There’s a popular HODL maxim in the crypto world: if you hold onto your crypto assets long enough, you can’t lose. At the same time, investors can hardly appreciate crypto sitting dormant in wallets, right?

That’s one of the reasons crypto staking is becoming wildly popular. Crypto enthusiasts park their funds in staking platforms to earn passive income. If you want to build a defi staking platform, this blog is for you. We’ll discuss all the major steps of the development process and explain how that works in practice.

Top Takeaways:

- To make a defi staking platform that outperforms competitors, focus on finding a money market protocol featuring a robust tokenomics model and growing user base. Your staking app’s tokenomics will have to work with the protocol’s rules.

- Designing a defi staking platform, glean inspiration from modern neo-banking and similar fintech apps. The serious drawback of existing defi staking platforms is rudimentary user interfaces, often targeting savvy crypto users.

- Defi staking solution development involves creating smart contracts interacting with solutions like the Anchor protocol and web/mobile applications that customers use to interact with blockchains.

Table of Contents:

- Basics of Crypto Staking

- 7 Reasons to Develop a DeFi Staking Platform

- Top DeFi Staking Platforms

- DeFi Staking Platform Development Features

- How to Choose a Tech Stack for DeFi Staking Platform Development

- 4 Steps for Our DeFi Staking Platform Development Process

- DeFi Staking Platform Development Costs

- Our Experience in DeFi Staking Platform Development Services

Basics of Crypto Staking

I suggest we start by discussing why staking platforms are gaining popularity and how they work. HODL, or holding crypto long-term, is a foundational concept in crypto. Patient investors get the maximum exposure to mad gains over extended periods.

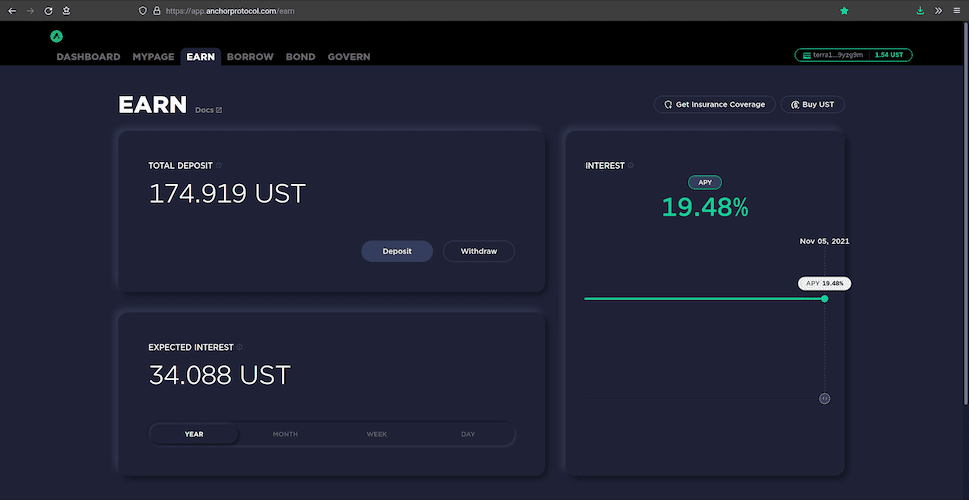

At the same time, crypto sitting in their wallets does absolutely nothing. Should investors choose to stake the crypto they are holding, it will generate passive income: up to 20% APY and sometimes even higher.

Where does the interest come from? From staking crypto on Proof-of-Stake blockchains and validating transactions, which is paid by users in network fees. Another source is lending and borrowing. Staked assets generate profits from fees paid by borrowers or traders from crypto asset liquidity pools (acting as liquidity providers).

In this rapidly growing sector, the role of a defi staking platforms cannot be overstated. These solutions are pivotal in driving growth by incorporating cutting-edge technologies and innovative features that cater to the needs of investors looking to maximize their earnings through staking. By collaborating with an experienced defi staking platform development company, entrepreneurs can leverage key factors such as security, user experience, and scalability, ensuring their platform stands out in the competitive DeFi landscape.

Related: How to Build a DeFi Lending Platform

So staking is akin to putting crypto into a savings account to earn rewards. To a certain degree, liquidity mining and yield farming also belong to staking.

Defi staking crypto app development

Please note that when we talk about defi staking platform development, we mean building apps working with decentralized protocols generating APY yields.

Building brand-new Compounds and Aaves takes years and requires significant investments in hardware and the creation of node networks besides software development. Therefore, this blog will focus on creating web and mobile apps that piggyback on existing well-recommended blockchain protocols.

7 Reasons to Develop a DeFi Staking Platform

Why would you make a defi staking platform? What are the benefits of the defi approach?

Blockchain advantages

First and foremost, a defi staking application gets all intrinsic advantages of blockchain technology:

- anonymity

Imagine an anonymous crypto bank where you don’t need to go through a KYC process to deposit funds into a savings account.

- transparency

All transactions are easily trackable on a blockchain and visible to all participants.

- censorship resistance

Customers keep complete control over their assets, and no one can freeze their “accounts.”

- no intermediaries

No intermediaries essentially mean smaller fees and full custody over crypto.

Higher returns

Second, staking apps offer higher yields than what we can get from bank deposits. However, the nominal value of APY at various protocols is designed to decline over time.

Embracing a defi staking platform development solution not only offers a gateway for participants to engage with the burgeoning crypto economy but also ensures they are ready to reap substantial returns. This approach democratizes access to wealth generation, allowing individuals to participate in financial systems previously out of reach, and prepares them for a future where digital assets play a central role.

Through-the-roof monetization

If the tokenomics of your defi staking app is well-thought-out, the solution attracts a critical mass of customers, and the primary token quickly appreciates in value. This means creators of defi staking platforms can quickly raise capital from early adopters, investing in the main platform’s token.

Related: How to Create a Crypto Token

Protection from volatility

Staking platforms are like safe parking lots where people can park their crypto gains while strategizing over their next moves.

Ever wondered how the digital finance world continues to evolve at a startling pace? If you’re looking to create a DeFi application that stands out in this rapidly changing landscape, we’ve got the insights and expertise that could turn your vision into reality.

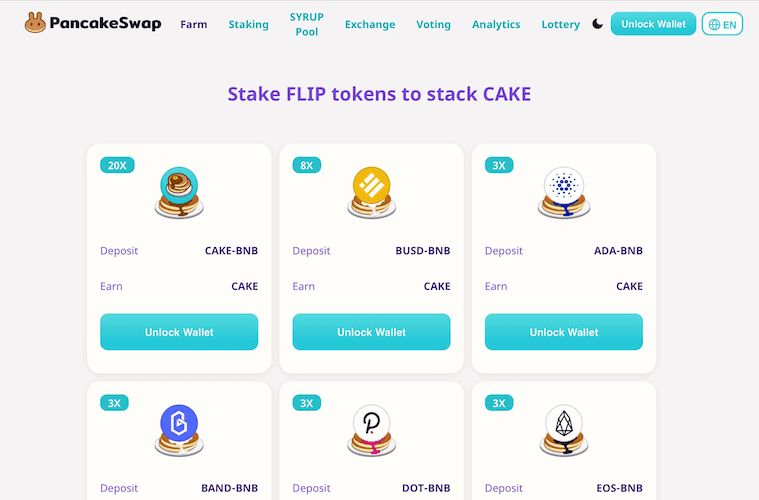

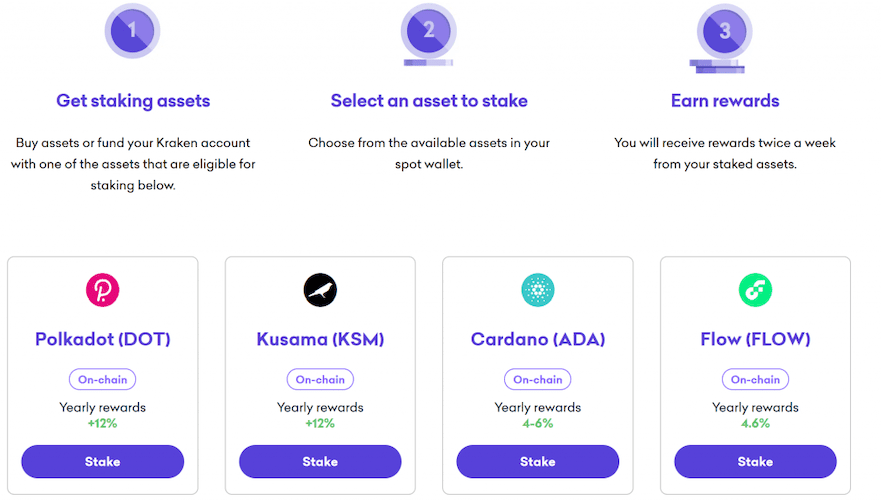

Top DeFi Staking Platforms

In the rapidly evolving world of decentralized finance, staking platforms play a pivotal role by offering users a way to earn passive income through the locking of their digital assets. The development of DeFi staking platforms has become a significant area of interest for entrepreneurs looking to tap into the lucrative DeFi market. Here, we explore some of the top DeFi staking platforms accessible in 2024, highlighting their unique features and the incentives they offer to users.

Lido on Ethereum

- Liquid Staking: Lido allows Ethereum holders to stake their ETH while retaining liquidity, issuing stETH in return, which can be used across the DeFi ecosystem.

- Decentralized and Secure: Operates in a fully decentralized manner, enhancing security and trustworthiness.

- No Minimum Staking Requirement: Users can stake any amount of ETH, making it accessible to a wide range of investors.

Ankr on Binance Smart Chain (BSC)

- Multi-Chain Accessibility: Ankr supports various blockchains, but its BSC implementation simplifies BNB staking.

Staking Rewards: Offers competitive staking rewards and distributes aBnB tokens that represent the staked BNB. - Enhanced Liquidity: Provides liquidity options through its liquid staking approach, allowing users to participate in other DeFi activities without unlocking their staked assets.

Renzo on Arbitrum

- Layer 2 Scaling: By operating on Arbitrum, Renzo leverages the layer 2 scaling solutions of Ethereum, offering faster transactions and reduced gas fees.

- Innovative Reward System: Implements unique reward structures that incentivize long-term staking and participation.

- Community Governance: Allows token holders to vote on key platform decisions, promoting a community-driven ecosystem.

Marinade Finance on Solana

- Automated Staking: Simplifies the staking process with automated features, making it easy for beginners to participate.

- Solana Ecosystem Integration: Fully integrated with Solana’s DeFi ecosystem, enhancing interoperability and utility of staked assets.

- mSOL Token: Issues mSOL as a liquid staking token, which appreciates in value as staking rewards accrue.

Stader on Polygon

- Polygon-Specific Solutions: Tailored to enhance the staking experience on the Polygon network, offering MaticX as a liquid staking token.

- Flexible Unstaking: Features a dynamic unstaking option that allows users to exit their staking positions without long waiting periods.

- DeFi Integrations: Extensive integration with other DeFi protocols on Polygon, increasing the utility and liquidity of staked assets.

The development of DeFi staking platforms like these not only provides valuable services to crypto holders but also enriches the overall DeFi ecosystem by introducing more liquidity and stability. Each platform’s approach to locking assets and creating incentives for stakers varies, offering diverse options for users depending on their risk appetite and investment strategy. As the DeFi landscape continues to mature, these platforms are likely to evolve, introducing more sophisticated features and services.

DeFi Staking Platform Development Features

What features do we need to foresee to create a defi staking platform that’s competitive?

On-ramping

Naturally, onboarding and crypto purchasing come first. That may involve going through KYC, although not necessarily if we want the solution to remain fully defi.

Gains calculator

The next thing we need is a calculator to show customers how their crypto deposits will grow on a platform. The APY may fluctuate depending on the amount of deposited crypto, lock-up period, and whether the customer holds a native platform’s token or not. In addition, we may allow customers to decide if the interest should be reinvested into deposits or paid out separately.

Reports

A decentralized staking app also needs to show the gains on graphs, along with the most critical protocol metrics, e.g., the size of a reserve fund (used for APY payouts when necessary) or historical change of the APY percentage.

Deposits/withdrawals

Customers need an easy way to stake and unstake, plus add more funds to existing deposits, which implies crypto wallet integration.

Notifications

Every time there’s a change in APY or whenever our staking app adds returns to user accounts, we need to notify customers.

Advanced options

Among advanced options we may add, there’s:

- portfolio management

- trading

- referral

- history of transactions

All these options help staking apps remove a lot of friction for customers looking for passive crypto income. Suppose they were to stake with a defi protocol directly on a blockchain. In that case, they’d have to install a crypto wallet, purchase stablecoins, trade them for the required tokens, and then make their way through puzzling interfaces.

Off-the-shelf staking

In recognizing the growing demand for streamlined DeFi solutions, the concept of a turnkey defi staking platform has emerged as a golden opportunity for businesses aiming to enter the staking space. These platforms are designed to simplify operations, allowing entrepreneurs to quickly launch their staking services without getting bogged down by the complexities of blockchain technology. By offering a comprehensive suite of features out-of-the-box, turnkey solutions empower businesses to focus on what they do best—understanding and serving their customers—while leaving the technical heavy lifting to the experts.

How to Choose a Tech Stack for DeFi Staking Platform Development

We don’t really get too much choice when considering a tech stack for defi staking app development. The main goal is to find a suitable protocol that generates enough staking rewards and has the potential for greater traction (developed blockchain ecosystem, vibrant tokenomics, low inflation rate, etc.).

Therefore, we have to stick with whatever technologies work for the blockchain and protocol of our choice, e.g., programming languages like Go and Solidity.

Moreover, when embarking on defi token staking development, it’s crucial to align your technology stack with the specific needs of token management and staking mechanisms. This includes not just picking the right blockchain protocol but also ensuring that the development tools and languages you choose are optimized for creating secure, efficient, and user-friendly staking functionalities. The right tech stack can significantly enhance the performance and reliability of your staking platform, making it more attractive to potential users.

Related: How to choose a tech stack for your application

As for front end applications developed for the web and mobile platforms, we’re free to go with various modern technologies. For example, React and Node for a web app and React Native or Flutter for mobile apps.

4 Steps for Our DeFi Staking Platform Development Process

When you set out to develop a defi staking platform, one of the critical stages you’ll encounter is the development phase. This phase is where your vision starts taking shape, transforming from concept to reality. It’s a journey that requires meticulous planning, a deep understanding of blockchain technology, and a keen eye for user experience. Working closely with a seasoned blockchain development team, you will navigate through the complexities of building a platform that is not only secure and scalable but also aligns with the unique needs of your target audience.

To quicly outline the steps:

- Step#1: Define your tokenomics strategy

- Step#2: Work on user flows and design

- Step#3: Code a staking smart contract + test

- Step#4: Deploy and maintain

You’ll need to take all the steps side by side with a blockchain development team. What should you expect on your journey to creating a successful decentralized staking software?

Step #1: Tokenomics

Tokenomics is an indispensable part of any crypto blockchain-related project. So no surprise that when you start a defi staking platform, you start with tokenomics.

Unlike most other software projects, crypto-related apps don’t need much research into the target audience. Simply because the audience is the whole world, of which only 1% uses crypto, and it splits between newbies and savvy customers (even tinier fraction of a percent).

The tokenomics of a project, on the other hand, has everything to do with the staking app’s business logic:

- What defi tokens will users stake?

- Which defi staking protocol to integrate with?

- Will there be lock-up terms?

- Which staking limits will the platform impose?

- How will the fees work?

- Will there be daily, weekly, or monthly payouts?

- Will the staking platform support compound interest?

These and many other questions need to be answered before starting defi staking solution development. Staking app developers will need to dig deeper into whether the platform will need to support its own token and how it should work.

The most straightforward approach is to piggyback any defi protocol or protocols (check defi aggregators) and take a cut on the yields they offer.

Step #2: User flows and design

The next step is designing the interface and user experience. To tell you the truth, the UX/UI side of the equation in defi apps sucks most of the time. That’s why we always recommend starting with a rapid prototype, aiming to verify the design with real platform investors before starting defi development.

This step saves much of the defi staking development budget that otherwise can be spent on developing something that doesn’t deliver and generates zero traction.

One great thing about designing a staking app’s UX/UI is that the space literally begs for innovations.

To design a defi staking platform that stands out from the competition with a user-friendly UI, take a look at leading neo-banking apps and see how you can transfer their UX into the crypto space.

Related: How to Build a Fintech App

Step #3: Development

Of course, you can’t create a defi staking solution bypassing development per se. What’s interesting about staking app development is that developers will work on two major parts:

- smart contracts

- web or mobile front ends

Each piece can be developed in parallel, so there’s no need for the mobile app development team to wait until blockchain developers are done with smart contracts.

Related: How to Make a Blockchain App

Smart contracts

Smart contracts realize the app’s tokenomics on a blockchain or blockchains if you envision integrating with multiple defi protocols. You can choose to deploy 100% decentralized smart contracts without an admin backdoor for updates or use a proxy smart contract to introduce updates once the app has been deployed.

Related: Smart Contract Development: The Ultimate Guide

For more details on how to develop a dApp using smart contracts, please refer to our previous blog.

Crypto wallets

As always, crypto wallets are the front door to any blockchain-related software. Therefore, you’ll need to foresee integrations with popular wallets like MetaMask and others. In addition, you may consider adding support for cold wallets like Ledger or Trezor.

Remember that if you create a crypto wallet unique to your platform, that will significantly simplify onboarding.

Building front ends

Developing mobile or web apps for customers staking cryptocurrency assets is not much different from creating non-blockchain software. The only peculiarity is these apps will need to connect to smart contracts deployed on a blockchain instead of APIs running on centralized servers.

Agile approach

The agile approach is critical to the success of a project when you develop a defi staking platform. First, crypto is a dynamic ecosystem with a rapidly growing number of new products. Second, many of these products, including defi protocols generating interest, remain pretty much a work in progress.

The beauty of agile is development team can remain flexible to all these changes, besides delivering on the traditional advantages of this software development method:

- transparency

- predictability

- faster time to market

- lower risks

- continuous improvement

The same principles apply to the development of customer-facing front end applications. Agile helps set up a defi staking platform so that ROI goals align with essential features and guarantee an optimal product-market fit.

Related: Agile App Development: The Ultimate Guide

Security

One may think that any software running on a blockchain is already secure, as data written to the app can’t be changed without a network consensus. At the same time, that applies only to genuinely decentralized apps that don’t have admin keys.

Remember that when you launch a defi staking platform with a built-in crypto wallet, you need to provide users with a seed phrase. Many consider this onboarding routine somewhat cumbersome. Instead, we can use a face ID scan and a special file that together act as a private key.

Testing

Running QA procedures with such hybrid solutions as defi staking apps is complicated because of the smart contracts. They are immutable and must be redeployed each time there’s a fix. Fortunately, developers can use test blockchain networks that imitate the main chain.

Related: Mobile App Testing: Best Practices, Tools, Steps and More

Step #4: Deploy and Maintain

When we deal with regular (read: non-blockchain) software, deploying and maintaining is pretty straightforward:

- upload apps to the App Store and Google Play

- switch the servers to a production, stress-tested environment

- keep releasing new versions with updates

However, when dealing with crypto products, we need to account for new versions of protocols that will work off newer smart contracts. We’ll need to reintegrate with them.

As for mobile and web apps’ features, these don’t affect the blockchain portion of the app — you can update as often as you see fit. Just set up an appropriate DevOps conveyor so that developers spend minimum time deploying new versions, for example, GitHub Actions.

Another thing to consider is adding Mixpanel or Google Analytics to the front end apps before deploying to analyze user behavior. Then, use Crashlytics to monitor app performance and identify new issues proactively. Of course, you catch most of the friction points during prototyping, but you never know which features users end up using the most, random bugs on different phone models, etc.

An agency with solid expertise in fintech application development services will suggest the same or similar integrations, critical to your app’s success.

<h2>

DeFi Staking Platform Development Costs

The cost of developing a defi staking app starts at $110,000. This includes creating a rapid prototype and MVP development of a cross-platform mobile app and the blockchain “server-side.”

Related: App Development Costs: Breaking it down

Our Experience in DeFi Staking Platform Development Services

Topflight has developed the MVP of a crypto staking app called Bury, which introduces the power of decentralized finance to an average Joe.

The premise is to allow newcomers to easily invest in stablecoins via an iPhone mobile app that delivers an impressive return on investment without dealing with any crypto complexities.

The software works as a bank savings account, showing users their gains and the balance history in dollars, among a few other things. If you want more details, please check out the case study or contact our experts to discuss your idea of a crypto staking app where customers can earn interest.

With the successful launch of Bury, we’ve paved the way for you dreaming of launching your own defi staking platform. This journey has equipped us with invaluable insights into the intricacies of DeFi staking app development, from conceptualization to execution. We understand the hurdles you might face, including regulatory compliance, technology selection, and creating a user-friendly experience that appeals to both seasoned crypto enthusiasts and newcomers alike. Our expertise is not just in building the platform but also in guiding our clients through the maze of decisions that lead to a successful launch.

[This blog was originally published in April 2022 and has been recently updated]

Frequently Asked Questions

What deFi protocols can you recommend?

The Anchor protocol on the Terra blockchain has been getting a lot of eyeballs lately. Other well-established protocols include Aave, Compound, and Yearn.

What is the preferred tech stack for creating a mobile staking app?

Native and cross-platform development frameworks still work. Either go with Kotlin/Swift for Android/iOS or React Native/Flutter.

Why does tokenomics go before design for staking apps during development?

While both will work together, tokenomics will still be the core for generating any traction with users.

Can I allow my customers to stake Bitcoin and other tokens not usually found on decentralized platforms?

You can only if you create a centralized staking app. Most CEXs allow staking BTC and many other coins/tokens not supported by defi solutions.

How long does it take to create a defi staking platform?

Between 6-8 months to launch a rough-and-ready MVP.