Only a few realize that financial literacy is a full-time job. Even then, think about all the broke economics professors you’ve met in your life. That’s why more and more people are turning to robo investing in an attempt to preserve and grow their wealth without losing sanity.

If you’re wondering how to get a robo advisor set up or want to learn how to build a robo advisor platform, you’re in the right place. Let’s look at all components that make up robo-advisory software and walk together through all the steps while building one.

Top Takeaways:

- The gist of successful robo advisor software is portfolio management carried out by ML algorithms that continue to evolve even past the customer profiling phase.

- When building a robo advisor, you’ll find yourself working on many different pieces besides the customer-facing mobile and web applications: a back-end management portal, a portal for employers, etc.

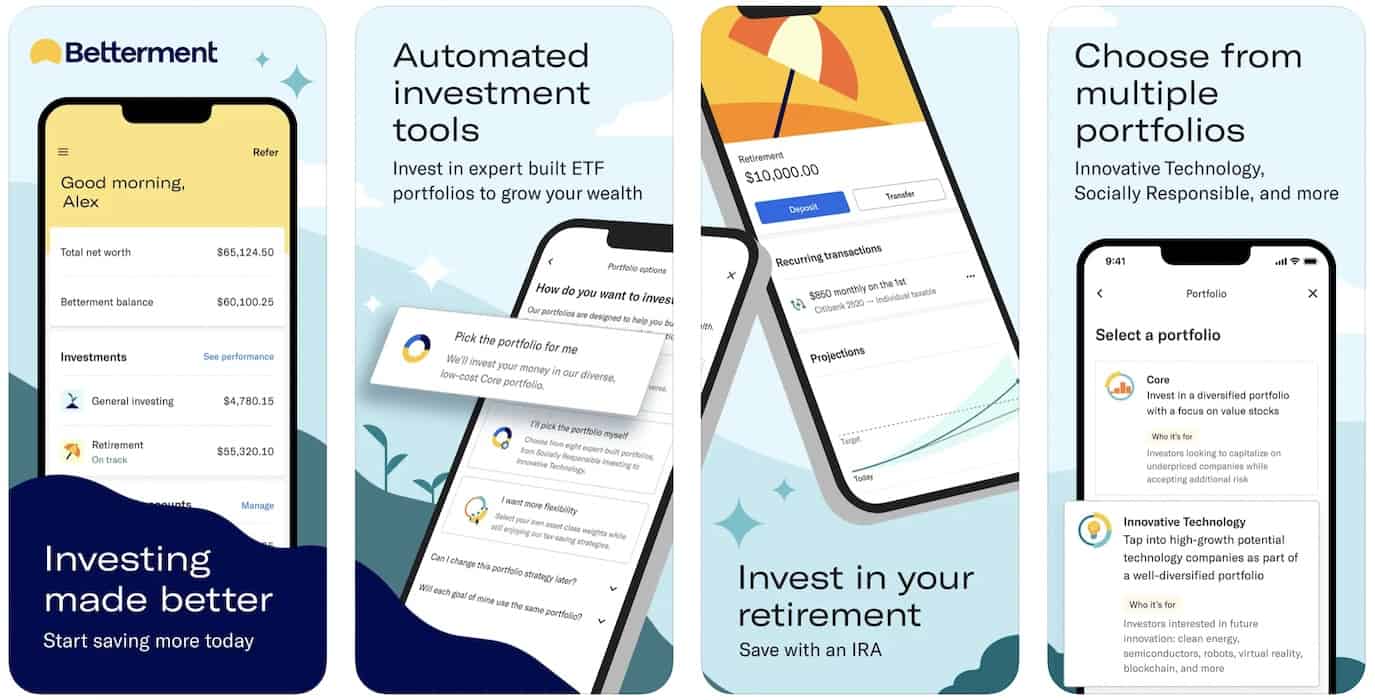

- The most recent trend with robo advisors is to include crypto investing options in a customer portfolio. One of the largest robo-advisory platforms, Betterment, will add crypto portfolios in the coming months.

Table of Contents:

- What Are Robo Advisors and How Do They Work?

- Who Should Use a Robo Advisor?

- Challenges of Building a Robo-Advisor

- Components of a Robo-Advisor

- Technologies Required for Building a Robo Advisor

- Ready-Made Tools and APIs for Making a Robo-Advising App

- How to Create a Robo Advisor in 5 Steps

- How Much Does It Cost to Make a Robo Advisor?

- How Topflight Can Help

What Are Robo Advisors and How Do They Work?

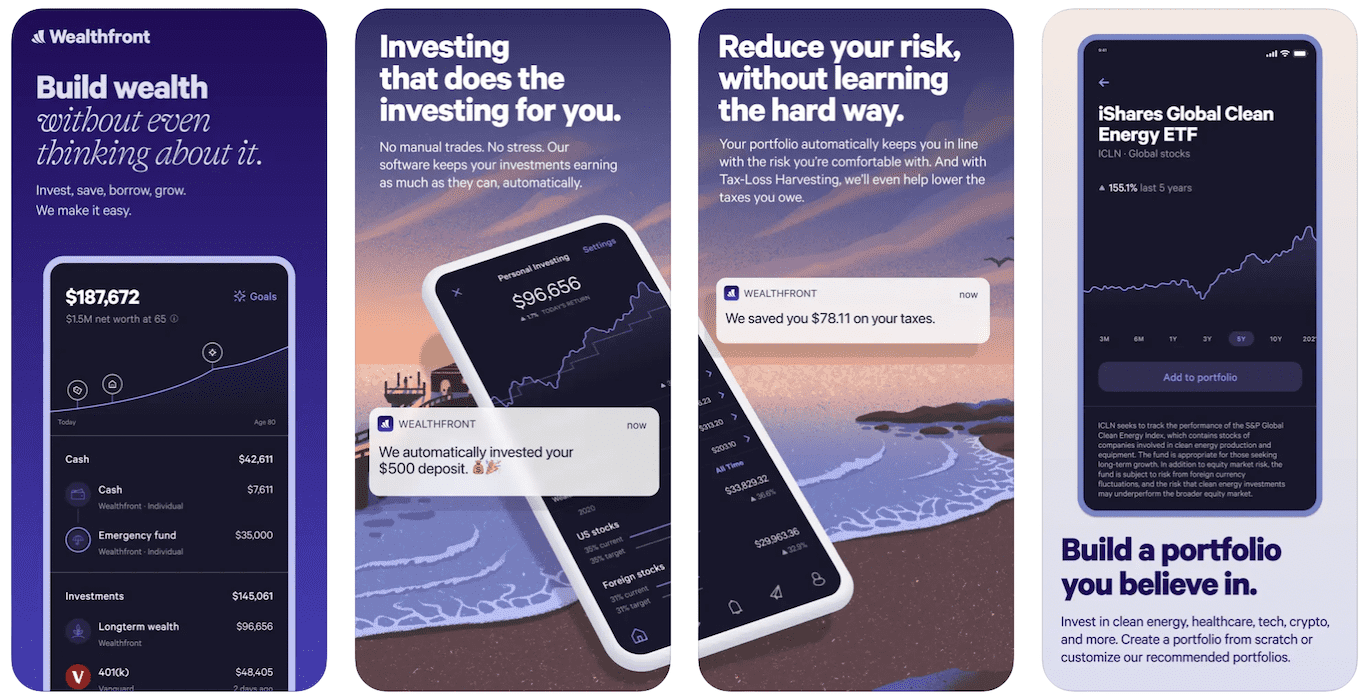

Robo advisors are smart algorithms that automatically build investment portfolios and manage them based on the customer’s financial situation, financial goals, and risk tolerance, among other things.

The beauty of these platforms is that they require zero investment knowledge from users. And so as long as the user understands that she needs an investment management plan, she can have peace of mind, completely outsourcing all investment routines to these automatic algorithms.

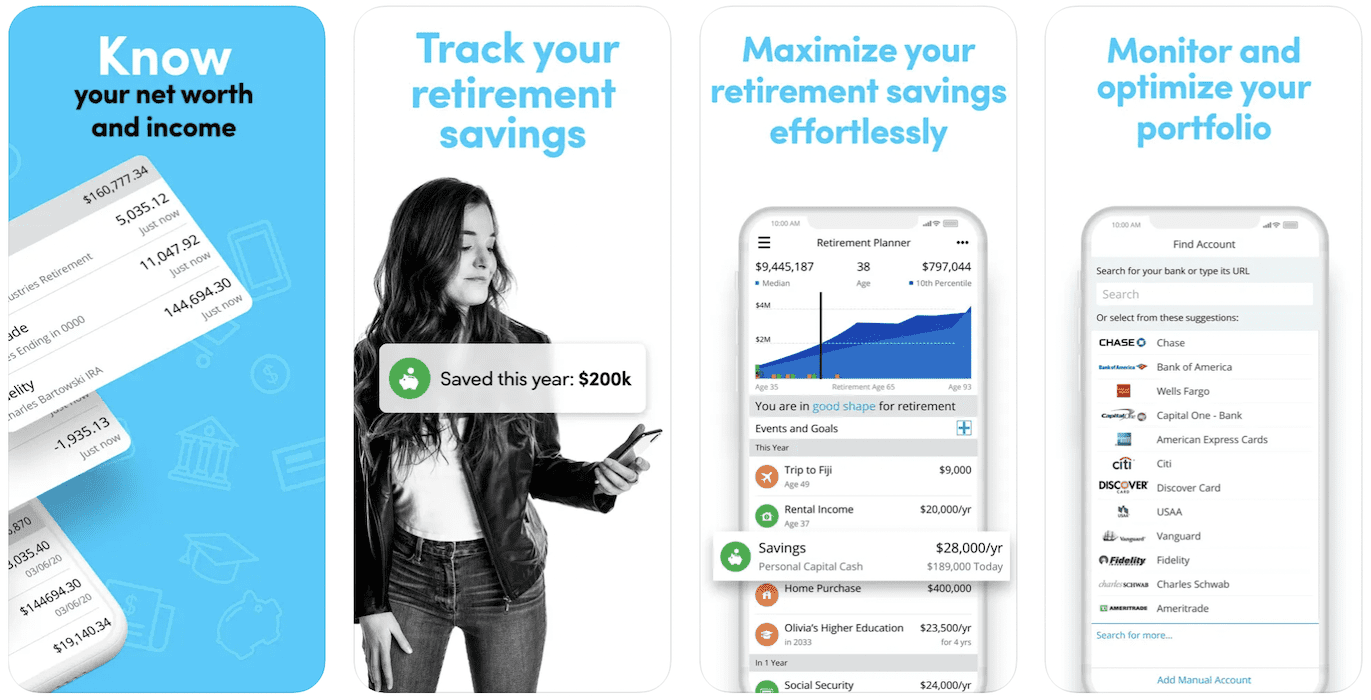

As a result, users don’t need to monitor financial markets, rebalance their portfolios and pick individual investment instruments. And since robots work 24/7, the pricing of under 1% of the annual portfolio value becomes way more tempting than fees associated with traditional human financial advising.

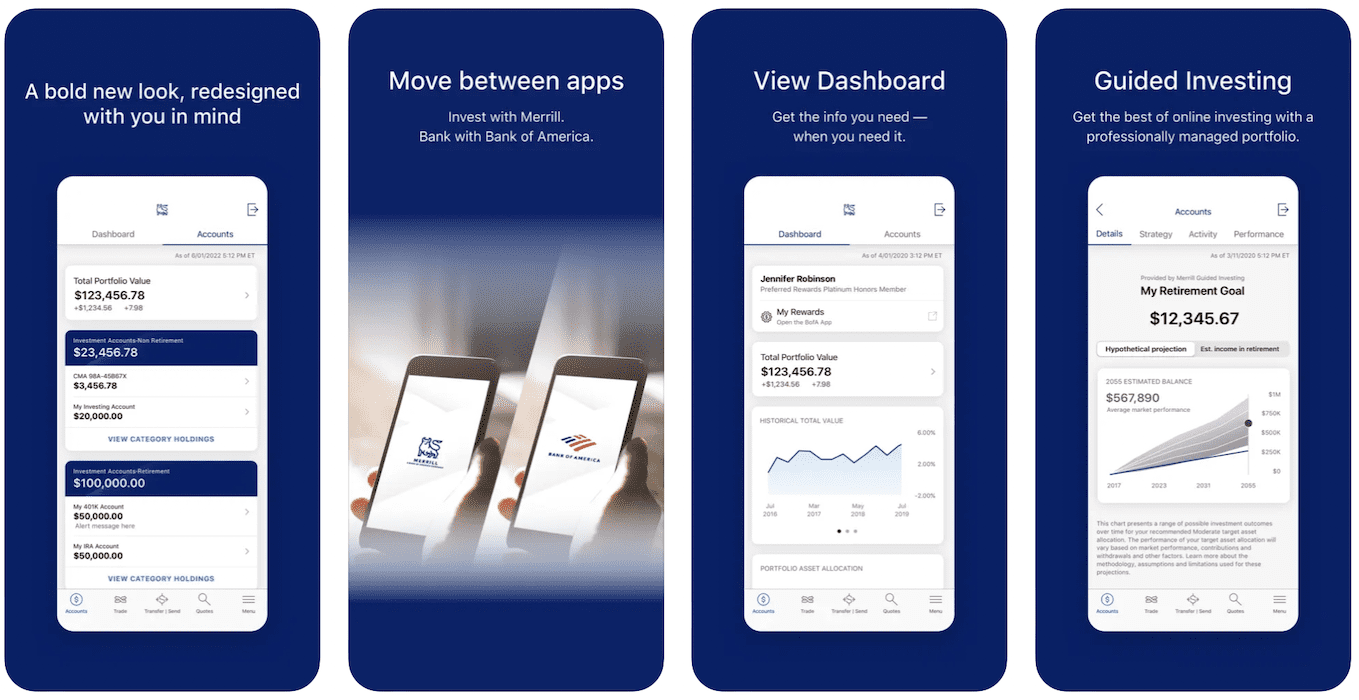

Today, most investment platforms, whether established banks or nascent fintechs, include some form of robo-advisory:

- fully automated asset allocation management

- investment advice based on the customer profile

From the technology standpoint, robo advisors are cloud platforms that can take any form on their customer-facing end. It can be:

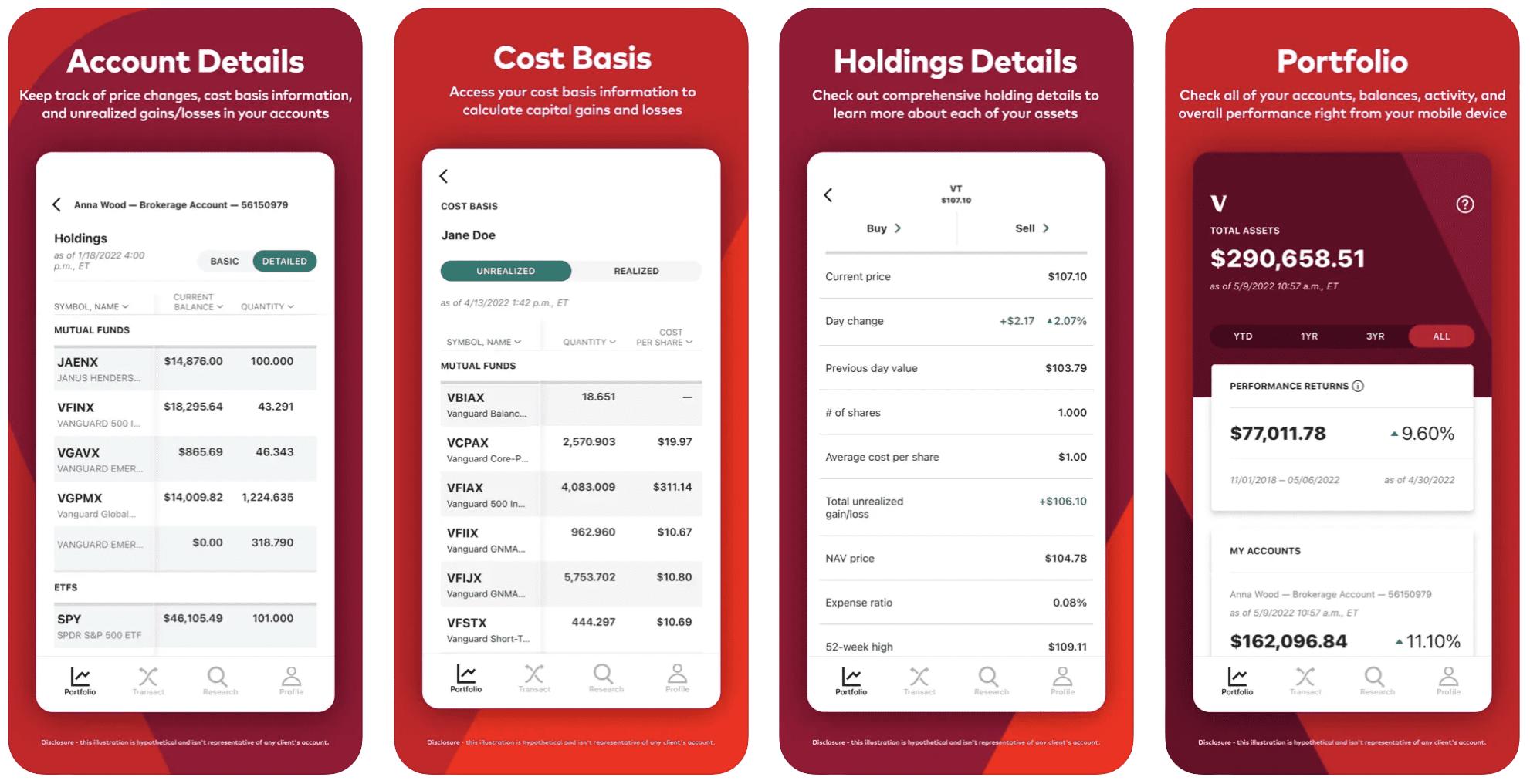

- a web dashboard

- a mobile app

- a tablet application

- a smartwatch app

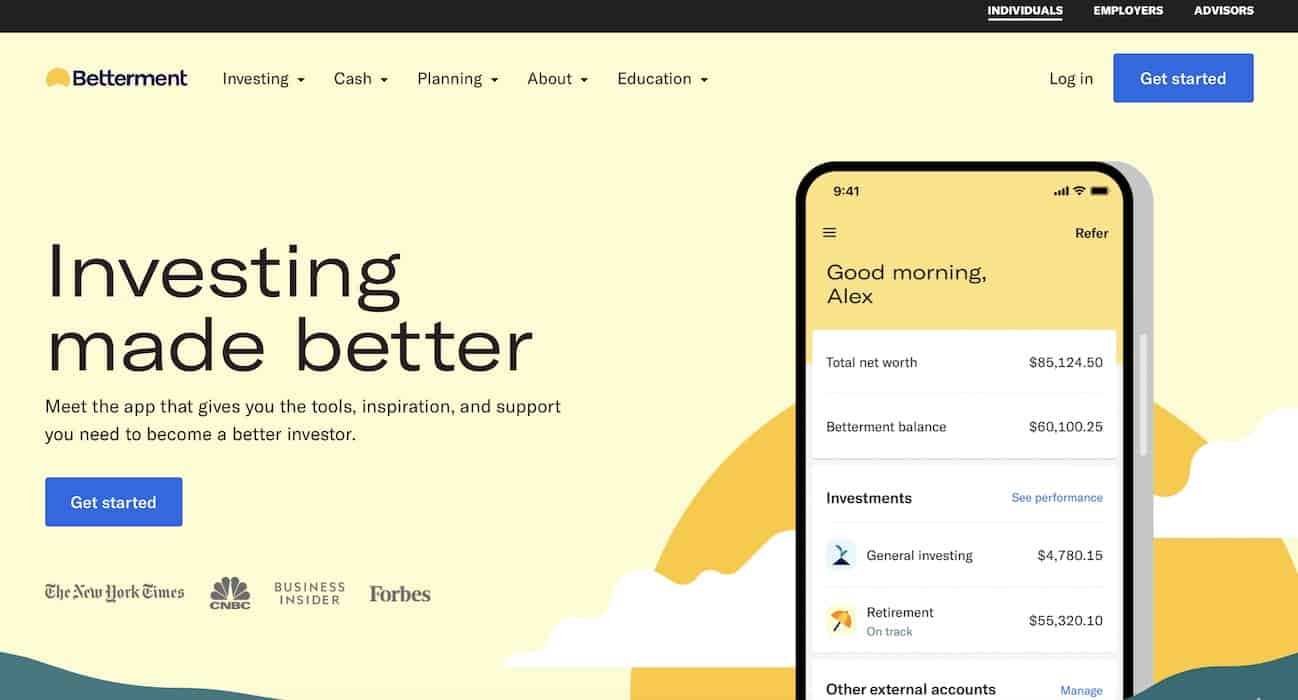

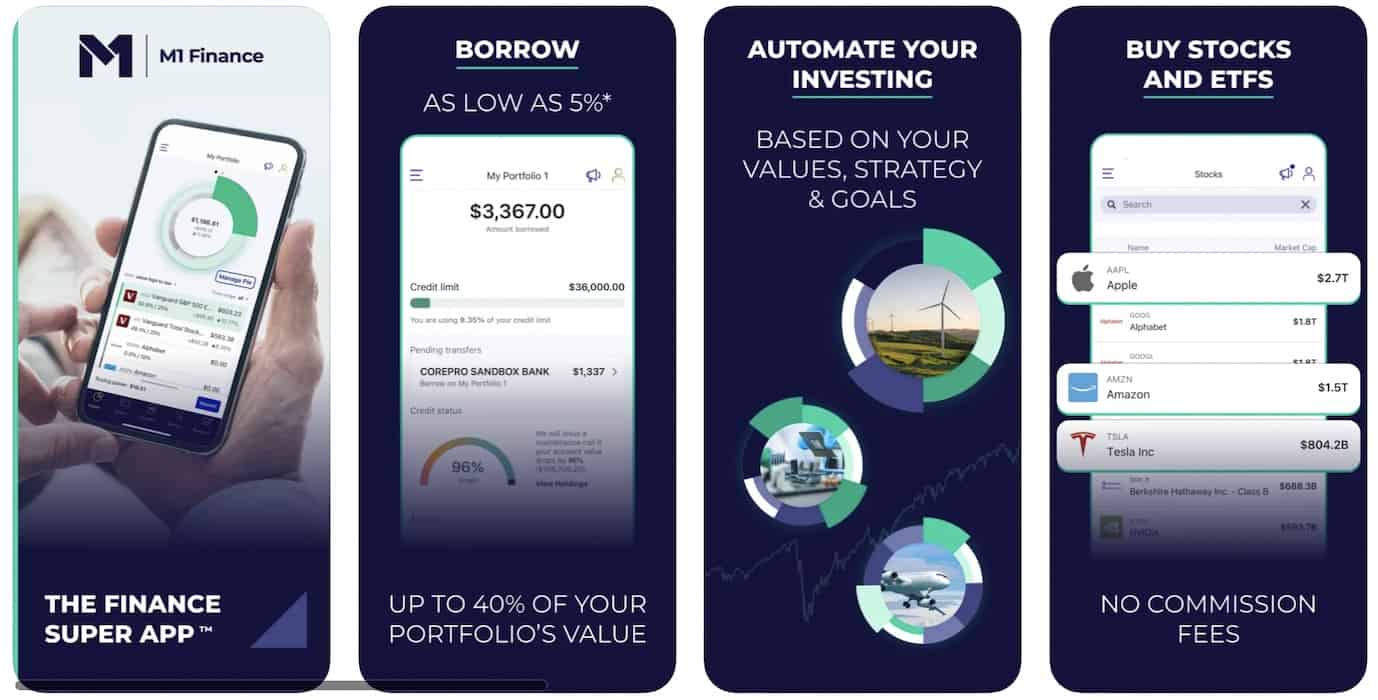

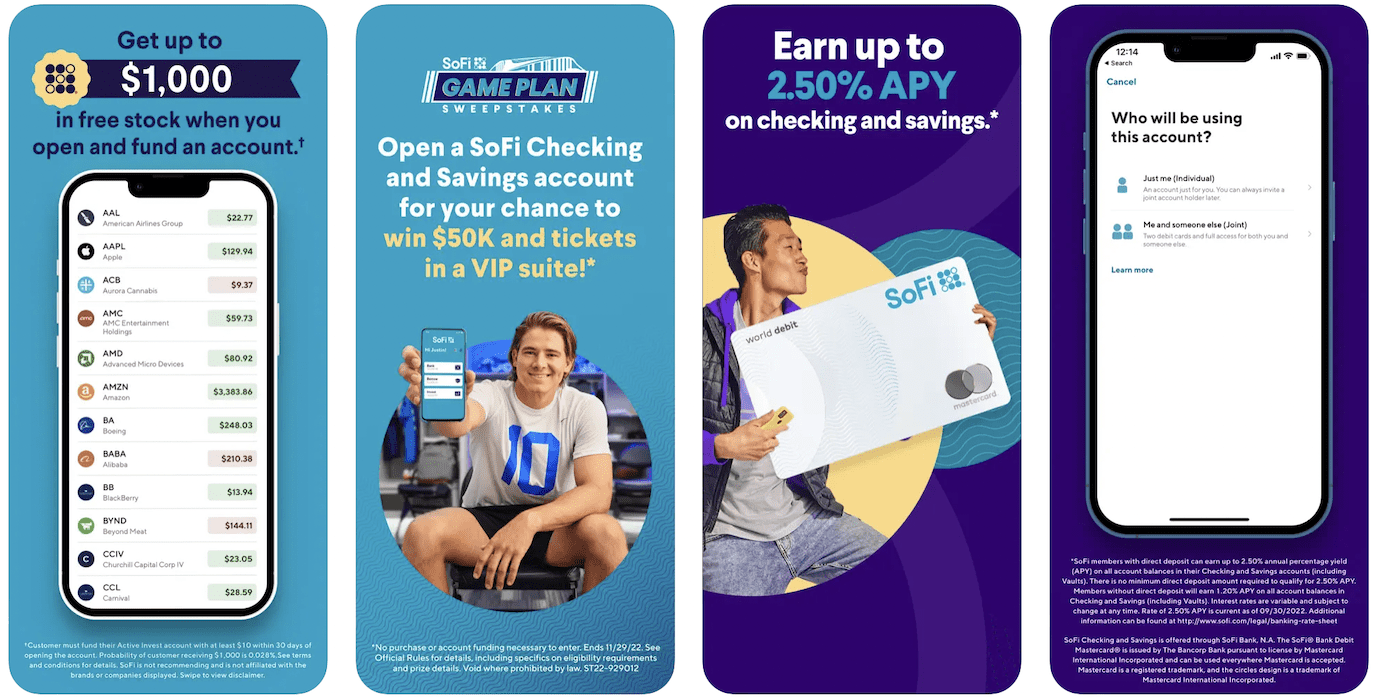

The most prominent robo advisor companies, like Betterment, M1 Finance, and Vanguard, offer their customers web and mobile apps for smartphones with investment and retirement accounts.

Related: Wearable App Development Guide

Who Should Use a Robo Advisor?

Automated investing is best suited for the average Joe, who may have as little as $100 to start with. In fact, that’s precisely why robo advisors took off. Traditionally, financial advisors have specific net-worth threshold requirements. You need at least $100,000 for a CFP/PFA to start working with you.

Also Read: Trading and Investing App Development Guide

Challenges of Building a Robo-Advisor

Unsurprisingly, the biggest challenge for a robo-advisor platform is onboarding ultra-high-net-worth customers.

Targeting high-net-worth individuals

How do you position for the rich, who are accustomed to white-glove, one-of-a-kind service? One approach is to offer a hybrid service, when AI runs operations and human advisors provide consulting.

Positioning – aren’t they all the same?

The second issue most robo-advisory software must address is differentiation. If other platforms also run on ML algorithms, how does that make you different from them? Companies tackle this problem by including additional services like insurance or real estate planning, but ultimately there needs to be a killer feature appealing to your target audience.

Also read: Machine Learning App Development Guide

Trust issue

Some people may feel insecure about allowing “robots” to manage their money. For veteran companies like Betterment, referrals have become a great tool to overcome this fear. However, the trust issue is something every fresh startup in this space needs to solve.

Complex technology

Finally, it is incredibly difficult to build your own robo advisor, regardless of whether you rely on some existing technologies or not. And if you need to integrate with your current banking infrastructure, the task is even more challenging.

Components of a Robo-Advisor

Before you make a robo advisor, let’s talk about its components. What do such platforms consist of?

Front ends for customers

On the surface, a robo-advisory solution seems more or less simple, right? It can be a single web dashboard for customers or a combination of several mobile and web apps. That’s how your customers perceive your platform — where they will onboard (KYC + profiling) and keep track of their funds.

Money management algorithms

What remains behind the scenes for customers is an ML platform with AI algorithms powering various portfolio options. Robo-advisory software may incorporate hundreds of portfolio options catering to different user profiles.

This is the engine of any robo-advisory solution, accumulating smart algorithms and the business logic for profiling customers according to their goals, risk appetite, investing capabilities, etc.

Related: How to create a personal finance app

Financial APIs

Next come financial APIs responsible for trading, portfolio balancing, and other integrations. Your robo-investing software may sync with customers’ bank accounts to automate long-term investments and offer advice on money management strategies.

Back-end system management

There also needs to be a playground for financial advisors to fine-tune and validate portfolio balancing mechanisms, create and manage investing algorithms, and track the overall financial performance of the system.

Portal for partners

Finally, employers looking to offer competitive 401(K) plans for their employees via a robo-advisory platform will need their own dashboard to track payroll, balances, earnings, etc.

Technologies Required for Building a Robo Advisor

I insist that there’s no magical list of bullet-proof technologies that you should absolutely stick with to create your own robo advisor. At the same time, since any automated investing software deals with machine learning, you’re likely to end up with Python, Java, or C++ for writing smart algorithms.

As for the front end, I’d suggest opting for React/Node for the web and React Native for the mobile app. But then you can also choose native technologies, e.g., Swift and Kotlin, or decide to go with Flutter.

Frankly speaking, it’s not even about choosing the right technologies but rather about the system’s overall architecture. To launch a robo advisor that’s scalable and secure, you’d probably have to stick with microservices, which, broadly speaking, allows your team to fine-tune each component of the system without affecting the user experience.

Another option is to go with a white-label solution. In this scenario, you only need to build customer-focused front ends.

However, if you’re integrating an off-the-shelf robo-advisory technology with an existing system, you need to double-check if the technologies are compatible and provide enough customization potential.

Your best bet is to find a reliable fintech app development services company and follow its advice.

Unleashing Fintech Innovation: Ready-Made Solutions for Building Robo Advisor Apps

Ever wondered how to accelerate the development of a robo advisor app? In today’s fast-paced fintech industry, ready-made solutions such as open-source tools, commercial off-the-shelf software, and white-label platforms are paving the way for rapid and efficient app development.

These powerful tools allow developers to integrate and customize various code blocks responsible for key features in robo advisor apps including:

- Trading APIs: Enable users to trade stocks or cryptocurrencies directly within the app.

Examples: TradingFront, Alpaca, Finnhub.

- Investment Portfolio Management: ML algorithms automate the process of managing diverse portfolios based on user profiles.

Examples: FactSet, Finbourne, Refinitiv, Alpaca.

- Customer Profiling: Understand user behavior and preferences to offer personalized financial advice and investment strategies.

- KYC Tools: Verify customer identity and ensure compliance with regulatory requirements.

Examples: GetID, Veriff, Chekk, Regula.

- Market Data Integration: Pull real-time data on crypto prices, stock prices, and more to keep users informed.

Examples: Twelve Data, YH Finance, Finage Currency Data Feed, Polygon.io.

- Bank Account Connection: Seamlessly connect to bank accounts for easy funds transfer and account management.

Examples: Plaid, ASA Financial, Volt, Bond, Fuse.

- Additional Service Integrations: Extend functionality with services like insurance, real estate planning, tax loss harvesting, or student loan management.

Some of these solutions come as white-label products that you can customize to your liking. Some are shipped as APIs or SDKs – the building blocks for spearheading development of critical parts of a robo advisor application.

Interested in exploring some of these solutions? Here are a few resources to get you started:

TradingFront

TradingFront is a software platform known for providing ready-made solutions for building robo-advisor software. It offers tools that help businesses create intuitive and efficient robo-advisors, thus enabling them to offer automated, algorithm-driven financial planning services to their customers. This platform is recognized for its flexibility and scalability, making it a popular choice among businesses in the fintech industry.

They offer both a white-label platform and APIs for enhancing robo-advisory software. Find more details on their website.

Alpaca

Alpaca is a developer-first unified platform offering an all-inclusive suite for investing, brokerage, custody, and post-trade processing. Its robust API collection enables the creation of end-to-end customizable trading software, allowing seamless onboarding and zero-commission stock trades. Alpaca’s comprehensive services are leveraged by fintech firms worldwide to deliver innovative investment solutions, making it a key player in democratizing finance.

Find out more about this golden standard of trading APIs, SDKs at their website.

Wealthica

This investment portfolio API helps you unleash the potential of your robo-trading app with consolidated financial data. Wealthica takes on the task of gathering and compiling your user’s financial data, including their holdings and transactions. This provides you with a comprehensive data toolkit, enabling you to concentrate on enhancing your app’s features rather than laboring over data collection. Once users link their account and grant access, you’re free to utilize the API to manage their data within your own app, creating a seamless and efficient user experience.

How to Create a Robo Advisor in 5 Steps

Let’s review the steps you need to take to develop a robo advisor.

-

Step #1: Discovery phase

Obviously, you want to start with identifying your ideal customer. What are their needs, and how your robo advisor will serve them? While there’s a lot to discover about your target demo and decide whether your solution will be b2c, b2b, or a combination of both, the discovery phase is also about identifying ROI goals and making technology approximations.

At Topflight, we like to kick off projects with a pre-flight workshop that serves this very purpose. We work together to identify:

- Priority features

- Business goals

- Technical architecture of the solution

You can find out more about why and how we run these workshops here.

-

Step #2: Proof of Concept

Usually, the next step is to start working on a rapid prototype, fleshing out the UX and UI of the software. However, when you create a robo advisor, you first need to develop a proof of concept. Why? Because the whole thing hinges on the machine learning algorithms’ efficiency.

-

Step #3: Design

Now, we can start working on designing the front ends. All the back-end systems need minimal to no design at all, at least in the beginning — when the management does not require fancy graphs. And as for the consumer-facing mobile and web apps, we work on the following:

- think through user flows

- create low-fidelity UI wireframes or sketches

- run these initial concepts by you

- design high-fidelity UI screens

- combine critical screens into an interactive prototype

- test the prototype with users

- adjust the UX/UI based on user feedback

- prepare the design assets for developers

By the way, developers (typically a lead developer) also have a say about the design because they are always abreast of the latest design guidelines on the mobile platforms and can gauge design feasibility.

Also Read: Design Guide to Building a Winning Product

Note the user testing part during the design phase. This helps us understand, for example, if the onboarding process is too laborious or whether the gamification techniques produce the desired effect.

-

Step #4: Development

After the proof of concept and design has been validated, it’s time for proper robo advisor development. Code gets written, automated and manual tests weed out bugs. And all this ideally happens in an agile manner, meaning we release updates every two weeks.

This agile approach is essential to delivering a product with an optimal product-market fit. Because the sooner we get real users to play with the software, the sooner we can optimize its various use cases and sometimes even UX.

It certainly helps to have a product manager and a project manager on your side during the development phase. They will keep you updated on the progress and help orchestrate the team’s efforts: front-end developers, mobile engineers, back-end coders, testers, and UX/UI engineers.

Related: How to make a trading and investment app

-

Step #5: Deployment and maintenance

Deployment and maintenance are the most exciting and tedious parts of software development at the same time. Deployment is exciting because we can finally release the robo advisor to the general public. For that to happen, programmers will switch the platform to the production environment — rigorously tested servers ready for the user inflow. They may also need to upload mobile apps to the App Store and Google Play.

As for maintenance, it will be an ongoing process involving monitoring the system performance for issues and evaluating user engagement patterns. This activity informs the next development cycle so that when the update is out, we not only add new features but also fix issues that most users might not be aware of.

How Much Does It Cost to Make a Robo Advisor?

The initial MVP (minimal viable product) will cost between $150,000 and $200,000. A lot will depend on

- whether we want to use white-label components or write the whole thing from scratch

- whether we’ll need to integrate with an existing baking infrastructure

- how many and what kind of front ends (mobile/web) we will build

- what features we want to include (e.g., adding a voice to our roboadvisor will make development more expensive)

Related: App Development Costs: The Complete Breakdown

How Topflight Can Help

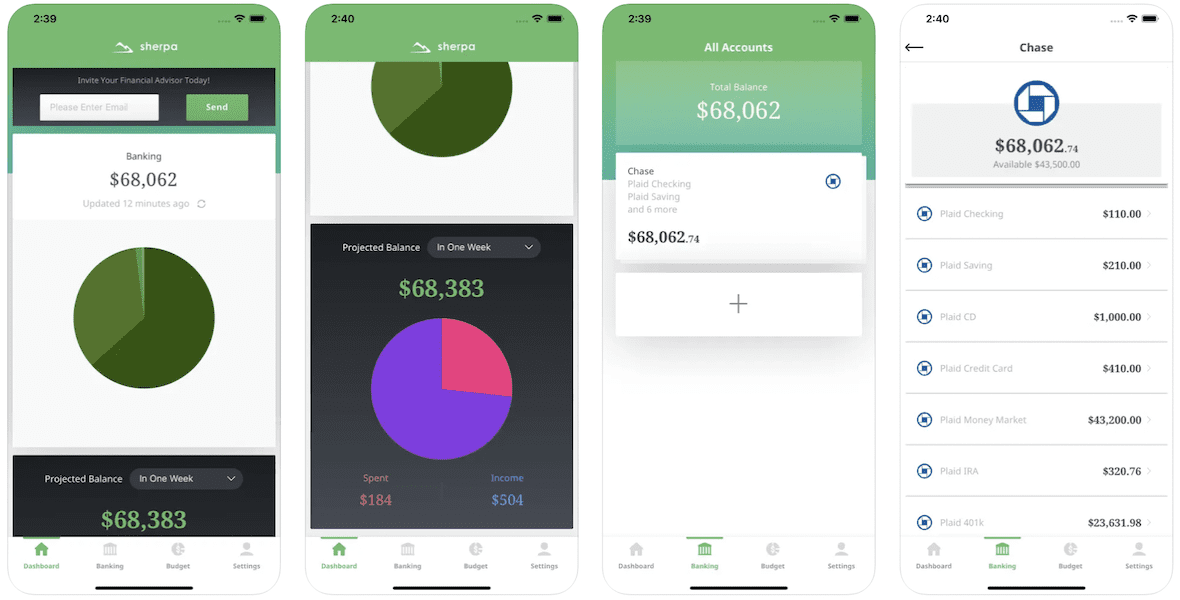

We worked on a few exciting applications in the realm of financial planning. One was for ALTO Solutions Group, a financial analysis and strategic development firm. Their Sherpa app analyses customers’ spending habits and makes appropriate budgetary projections.

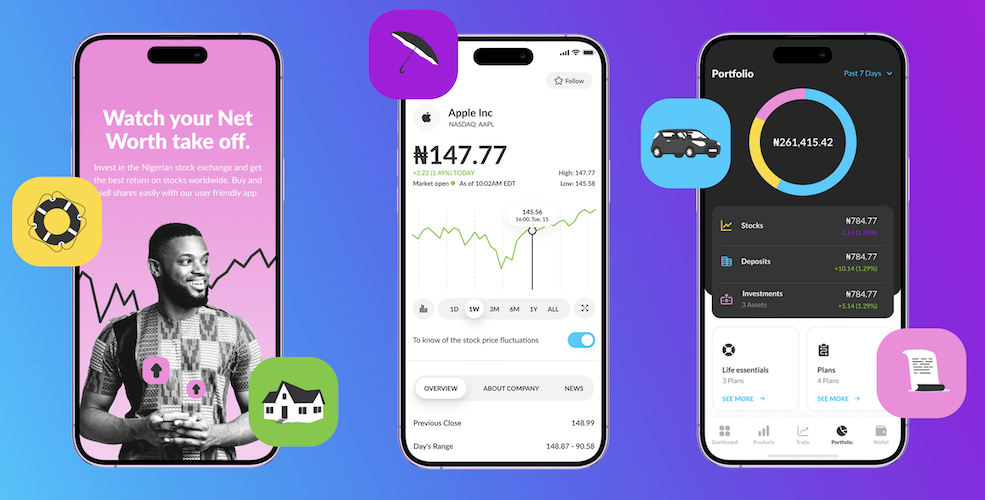

Another app we’re proud to showcase is Wealth by Coronation. This is a mobile app designed to help users manage their investment portfolios. It provides real-time access to portfolio values and transaction history, enabling users to stay informed about their investments. The app also features a user-friendly interface and secure login system to ensure a seamless and safe user experience

Our experts will be happy to talk about starting a robo advisor business. Reach out today if you have any questions.

[This blog was originally published in October 2022, and was recently updated]

Frequently Asked Questions

What's the ideal tech stack for developing a robo advisor?

There’s no such thing. Your team will help you pick the right technologies based on your unique situation. Anybody giving you a precise stack without even reviewing your idea simply has the most experience working with these technologies.

What's the required team composition to build a successful robo-advisory software?

Product manager, project manager, business analyst, full-stack developers, mobile developers, QA engineers, and designers. The know-how about portfolio building should come from your expert financial advisors — ML algos are smart only if you know how to train them.

What should I pay special attention to when creating a robo advisor?

The onboarding process — you will need a lot of data from the customer. Yet, you don’t want to make the onboarding routine too complicated. Think gamification.

How long does it take to start a robo advisor?

Somewhere between six and nine months, depending on where you are on your journey. We typically deliver a rapid prototype within a month, work on a proof of concept for around three months, and wrap it up with an MVP for another three to five months.