It’s 2024, and the crypto community seems to concur with Bitcoin failing as peer-to-peer digital cash and Ethereum not becoming the world’s computer. Yet, trillions of dollars keep circulating in the crypto defi space. No wonder entrepreneurs rush to create a defi app and join this booming crypto economy.

In this blog, we’ll discuss all the intricacies of defi app deployment often overlooked by business owners and provide actionable tips to make your defi app a winner.

Top Takeaways:

- Before building a defi app, you will need to decide at least on the blockchain and the product’s tokenomics. These decisions will drive all further choices of technologies, protocols, etc.

- A genuinely decentralized application cannot be changed once deployed on a blockchain. Therefore, a proper migration strategy for future releases should be considered beforehand. All defi apps with admin keys risk being hacked.

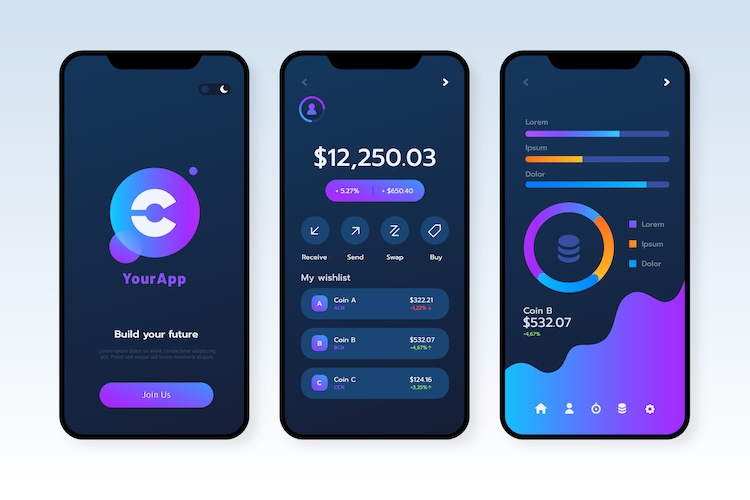

- The key to creating a top-performing defi app is using proven UX/UI tactics from the “web 2.0” niche and streamlining onboarding as much as possible.

Table of Contents:

- Sinking In: DeFi vs. Dapps

- The Future of Decentralized Finance

- Types of DeFi Apps

- Key Features of DeFi Applications

- Challenges in Building DeFi Apps

- Tech Stack for DeFi Application Development

- Steps to Develop a DeFi App

- Cost to Build a DeFi Application

- Our Experience in DeFi Application Development

Sinking In: DeFi vs. Dapps

I think we should start by clarifying the key terms to confirm we are on the same page. I know the terms dapp and defi get confused quite often.

DeFi (or defi) simply means decentralized finance and describes any blockchain software that has to do with finances. As you know, blockchains thrive on transactions.

In fact, secure, anonymous, intermediary-free, and immutable transactions are the core of any blockchain. So no wonder many blockchain applications are defi by default.

Dapps (or dApps) are decentralized applications. Obviously, a very broad term describing any blockchain application at all, including defi apps and everything in between, like a blockchain app for gathering patient consent or an EHR system on a distributed ledger.

Related: Blockchain App Development: Everything You Need to Know

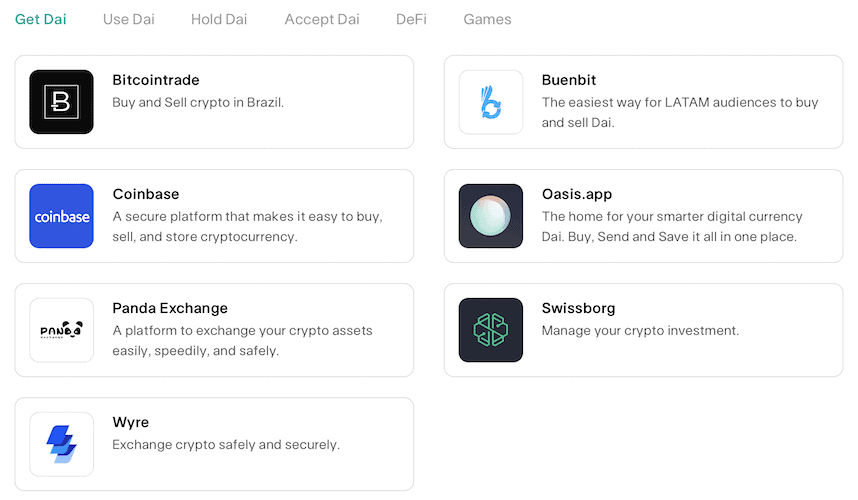

We should also mention CeFi — centralized finance — which in crypto means software like CoinBase. That’s a centralized business entity, a private company with physical headquarters and all other attributes commonly found in traditional off-chain businesses.

From the technical point of view, any CeFi application runs on proprietary servers and is fully controlled by its owners. Yes, such apps still connect to blockchains, but they don’t rely on them for their core features.

In this blog, we’ll be talking about defi application development specifically. So any decentralized software living on a blockchain dealing with cryptocurrencies and defi tokens.

Read more on how to build a dApp here.

The Future of Decentralized Finance

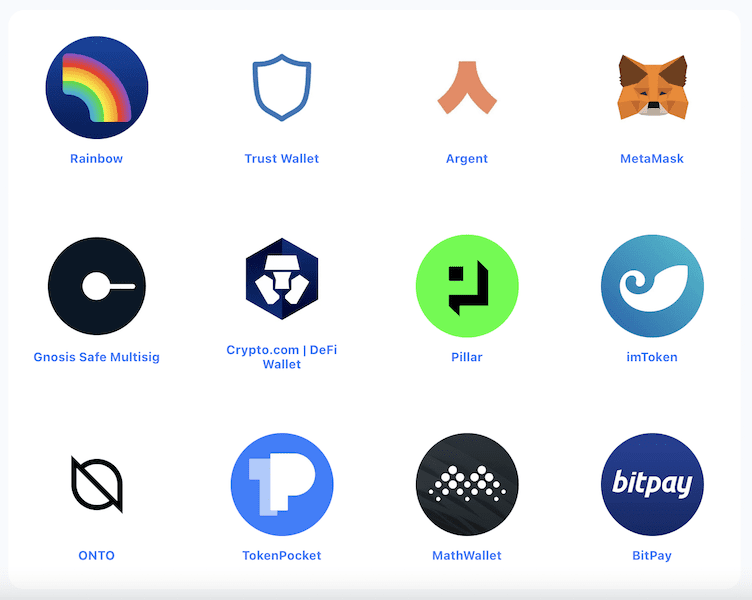

Defi is blossoming into a state-of-the-art digi-economy:

- decentralized protocols grew by 650% to $150 billion in 2021, and today in 2024 the TVL metric is well over $200 billion ( wait till it’s full-blown bull market)

- the average number of dapps across various chains has at least doubled since last year

- the number of unique active wallets interacting with dapps has grown by 3-4x in 2024 compared to 2023

- your friends start asking about crypto investing and NFTs

At the same time, crypto crime makes the space look spooky. According to blockchain analytics firm Chainalysis, defi protocols lost $2.3b in 2021 due to security issues. In 2024, though, the situation has improved: blockchain protocols lost approximately $1.9 billion due to theft and security compromises.

Another threshold to broader adoption of defi applications is UX/UI. A great deal of defi software is designed and built by developers well-versed in crypto technologies. However, for newbies, the interfaces developers come up with often feel overwhelming: customers need to parse through new notions of tokenomics and then catch up with all the UI gear.

On top of that, many newcomers end up using centralized crypto apps like centralized crypto exchanges, looking for quick gains and enjoying intuitive interfaces.

Therefore, developing a successful defi app involves designing attractive retention mechanisms and following security best practices. The latter also includes educating customers on how they can protect their crypto assets.

You can also learn about how to start a cryptocurrency exchange in our dedicated blog.

Types of DeFi Apps

Please note that even though we list them here as different types of defi apps, these features can be successfully combined within a single defi application.

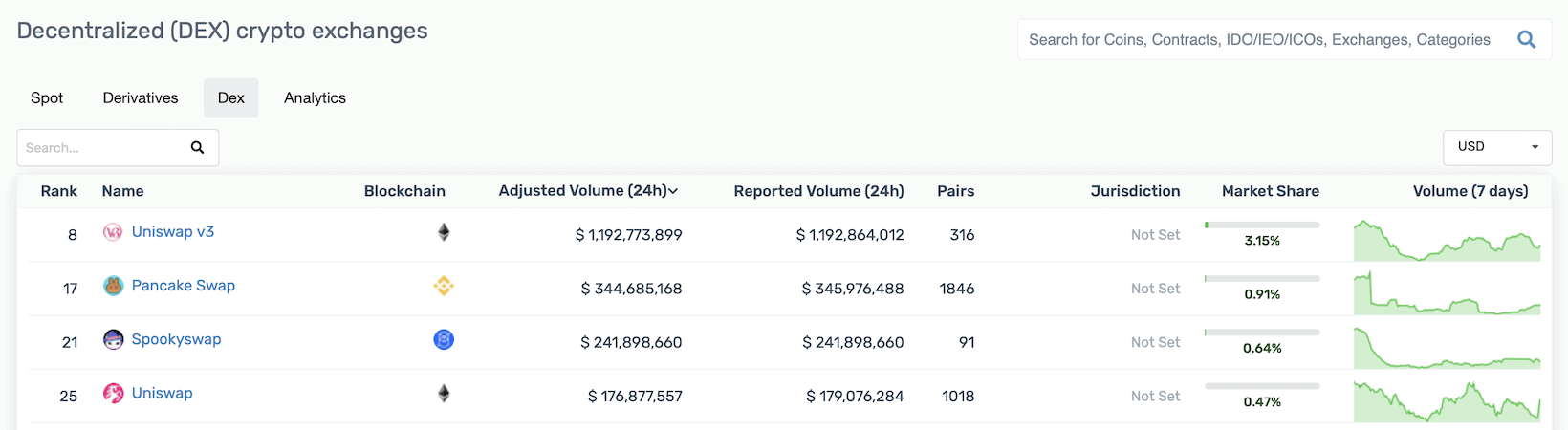

DEX

DEXs or simply swaps are by far the most popular defi applications right now. For instance, UniSwap hosts one-third of all transactions on the Ethereum blockchain at its peak times.

Apart from trading, customers can also participate in liquidity pools (aka field farming) when users can deposit and lock their crypto assets, making them available for trading.

We discuss how to develop a DeFi crypto exchange in a separate blog.

NFTs

Minting, selling, and (lately even) trading digital objects of art have become the latest crypto craze.

Related: NFT App Development: The Complete Guide

Defi banking

Defi apps connecting to algorithmic protocols generate interest higher than in traditional banks. Defi banks offer all sorts of staking and other rewards programs. (You can read up on defi staking platform development in a separate blog)

Lending/borrowing

The second most popular niche in crypto defi software, although reports indicate that there are not enough borrowers right now, with more customers looking to lend and generate income.

You may also be interested: How to Create a DeFi Lending Platform

Defi crowdfunding platforms

Decentralized crowdfunding platforms allow founders to raise funds transparently while avoiding overfunding.

DAOs

Decentralized autonomous organizations are self-governed entities with automated decision-making. Every holder of a DAO token (e.g., MakerDAO’s ERC20 tokens) gets to vote for the project development.

Asset tokenization

A simple way to represent ownership rights to different material objects on a blockchain.

Key Features of DeFi Applications

When we’re talking about building defi apps, it’s like assembling a high-performance sports car. You need the right parts, tuned to perfection, to really make it roar.

Core Functionality of Any DeFi App

Here’s the rundown on the essential components that give a defi app its horsepower:

- Decentralization: The backbone of defi, ensuring that the power remains in the users’ hands, not centralized authorities.

- Immutability and Transparency: A blockchain’s promise that what goes in, doesn’t get tampered with — everything’s out in the open.

- Smart Contract Functionality: These aren’t just contracts; they’re the self-driving cars of the blockchain world, automating the nitty-gritty.

- Interoperability: Think of this as the app’s ability to play nice with others, creating a seamless ecosystem.

- User-Controlled Data and Privacy: Giving power back to the people, with the keys to their digital kingdom firmly in their hands.

- Scalability: Because nobody likes waiting in line, not even your transactions.

- Governance: This is where the community gets to steer the ship, making the big decisions together.

Each of these features isn’t just a checkbox. They’re what make defi apps stand out from the crowd, offering a blend of security, efficiency, and user empowerment. Therefore, knowledge of these core feautures when creating a defi application is crucial.

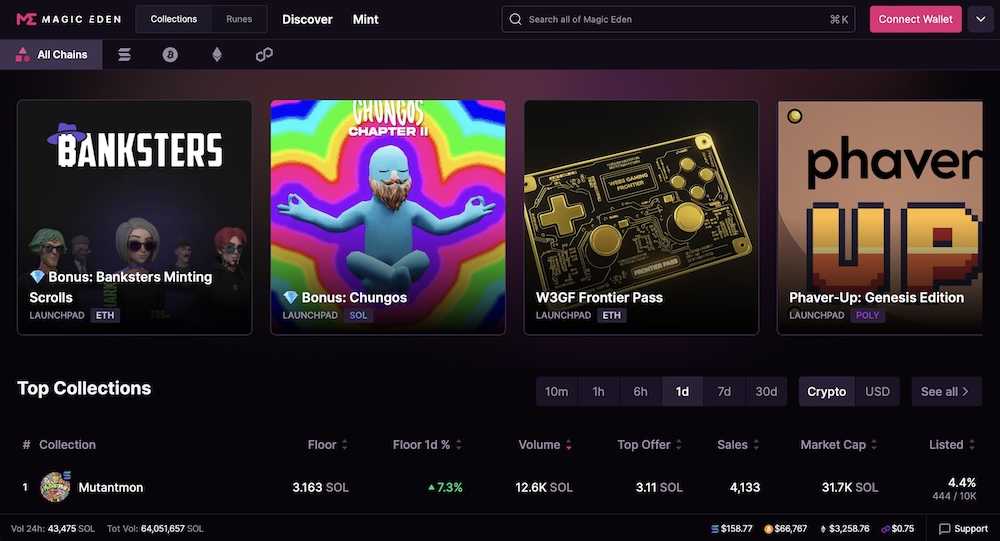

Popular NFT marketplace, Magic Eden, on Soylana and Ethereum

User-Centric Features That Make DeFi Software Shine

Now, imagine walking into a state-of-the-art financial hub where you’re greeted not by tellers, but by a suite of tools designed to make your financial adventures both profitable and enjoyable. Welcome to the user-centric features of defi apps:

Liquidity Pools

Have you ever been to a potluck where everyone’s dish contributes to a more fantastic feast? That’s the essence of liquidity pools in the defi world. By pooling their assets, users can earn transaction fees as rewards, making it a win-win for everyone involved. It’s the perfect blend of community spirit and financial incentive, laying the groundwork for the marvels of decentralized finance.

Automated Market Makers (AMM)

Imagine a stock market where algorithms replace traditional brokers, constantly balancing supply and demand to determine prices. That’s AMM for you—a revolutionary concept ensuring that trading is seamless, efficient, and always on. This is how defi turns the complexity of financial markets into something as straightforward as shopping online.

Yield Farming

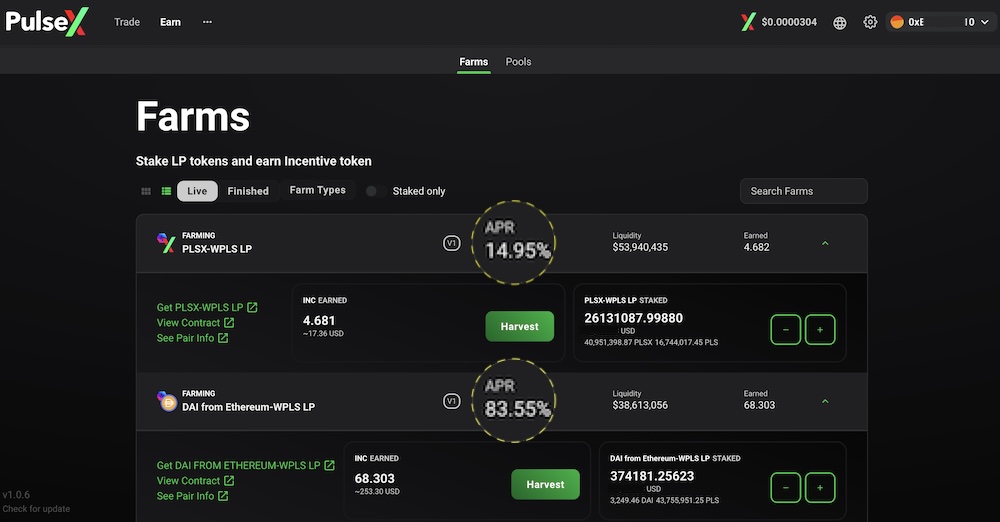

Yield farming turns the concept of passive income into an engaging activity. By staking or lending your digital assets on defi platforms, you’re essentially planting seeds in fertile ground, waiting for them to sprout rewards. It’s an innovative way to engage with your investments actively, offering a fresh perspective on earning in the crypto landscape.

I love APRs on these farms (90% – 160% most of the time)

Staking

Staking is akin to putting your money to work while you kick back and relax. By locking up certain tokens, you help secure the network or get a say in its governance, all while earning rewards. It’s a method that not only supports the underlying blockchain but also rewards you for your contribution.

Trading

With DEXs, the middleman in trading is out of the equation. Users trade directly with one another, enhancing privacy and reducing risks associated with intermediaries. This opens up a realm of trading possibilities, giving you control and freedom over your transactions like never before.

Flash Loans

Need funds for a quick arbitrage or liquidity swap? Flash loans allow you to borrow and repay within a single transaction block—no collateral needed. It’s a unique feature of defi that enables sophisticated financial maneuvers, offering opportunities for those who can move fast.

Synthetic Assets

Why limit your portfolio to assets you physically own? With synthetic assets, you can gain exposure to a wide range of investments, from commodities to currencies, all without holding the underlying assets. It’s a powerful tool for diversification, allowing investors to spread their risks and opportunities across the global market.

Privacy Features

In defi, your financial privacy is paramount. Advanced security measures ensure that while transactions are transparent and verifiable, your personal and financial data remain under wraps. This level of privacy is a significant shift from traditional finance, offering peace of mind in your dealings.

Gnosis Safe: secure defi wallet and the tech behnid multi-sig crypto wallets

Compliance and KYC/AML

As the defi sector matures, navigating regulatory requirements becomes increasingly crucial. Incorporating KYC/AML protocols helps platforms align with legal standards while striving to preserve the ethos of decentralization. It’s a delicate balance, but essential for fostering trust and longevity in the defi ecosystem.

Understanding and integrating these features effectively not only enhances the appeal of defi applications but also paves the way for innovation and growth within this dynamic field. For entrepreneurs ready to venture into defi, these insights are your toolkit for success in the decentralized finance landscape.

Challenges in Building DeFi Apps

Venturing into the world of decentralized finance is an exciting prospect for any entrepreneur. However, the path to successfully build a defi application is riddled with challenges that require careful navigation. Here, we’ll explore some of these hurdles, emphasizing not just the problems but also providing solutions to help you set up a defi application that’s both functional and impactful.

Navigating Regulatory Waters

One of the first challenges you’ll encounter is the complex regulatory environment surrounding defi. Given its decentralized nature, decentralized financial applications operate outside the realm of traditional financial intermediaries, presenting a unique set of legal considerations. It’s essential to stay abreast of the latest regulations in your target markets to ensure compliance while maintaining the decentralized ethos. Consulting with legal experts in blockchain and finance is not just advisable; it’s imperative.

The SEC telling Crypto firms to come in and talk

Ensuring Robust Security Measures

Security is paramount when you aim to build a defi application. The decentralized aspect of defi applications removes intermediaries, placing a significant emphasis on the technology itself to safeguard assets. Smart contract vulnerabilities, front-running, and other types of attacks are real threats. Implementing rigorous testing procedures, including smart contract audits and employing best practices in code development, are essential steps toward fortifying your application against malicious actors.

Achieving Scalability and Performance

The scalability trilemma continues to challenge blockchain developers, demanding a balance between decentralization, security, and scalability. High transaction fees and slow processing times can deter users from engaging with your DeFi application. Exploring Layer 2 solutions, sidechains, or alternative blockchain protocols can help overcome these hurdles, enhancing your app’s performance without compromising on its decentralized principles.

Crafting a User-Friendly Experience

Despite the revolutionary potential of DeFinance, user adoption hinges on the ease of use of the application. The complexity of blockchain technology and the novelty of defi concepts can be daunting for the uninitiated. Designing an intuitive user interface (UI) and seamless user experience (UX) is crucial to bridge the gap between sophisticated defi functionalities and end-users. Incorporate clear instructions, educational content, and straightforward navigation to encourage wider adoption.

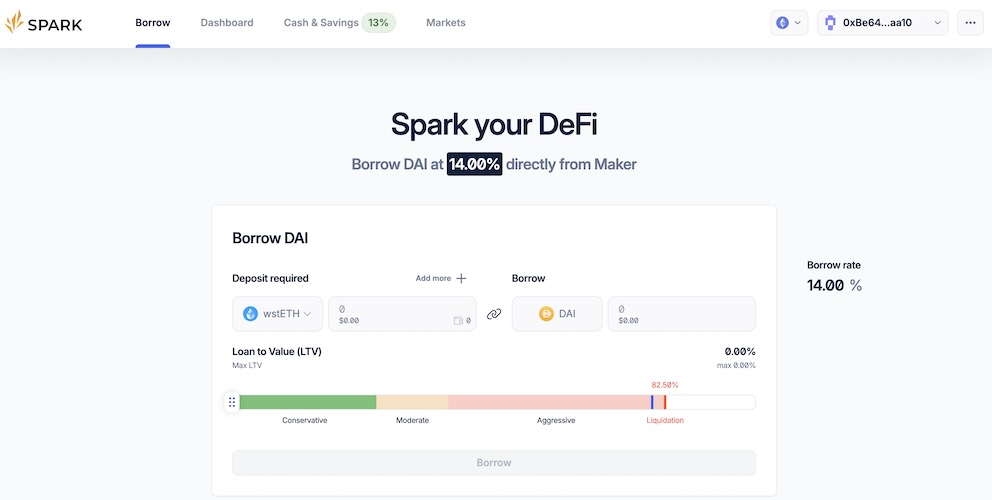

Let’s say I want to borrow crypto for the very first time – how much time will I spend to decode this UI?

Integrating with Existing Ecosystems

For defi applications to function effectively, they need to integrate with various components of the blockchain ecosystem, including crypto wallets, other defi platforms, and oracles for real-time data. This interoperability is essential for creating a cohesive user experience but can pose significant technical challenges. Prioritize building modular and flexible architectures that can adapt to evolving standards and easily connect with external services.

Establishing a Clear Value Proposition

With the burgeoning number of defi applications in the market, standing out requires more than just launching another platform. Identifying and clearly communicating your defi software’s unique value proposition is vital. What sets your application apart? Is it offering unparalleled yields, groundbreaking financial instruments, or a niche market focus? Understanding your target audience and tailoring your messaging to address their specific pain points can significantly enhance your application’s appeal.

Managing Cost Implications

Finally, setting up a defi product is not just a technical endeavor; it’s also a financial one. The costs associated with development, auditing, marketing, and ongoing maintenance can accumulate quickly. Effective cost management, possibly through strategic partnerships or seeking funding, can alleviate financial pressures and ensure sustainable growth.

Navigating the complexities of building and launching a defi application requires a blend of technical expertise, legal insight, and market understanding. At Topflight, we’ve tackled these challenges head-on, leveraging our deep domain knowledge to develop cutting-edge DeFi applications for our clients.

By addressing these issues proactively, you can not only mitigate risks but also unlock the transformative potential of decentralized finance, creating solutions that empower users and reshape the financial landscape.

Tech Stack for DeFi Application Development

When it comes to defi apps development, selecting the right tech stack is akin to setting the foundation for a skyscraper. It needs to be robust, adaptable, and capable of supporting your application’s ambitions, both now and in the future. Let’s break down the essential components of a tech stack that you need to consider to create a defi application that’s not only functional but revolutionary.

Tech Stack Depends on Your Network of Choice

The choice of blockchain network lays the groundwork for your defi software. Each blockchain has its own set of features, capabilities, and constraints, so it’s vital to choose one that aligns with your application’s objectives. Remember, different networks may require different programming skills:

- Ethereum: The most popular choice for defi applications, thanks to its vast ecosystem and developer support. Solidity is the go-to programming language for developing on Ethereum and other EVM (Ethereum Virtual Machine) compatible blockchains.

- Solana: Known for its high throughput and low transaction costs. If you’re aiming for performance at scale, Solana might be your pick. Just keep in mind, it requires knowledge of Rust programming language.

Essential Development Tools and Frameworks

Once you’ve picked a blockchain, it’s time to gear up with the right tools and frameworks to bring your defi product to life. Here are some that have become almost synonymous with blockchain development:

- Hardhat and Truffle: These are among the most used frameworks for smart contract development and testing, especially within the Ethereum community. They help developers deploy contracts, run tests, and debug code.

- Web3.js and Ethers.js: Consider these your bridges between the blockchain and your application. They allow your web application to interact with the Ethereum blockchain, managing smart contracts, making transactions, and accessing blockchain data.

Frontend and User Interface

No matter how sophisticated your backend is, user adoption hinges on the frontend experience. For crafting engaging and intuitive user interfaces, the following technologies are widely used:

- React.js: A JavaScript library for building user interfaces. It’s known for its efficiency and flexibility, making it a top choice for defi projects.

- Vue.js: Another popular JavaScript framework that’s gaining traction for its simplicity and ease of integration, perfect for startups looking to quickly bring their ideas to market.

Integrating Additional Services

Dedi solutions often require integration with external services to enhance functionality and user experience. This includes:

- Oracles: Services like Chainlink provide real-world data to smart contracts, which is critical for many defi programs such as synthetic assets or stablecoins.

- IPFS (InterPlanetary File System): For decentralized storage solutions, ensuring that your application remains truly distributed.

Security and Testing

Given the financial implications of DeFi applications, security cannot be understated. Utilizing tools like MythX for smart contract vulnerability scanning or incorporating comprehensive audit practices before launch can save much more than just money – they protect your reputation and user trust.

Continuous Learning and Adaptation

The blockchain landscape is perpetually evolving, with new standards and best practices emerging regularly. Staying informed and ready to adapt your tech stack is crucial. Participation in developer communities and ongoing education in blockchain development will keep your skills sharp and your application competitive.

As you can see, the tech stack for defi apps development is both diverse and dynamic. From choosing the right blockchain network and mastering the requisite programming languages to leveraging powerful frameworks and ensuring top-notch security, every element plays a pivotal role in the success of your defi product.

Remember, while tools and technologies form the backbone of your app, understanding the unique needs of your target audience and the specific challenges of the defi sector is what ultimately sets you apart. At Topflight, we combine this comprehensive technical toolkit with deep domain expertise to help our clients not just enter but excel in the space of decentralized finance.

Steps to Develop a DeFi App

How do we build a defi app that generates enough traction and remains financially viable in the long run? If we strip down any defi app to essentials, we’ll see software that:

- runs on a particular blockchain (or across multiple chains)

- has its business logic (tokenomics) codified in smart contracts

- provides the user interface (web/mobile/desktop applications)

- connects with crypto wallets or offers its own wallet

- might interact with off-chain data

When it comes to user-facing web or mobile apps, defi app development is pretty straightforward. We cover the required steps in various blogs at length (e.g., when talking about fintech app development services).

How to Make a DeFi Apps: 5 Steps

Here’s how to make a DeFi application in 5 (not-too-simple) steps:

- discovery phase

- design and prototyping

- development

- quality assurance (QA)

- maintenance

The outlined steps focus solely on creating sticky user experiences and adjusting the software feature set to changing market conditions. In essence, we still need to build a fintech app — only it will operate on a chain.

However, the blockchain-specific aspects of creating a defi application, such as network selection, tokenomics, and others, need a little more attention.

Please note that even though dev teams define most of the following specifics during the discovery step, the crypto space is so dynamic that additional adjustments may occur during product development.

Fortunately, the agile development methodology favors such a flexible approach, allowing for technical and UX changes mid-project, provided they guarantee better product-market fit.

If you’re interested in mobile wallet app development, check out our insightful blog post that delves into best practices and key considerations.

Step #1: What blockchain to use?

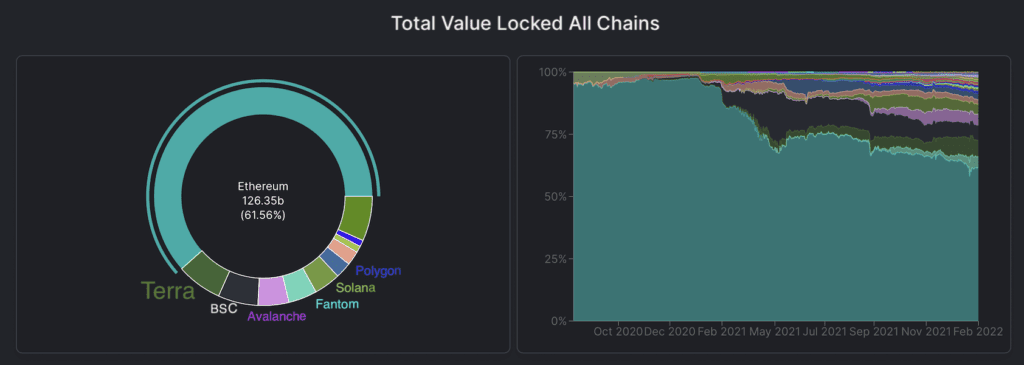

Today, the Ethereum network is hands-down the largest defi platform. The chain’s total value locked (TVL) metric shadows the rest of the competition.

How can we explain to a newbie that a simple transaction in our decentralizedapp on Ethereum may cost them $60-$120 in network fees?

Not surprisingly, defi app development companies have started to look for alternatives. As you can see from the graph, 2021 was the year when other blockchains started making a noticeable dent in Ethereum’s defi monopoly. Today (as we head to a new bull run in the midst of 2024), Solana seems like everybody’s favorite, with other protocols like BNB Chain, Tron, and Fantom making more waves and layer-2 networks following close behind (Arbitrum and Polygon, for example).

So, how do you choose a blockchain to develop a defi app?

- support for smart contract

Smart contracts are the heart and soul of any defi app because it contains all the business logic of an application. Therefore, the chain must support them. Fortunately, most new blockchains do.

- user adoption

How many users does the chain have, and what is their economic power?

- network fees and speed of transactions

Of course, we are looking for a balance of minimal costs and max speeds.

- technology stack

What programming languages are required for writing native defi applications? Is this something entirely new with few developer resources available, or can we use Solidity (smart contracts) or Go like on Ethereum? What’s the development environment like?

Read more on how to create a smart contract here.

- developed ecosystem?

Finally, the choice will depend on the versatility of the defi apps already present on the chain. Have acclaimed Ethereum titles like Aave or UniSwap already migrated to this new chain? Does the blockchain have open defi protocols and bridges to other networks?

Finding answers to these and other similar questions will help you find the most appropriate chain to start a defi app. Other chains that often pose as candidates for creating a defi application include:

- Terra ($13,2b)

- Binance Smart Chain ($11,9b)

- Avalanche ($9,1b)

- Fantom ($8,7b)

- Solana ($7,6b)

- Polygon ($4,8b)

These chains also follow Ethereum in terms of TVL metrics. Of course, the choice will also depend on the nature of your product and whether or not it will need to integrate with other chains too.

Step #2: Define tokenomics

Tokenomics is the most crucial part of any decentralized application. Of course, certain types of defi software, like portfolio managers, don’t require creating a crypto token to set up a defi app.

However, most successful decentralized financial applications introduce new tokens and different mechanics for working with them, for example:

- staking

- donating to a liquidity pool

- exchanging

In addition, you will need to decide whether the token you create will be inflationary or deflationary, how it will be distributed/awarded to users, what consensus mechanism it will support, whether users holding the token will have any voting rights, if it will be a stablecoin or not, and many many other things.

All these logistics will live in smart contracts that work as immutable servers running on a blockchain. By the way, when it comes to decentralization, there’s something we need to discuss.

How much decentralization do you want?

One of the issues with blockchain apps is they are hard to update. I mean, the user-facing mobile and web apps are fine: they still run on the cloud, and you can update them as frequently as you need. In the background, they still talk to smart contracts.

But how do we update the smart contract with all the business logic? After we deploy a defi app, its smart contract remains completely immune to any changes, just like any data on a blockchain. Making changes would mean developing a new contract, deploying it to the chain, and connecting the front end pieces to this new contract.

At the same time, there are technologies allowing for more ingenious contract updates where we can use a proxy contract that can point to a newly deployed smart contract. We can use tools like OpenZeppelin for this purpose.

One thing to remember, though, is this method introduces an entry point for bad actors because the proxy contract is managed with admin keys. If the admin keys have been compromised, a hack will likely happen.

Step #3: Integrate crypto wallets

Since every defi deals with crypto, it stands to reason that users will need a crypto wallet. The usual practice is to allow customers to connect their own wallets that they have come to trust.

On the other hand, nothing prevents you from developing your own crypto wallet and offering private keys (usually in the form of a seed phrase) to users. Why do most decentralized applications advise users to bring their own crypto wallets?

- the trust issue

- focus on pro users

- faster time to market

Related: Crypto Wallet Development: Everything You Need to Know

That said, having your own crypto wallet integrated with your defi app, especially if it offers any extra functionality besides transactions, e.g., monitoring yields, is a benefit. I suggest using tools similar to Everchain, supporting multiple tokens and coins from different blockchains.

As for integrating with existing non-custodial wallets, we can use services like WalletConnect, which greatly simplify the integration process, and require minimum user input to connect.

Step #4: Working with oracles

Sometimes a defi needs to get off-chain data for correct execution. Let’s say we’re building a defi app for travel insurance. Our smart contract will need data on canceled flights and weather in order to trigger transactions to customers eligible for insurance payouts.

This off-chain data comes from oracles, aka data feeds. Ideally, we’d need to rely on solutions like ChainLink because their oracles essentially mimic blockchain operations with independent nodes reaching consensus before submitting the results to a blockchain.

Otherwise, a centralized oracle, which can be hacked, becomes a significant threat to our defi app.

Cost to Build a DeFi Application

The cost to make a defi app may vary significantly, e.g., from $60,000 to $300,000, depending on the scope. Development of a DEX for swapping tokens will naturally require way more effort than building, say, a mobile crypto wallet or other more straightforward defi projects.

Related: App Development Costs: Breaking it Down

Our Experience in DeFi Application Development

The reality is only 1 percent of the Earth’s population takes part in the crypto revolution. I believe defi apps will be the next wave of adoption, offering intuitive user experiences like fintech apps built around traditional financial services.

One of the recent defi apps we built was Bury Finance which completely alleviates all crypto complexities from the user experience, introducing newcomers to the high yield crypto gains.

Even though the mobile app uses stablecoin-based protocols to invest customers’ funds in crypto, they still get the dollar-equivalent representation of their portfolio. We continue enhancing this product with even more powerful and promising integrations.

It’s an inspiring example of how to design a defi app that captivates customers’ attention and delivers actual value.

Here are more examples from our portfolio:

CitizenFinance. Empowering the GameFi Economy

- Challenge: Creating a cross-chain DeFi ecosystem for a metaverse game that supports user-owned tokenized assets.

- Solution: Orchestrated a suite of DeFi apps allowing players to earn, trade, stake, and lend their in-game NFT assets. This included developing a multi-chain DEX, integrating staking and lending protocols, and ensuring seamless NFT marketplace transactions.

- Outcome: A robust GameFi ecosystem where players enjoy true ownership and financial activities within the game world. Our choice of Polygon and Binance Smart Chain addressed transaction speed and cost concerns, fostering a thriving in-game economy.

Toolbox. Fostering a DIY Crypto Ecosystem

- Challenge: Building a unique crypto ecosystem tailored for the DIY community that reflects the client’s vision and passion.

- Solution: We assembled a dedicated team that developed the Toolbox Token ecosystem, designed to serve the DIY community’s specific needs. This involved creating a platform for DIY enthusiasts to engage in cryptocurrency-related activities directly aligned with Toolbox LLC’s ethos.

- Outcome: A successful launch of the Toolbox Token ecosystem, which has become a hub for the DIY community to explore and participate in the crypto space. Our shared passion with the client for the project was key to its success, demonstrating our ability to translate visionary ideas into functional realities.

Through these diverse projects, Topflight has solidified its position as a leader in DeFi app development. Our process, from rapid prototyping to agile development, allows us to adapt to the fast-paced changes in blockchain technology, ensuring our clients remain at the forefront of innovation. Whether it’s simplifying the complex world of DeFi investing, enriching the gaming experience through financial tools, or building niche community platforms, our expertise is unmatched.

Our commitment to understanding each project’s unique needs, combined with our technical prowess, makes us an ideal partner for startups looking to make a mark in the DeFi space. At Topflight, we’re not just building DeFi apps; we help you shape the future of decentralized finance.

[This blog was originally posted on 2/23/2022 but has been updated with more recent content]

Frequently Asked Questions

Is there a way to combine defi with cefi?

I believe that will be the next big wave in the defi/cefi space once institutional investors start to massively join the crypto finances. If you represent an enterprise looking to merge defi and cefi in an attempt to create a compelling solution, reach out.

How do I guarantee the most security for my defi app?

The most glaring security holes include missing event emissions, incorrect input validation, the use of an unlocked compiler version, and reliance on unaudited third-party APIs.

Can you build a defi wallet?

Yes, if you have the vision for a killer feature.

How do I monetize a decentralized application?

Even though decentralized software often implies free participation (meaning no subscriptions or gated content), you can set up fees paid to developers’ addresses. Another option is to get value from proprietary tokens tied to your application.

How long does it take to build a defi app?

4-6 months for an MVP.