If COVID-19 has taught us one thing, it’s that a mobile app is no longer a luxury. In the case of insurance, not just because their customers can easily file a claim and track it, not because their support staff gets relief, and finally, not because of the convenience of mobile payments. The truth be told, the whole insurtech industry is going towards digital mobile-first experiences.

If you think it’s time to delight your customers with a mobile-tailored experience, we’ll take you through the main steps of insurance mobile app development and offer you a glimpse into the best practices.

Table of Contents:

- Why Your Company Needs to Make an Insurance App

- Types of Insurance Apps

- Digital Health Wallets

- Top 3 Successful Insurance Apps

- Trends in Insurance Application Development

- Must-Have Features in Mobile Insurance Applications

- 3 Steps to Develop an Insurance App

- How Much Does it Cost to Build an Insurance App

Why Your Company Needs to Make an Insurance App

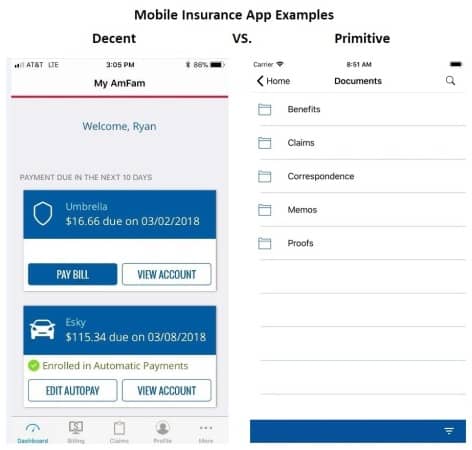

I’ve recently run into a list of the top 100 insurance companies compiled by Insurance Journal. So I wondered how many of those had a decent mobile app? What’s your best guess? Only 18 of these top 100 companies have decent-to-OKish mobile apps.

Here are a few noteworthy facts I’ve discovered about the insurance business and the insurance app development world:

- 51% of the top 100 agencies have no mobile application at all

- 30 of them have primitive mobile apps

- 5 offer apps through partnerships with companies like Figo Pet or Delta Dental

- top 6 companies have 3 or more mobile apps in their portfolios

- 3 of the top 10 agencies have no apps

What does it tell us about the insurance market? Well, for one thing — the opportunity is right there. The incumbents will eventually cave in and invest in mobile apps to chase innovative mobile-first insurance disruptors.

On the other hand, a search on the App Store reveals circa 2,500 insurance-related mobile apps. One consolation is that people probably still don’t shop for such products through mobile stores, right?

I don’t know about you, but to me, the writing is all over the wall: unless you offer your customers exceptional mobile insurance service, you may start losing them to more hip companies like Lemonade. Custom insurance mobile app development to the rescue!

These startups are going mobile-first targeting individuals and business insurance alike. They know their customers are spending more and more time on their phones, and they meet them right there, smartly applying smartphone features.

In the end, you need a mobile insurance application to:

- provide on-demand insurance services

- promote self-service among customers

- automate claims processing

- optimize support costs

Types of Insurance Apps

Before we give you the specifics of how to develop an insurance app, let’s spend a little time reviewing the types of insurance app that can be created.

When people talk about types of mobile insurance apps, they most often think about life insurance, travel insurance, yadda-yadda-yadda. While this classification does make sense to a degree, wouldn’t you agree that a full-stack agency is likely to cover all these and many other variants of insurance policies?

Should such companies build a separate solution for each type of coverage they are offering? Yes, and no. We’ll touch on that later on. For now, let’s look at the types of insurance apps from a different angle.

Apps for insured

Apps that we use to buy the insurance and file claims are the most popular group by far. We’ll discuss the app features ideal for such apps in a tad (like the ubiquitous customer service), but let’s just remember that these apps coordinate between insurers and the insured.

Apps for agents

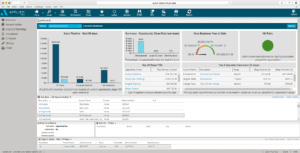

If you’ve ever seen the software that agents work with, you know it’s not meant for mobile. Online insurance app development has reigned this space for a long time.

Therefore, mobile app development for insurance brokers becomes another lucrative option.

At the same time, I can see how a mobile-optimized CRM, synced with back-end operations, can help agents close more sales. Such an app would keep all data on prospect and client policies, the history of their claims, and everything else agents need to remain fully equipped out in the wild.

Keep in mind that besides the UX/UI, mobile app development for insurance agents wouldn’t differ much from creating the same app for retail customers.

Apps for vehicles

One of the recent trends in the insurance sector is to have customers install special apps that work in tandem with sensors installed into a vehicle. That’s done to track and analyze their driving behavior and dynamically adjust the pricing of their premiums.

As more advanced sensors become available, e.g., water leakage or gunfire detectors, I expect to see more IoT-based products like auto insurance software coming to the market.

Why have a separate application like that and not have sensors send data wirelessly directly to the cloud? The car insurance app makes controlling these smart gadgets much easier and data harvesting much more reliable as it’s happening via an energy-efficient BLE connection.

P2P

When people pool their premiums without a central authority that decides about payouts in case of an accident, that’s called p2p. The Lemonade app is a brilliant example of a successful p2p application for the insured.

Related: P2P Payments App Development

Aggregators

Your mobile insurance solution may pose as an aggregator of various insurance programs and policies from a multitude of carriers. Using AI technologies, it’s possible to achieve the required level of personalization and offer users custom-tailored, best-fitting products.

If you choose this path, you’ll obviously need to take care of integrations via APIs. Either utilizing existing APIs provided by insurance companies or offer them your own tools for seamless integration. Such an aggregator insurance application is extremely lucrative for family plans when we can use personalization options to the fullest.

Digital Health Wallets

There’s yet another nascent insurance app type that deserves a special mention. Such applications aim to give users insights into their insurance usage and healthcare spendings.

To provide these details to users, an app requires data that can be retrieved from various insurance APIs, such as Ribbon, ChangeHealthcare, and combined with financial APIs like Plaid.

By bundling and analyzing such insurance coverage and financial data, health wallet apps can help users optimize their care-related expenditures:

- Prognose out-of-pocket expenses

- Show HSA and HRA balances

- Display the efficient use of benefits

If you add in the option to search for in- and out-of-network providers with pricing and user ratings plus alternative insurance plans, you’re looking at a potential disruptor app on the edge of insurtech. Such health wallet apps could not only recommend best fitting care providers and healthcare plans but also help users save more and invest their HSA funds.

Top 3 Successful Insurance Apps

Let’s review some of the most successful startups offering their services via mobile insurance apps.

Lemonade

Founded: 2015

Headquarters: NY, USA

Type of insurance: renters, condo, co-op, homeowners, life, and pet health.

Description: Lemonade is a peer-to-peer insurance company that donates unused premiums to charities. The company keeps the record for issuing policies and processing claims. The application maintains high ratings on mobile stores, which indicates a high level of customer satisfaction.

Key features:

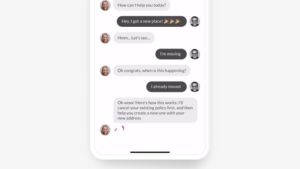

- AI-enabled chatbot

- Highly personalized policies

- Choose a charity to donate unused premiums

Metromile

Founded: 2011

Headquarters: California, USA

Type of insurance: Cars.

Description: Metromile is a pay-per-mile car insurance company that customizes each insurance policy individually to provide drivers with the most affordable options.

Key features:

- Customizable coverage

- Preview your rate with the Ride-Along feature

- Street sweeping alerts to avoid fines

Oscar

Founded: 2012

Headquarters: NY, USA

Type of insurance: health.

Description: Oscar simplifies health insurance by getting rid of copays and coinsurance. The company uses telemedicine to provide the insured with doctor consultations.

Key features:

- Book an appointment

- Prescriptions and lab results

- Telemedicine

Read more about health insurance app development in our guide.

Trends in Insurance Application Development

There are a couple of things that are cool in the insurance app development world right now. I thought you might want to know about them to level up your insurance solutions.

Telematics

The idea is to provide car owners with a GPS-enabled sensor bundled with a tracking mobile app. Based on the car owner’s real-time driving behavior, insurers can adjust their policy details for vehicle insurance plans.

Chatbots and AI/ML

A chatbot is a great companion to take users through multiple survey steps without them noticing the strain. It’s also great for surfacing any info users may be looking for inside the application and for offering other add-on products. And an AI/ML engine will help predict what the user is after.

Another application of these technologies is customer support: a chatbot or live chat.

Related: Machine Learning App Development Guide

Also Read: How to Build a Chatbot

APIs

Many agencies in the space realize that their insurance experience can extend well beyond their mobile applications if they have a simple and elegant API. Imagine an app for renting apartments or commercial property with a built-in insurance option, which comes via an API from a standalone provider. This approach has a great potential to liberate the insurance company app development process for lots and lots of incumbents in the insurance industry.

Must-Have Features in Mobile Insurance Applications

What features does your app need to lure in clients? Ideally, your mobile app for insurance allows your customers to do the same stuff they do in a desktop web portal or when visiting or calling your agency, right?

You could further motivate them to use the app (and thus run with your business optimization plan) by accrediting each customer bonus points for in-app actions vs. traditional ways of interacting with your agency. But those are nuances. Let’s talk about the core features people want in a mobile insurance app. They partially answer the question of how to create an insurance app, regardless of whether your market is auto or property insurance.

Claims management

Being able to submit a claim via an application in case of an accident is probably the biggest selling point of any mobile insurance application. Simply because there’s an easy way to submit insurance claims without waiting on the phone.

In fact, a mobile app allows the insured to provide an accurate representation of an incident faster, e.g., using video and pictures. On top of that, the solution can track their location, and they can get help more quickly. As a result, customers will enjoy faster claim processing.

Quick access to policies and ID cards

Another upside of having an insurance app is all your policies are just a tap away, and you can always easily review them on the go. Plus, no need to carry around a proof-of-insurance card for your vehicle — it’s securely stored in your smartphone.

Payments

Of course, you’d love to simplify the payment process for your customers as much as possible during general insurance app development. Therefore, a payment section where they can add their cards and set up an auto-payment option makes all the sense in the world.

Virtual agency

Since the app will serve as the main proxy for customers when they need to interact with you, think about all the products you want to market in the mobile product and how you can cross-reference them.

There should also be all regular contacts, including addresses, phone numbers, emails, etc. Actually, try to think of the app as a sort of virtual representation of your entire agency, where customers can find insurance agents on demand.

Knowledgebase

Finally, you might want to include any insurance related educational materials that help your clients become more knowledgeable and responsible policyholders. The ability to serve interactive content instead of static PDF documents will be beneficial.

Insurance agent app development

We’ve just covered the features for insurance-related apps serving the insured. Now, let’s briefly review what functionality should be implemented if you need a mobile app for your agents.

In essence, we’d like the agents to be able to serve your customers on the go. So the mobile app design would replicate a CRM interface with all the customer records.

Therefore, most of the time, it’s going to be a mobile version of the CRM deployed at your agency and an admin panel on the web for management purposes. The latter is a prerequisite of insurance enterprise app development.

However, if you’d like the agents to be able to provide quotes, this functionality needs to be implemented separately. The application should also offer features for agents to process incoming claims.

3 Steps to Develop an Insurance App

If you read our previous blogs, you already know the drill: we start with rapid prototyping and go through user verification, development and QA, and deployment — in that order.

So instead of going through all the stages of custom mobile app development again, let’s just focus on what is essential when you build a mobile insurance app. Here’s what really matters when you create an app for an insurance agency.

Step 1: Connect to backend

The chances are you already use some CRM to keep tabs on customers. Ideally, the mobile app should hook up in this same CRM and pull all customer data from there. In this case, all customer data will be synced between the app and your backend operations.

However, if you don’t already own a CRM system, it’s recommended that you pick a backend that’s easy to integrate with via APIs. That’s going to become a significant factor as you scale.

Besides storing and managing customer data, the backend will allow you to:

- schedule and send out push notifications

- set up geo zones

- sync data from other third-party services

Step 2: Use mobile devices’ capabilities to the full

First of all, accept that you will need an app for iPhone and Android smartphones. Therefore, opting for a technology that allows cross-platform development, e.g., React Native or Flutter, is a solid tech stack option.

Next, think through what smartphone features you’d want to tap into:

- Apple Wallet and Google Pay to store ID card and integrate with payments

- Siri shortcuts and Google Assistant to bring up an ID with a voice command

- GPS (geolocation) to find nearby agents, offices, etc.

- TouchID and FaceID to protect sensitive data

- Notifications to remind about upcoming payments and new deals

- Lidar for sending realistic 3D scans of objects

It also helps to think through the user experience in different situations as you continue to develop an insurance mobile application. For example, it’s likely they can be on a slow connection or off the internet entirely for some time.

Enabling offline in-app data storage effectively solves the issue with immediate access to a policy or ID in such cases. Think through the UI/UX for such edge cases thoroughly. Partnering with experienced mobile app developers and designer will be critical to achieve a butter-smooth UX.

Step 3: Integrate for scalability

During insurance mobile application development, there’s no need to reinvent the wheel when there’s a chance to integrate with a proven piece of technology. When building an insurance app, you and your app developers must consider the following integrations:

- DocuSign for enabling digital signing

- Twilio to provide out-of-the-box chat functionality

- Native video recording for capturing accidents on the camera

- Google and Apple Maps for roadside assistance

- Apple Health and Google Fit for individual offers on life/health coverage

- Twilio again, for 2-factor authentication

Of course, you shouldn’t neglect quality assurance and test all developed features before releasing the software.

If you consider these three steps when building an insurance app, it will be hard to screw up. One caveat is to choose the right app development company.

Hopefully, this info gives you enough details for your research into how to build an insurance app.

How Much Does it Cost to Build an Insurance App

A mobile insurance application without AI may cost around $90,000 — $190,000 (on the MVP level). Such an app would include many features we discussed in this blog, except for an AI assistant (aka chatbot). To get a better idea about the cost of creating a mobile insurance application at Topflight, please review our Vision to Traction system.

You may also find a wealth of info about the cost to build an app in our dedicated blog.

You can schedule a call with one of our experts for a free consultation. We’ll be happy to help you start an insurance app.

Related Articles:

Frequently Asked Questions

Is there a way to provide secure digital signing right in the mobile application without developing this feature from scratch?

Yes, you can use services like DocuSign or HelloSign.

How long does it take to build an insurance app?

Two-three months for an MVP and around five-six months for a full-fledged solution.

What additional security features are available for protecting sensitive custom data in the application?

Besides bio authentication options, you may opt for two-factor authentication.

Can you create an insurance agency app using some cross-platform development tools?

Yes, we recommend React Native to ship iOS and Android applications faster and on a leaner budget.