Healthcare software development companies used to be the quiet plumbers of digital health; in 2025 they’re elbowing into boardrooms with a $67.7 billion market tag and a 14.9% growth clip. Venture funding is still frothy, AI is table stakes, and every hospital CFO is whisper-screaming “ROI or die.”

If you’re a clinician-founder, digital-health entrepreneur, or exec who moonlights as a fire-wielder of EHR headaches, the vendor landscape feels like Comic-Con on double espresso—crowded, loud, and full of cosplay claims.

This guide pares it down: why buyers flock to specialized shops, how the best firms actually move the needle, and which names deserve a seat at your next RFP round. Ready to separate rocket ships from vaporware? Let’s dive in.

Key Takeaways

- Specialised medical software development companies plug the talent and compliance gaps that hospital HR can’t fill—spinning up HIPAA-ready, FHIR-savvy squads in weeks and trimming total cost of ownership by 25-40 %.

- Buying modular platforms—not monoliths—from a seasoned hospital software development company lets you tap fast-moving trends (AI scribes, remote monitoring, cloud PACS) without re-inventing HL7 wheels or flunking SOC 2 audits.

- A blended shortlist—pairing the velocity of boutiques with the scale of the largest healthcare software companies—delivers the sweet spot of speed, governance and board-level ROI; Topflight sits in that “fast-but-buttoned-up” lane.

Table of Contents

- Why Medical Organizations Turn to Healthcare Software Development Companies

- How Top Medical Software Companies Transform the Industry

- Top Healthcare Software Development Companies in 2025

- How to Choose the Right Medical Software Engineering Company

- Key Healthcare Software Solutions Development You Should Know

- Operational Efficiency Playbook (2025 Edition)

- Why Choose Topflight as Your Healthcare Software Development Agency

Quick Comparison of Leading Healthcare Software Dev Shops

Skim-time is real: before we dive into why health systems outsource, here’s a one-screen snapshot of the vendors we’ll be dissecting later. Use it as your cheat-sheet or scroll on for the juicy details.

| Company | Founded | Team size* | Flagship differentiator | Public rating |

|---|---|---|---|---|

| Accenture | 1989 | ≈ 774 000 | Enterprise “Distiller™” agentic-AI framework for large-scale clinical copilots | 4.3/5 (G2) |

| Philips HealthTech | 1891 | ∼ 67 000 | Device-cloud stack (MRI ↔ Azure + FHIR/RPM APIs) | — |

| ScienceSoft | 1989 | 750+ | AI-driven analytics & decision support for mid-size systems | 4.8 / 5 (Clutch) |

| Innowise | 2007 | 2 300+ | Staff-aug “turbo” squads with pre-wired HL7/FHIR middleware | 4.9 / 5 (Clutch) |

| Intellectsoft | 2007 | 50 – 249 | Design-forward telehealth, wearables & blockchain audits | 4.9 / 5 (Clutch) |

| Netguru | 2008 | 250 – 999 | Patient-facing UX for oncology & mental-health portals | 4.8 / 5 (Clutch) |

| Optimum Healthcare IT | 2012 | 501 – 1 000 | Epic/Cerner go-lives & IT-planning (Best-in-KLAS 2025) | 94.8 / 100 (KLAS) |

| Topflight | 2015 | 46 | HIPAA-native mobile builds + AI scribes/coding suite | 4.9 / 5 (Clutch) |

*Latest publicly available head-count brackets (Clutch, LinkedIn, or company filings).

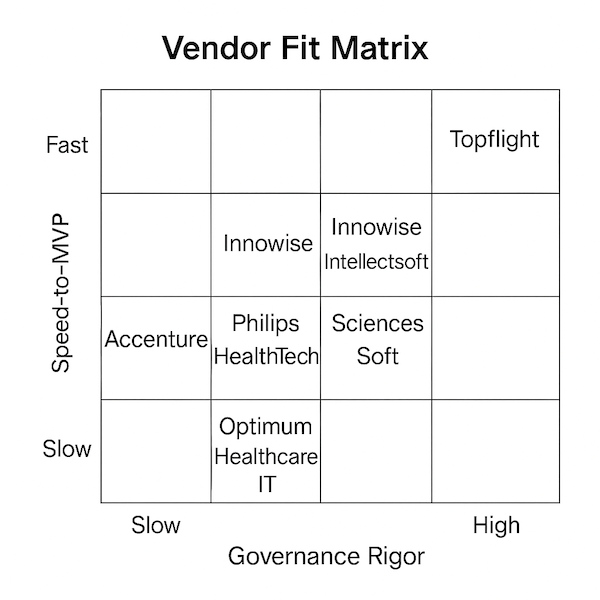

Here’s also where each vendor lands on the Speed vs. Compliance continuum.

Why Medical Organizations Turn to Healthcare Software Development Companies

Talent drought, meet compliance overload: More than 80% of U.S. health-care executives say 2025 will be another year of brutal hiring shortages for tech roles—from HL7 integration engineers to AI prompt-tuning specialists. Clinicians can’t wait for HR to fill a six-month req while their EHR grinds productivity into pulp.

Speed and Focus Trump Head-Count Pride

A lean “medical software development company” can spin up a full‐stack squad in weeks, ship an MVP in three sprints, and disappear the headache of DevSecOps. Hospitals keep clinicians on patients, not on GitHub PR reviews.

Regulatory Landmines Are Already Mapped

Specialists live and breathe HIPAA, ONC certification, and SOC 2. One midsize Texas hospital cut validation time by 30% after shifting its patient-access portal to a vendor with pre-baked PHI encryption modules, freeing up $1.2 M in capital for new MRI coils.

Cost Transparency Wins Board Approval

A 2025 cost-model audit shows outsourced builds average 25–40% less TCO than assembling an internal team—once you tally recruitment, turnover, and tooling licenses. CFOs like line items they can amortize, not head-count they can’t shed.

Innovation Without Vendor Lock-In

Modern partners work API-first—FHIR, SMART-on-FHIR, GraphQL—so provider orgs can swap components without a forklift rewrite. That’s especially handy when Big-Tech cloud rates spike or payer workflows change overnight.

Bottom line: medical software development companies aren’t a luxury; they’re the only way most provider groups can keep pace with AI-driven care models, looming cybersecurity regulations, and an angry spreadsheet wielded by finance.

How Top Medical Software Companies Transform the Healthcare Industry

1. Turning Pajama-Time Into Prime Time

AI scribes and copilots from the likes of Nuance (Microsoft) and Abridge are shaving ≈ 60 minutes of nightly charting off physicians’ schedules; the AMA reports that 57% of doctors now see administrative-burden relief as AI’s No. 1 use-case—beating diagnostics, outcomes, and revenue gains by a country mile.

2. Interop that Actually Interoperates

The Cures Act + HTI-1 timeline has lit a fire: 90% of health systems are expected to expose FHIR APIs by year-end 2025, letting third-party applications bolt into Epic, Oracle Health, and Meditech with SMART-on-FHIR handshakes instead of HL7 elbow grease.

Top healthcare software companies ride that wave by building plug-in modules rather than monoliths—think Particle Health’s patient-matching API or Ribbon’s provider directory.

3. Cloud Economics without the Sticker Shock

ClearDATA’s 2024 analysis shows properly planned migrations cut total cost of ownership 25–40% versus on-prem iron once you price in hardware refreshes, patch cycles, and breach insurance. Vendors that arrive with pre-hardened landing zones and HITRUST inheritance shrink the CFO’s risk column even further.

4. Virtual-Care Rails Everywhere

Remote Patient Monitoring in the U.S. hit $2.3B in 2024 and is compounding at 18% CAGR through 2030. Leading firms bake device SDKs, FDA-class II workflows, and payer-billing logic into starter kits so founders can launch in weeks, not quarters.

5. Gen-AI Agents, Not Just Chatbots

Google Cloud notes that clinicians spend one-third of their week on paperwork ripe for AI delegation; early deployments at Highmark Health and MEDITECH’s Expanse are already summarizing charts and slashing prior-auth lag.

The best software partners bundle these LLM helpers with guardrails—bias checks, PHI redaction, and audit trails—so compliance officers sleep at night.

Takeaway: The top healthcare software development companies aren’t merely writing code; they’re packaging regulatory muscle, cloud economics, and AI horsepower into drop-in accelerators. If your incumbent vendor still talks about “interfacing” in 2025, it’s time to swipe left.

Top Healthcare Software Development Companies in 2025

We sifted through 120+ agencies that claim HIPAA chops and lopped off any that failed at least one of these:

- ≥ 10 years in business (stability trumps shiny logos).

- Dedicated healthcare portfolio—not “we once built a step-counter.”

- Proven compliance muscle (ISO 13485/27001, HITRUST, or Best-in-KLAS badges).

- Public case studies with named provider or life-science clients.

- Clutch/G2 rating ≥ 4.8 or equivalent social proof.

Only eight names survived the gauntlet—that’s who you’ll meet below. Here’s the list:

1. Accenture — Enterprise Heavyweight

- Founded / HQ: 1989, Dublin 🇮🇪

- Team and reach: ≈ 774 k pros across 120 countries

- Bragging rights: Rolled out the 2025 Distiller™ agentic-AI framework for scalable clinical copilots

- Best for: Multi-hospital “rip-and-replace” transformations where CIOs need both FHIR plumbing and board-level change-management.

- Pricing at a Glance: Enterprise programs typically start around $250 k+; hourly rate undisclosed.

2. Philips HealthTech — Device-Cloud Powerhouse

- Founded / HQ: 1891, Amsterdam 🇳🇱

- Workforce: ~67 k employees, sales and service in 100+ countries

- Sweet spot: MRI, patient-monitoring, RPM devices tied to an Azure-native cloud and HL7/FHIR APIs.

- Best for: Providers that want hardware + informatics under one brand (think ICU telemetry streaming straight into the EHR).

- Pricing at a Glance: full cloud-PACS roll-outs often hit high-six figures.

3. ScienceSoft — AI and Analytics Specialist

- Founded / HQ: 1989, McKinney TX 🇺🇸

- Bench strength: 750+ healthcare IT pros, 35 years in regulated builds

- Proof: FT Americas Growth Champion 2025, Top 100 Women in Health IT honoree

- Best for: Mid-size health systems chasing AI-driven decision support without a Big-4 price tag.

- Pricing at a Glance: $5k+ minimum project • $50-99/hr.

4. Innowise — Staff-Aug on Turbo

- Founded: 2007

- Scale and certs: 2,500+ engineers, ISO 13485/9001/27001 triple-stack

- Edge: Can spin up XR or IoT POCs in < 6 weeks thanks to pre-wired HL7/FHIR middleware.

- Best for: Product teams that need rapid capacity bursts without skimping on compliance.

- Pricing at a Glance: $10k+ minimum project • $50-99/hr.

5. Intellectsoft — Design-Forward Boutique

- Founded / HQ: 2007, Palo Alto 🇺🇸

- Footprint: ~800 staff worldwide with 600+ solutions shipped

- Calling card: Telehealth, wearables, and blockchain audit trails for pharma supply chains.

- Best for: Startups needing a slick UX layer without losing HIPAA/GDPR rigor.

- Pricing at a Glance: $50k+ minimum project • $50-99/hr.

6. Netguru — UX Aficionado

- Founded / HQ: 2008, Poznań 🇵🇱

- Team size: 900+ employees across 15 countries

- Client love: Oncology portals and mental-health apps that feel like consumer tech—because they are.

- Best for: Venturing into patient-facing apps where App-Store ratings make or break adoption.

- Pricing at a Glance: $25k+ minimum project • $50-99/hr.

7. Optimum Healthcare IT — EHR Fixer-Upper

- Founded / HQ: 2012, Jacksonville Beach FL 🇺🇸

- Cred: Best in KLAS 2025 for IT Planning and Assessment

- Focus: Epic and Cerner go-lives, ServiceNow workflows, and post-implementation optimization.

- Best for: Hospitals drowning in EHR technical debt and looking for a proven quarterback.

- Pricing at a Glance: Epic/Cerner go-live bundles kick off at $100k+; small-hospital Epic installs frequently range $500k–1M.

8. Topflight — Mobile-First, Web-Ready Maverick

- Founded / HQ: 2015, Irvine CA 🇺🇸

- Niche: HIPAA-native iOS/Android builds for Cedars-Sinai, Stanford, Merck—plus AI solutions (Clinical Documentation Automation, Predictive Analytics, Automated Clinical Decision Making, Revenue Cycle Management, Patient Engagement) that actually clear security reviews.

- Best for: Clinician-founders chasing a production-ready MVP (4–6 sprints) that won’t implode when real PHI shows up.

- Pricing at a Glance: $50k+ minimum project • $100-149/hr.

Checklist next time you draft that RFP: line up one enterprise titan (scale), one mid-market veteran (cost control), and one boutique sprinter (speed). The mix beats betting your entire budget on a single logo—especially in a market that’s mutating faster than a CRISPR demo at BIO-Tech Expo.

How to Choose the Right Medical Software Engineering Company

1 — Start With Risk Math, Not Logo Lust

A single PHI breach still rings up ≈ $9.8 million in damage, almost double every other vertical. Factor that into your vendor calculus before chasing the biggest healthcare software companies just because their booths were shiny at HIMSS.

2 — Demand Proof Of Velocity

Hospitals report RFPs dragging 9 months – 3 years when the vendor can’t map clinical workflows on day one. Ask for time-boxed case studies (e.g., “We shipped a FHIR-ready patient-portal MVP in 14 weeks”)—and verify with references.

3 — Audit Their Compliance Muscle In The Wild

ISO 13485, HITRUST, and recent SOC 2 Type II letters are table stakes. Next, scan their public GitHub or release notes for updates tied to CMS’s HTI-1 rules. If your prospective hospital software development company hasn’t pushed a FHIR R5 upgrade yet, walk.

Pro tip: Slip them a “mini-HIPAA” scenario—ask how they’d encrypt off-line data sync for a rural RPM app—and watch who fumbles.

4 — Interrogate Their Failure Résumé

Over 50% of EHR projects still miss ROI targets because of scope creep or integration gridlock. A mature partner can tell you how they blew a deadline, fixed it, and codified the lesson; the immature one blames client indecision.

5 — Follow The Money Trail

Get transparent, all-in pricing: discovery, build, DevSecOps, and two years of support. Then benchmark it against the cost of developing a healthcare app internally—often 25–40% higher once you load in recruiting and turnover.

6 — Check For “Day-One Interoperability”

FHIR R4, SMART-on-FHIR PKCE flows, and prebuilt HL7 bridges should already live in their codebase. Bonus points if they’ve published a guide on HIPAA-compliant software development—it signals institutional muscle, not just marketing gloss.

7 — Size Vs. Fit

The largest healthcare software companies bring scale but may park you behind big-pharma retainer clients. A boutique hits warp-speed but can stall if two senior architects quit. Mix one of each on your shortlist, then score them on domain focus, bench depth, and governance rigor.

Decision checkpoint: If a contender can’t hand you (a) a breach-response runbook, (b) three live FHIR endpoints, and (c) a project plan that survives CFO scrutiny, swipe left—your patient data, margins, and sanity will thank you.

Key Healthcare Software Solutions Development You Should Know

Below is the “greatest-hits” playlist every digital-health founder should have on shuffle. Together, they cover the bulk of 2025 buying budgets—and the keywords Google expects to see when you talk about healthcare software development solutions.

| Solution | Why It Matters in 2025 | What Top Vendors Bring to the Table |

| Modern EHR and FHIR Extensions | ONC’s HTI-1 rule forces seamless data-sharing by Jan 2026; health systems scrambling to expose R4/R5 APIs. | Pre-built SMART-on-FHIR launch flows, CDS Hooks, and middleware that lets you plug into Epic/Cerner without a six-figure interface-engine line item. (See how to build an EHR system) |

| Telemedicine and Virtual-Care Platforms | RPM and telehealth CPT codes 99212-5, 99457, 99458 generated $5.8B in reimbursable claims in 2024. | HIPAA-ready video SDKs, e-prescribing rails, and device-agnostic WebRTC stacks that hit 99.9% uptime—even in rural bandwidth deserts. |

| AI-Driven Clinical Decision Support | FDA’s 2025 draft guidance for “predetermined change-control plans” green-lights continuous-learning models. | Built-in audit trails, bias-monitoring dashboards, and model-version governance that keep your lawyers calm while doctors get faster diagnoses. |

| Patient Engagement and Portals | Portals tied to mobile push reduce no-shows 30% and raise 90-day adherence 22%. | Cross-platform Flutter/React Native apps, device biometrics, and HL7 appointment-sync—all without hard-coding SMS gateways. |

| Medical Billing and RCM Automation | Average claim denial now tops 11%; AI coding assistants cut resubmits in half. | FHIR-to-X12 translators, payer-rules engines, and workflow bots that surface denial root-causes in real time. (See how to create medical billing software) |

| Imaging and 3-D Visualization | Cloud PACS adoption jumped from 11% to 34% in two years. | Zero-footprint DICOM viewers, GPU-backed segmentation, and ISO 13485 pipelines that turn radiology AI into a billable service line. |

| mHealth Companion Apps | Smartphone-linked devices (CGMs, smart inhalers) add $1.9B to the IoT-for-health pie yearly. | Off-line data caching, BLE device SDKs, and FDA-SaMD compliance scaffolding that works from day one. (See healthcare app development) |

| Data Lakes and Predictive Analytics | CMS value-based-care bonuses hinge on measurable outcomes. | De-identified patient-data vaults, Snowflake/BigQuery accelerators, and ready-made dashboards that let clinicians spot deteriorating vitals before the 30-day readmit window. |

Bottom line: Whether you’re chasing patient engagement, payer compliance, or razor-thin operating margins, betting on vendors that already ship these modules trims months off your roadmap and spares you a second mortgage on DevSecOps.

For founders who’d rather focus on product-market fit than reinvent HL7 wheels, picking the right solution stack is the difference between Series B and a burn-rate bonfire.

Operational Efficiency Playbook (2025 Edition)

Digital transformation isn’t just a 🍬-cool buzzword in the healthcare sector; it’s the difference between heroic patient care and spreadsheet-driven panic.

Use this checklist to make sure your next vendor pitch lands with both IT developers and front-line healthcare professionals.

- Data-driven management systems – pull real-time health information from EHR implementation logs and surface it as actionable data analytics for clinical operations leads.

- Practice management and management software – automate prior-auth and scheduling to boost operational efficiency by double digits (check our select case studies for proof).

- Mobile app development + patient portals – keep patients engaged post-visit and reduce readmits while meeting high quality reporting standards.

- Medical imaging and computer-vision add-ons – let AI flag “can’t-miss” anomalies so radiologists spend time on major cases, not pixel hunts.

- Telemedicine platforms – widen access to rural populations and capture new service-line revenue without ballooning head-count.

- Key services custom to your industries medical niche—whether you’re specializing in oncology workflows or pediatrics triage bots.

- Web development for healthcare – modern front-ends that load in <1 s keep healthcare organizations and regulators equally happy.

Pro tip: Ask each shortlisted developer to show where these items are already listed in their roadmap. The vendors who can demo live dashboards—rather than PowerPoints—are the ones who’ll actually streamline your day-to-day operations.

Why Choose Topflight as Your Healthcare Software Development Agency

The directory above gives you plenty of software companies in healthcare to consider, but here’s why clients like Cedars-Sinai and Merck still slide our number across the table:

Mobile-First, Web-Ready Muscle

Topflight meets clinicians wherever care actually happens—native iOS / Android and responsive web portals. A few scoreboard snapshots:

- $1.14M in revenue recovered by GaleAI — an AI-powered medical-coding web app.

- 50% drop in post-op clinic visits after we shipped an AI-enabled smartphone-as-sensor MSK suite.

- 7-figure ARR in under 6 months for a D2C startup after launching a seamless medication storefront.

That blend of mobile speed plus web reach is why Walker Tracker trusted us with the rebuild that led to its acquisition by Terryberry—and why health-tech heavyweights like Medable ($91M raised) and Tula Health ($24.1M raised) keep our number on speed-dial.

Every build ships with offline-first sync, Face ID/biometric auth, and a UX physicians won’t side-eye in the hallway—no upsells required.

Compliance Baked, Not Sprinkled

Our GaleAI coding platform recovered millions in missed revenue while keeping PHI locked tighter than Fort Knox, thanks to ISO 13485-style pipelines and HITRUST-inheritable infrastructure.

EHR Integration Without a Prayer Circle

Whether it’s Epic OAuth, Athena FHIR, or Canvas GraphQL, our experts have the skills and tools that carve ≈30% off typical interface timelines. If you want receipts, skim our public Epic-integration guide or the Cerner-vs-Epic teardown.

Quick sanity check before you sign any SOW:

- Does the vendor demo a live SMART-on-FHIR launch flow?

- Can they show a SOC 2 Type II letter dated within the last 12 months?

AI That Actually Works in Production

From generative scribes to predictive care optimization, Topflight doesn’t just build “AI features”—we deliver production-grade healthcare AI systems that make money, save time, and hold up to compliance scrutiny.

- GaleAI uncovered $1.14M in undercoded claims annually, auto-generating compliant CPT codes from clinical notes in seconds—at less than 1% of the recovered revenue cost.

- Allheartz turned smartphones into AI-powered MSK sensors, guiding at-home joint exams via real-time pose detection—leading to 50% fewer post-op visits and 70% injury reduction.

- MiLife shipped a GenAI assistant that lets frontline mental health staff instantly surface key patient info from thousands of records—no more digging through EHRs or memorizing every client detail.

Under the hood, we deploy custom LLMs, secure RAG pipelines, and vector databases tailored for FHIR/HL7. Each build comes hardened with:

- PHI-safe model architecture and hosting

- Audit trails and rollback plans

- Bias monitoring and performance telemetry

- Private LLM deployments (Azure OpenAI, Claude, or local)

This isn’t AI theater—it’s enterprise-grade automation that clinicians actually use, compliance teams approve, and CFOs greenlight.

Boutique Speed, Enterprise Governance

You get a named squad from discovery to post-launch, but our QA gates and incident playbooks look eerily like what you’d see from the largest healthcare software companies—minus the 200-page change-order ritual.

If you’d rather chase product-market fit than reinvent HL7 wheels, hit the “Book Consultation” button and let’s scope an MVP that won’t implode when real PHI hits production. The top healthcare software companies move fast and color inside the compliance lines — we just do it with a bit more swagger.

Frequently Asked Questions

What are the key benefits of partnering with a healthcare software development company?

You get speed, compliance, and scalability without the HR headache. The right partner spins up HIPAA-ready teams fast, brings prebuilt FHIR modules, and slashes TCO by 25–40% compared to building in-house—all while accelerating time-to-value.

How do top healthcare software vendors ensure regulatory compliance like HIPAA and GDPR?

The best teams bake compliance into every layer: HITRUST-ready cloud infrastructure, SOC 2 Type II practices, role-based access controls, and detailed audit trails. Many also provide compliance documentation upfront to satisfy legal and security reviews from day one.

What types of custom healthcare software solutions are most in demand today?

Healthcare organizations are prioritizing solutions that boost operational efficiency and patient engagement. Top demand areas include: EHR extensions with SMART-on-FHIR, AI-powered clinical decision tools, telemedicine platforms, remote patient monitoring, medical billing and coding automation, mobile-first patient portals.

How do I choose the right medical software development company for my organization?

Look for firms with healthcare-specific portfolios, live FHIR integrations, and proven outcomes in select case studies. Bonus points if they offer fixed-scope MVP packages, AI capabilities, and strong product governance across design, dev, and DevSecOps.

What makes the biggest healthcare software companies stand out in 2025?

The leaders in this space combine vertical expertise with scalable AI and cloud infrastructure. They offer modular, interoperable tools that support digital transformation without locking you into monoliths—and they move fast without compromising compliance.