Building a payment gateway system from the ground up is an intriguing endeavor in today’s digital landscape. As a C-level executive, you need to understand the basics of how to build a payment gateway from scratch that is secure and reliable.

This blog will provide an overview of the key steps in developing a payment gateway system, including the technology and infrastructure needed, the process of setting up the system, and the security measures that must be taken. We’ll also touch upon the benefits of developing a custom platform from scratch vs. adopting and tailoring a pre-existing, white-label payment gateway.

By the end of this blog, you’ll have a better understanding of how to make a payment gateway system that meets the needs of your business.

Top Takeaways:

- Understanding the Technology: Building a payment gateway platform requires a strong understanding of the technology and infrastructure involved. This includes knowledge about the software programming languages, data encryption, and systems architecture needed to create a robust payment system.

- Security is Key: One of the paramount considerations in developing a payment gateway system is security. This involves ensuring that customer payment information is securely transmitted and stored, protecting against potential cyber threats, and conforming to regulatory standards.

- Custom vs. White-label Payment Solutions: There are benefits to both developing a custom system from the ground up and adopting a white-label gateway. Your business needs, resources, and technical capabilities should dictate the choice between the two.

Table of Contents:

- What is a Payment Gateway?

- Payment Gateways Market Overview

- Building vs. Using a White-Label Payment System

- Key Features of a Good Payment Gateway

- Legal and Compliance Requirements to Start a Payment Gateway Business

- Technical Requirements for Building a Payment Gateway

- Steps to Develop a Payment System

- Post-Launch Maintenance and Customer Service

- Best Practices for Developing, Testing, and Releasing a Payment Gateway

- How Topflight Can Help

What is a Payment Gateway?

A payment gateway is a system that enables customers to securely make payments online. It is an essential part of any e-commerce business, allowing customers to purchase using credit and debit cards or other payment methods. Payment gateway systems can be set up from scratch or integrated into existing websites or applications as a ready-made solution.

To create a payment gateway website, we must carefully consider the customer experience, security protocols, and payment options. It is critical to select gateway integrations that are reliable and secure and offer a range of payment modes. Additionally, the gateway must be integrated into the website, including setting up the checkout page and ensuring the customer’s information is encrypted and secure.

Integrating a payment gateway into an existing website or application can be complicated. It requires a deep understanding of the payment gateway system and the ability to integrate it into the existing codebase. Additionally, the gateway must be tested to ensure it is working correctly and securely.

However, building a payment system from scratch is even more complex. Let’s delve into how these systems operate to better understand how we can create such a platform.

How Do Payment Gateways Work?

Payment gateways orchestrate the process of online transactions, connecting various entities to ensure a secure and smooth payment process. Here’s a step-by-step walkthrough of what happens behind the scenes:

- Initiation: The transaction process begins when a cardholder inputs their card details into the merchant’s website or application during checkout. Once they authorize the transaction, the payment gateway receives this card information.

- Encryption: The gateway encrypts the transaction details, including card number, expiry date, and CVV. This safeguard ensures the info is securely transmitted to the merchant‘s processor.

- Authorization Request: The merchant’s processor forwards the transaction information to the card network (like Visa/MasterCard), which routes it to the issuing bank (cardholder’s bank) for authorization.

- Transaction Approval/Declination: The issuer validates the details of the card and checks if the cardholder has sufficient funds or credit. Based on this, the issuer approves or declines the transaction. The card network relays this response to the merchant’s processor.

- Confirmation: If approved, the transaction information is sent back via the payment gateway to the merchant’s website. The website then displays a confirmation message to the cardholder.

- Settlement: After completing the transaction, the merchant sends all their approved authorizations in a batch to their processor at the end of the day. The processor forwards these to the respective card networks, which in turn route them to the issuing banks. The issuer then transfers the funds to the acquirer (merchant’s bank), which finally deposits the money into the merchant’s account.

This entire process, from initiation to settlement, takes just a few seconds, making the e-commerce experience seamless and convenient for the cardholder.

Payment Gateways Market Overview

The digital payments market is on an upward trajectory, powered by the rise in e-commerce and mobile payments, along with a surge in contactless payments, thanks to the COVID-19 pandemic. Digital wallets and mobile apps like PayPal, Venmo, and Cash App are increasingly popular, facilitating secure transactions at a touch. The fintech revolution and the integration of blockchain technology into transactional systems have further bolstered the growth of this market.

Convenience, speed, and increasing digitalization of businesses are key reasons behind the trend toward digital payments. E-commerce growth and the enhanced need for secure, efficient payment transaction systems for cross-border transactions further fuels this trend. The global digital payments market is set to see a positive growth rate in the coming years, with Asia-Pacific leading the pack, followed by North America and Europe, due to the widespread adoption of digital transactions in these regions.

According to recent statistics, over two-thirds of Americans prefer to pay digitally.

The future of digital payments looks promising, with forecasts indicating a surge in transaction value to an impressive $2,041.00 billion by 2023. If this growth trajectory maintains its pace, we’re looking at an astounding annual growth rate of 14.66% between 2023 and 2027, pushing the total transaction value to a whopping $3,528.00 billion by 2027.

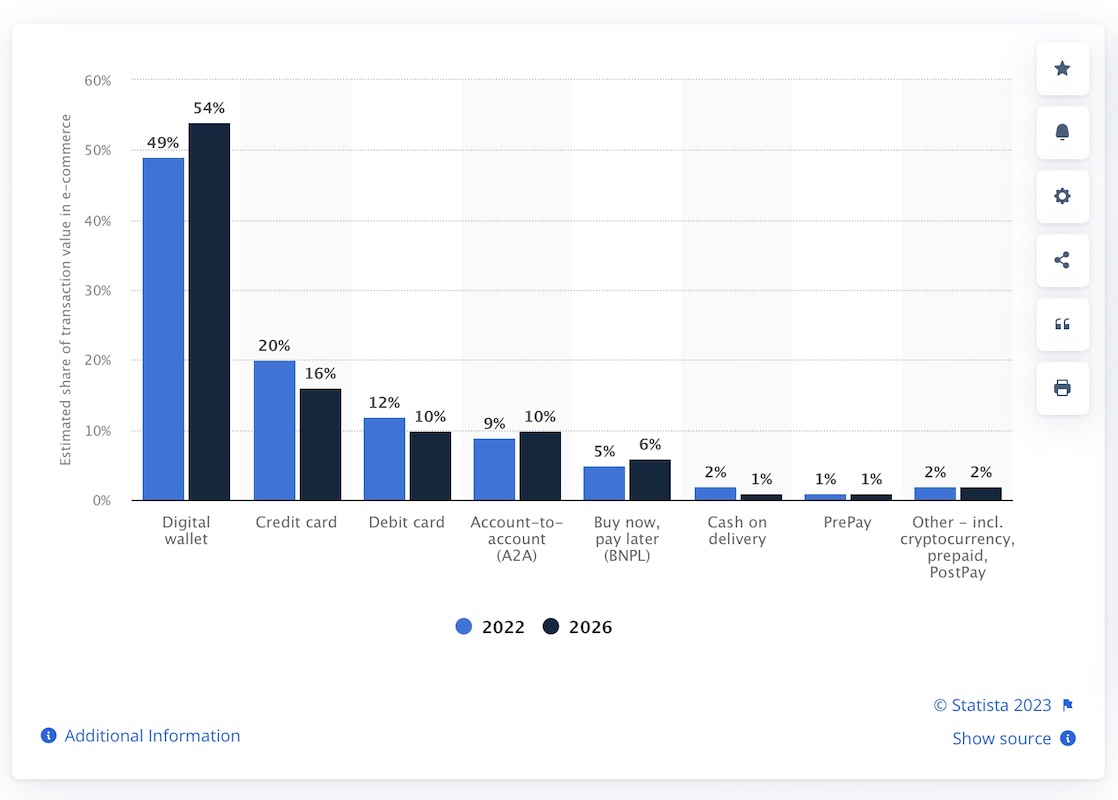

According to Statista, in 2022, we observed a remarkable trend – mobile wallets were the preferred choice for nearly half of all e-commerce payment transactions globally, securing its position as the reigning champion of online payment methods. This popularity isn’t slowing down anytime soon, with predictions showing an upswing to over 54 percent by 2026.

Not surprisingly, there’s little shortage of competition, too. When considering the development of a payment platform, you should realize that your likely competitors will be companies like Stripe, PayPal, Square, Alipay, Amazon Pay, and other behemoths. This brings us closer to the next point: should you build from scratch or integrate?

Building vs. Using a White-Label Payment System

Developing a custom payment platform from scratch is insane, considering the availability of numerous white-label and open-source solutions.

If your only goal is to accept customer payments, adding a few lines of code from a trusted payment service provider like Stripe or Authorize is simpler and more efficient. Spending a year or two on coding something less robust than Stripe is not worth the effort.

However, some businesses still opt for the custom-built payment system. So, who are these companies? Well, they can be categorized into a few groups:

- Businesses looking to become payment service providers.

- High-growth companies like Uber, with multiple lines of business and an enormous number of daily transactions (where processing and other fees amount to millions).

- Companies that have identified unique use cases, such as reimbursements for medical practices, and so on.

- Banks and existing PSPs looking to upgrade their legacy systems

When thinking about the custom-built or white-label options, it’s crucial to consider the cost and time investment of building a payment gateway system versus the ease of implementation that comes with a white-label system. Let’s start by reviewing the pros and cons of creating such a gateway from scratch.

Pros of Creating a Custom Payment Gateway

- Customization: A custom-built payment gateway is designed and developed to cater specifically to the unique needs of your business. This allows maximum flexibility and adaptability, enabling the system to change and grow as your digital payments business does.

- Brand Consistency: Having a custom-built platform allows you to maintain the look and feel of your brand throughout the transaction process, which can enhance the customer experience and build trust.

- Control Over Transactions: Owning your payment gateway gives you control over transactions, which can be beneficial for managing cash flow and reducing costs.

- Control Over User Experience: You can tailor the transaction process to be intuitive and user-friendly, creating a seamless experience that can lead to increased customer satisfaction and loyalty.

Also Read: Custom Mobile App Development Guide

Cons of Creating a Custom Payment Gateway

- Cost: Developing a custom payment gateway can be expensive. In addition to the initial development costs, there will also be ongoing costs for maintenance, updates, and meeting legal and compliance requirements.

- Time: It requires a significant investment of time to develop a custom payment gateway. Depending on the system’s complexity, it could take months or even years to build.

- Technical Knowledge: Building a payment gateway requires high technical expertise. You’ll need a skilled development team to build, implement, and maintain the system.

Pros of Deploying a White-Label Payment Platform

- Reduced Development Time and Cost: By integrating a white-label payment portal, you bypass the time and expenses associated with building an in-house solution. This includes everything from coding to testing to maintenance.

- Immediate Compliance: White-label solutions already comply with all necessary regulations and standards, such as PCI DSS, removing another significant worry.

- Reliable Security Measures: Off-the-shelf payment gateways come with in-built security measures, such as encryption and tokenization, to ensure transactions are secure. They also provide regular updates to counter emerging threats.

- Scalability: As your business grows, these platforms can scale alongside, handling the increasing volume of transactions without requiring any additional development on your part.

- Access to Additional Features: Many white-label payment platforms come with additional features like fraud detection, detailed reporting, and analytics, helping you to gain better insights into your business.

- User-Friendly Interfaces: These platforms often feature intuitive interfaces and seamless checkout experiences, reducing the potential for transaction abandonment and increasing customer satisfaction.

- Customer Support: You get access to a professional support team that can assist with any issues, saving you from the need to hire a dedicated support team for your gateway.

Cons of Deploying a White-Label Payment Platform

- Lack of Customization: While white-label platforms do offer some level of customization, it’s typically not to the same extent as a custom-built solution. Your business might need to adapt to the platform’s functionality rather than the platform adapting to your unique needs.

- Dependency: You become dependent on the white-label service provider for updates, maintenance, and any customization you require. This can be a risk if the provider goes out of business, has a service outage, or if there are disagreements between you and the provider.

- Cost of Service: While the initial price of a white-label solution is lower than a custom solution, the ongoing costs can add up. These can include transaction fees, monthly services fees, and charges for additional features or services.

- Generic User Experience: While many white-label solutions provide user-friendly interfaces, they often lack the personal touch and brand consistency that a custom-built payment gateway can offer.

- Limited Control Over Transactions: A white-label solution gives you less control over transactions. The payment service provider takes care of everything, which means you have less visibility and control over the transaction process and any issues that may arise.

- Vendor Lock-in: Often, migrating from one payment portal to another can be complex and time-consuming. This can make it difficult to switch providers if you’re unhappy with their service or if you find a better deal elsewhere.

Key Features of a Good Payment Gateway

When it comes to e-commerce in 2023, building your own online payment system or gateway is more than a trend – it’s a necessity. The ability to securely process transactions, whether one-time or recurring payments, directly impacts the success of your online business.

But what other options should you consider when setting out to create your own payment gateway that’s easy to use?

- Security: This is paramount. Your platform should adhere to high encryption standards and comply with the Payment Card Industry Data Security Standard (PCI DSS) to ensure that all transactions are secure. Incorporating two-factor authentication can also add an extra layer of data security.

- Transaction Fees: Be transparent about transaction fees. Customers appreciate knowing upfront what they’ll be charged when using your system.

- PoS Virtual Terminals: Such Point-of-Sale terminals allow merchants to process payments without a physical credit card terminal, which is particularly useful for businesses accepting payments over the phone or via mail order.

- Presence on All Platforms: Your payment gateway should work seamlessly across all platforms – desktop, mobile, or tablet. This ensures customers can make payments conveniently, regardless of their device.

- Ease of Integration with External Systems: Your payment gateway should easily integrate with external systems like the merchant’s accounting system. This not only simplifies finances but also assists in inventory management.

- Interface for Merchants to Manage Disputes: Provide a user-friendly interface that allows merchants to easily manage disputes. This can help resolve issues quickly and maintain good customer relationships.

- Direct Debit Payments: Offer direct debit payments as a convenient option for customers, allowing them to make debit card payments directly from their bank account.

- User Roles & Permissions Management: Enable easy management of user roles and permissions to maintain the security and integrity of the system.

- Transactions Management: Include detailed reporting and invoicing options to simplify business transaction management.

- Merchant’s Digital Wallet: A digital wallet feature can provide an additional layer of convenience for customers, allowing them to store their payment information securely and make transactions more quickly.

Also Read: E-Wallet App Development Guide

As you can see, to create an online payment system, we must balance convenience and security. By ensuring smooth transactions and protecting customer data, your payment gateway can significantly contribute to the success of your digital payments venture.

Legal and Compliance Requirements to Start a Payment Gateway Business

When developing a payment gateway system, it is essential to understand the legal and compliance requirements associated with the process. Here are some regulation frameworks to consider.

Top-of-mind regulation frameworks for creating a payment gateway

- PCI DSS

Payment Card Industry Data Security Standard (PCI DSS) is the primary standard for secure payment processing software and must be adhered to when developing a payment gateway. This is particularly important for payment providers offering safe and reliable payment services.

To comply with PCI DSS, payment gateways, and by extension, payment providers must meet its 12 high-level requirements, further divided into more specific sub-requirements. The main areas of focus are:

- Secure network: Payment services should install and maintain a firewall configuration to protect cardholder data. Use strong passwords and avoid using default settings.

- Cardholder data protection: Encrypt cardholder data when transmitting it over public networks. Protect stored cardholder data, a fundamental aspect of payment services.

- Vulnerability management: Payment providers should use and regularly update antivirus software. Develop and maintain secure systems and applications.

- Access control: Restrict access to cardholder data based on a business need-to-know basis. Assign unique IDs to individuals with computer access. Control physical access to cardholder data.

- Network monitoring and testing: Track and monitor all access to network resources and cardholder data. Regularly test security systems and processes as part of the comprehensive payment services.

- Information security policy: Establish, publish, maintain, and distribute a comprehensive information security policy.

These measures ensure the security and integrity of payment gateways, making them reliable choices for businesses seeking secure payment providers.

- GDPR

When it comes to payment gateways processing personal data related to bank accounts, credit cards, and debit cards of individuals in the EU, compliance with the General Data Protection Regulation (GDPR) principles and requirements is mandatory. These include:

- Lawfulness, fairness, and transparency: Clearly communicate the purpose and legal basis for data processing.

- Data minimization: Collect and process only the minimum personal data necessary.

- Accuracy: Ensure personal data is accurate and provide the right to rectify inaccurate information.

- Storage limitation: Store personal data only as long as necessary.

- Security: Implement appropriate measures to protect against unauthorized processing and accidental loss or damage.

- Accountability: Maintain records, conduct impact assessments, and appoint a data protection officer when necessary.

Payment gateways outside the EU must comply with GDPR if they process EU individuals’ personal data, facing potential fines of up to 20 million euro in case of non-compliance.

- CCPA

The California Consumer Privacy Act (CCPA) grants new rights to California residents regarding their personal information, impacting companies operating in California and beyond.

The CCPA’s provisions include:

- Transparency: Gateways must inform consumers about collected personal information, its purpose, and any third-party sharing.

- Consumer rights: Gateways respect rights such as knowing, deleting, opting out of sale, and non-discrimination.

- Opt-out mechanisms: Provide a clear “Do Not Sell My Personal Information” link on websites or apps.

- Verification: Gateways establish a process to verify consumer requests.

- Data security: Implement reasonable measures to protect personal information.

- EMV framework (Europay, Mastercard, and Visa)

EMV, a global standard for secure credit and debit card processing, plays a significant role in multi-currency transactions. This technology, which uses microprocessor chips in payment cards (card-present transactions), helps prevent fraud and enables businesses to get a payment gateway with solid security.

Payment gateways should consider the following factors when implementing EMV:

- Compliance: Ensure that the payment gateway’s hardware and software are EMV-compliant, adhering to the specifications and requirements set by the EMVCo organization.

- Ensuring long-term viability: Consider adopting contactless EMV technology, such as NFC-enabled cards and mobile wallets, to meet consumers’ evolving needs and preferences.

- Integrations: Verify that EMV technology can seamlessly integrate with the gateway’s existing systems, applications, and infrastructure.

- Education: Provide training and support to merchants and staff on handling and processing EMV card transactions correctly.

To understand the intricacies involved when you create a trading app, check out our expert insights and practical advice.

Other security measures

To ensure the highest level of security for payment processing, the following measures must be implemented when you set out to develop a payment gateway:

- Secure Sockets Layer (SSL) and Transport Layer Security (TLS)

These data encryption methods ensure that sensitive information remains secure during transmission.

- Two-Factor Authentication (2FA) or Multi-Factor Authentication (MFA)

These authentication mechanisms add an extra layer of security by requiring users to provide additional credentials, such as a verification code sent to their mobile device.

- 3-D Secure

3DS should be utilized to provide an extra layer of security for online transactions where EVM standards apply. This protocol adds an additional authentication step during checkout, reducing the risk of fraudulent transactions.

- Tokenization

The tokenization process protects PII (Personal Identifying Information) by replacing payment card data with unique identification symbols, known as tokens, which are meaningless to hackers even if intercepted.

- Peer-to-peer encryption (P2PE)

P2PE ensures that card data is encrypted from the point of entry, such as a card reader, until it reaches the processor.

By implementing these security measures during payment gateway software development, businesses can safeguard payment data and protect against potential threats. Compliance with these regulations and tech standards is essential for the success of any transaction system.

Technical Requirements for Building a Payment Gateway

Researching the various technologies available for building a payment gateway system is crucial, depending on your specific requirements. Here is an example of how you can evaluate the functional and non-functional needs of your system:

- Are we setting up a payment gateway for an e-commerce application like Ebay or for healthcare providers, etc?

- What payment options (credit cards, PayPal, bank cards, etc.) do we want to support?

- Do we plan to integrate a payment system with third-party processors (e.g., Stripe, Braintree, Square)?

- Do we want to store credit card data directly on our platform?

- Will the application be global or, for example, US-only? How many currencies should we handle?

- How many transactions do we expect per day or second, taking into account peak periods?

- Do we plan to use the system on a mobile app or website?

Related: How to build a p2p payment app

- Are there special requirements for different types of customers (businesses or consumers)? For example, do we want to offer a pay-out flow for seller payments?

- Can we expect our platform to perform reconciliation to fix any inconsistencies among internal and external services?

An Example of a Tech Stack for Building a Payment Gateway System

Here’s the list of technologies that Uber decided to rely on when the company decided to create an online payment gateway:

- Apache Kafka

- Go

- Java

- NodeJS

- Python

- Cerberus

- Grafana

- Elasticsearch

- Kabana

This is neither a complete nor definitive list of technologies that help you set up a payment gateway. Ultimately, the choice of technology depends on your specific requirements and preferences.

For example, if you’re focused on security and reliability, then Python might be a good option, as it provides robust cryptography libraries to ensure secure transactions. However, if speed is of the essence, then NodeJS might be a more suitable choice, as its asynchronous architecture is better suited for handling multiple requests quickly.

Key Points to Consider

While we often suggest utilizing off-the-shelf solutions to expedite development and launch products faster, it’s important to remember that nearly every functionality is crucial with payment gateway development. Can you depend on third parties to outsource certain features, such as AI-powered real-time anti-fraud management?

You may, however, find a white-label platform or open-source solution that aligns with your objectives and implement a payment gateway upon that. Nevertheless, even if you decide to pursue that route, always conduct a technical audit before investing in a white-label platform or deploying open-source code. This precaution ensures you won’t end up with a malfunctioning app if the code base isn’t easily updated.

Related: Fintech app development

Another significant aspect is the technical requirements imposed by third-party services you plan to integrate. For instance, if a healthcare billing system only offers integration via SOAP APIs, this restricts your technical choices and may necessitate additional development efforts on your part.

Steps to Develop a Payment System

Creating a payment gateway system requires a lot of planning and development. Please treat the following steps as a very rough outline and general directions. We also encourage you to check out our guide on how to start a fintech company.

Step 1: Obtaining Licenses and Securing Key Partnerships

To kickstart the project, the legal team will focus on obtaining the necessary licenses and establishing partnerships with acquiring banks, electronic payment firms, and financial institutions. These partners will serve as merchant account operators and processors, ensuring smooth and secure payment transactions.

Step 2: Architecting with Security in Mind

When designing the system architecture, prioritize security as a top consideration. Explore options such as leveraging a white-label solution or an open-source project that can serve as a foundation for development efforts. This will help streamline the process and ensure robust security measures are in place.

Whether you opt for a pre-existing code base or make a payment system from scratch, prioritizing security is paramount when designing the product’s architecture.

Step 3: Prototyping and Design

Prototype the payment gateway solution by creating a clickable prototype and conducting tests with different audiences, including merchants and customers. This will provide valuable insights and feedback to refine and enhance the system to meet user requirements effectively.

Step 4: Coding

During the coding phase, it’s important to remember that most of the development won’t be visible to consumers (takes place on the back-end). In payment gateway systems, a significant amount of functionality occurs behind the scenes, unlike typical consumer apps focusing on the user interface.

When planning your development efforts, it is crucial to consider the following recommendations for your tech partners. We advise focusing on a select few key areas that they should prioritize:

- Only partner with companies with demonstrated expertise in fintech app development services.

Choosing an experienced fintech development partner is crucial for the success of your payment gateway. They will navigate challenges, ensure regulatory compliance, integrate with financial institutions, and deliver a secure and efficient solution.

- Ensure proper collaboration and coordination among a large multidisciplinary team, including designers, developers, QA engineers, and DevOps specialists.

You will likely need multiple project managers, each overseeing a specific functionality segment. These project managers will orchestrate the entire effort as the linchpin between the various development teams. This comprehensive project management approach will ensure that all aspects of the system are developed in harmony, allowing for efficient and timely completion of the project.

- Adopt an agile approach to development, prioritizing testing automation. This will streamline the development process and improve efficiency.

Testing is an integral part of developing a payment gateway system. It comprises various stages, from unit testing to UAT testing to load testing to integration testing, verifying the cohesive functionality of the entire system. The prime objective is ensuring the gateway operates seamlessly, handling transactions smoothly and securely.

- Establish a robust DevOps setup with multiple environments to support seamless deployment and testing.

A well-established DevOps setup includes multiple environments, such as development, staging, and production, each serving a unique purpose in the software development lifecycle.

- Focus on building user-friendly portals for merchants, integrations, SDKs, payment APIs, and other essential components that will make your platform ubiquitous. These components are critical for a successful user experience and business integration.

Effective collaboration, agile development, robust DevOps, and user-friendly components are crucial to achieving project goals.

Also Read: Fintech App Development Guide

Step 5: Release and Maintenance Strategy

Plan for a gradual, regional release of the payment gateway solution. This approach allows for controlled rollout and ensures any issues or challenges can be addressed promptly. Ongoing maintenance and updates will be crucial to keep the system running smoothly and to incorporate enhancements based on user feedback and evolving industry standards.

Post-Launch Maintenance and Customer Service

After a successful launch, the real test begins; the payment gateway system must prove its reliability and performance over time. A robust DevOps system is fundamental to this phase, enabling the gradual release of updates and the swift resolution of issues.

Here are the key elements to focus on post-launch:

- Integrated Monitoring Services: These tools oversee the system in real-time, swiftly identifying and alerting about any issues. By catching problems early, system developers can act promptly, minimizing downtime and maintaining a smooth user experience.

- Analytics Platform Integration: By integrating with analytics platforms, you can monitor user behavior and track a multitude of metrics. This data-driven approach allows you to continuously understand and optimize the system’s performance. It informs your decision-making, from user interface improvements to refining transaction processes.

- Customer Service: Excellent customer service is crucial for maintaining the flawless operation of your payment gateway. Whether resolving user inquiries, addressing technical issues, or providing clear transaction information, a dedicated customer service team can significantly enhance the user experience.

- Ongoing Maintenance and Updates: The digital landscape constantly evolves, and your payment gateway must adapt to stay ahead. Regular updates and maintenance are necessary to incorporate new security measures, accommodate changing financial regulations, and improve system functionalities.

Remember, the goal post-launch is to sustain operations and continuously improve them, capitalizing on emerging opportunities and addressing challenges swiftly. By focusing on these areas, you can ensure your platform remains a reliable, secure, and user-friendly solution that stands the test of time.

Best Practices for Developing, Testing, and Releasing a Payment Gateway

It takes precision, strategy, and comprehensive technical acumen to set up an online payment system successfully. Here are some best practices and techniques for building and integrating complex payment systems:

Implement a microservices architecture

This approach allows each component to function independently while working cohesively within the system. Microservices architecture takes advantage of cloud computing, enabling each service to scale individually based on demand. For payment gateways, this could mean having separate services for user authentication, transaction processing, fraud detection, and more.

This independent service model allows for easier updates and maintenance—updating one service without affecting the entire system is possible. In addition, the fault isolation provided by this architecture can prevent a single failing component from bringing down the whole system. Microservices architecture, therefore, not only improves system resilience and scalability but also enhances the speed of development and deployment, which is crucial for any time-consuming project like building a payment processor.

Use asynchronous communication between microservices

In general, synchronous communication is more straightforward in design but sacrifices service autonomy. As the dependency graph grows, overall performance suffers. On the other hand, asynchronous communication prioritizes scalability and resilience, even at the expense of design simplicity and consistency.

When working on a large-scale payment system with complex business logic and multiple third-party dependencies, choosing asynchronous communication is the smarter choice.

Handle edge cases, including failed payments

To prevent double charging caused by network errors or timeouts, utilize the idempotency check. From an API perspective, idempotency ensures that clients can make repetitive calls and achieve consistent outcomes.

Make sure system security and compliance are up to date

A payment gateway must comply with the strictest fintech industry standards, such as PCI-DSS Level 1. Therefore, all components of your payment processor—whether it’s servers, databases, or APIs—must be regularly monitored and updated to ensure secure transactions.

Resolve data inconsistency

Various techniques can be employed to ensure data consistency in a payment system. Consensus algorithms like Paxos or Raft offer reliable solutions, while consensus-based distributed databases can also address the challenge.

Data inconsistency becomes a concern in a distributed environment where communication between services can fail.

Ensure data integrity

To safeguard against data loss, create regional database replicas and take regular snapshots. This proactive approach helps maintain the integrity of your valuable data and provides added peace of mind.

Deploy in-house debugging tools

Deploying advanced debugging tools empowers staff to efficiently review various aspects of a payment transaction. These tools provide access to transaction status, processing server history, PSP records, and more. By leveraging these capabilities, businesses can gain deeper insights and enhance their analysis, ensuring smoother and more reliable operations.

Set up an all-inclusive configuration for QA

The distributed nature of the payments platform (many loosely coupled moving parts) requires complex configurations for test environments. Use:

- Sandbox testing

- Testing with real cards

- Testing in production

- Data-driven rollouts

- Monitoring (custom dashboards segmented by proper metrics)

- Machine learning-based alerting for anomaly detection

How Topflight Can Help

At Topflight, we specialize in developing secure and reliable fintech solutions. Our team of dedicated experts uses cutting-edge technology to create robust solutions that meet the highest security standards and optimize the user experience for clients worldwide. We understand the complexities involved in developing a payment gateway, and our commitment to quality ensures that systems are built with precision and care.

If you plan to build a payment processor or a payment gateway system, get in touch.

Frequently Asked Questions

How secure is a payment gateway?

These gateways are highly secure as they must comply with the stringent regulations set forth by PCI-DSS Level 1. Businesses should take additional measures such as regularly monitoring and updating components, using authentication and encryption protocols, setting up regional database replicas, taking regular snapshots for data integrity, and deploying advanced debugging tools to ensure the payment gateway is secure at all times.

How can businesses ensure data consistency in a payment system?

To ensure data consistency in such a system, various techniques can be employed. Consensus algorithms like Paxos or Raft offer reliable solutions, while consensus-based distributed databases can also address the challenge. Additionally, businesses should utilize the idempotency check to prevent double charging caused by network errors or timeouts. Idempotency ensures that clients can make repetitive calls and achieve consistent outcomes.

How much does it cost to make a payment platform?

$400,000 – $500,000 to get you off the ground.

What should businesses consider when making a payment system?

Businesses should consider various aspects such as the communication model (synchronous vs. asynchronous), edge cases such as failed transactions, security and compliance regulations, data consistency, and data integrity. Additionally, they should set up an all-inclusive quality assurance (QA) configuration that includes sandbox testing with real cards, testing in production, data-driven rollouts, monitoring, and machine learning-based alerting for anomaly detection.

What benefits do I get if I make my own payment gateway?

Developing a payment gateway can offer numerous advantages, such as improved user experience, increased security, convenience in terms of payments and transactions, better scalability options, and enhanced customer trust. It also helps businesses stay ahead in the digital age by keeping up with the latest technological advances. By leveraging the power of payment gateway solutions, companies can achieve greater efficiency and streamline their operations.