What are the top three things you need to start a healthcare startup? Based on my observations of founders working with Topflight Apps, I’d say passion, experience/connections in the healthcare space, and a little luck.

Then why do 90% of startups fail? Do their founders lack these prerequisites? Probably not. I think the reason is the top-3 approach is too simplistic. You’d probably agree that there’s a whole conglomerate of conditions and requirements for a medical startup to succeed. So why don’t we take a closer look at how to start a health startup?

Top Takeaways:

- No one but you knows how to build a thriving healthcare startup. If you allow a word of advice, always start with prototyping, build an MVP with a single key feature, and launch it as early as possible to gather feedback.

- There is no need to reinvent the wheel. Even if you want to build something as robust as a telehealth app, we have tech partnerships to drastically improve time to market by using off-the-shelf customizable technologies.

Table of Contents:

- The Nuances of Starting a Startup in the Medical Space

- Top 3 Successful Health Startups

- Niches and Business Ideas for Building a Medical Startup

- How to Build a Team for a Medical Startup

- Step-by-step Guide on Launching a Health Startup

- Why Do Some Healthcare Startups Fail?

- TopFlight Apps Advice on Launching a Healthcare Startup

The Nuances of Starting a Startup in the Medical Space

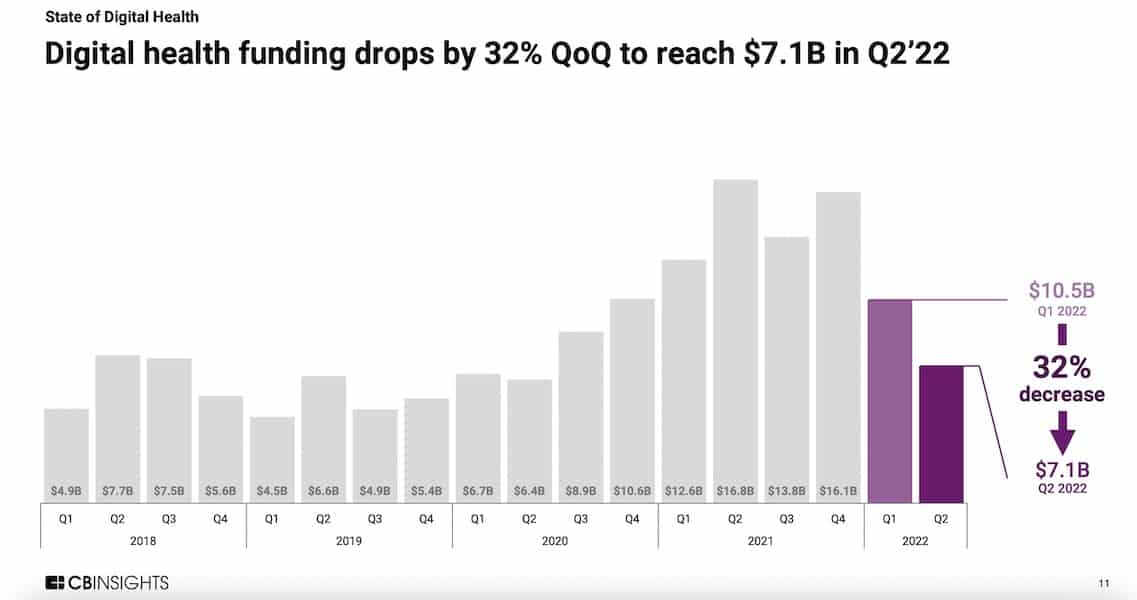

According to CB Insights, digital health funding is returning to the pre-COVID level. That means even more hustle and determination for entrepreneurs. What do you need to consider when launching a healthcare startup in these uncertain times?

Image source: CB Insights, State of Digital Health Q2’22 Report

Image source: CB Insights, State of Digital Health Q2’22 Report

Align your passion with market opportunities

First and foremost, you must honestly answer whether your business idea is lucrative enough. How long will it take to generate stable revenue? Will you be able to launch anything tangible within a year to start onboarding customers?

Passion alone may not suffice: you need to focus on the niches with the most ROI potential. We’ll talk about that in a bit more detail.

Regulations

Getting legal counsel is not something that you can postpone when building a digital healthcare company. In the industry that’s so regulated (think HIPAA, HITECH Act, GDPR, FDA guidances, etc.), you can’t figure the legal stuff out later on in the process.

Related: HIPAA Compliant App Development: Everything You Need to Know

As long as your software or medical devices touch protected health information (PHI), you must discover the boundaries before developing the solution.

Concise product roadmap

Don’t waste too much time working on a detailed roadmap because your product will adapt to the market. Yes, the initial MVP should already be pretty much aligned with customers’ expectations (and we’ll discuss the instruments in a bit), but that won’t stop there.

A too detailed roadmap can quickly lead to technical debt — remnants of unnecessary code, no longer needed because you have pivoted.

Choosing a team with the right competences

If you’ve never worked with development teams before, keep in mind that you will need more than developers, i.e., coders stacking lines of code. You will need UX/UI designers, QA engineers, and DevOps specialists. In a perfect world, your team would also offer some mobile marketing chops to help with promoting your software once it’s released.

Choose partners wisely

I bet many entrepreneurs would trade an enterprise contract that takes months (or even years) to sign for multiple smaller contracts. Because these smaller contracts offer precious feedback helping a startup advance to the perfect product-market fit.

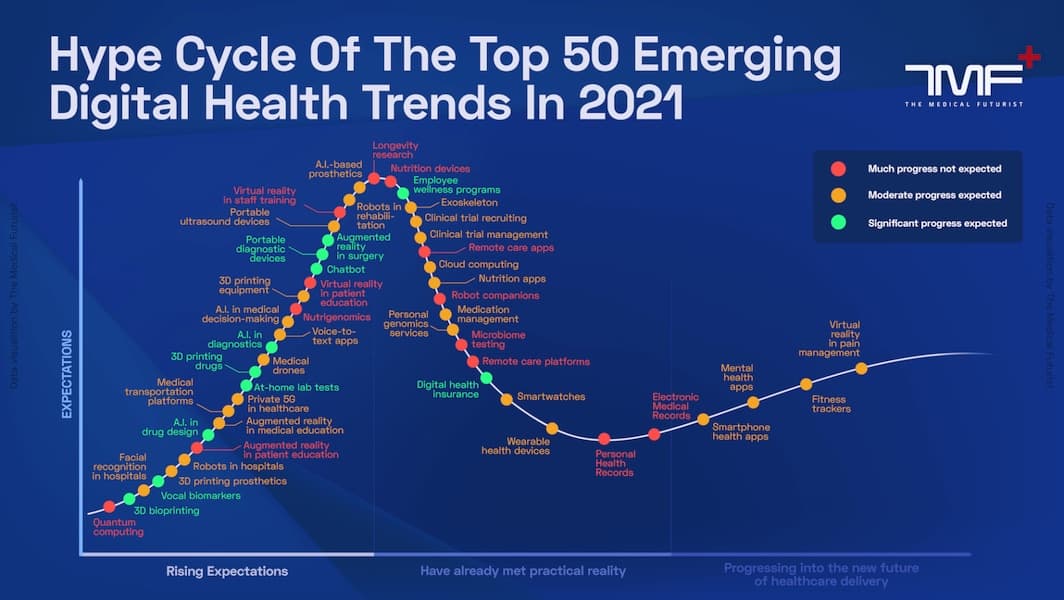

Image source: The Medical Futurist

Image source: The Medical Futurist

Rely on proven technologies instead of building from scratch

This one is easy enough. In our day and age, technologies are so robust and developed that there’s no shortage of ready solutions, from cloud infrastructures optimized for various use cases to feature-specific code libraries.

Working with legacy systems

Depending on your target audience, you might need to integrate your software with legacy systems, which are common among established hospitals and clinics. Moreover, interoperability is a must for modern healthcare solutions. Therefore, find out about EHR and other platforms you will have to sync with in advance.

Takes time to turn a profit

According to Zippia, startups take, on average, three to four years to become profitable. Unfortunately, in healthcare, it may take even longer:

“You need to think of it as a five to 10-year minimum kind of initiative. You might get lucky, you might get taken out, you might IPO, but the reality is that it’s going to take a long time.”

Steven Krein, Co-Founder and CEO of StartUpHealth

Top 3 Successful Health Startups

How about we talk about three successful healthcare startups we partner with at different stages of their journeys? That might give you some direction for creating a successful low-cost healthcare startup company.

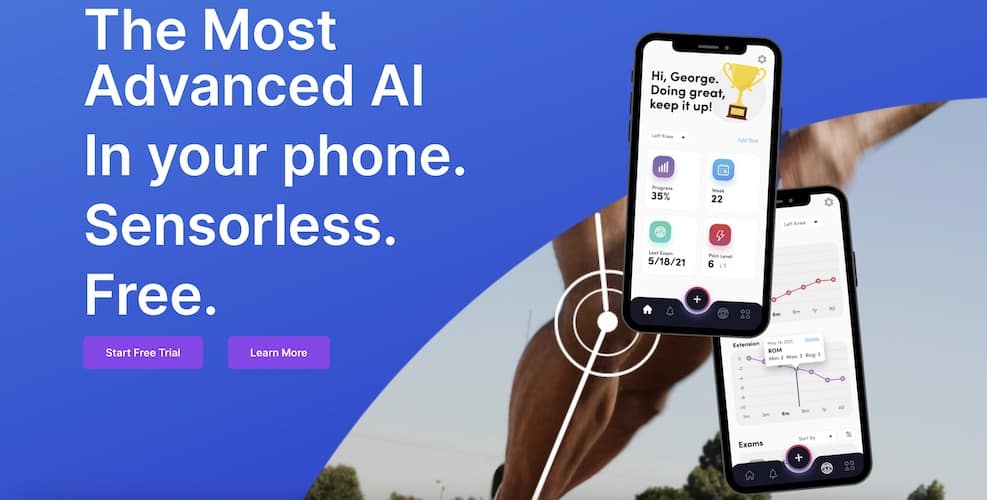

Allheartz — an early-stage startup

Founded: 2022

Target audience: physiotherapists, sports coaches, athletes

What it does: remote physiotherapy backed by computer vision

What it does: remote physiotherapy backed by computer vision

- reduces in-person consultations by 50%

- up to 80% less time spent on clerical work

- better patient outcomes with AI-guided remote exams

Technology: AI/ML; mobile and web applications for patients, doctors, and coaches.

Wins: the startup is in a customer-acquisition phase; we can’t disclose any partnership agreements at this time.

SoberBuddy — active growth

Founded: 2020

Target audience: people with dangerous habits and addiction; self-help communities, recovery centers.

What it does: a virtual recovery coach in the form of a chatbot

- helps stay on track by offering personalized challenges

- 4.9 / 4.7 rating in the App Store and Google Play

Technology: a mobile app for iOS and Android; a web application for admins.

Wins: 55% of the SoberBuddy community said that SoberBuddy has helped them get sober. Recently raised $1.25m to continue pushing innovations and turning the platform into a turnkey solution for sobering centers.

Walker Tracker — mission accomplished

Founded: 2006; partnered with Topflight since 2019

Target audience: enterprises and SMBs looking to introduce wellness programs for their employees.

![]() What it does: a SaaS platform allows tracking steps and other activities and converting them into steps to enable innovative employee health and benefits programs.

What it does: a SaaS platform allows tracking steps and other activities and converting them into steps to enable innovative employee health and benefits programs.

Technology: mobile app for iOS/Android and a web application for businesses.

Wins: acquired by TerryBerry in 2022.

Niches and Business Ideas for Building a Medical Startup

Healthcare is quite a broad space. There are all these disciplines like therapeutics and mental health; there are on-demand, staffing, and billing solutions; there’s a processes optimization route, and so much more! So how do you pick a niche to apply your business idea and build a medical startup that’s likely to succeed?

Obviously, you already have something on your mind, hopefully coming from your hands-on experience in medicine. Let’s just list a few niches that might be of interest:

- On-demand physicians and nurses (including telemedicine)

- Ecommerce

- Staffing solutions (ala marketplaces for shift workers)

- Diagnostic applications working with smart devices

- Remote patient monitoring platforms

- All sorts of patient portals

- Practice management software and other healthcare coordination solutions

- Payments and insurance-related platforms

Related: Remote Patient Monitoring App Development

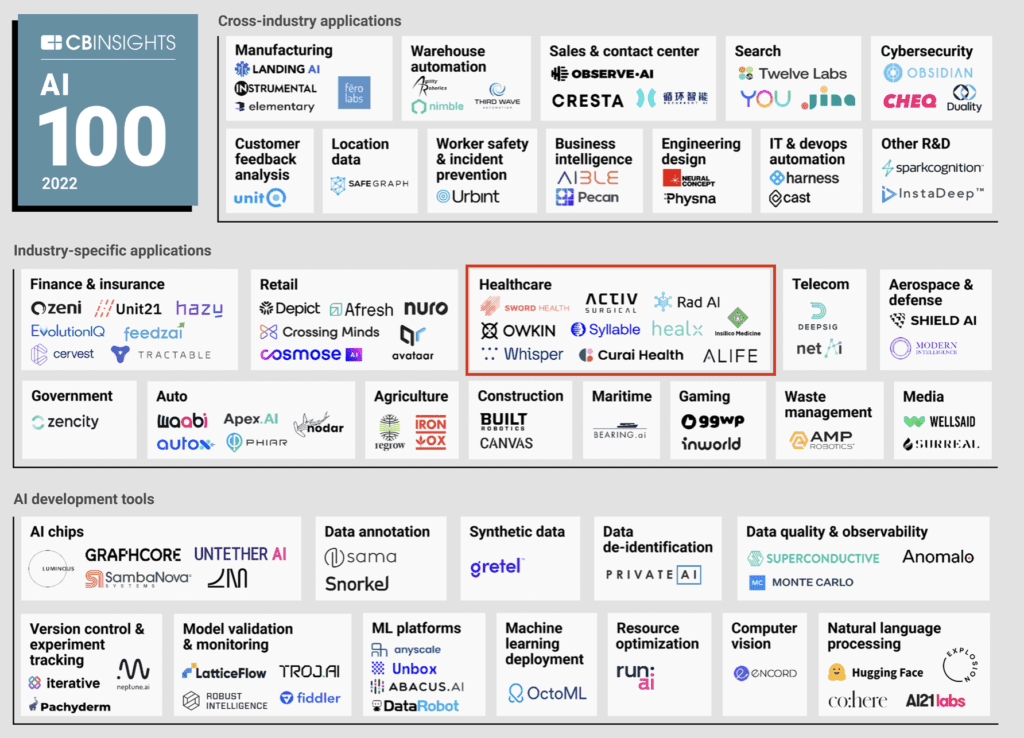

The latest trend is to pick one of these niches or zoom in on an even more narrow sub-niche and apply AI, IoT, AR, blockchain, or any other cutting-edge technology. You’re on the right track as long as your healthcare product promotes value-based care.

Image source: AI 100: The most promising artificial intelligence startups of 2022 by CB Insights

Image source: AI 100: The most promising artificial intelligence startups of 2022 by CB Insights

How to Build a Team for a Medical Startup

It’s pretty simple. Besides a multi-talented team for creating software, you will need subject matter experts (ideally, people who would use your app daily) and a lawyer competent in all things healthcare. That’s the gist of it.

Some would advise you to get a chief technical office (CTO), stressing the role as the core required competence on your team. However, as per our experience, it’s better to find a well-balanced team of developers with the expertise to create a proper architecture and think through all other technical aspects of the software.

Besides, when working with a competent team, you will likely also interact with a product manager and other similar roles. They will ensure that your business goals accurately reflect the project’s technical setup.

The same is valid for hiring a dedicated lawyer — you probably be better off outsourcing their services in the beginning.

Here’s some hard-earned advice on startup hiring we got from a founder of Moxie, a comprehensive digital platform for running a MedSpa:

With any startup, bringing the right people on board is crucial to fueling growth. We’re generally looking for people who have done it before – internally, we say “no first rodeos.” Of course, being an early-stage company means we have financial constraints, but that means we have to get creative. For instance, we’ve learned that fractional employees can bring enormous value, even if they’re working part-time. It’s not about the number of hours our people put in, but about the skills and experience they bring and their commitment to our mission.

Dan Friedman, President, Moxie

Step-by-step Guide on Launching a Health Startup

Now let’s review the steps you need to take to start a medical startup.

Target audience research and regulations

You need to know about your customers’ needs. However, verifying that your business idea will not violate HIPAA and other applicable laws is even more critical.

Create a rapid prototype

Creating a rapid prototype means designing the most critical screens of the software and connecting them all together. Such a clickable prototype (even though with dumb data) can help gauge feedback from test users and proceed to the next step.

Get funding for MVP development

An elevator pitch is nice, but when you have something to show is even better. That’s where the rapid prototype you’ve built will shine. Some of the funding sources for health startups include:

- VC funds

- friends and relatives

- angel investors

- grants

- business incubators and accelerators

I’d speak with friends investing in crypto before starting a health tech startup. They’re very likely to make an investment during the bear market because the crypto space becomes too stale.

Create an MVP

Once you have the seed money, it’s time to build a minimum viable product (MVP). During this step, you will need to find a healthcare app development company unless the team who made the prototype already offers this expertise.

Onboard customers

Once the MVP is released, your job is to find paying customers. You will probably experiment with monetization and business models at this point a lot. It’s not something too laborious tech-wise to implement, so pick whatever works best for your customers.

Continue improving the product

As you gain customers, the product’s backlog will grow faster, filling with new requirements and issues. Then, when the profit starts paying for these enhancements, you know you’ve almost done it.

Read more on how to build a healthcare app here.

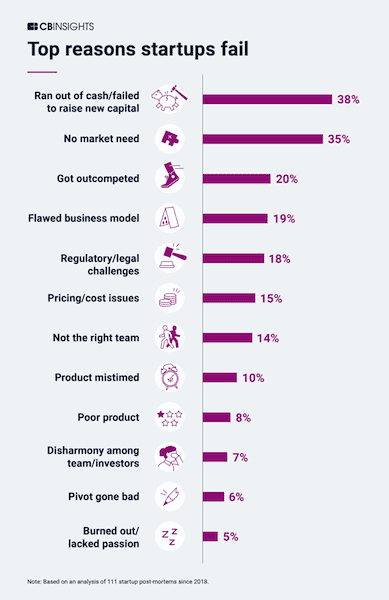

Why Do Some Healthcare Startups Fail?

Of course, many things can go south when launching a startup in the medical sector. I suggest we list a few of the most common pitfalls to look out for.

Image source: The Top 12 Reasons Startups Fail by CB Insights

Missing product-market fit

Who will use it if your product doesn’t solve a customer’s problem or does it inefficiently?

Skip the prototyping phase

Raising seed money is more complicated without a prototype, and validating your business idea will require more resources.

Building a too robust MVP

You need to start generating traction with an app as soon as possible, releasing an MVP with only essential features.

Infinite pivoting

The other extreme many startups face in the healthcare sector is endlessly adjusting requirements to cover new use cases and ending up with a misfit product.

Work with an incompetent development team

From throw-away code to lackluster design and tech debt, choosing the right development partner is akin to walking a minefield.

Ignore regulations

Getting fined or risking an entire business because of negligence in legal matters should be out of the question when you’re getting started with a health startup. Therefore, building a HIPAA-compliant product from the get-go is a must.

Chasing wrong customers

Finally, you can be after the wrong companies: slow-moving enterprises, other startups still working on their profitability, or businesses with short-term goals.

Topflight Apps Advice on Launching a Healthcare Startup

We’ve seen the most success with startup founders from the healthcare space who already had key connections and relevant experience.

The way we help our partners to launch a medical startup is by going through these steps:

- Pre-flight workshop

- Rapid prototyping

- Working on a PoC

- Creating an MVP

- Maintenance and scaling

These steps have helped startup founders raise more than $188m to grow their businesses. Here’s an insider story from our CEO about Walker Tracker. This healthcare startup got acquired in 2022 after working with us on their wellness mobile SaaS app for three years.

If you plan on starting a digital health startup, reach out to our experts. We love working on products improving people’s lives.

Frequently Asked Questions

What's the first step for creating a successful medical startup company?

Find a qualified partner who can channel your business concept into an interactive prototype.

What's the most typical challenge for new companies in the healthcare industry?

Not taking into account potential partners’ legacy systems they need to integrate with.

Is there a recommended tech stack I should stick to?

Absolutely not, as long as you choose an experienced development partner. Practically any technology can be applied in a scalable way.

Give me a random piece of advice, but no bs.

Well, how about gauging the interest of your target audience by selling them a prototype of your product while using a combination of low-code, no-code, and existing solutions?

What are the most popular business ideas for a medtech startup?

Applying AI, IoT, AR, or blockchain to advance value-based healthcare will remain a boon to market players who know how to deal with incumbents.