I’ll be honest — I’m not a huge fan of gamification in banking apps. In fact, the last straw before I dropped my banking app was yet another gamification trick. Imagine getting daily alerts with money horoscopes to spin a wheel and (never) win some cash. And that’s on top of useless badges and constant ads to invite friends.

Of course, I don’t believe that all gamification in digital banking has to be this lousy. So why don’t we review some fine examples of gamified user experiences in banking apps and find a way to spice up your mobile banking software?

Top Takeaways:

- Gamification in finances has little to do with gimmicking popular gameplay in a banking application in an attempt to entertain customers. Instead, we should focus on delivering add-on value wrapped into gamified experiences to better engage customers.

- Take a look at customizable off-the-shelf gamification solutions like Gamify, Goama, StriveCloud, or Moroku to see if they cover your vision for creating game-like experiences for your customers.

- The main challenges to implementing game mechanics in banking software are creating lasting, evolving user experiences and catering to different audiences within a single app.

Table of Contents:

- Principles of Gamification in Banking

- Gamification Examples in Banking

- Benefits of Gamification in Banking Apps

- Challenges of Gamification in Banking

- Implementation of Gamification in Finance and Banking

- How Topflight Can Help

Principles of Gamification in Banking

Let’s start by defining gamification. What is it? The mainstream narrative feeds us the story about bored millennials and gen Z consumers. Apparently, these video-game enthusiasts (myself included) need an additional stimulus to continuously engage with something as dull (supposedly) as finances.

Even if the story is partially true, does it mean banks need to re-engineer their banking apps into mobile games? Fortunately, no. Simply put, gamification means we need to find ways to inject game mechanics into user interactions with our apps.

In other words, it’s not about games but rather about using game-like principles in software to make fintech and banking applications more engaging:

- challenges

- sense of achievement

- competitiveness

- rewards

- high interactivity

- personalized, evolving user experience

To successfully apply these principles in banking software, we need to identify its primary use cases. What user activity in a banking app do we want to reinforce? What will benefit our customers and our business the most?

On the surface, it looks like banks chiefly deal with savings, budgeting, and teaching kids to earn and manage money when it comes to gamification.

Related: Trading and investing app development guide

Alternatively, we’ll take a closer look at our business’s core value propositions and try to find new ways to apply gamification scenarios in our banking apps. Alas, I’m not that deep in the banking trenches. So, I’d have to go by studying what leading applications have to offer at the moment. Care to take a look?

Gamification Examples in Banking

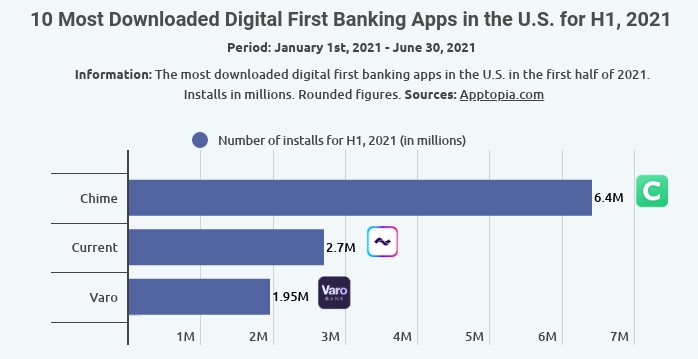

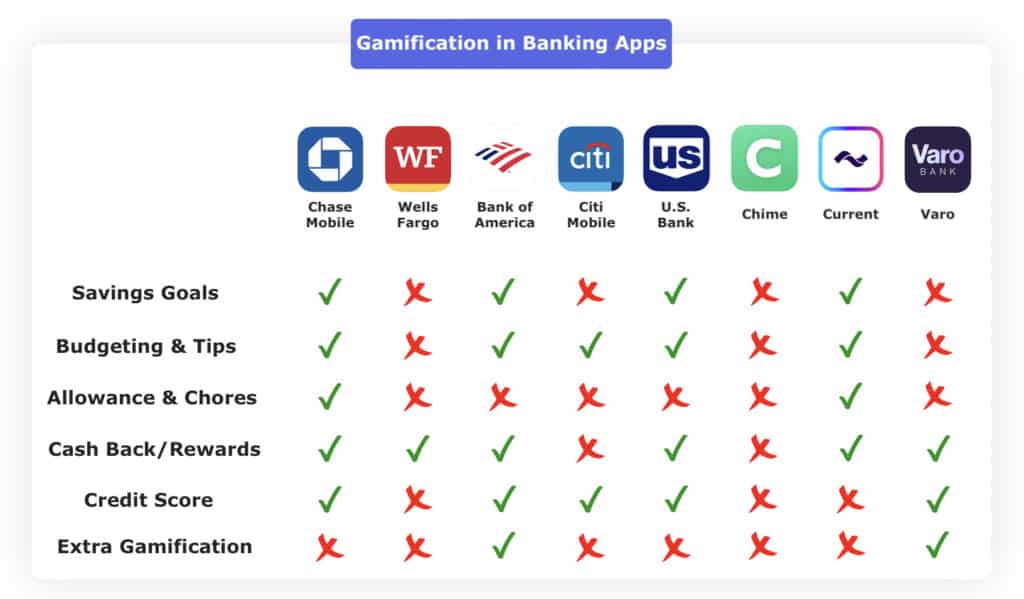

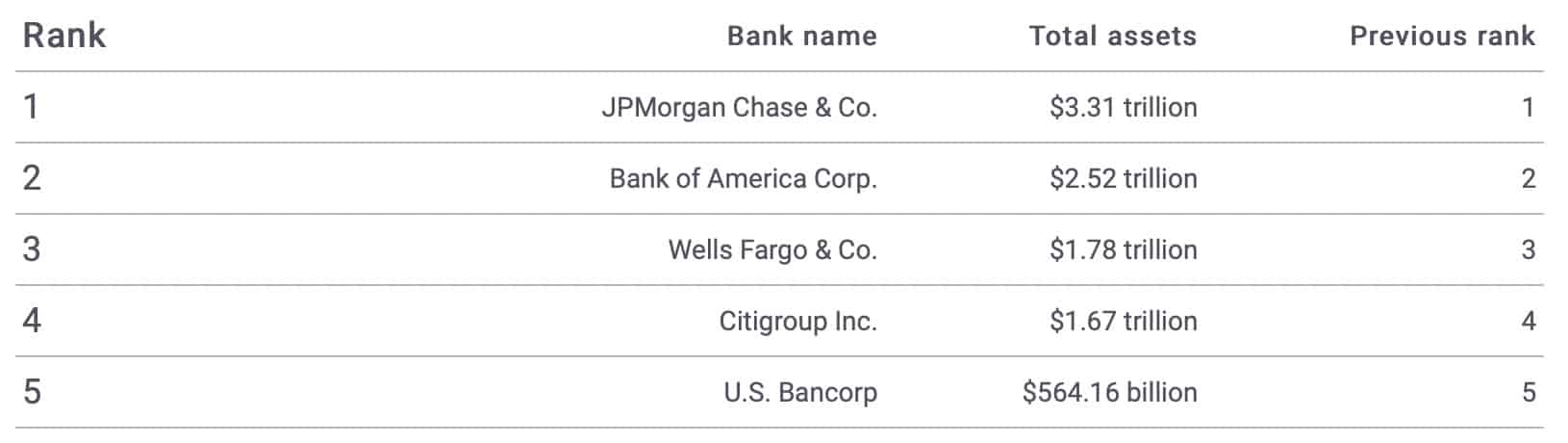

Ok, so I thought, let’s look at the top banking apps and see how they fare in terms of gamification. I’ve checked out the mobile apps from these top banks and also reviewed a few popular neobanks: Chime, Current, and Varo.

Minimum gamification

To my surprise, both traditional banking apps and trailblazing neobank have minimum gamification features. Actually, I haven’t yet run into a mainstream banking app where game mechanics are the cornerstone of user experience.

Related: Neobank App Development: Everything You Need to Know

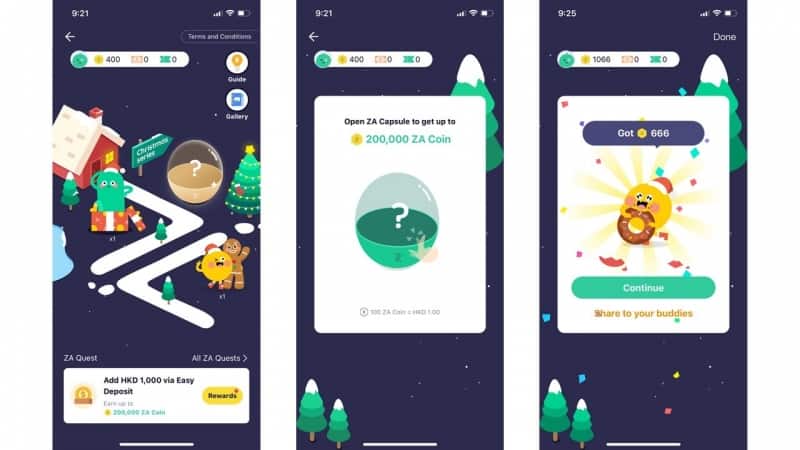

However, we can note ZA Bank’s mobile app, where they offer customers to play a PowerDraw game for a chance to win 200 percent cashback for offline purchases. Customers may also join the ZA quests to earn redeemable points:

Even so, this Hong Kong bank seems like an exception when stacked against the largest banking apps in the U.S. Let’s look at the game-like elements we usually find in the latter.

Savings goals

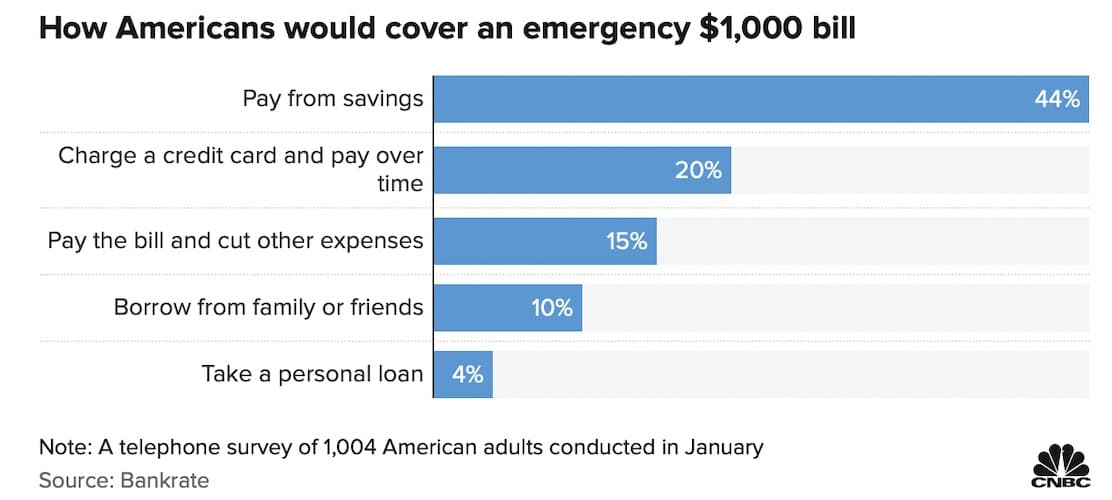

The more money we keep in banks, the better for banks and some of us. As you’re probably aware, more than half of the U.S. population does not have substantial savings.

Some would say, “Almost like completing a level in a game!” But is this why customers do this? To see a progress bar complete or to receive another badge? Or because people realize that they need an emergency fund?

In that sense, these goal-setting gimmicks play a supporting role, probably making the process less painful.

Budgeting

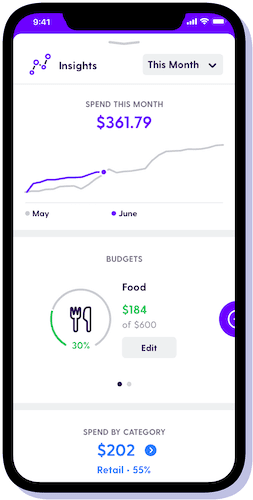

Budgeting is a perfect example of a typical game-like option. Users track how they spend their money on different categories and, in some cases, even set limits for specific categories, like in neobank Current.

Some apps, e.g., U.S. Bank or Chase Mobile, provide additional insights by watching money-in/out and analyzing customers’ spending habits within a meaningful time frame.

Related: Creating a budget tracking app: The Complete Guide

Chores and allowance tracking

Yet another game-like option to introduce digital cash allowance and chore management. Parents set chore goals for kids and watch their first attempts at finance management.

Cashback and rewards

Today, cashback is quite ubiquitous in banking apps. Yet, some banks find creative ways to enhance this experience with game theory. For example, customers can earn badges or find companies and financial institutions on a map where they can redeem and earn more points.

Credit score monitoring

Finally, some banking apps, like Chase Mobile, introduce tools to monitor and improve the credit score. Everybody loves charts with points and tips on improving their standings.

Take a look at how far down the gamification path these leading mobile banks have gone.

Exceptions

Varo and a couple of other banks partner with Long Game — casual mobile games that live in a separate mobile app but integrate with customers’ bank accounts. Players can earn points and turn them into digital cash.

Please note that this gamification happens outside of the actual banking applications.

By the way, Long Game has been recently acquired by Truist Bank (#7 by total assets). Why have they done it? I bet the plan is to integrate gamification elements right into the Truist mobile banking app.

Blast from the past

Let’s talk about some of the gamification examples in banking from the past.

JP Morgan and Wells Fargo released stand-alone banking apps around 2017-ish to target millennials. They had emojis for rating purchases and creating emotion-based auto saving rules, saving challenges, kudos messages, and whatnot.

How did these three apps (Finn by JP and Greenhouse/Daily Change by WF) perform? Swept under the rug. Why? Because people don’t use banking apps to play games or savor game-like experiences.

JP probably had to reuse everything they learned from those gamification experiments in their main mobile app — Chase Mobile. And Wells Fargo (see the chart above, almost zero gamification) probably said, “F** it, we’ll just make sure our web app looks nice on mobile.”

There was also an online BBVA game (not mobile, mind you!) that won an innovation award in 2013. The bank is no more (its U.S. subsidiary was acquired by PNC in 2021), and the game has been looong gone. End of story.

Related: Build a Fintech App

Based on this analysis, it seems that most organizations still remain conservative to gamification in digital banks, while some are already dipping their toes in the water.

Benefits of Gamification in Banking Apps

We should have probably started with this, but still, let’s discuss why banks chase the gamification trend at all. What advantages can game mechanics bring to the table?

Attract new audiences

As long as you believe that certain groups of users are more susceptible to gamified experiences and appreciate your efforts, gamification should work out for your banking app. Remember that nostalgia for 8-bit games is also quite a trend right now.

Customer loyalty

Customers love brands that feel personal and educate them on finances. Gamification can create a positive brand for your company. However, beware of gimmicky attempts to entertain your customers.

Customer research

By studying how users interact with game-like features of the app, you can get valuable data about their habits and preferences. That, in turn, can be used to adjust the entire banking app. You could also introduce quiz tours to walk users through the app and explain its essential features. As a result, customers may choose to use more services provided by your banking app.

Higher engagement

Finally, artfully executed gamification ideas in banking apps keep users engaged. The idea is that the more time they spend in a banking app, the higher the chances of them discovering additional services.

Related: Build a Mobile Banking App

Challenges of Gamification in Banking

I bet we’d see way more gamification in finance and banking if this were easier to achieve. Unfortunately, there are quite a few challenges. What are they?

Commoditization

All banking apps can wind up with identical looks: the same options and game elements. Banks have to double down on innovations to make their apps look unique and substantially differentiate their game-like options.

Finances can’t be fun

I think society is overcoming this one lately. However, finding the right balance between a helpful feature wrapped into a gaming experience and a gimmick is still burdensome. Besides, many people still view financial decisions as a pretty serious business, and rightfully so.

Social competition

How much do you think people are willing to rank against others on a leaderboard when it comes to money? Don’t get me wrong, I’m all for competitiveness as the engine of progress.

At the same time, I don’t see myself bursting with joy staring at a leaderboard where I overperform or lag behind my friends and peers (let’s say, in terms of how much we saved last month). Plus, how do you go around the privacy policy and security concerns?

So even though most successful games rely on a social component, it takes some talent to implement that in a banking app in an acceptable way.

Catering to multiple audiences at once

People have different attitudes towards gaming. How do you make such experiences discoverable without sticking them into everybody’s face?

When you introduce new gamification elements, will the app still feel the same? Do these “games” make the software’s look-and-feel inconsistent? How do users notice it? Do you use banners or have a special dedicated section?

In essence, you need to answer this question, “How to make a gaming experience truly complementary without distracting users from doing what you want them to do in your banking app?”

Creating lasting experiences

Some of the successful gamification attempts in banking no longer exist because customers get bored with time. Conventional games have specific renewal rates. So, you’ll need to think through a gaming experience that lasts long enough to tap into customers’ financial behavior. Do you keep adding levels and challenges over time? Or do you introduce new games altogether?

Implementation of Gamification in Finance and Banking

Writing about the gamification of banking apps and online banking from the point of view of implementation could easily take a separate blog. Instead, let’s talk about the proper approaches to implementing game mechanics in banking products.

10,000-foot view

We can add gamification items straight into a mobile or web banking app. An alternative approach is to develop a stand-alone gamified application that works in tandem with the principal banking app. Yet another method is to create a web-based “game” and then make it accessible via mobile apps on different platforms.

Use cutting-edge technologies

It seems obvious (but I guess, a little risky to established banks) to add game-like elements by using technologies that blend the digital and real worlds. For example, augmented reality, NFC tags, AppClips (on iPhone), barcodes, etc. — they can all serve to create engaging experiences on the edge of the physical and digital worlds.

Research target audience

Decide whether your users are explorers, achievers, or socializers. What game mechanics would serve best to create sticky experiences for them? Because there are quite a few to choose from:

- Badges and leaderboards

- Levels and progress bars

- Journeys and quizzes

- Points and rewards

I also encourage you to make these game-like use-cases optional. On the other hand, if gamification is the core of your investment banking or retail banking app, there’s no need to hide it.

Code from scratch or use ready components

Finally, you can always choose whether you want to implement gamification in banking & financials using custom code or by reusing off-the-shelf solutions. The custom approach guarantees uniqueness and perfectly tailored experiences for the consumer.

However, ready-made platforms like Gizmo by Gamify or Moroku allow you to create faster experiments while still preserving some customization options.

How Topflight Can Help

We love working on innovative fintech solutions (check out our fintech app development services) that look to reasonably gamify user experiences. In our portfolio, we have a budgeting app that connects to bank accounts, analyzes spending habits, and calculates future budgets for customers. The app offers advice on budgeting to help millennials take control of their finances.

If you’d like to discuss how you can leverage gamification in the banking sector, reach out to our experts and schedule a call.

Frequently Asked Questions

So you're saying gamification is not about adding casual games into a banking app?

Precisely, it’s about adding game mechanics to incentivize users to return to the app, again and again, looking to overcome challenges and score. Casual games can be part of that.

What private banking apps have skillfully designed gamified use cases?

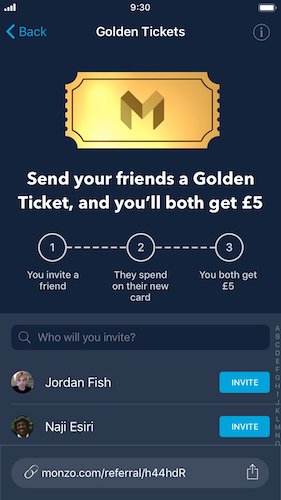

Chase, Bank of America, PNC, Current, and Monzo should, by all means, be at the top of your list.

What are the typical use cases to engage customers with gamification in financial services?

Savings, goals, budgeting, and increasing financial literacy. Some banks use casual mini-games to multiply the number of active daily users, hoping that frequent visits will lead to a discovery of their add-on services.

How long does it take to implement gamification in mobile apps?

Hard to tell. That depends on the scope and how well the app has been architectured (open APIs in place?). Again, if you’re starting from scratch, it’s one budget (somewhere between $150,000 and $230,000). And if you want to augment an existing solution, it’s a smaller budget. Our approach is you should have a Proof of Concept — something tangible for a focus group to test — within 3-4 months and then grow from there.

What game-like element can you suggest as a safe bet?

I would applaud a banking app that allows me to earn points based on how well I stick to a categorized (weekly or monthly) budget that I set myself in the app. The app should also provide recommendations for budget planning based on my spending habits. The points I earn can be spent on subscriptions unlocking additional banking services. Try to come up with unique use cases of gamification in e-banking. For example, consider if you could help users with taxes and investments besides deposits and loaded credit cards.