.

#6: How do I manage crypto as the platform owner?

Apparently, crypto payment gateway providers don’t code their platforms just to convert crypto into fiat at transaction time. Unfortunately, that would be close to gambling. Instead, they reap the rewards of sound crypto investment strategies and enjoy the extraordinary ROI only possible in crypto at the moment.

Surely, to manage their internal mass crypto transactions, they’d need a web portal hooked with a centralized exchange of some sort. You could use such a portal to set the rules for managing blockchain assets, e.g., what price you liquidate, etc.

8. Time for Crypto Payment Processor Development

Do you feel like we’re still scratching the surface with all these questions? We’ll be happy to provide you with more guidance and information about crypto gateway development.

Feel free to book a free consultation with our experts. Our blockchain developers will be happy to help you change the finance landscape.

Related Articles:

- P2P App Development Guide

- Fintech App Development Guide

- How to Build a Neobank

- How to Make a Banking Application

Frequently Asked Questions

What is a crypto payment gateway?

Just another type of payment gateway allowing to process blockchain transactions.

What are some popular blockchain payment solutions?

BitPay, CoinBase, NOWPayments, Blockonomics.

Do I need to develop my own token to accept crypto payments?

Only if you plan to design DeFi applications on a blockchain.

Why not simply put a wallet address on the site to start accepting cryptocurrencies?

Manual processing, convoluted regulation, tax uncertainty.

What cryptocurrencies should I focus on when developing a blockchain payment solution?

Bitcoin and Ethereum are no-brainers; you might also want to add stablecoins pegged at the US dollar cost.