The app development cost of every project (whether a healthcare app or not) comes down to three essential components: effort, hourly rate, and time frame.

-

-

- Effort — How many resources counted in man-hours will it take to deliver a project?

- Hourly rate — What’s the price of a man-hour?

- Time frame — What’s the deadline for delivering the project?

-

And so, the formula for the health app development cost is far from being obscure:

Hours (effort) X Hourly Rate (dollars) = Cost of App Development

However, intricacies quickly pile up when determining the required effort, especially for projects with tight deadlines. On top of that, agencies may have different rates for various app development disciplines, such as design, code, and QA, among others.

Now throw in HIPAA compliance and other regulations-related pitfalls typical of healthcare app development.

How does a business owner make sense of all that? How do they know they are not comparing apples to oranges when looking at quotes and estimates from different companies? How do they ensure every dollar goes towards greater traction and adoption of their products?

Let’s discuss and find answers to these and many other questions so that your app cost negotiations become more effective. I promise, “How much does it cost to make a medical app?” won’t sound this challenging anymore.

Top Takeaways:

- The average mhealth app costs $125K if the total development costs are optimized by applying AI coding principles and using pre-built HIPAA-compliant customizable modules.

- For projects that last longer than 3 months, it’s best to choose the time-and-materials approach characteristic of agile development. The main benefit of following agile best practices is a flexible design and development process, which leads to finding an optimal product-market fit faster.

- Topflight’s Vision-to-Traction System is the best answer to “How much does it cost to develop a healthcare app?” The system takes the best from fixed-price and time-and-materials approaches and guarantees satisfactory end results while taking advantage of agile’s flexible development process.

Table of Contents:

- Healthcare App Development Cost at a Glance

- Primary Cost Drivers in Healthcare App Development

- Detailed Healthcare App Development Cost Analysis by Component

- Healthcare App Development Cost by Solution Type

- Healthcare App Development Cost by Specialty

- Healthcare App Development Contract Models and Pricing Strategies

- Healthcare App Cost Estimation Framework

- Why Medical Apps Cost More Than Consumer Apps

- Future of Healthcare App Development Costs

- Investment vs Returns in Healthcare App Development

- Cost Optimization Strategies for Healthcare Apps

- Avoiding Budget Overruns in Healthcare App Projects

- Why Topflight Keeps Healthcare-App Budgets in Check

Healthcare App Development Cost at a Glance

The cost of healthcare app development depends on the type of app you want to build, its features, and compliance requirements like HIPAA. Below is a quick breakdown of estimated costs and timelines for popular healthcare app types.

| Health App Type | Estimated Cost ($) | Development Time |

|---|---|---|

| Telemedicine App | $150,000 – $450,000 | 16 – 32 weeks |

| Fitness and Wellness App | $55,000 – $120,000 | 8 – 20 weeks |

| Chronic Disease Management App | $65,000 – $280,000 | 15 – 40 weeks |

| Appointment Scheduling App | $50,000 – $75,000 | 6 – 12 weeks |

| Health Records and EMR App | $50,000 – $150,000 | 12 – 24 weeks |

| Average Cost Range | $50,000 – $450,000 | 6 – 40 Weeks |

The cost of developing a healthcare app ranges from $50,000 to $450,000+ and typically takes 6 to 40 weeks. These figures vary based on factors like app complexity, required features, and compliance with regulations such as HIPAA, which can significantly impact both cost and timeline.

Healthcare App Cost by Complexity Level

- Simple MVP (1 surface, no EHR write-back): $60K–$120K (~8–16 wks)

- Moderate (2 surfaces, 1–2 integrations): $120K–$220K (~12–24 wks)

- Advanced/Enterprise (multi-role, EHR + RCM): $220K–$450K+ (~20–40 wks)

Regional Cost Variations in Healthcare App Development

- US-only teams trend at the top of ranges

- Blended US + nearshore usually lands mid-band

- Mostly offshore hits lower band, but coordination/QA drag can erode savings

Hidden Costs in Healthcare App Projects

- Integration drift (sandbox→prod), vendor certifications, BAA/legal reviews

- Security/ops: audit logs, key rotation, backups/DR, pen-test fixes

- App store compliance, accessibility polish, analytics taxonomy, PM & launch ops

Quick Cost Calculator for Healthcare Apps

Step 1 — Pick a base by complexity (use mid-points)

- Simple: $90K

- Moderate: $170K

- Advanced: $335K

Step 2 — Add compliance track (if needed)

- HIPAA baseline: +$10K–$25K

- FDA SaMD (Class I–II): +$25K–$80K

- SOC 2 support: +$15K–$60K

Step 3 — Add integrations (per vendor)

- Read-only FHIR: +$8K–$20K

- Limited write-back (orders/notes): +$25K–$60K

- Multi-vendor (e.g., Epic + Athena + clearinghouse): add 30–50% overhead

Step 4 — Add scale envelope (if >10K MAU)

+$10K–$120K depending on tier (≤10K / 10K–100K / 100K+)

Napkin math example: Moderate base $170K + HIPAA $20K + FHIR read-only $12K ≈ $202K before region/scale.

Primary Cost Drivers in Healthcare App Development

Here’s how those top-line ranges break down at a glance—by complexity, region, and commonly missed line items—then we dig in below. We unpack the drivers across region, integrations, compliance scope, and scalability—so you can see where feature complexity and patient data security actually move your healthcare mobile application pricing.

Healthcare App Development Cost by Complexity

Use these as planning anchors; tighten after discovery:

- Simple MVP (single surface, no EHR write-back): $60K–$120K, ~8–16 weeks.

- Moderate (2 surfaces, 1–2 integrations, limited write-back): $120K–$220K, ~12–24 weeks.

- Advanced/Enterprise (multi-role, real-time, EHR + RCM): $220K–$450K+, ~20–40 weeks.

| Complexity Tier | Scope (surfaces / roles) | Integrations | Data & compliance | Representative features | Cost estimate | Timeline |

|---|---|---|---|---|---|---|

| Simple MVP | 1 surface, single role | Auth / payments / notifications; no EHR write-back | HIPAA-safe flows, minimal ePHI, BAA with hosting | Onboarding, basic tracking, simple booking, push notifications | $60K–$120K | ~8–16 weeks |

| Moderate | 2 surfaces (patient + admin/provider), 1–2 roles | 1–2 integrations (video, device cloud, EHR read or limited write-back) | ePHI storage, RBAC, audit logs, encryption at rest/in transit | Televisits, secure messaging, RPM-lite dashboards, real-time features | $120K–$220K | ~12–24 weeks |

| Advanced / Enterprise | 3+ surfaces, multi-role (patient, provider, ops) | EHR + RCM, device cloud, eventing/queues | Full HIPAA program, BAAs with vendors, SSO, audit, backups/DR | Order/write-back, care-team inbox, alerts/triage, analytics | $220K–$450K+ | ~20–40 weeks |

“Surfaces” = distinct user apps (e.g., iOS, Android, web, admin). Timelines assume focused scope with parallelized design/engineering.

Regional Healthcare App Cost Variation

If you’re choosing between US-only, blended US+nearshore, or primarily offshore, the real variable isn’t just the rate card—it’s throughput and rework risk. Regional strategy should follow the app’s stage and regulatory surface.

When to prefer each mix:

- US-only: early requirements/UX, clinical workflows, regulatory planning, and first EHR integrations where latency and “shared vocabulary” matter most.

- Blended US+nearshore: feature expansion, test automation, data pipelines, analytics—keep US leads for discovery/reviews, nearshore for steady build/QA.

- Primarily offshore: well-specced, repeatable work streams with strong test coverage and a stable integration footprint.

How region impacts budget (beyond rates):

- Cycle time: time-zone overlap and decision latency can add or remove entire sprints.

- Defect economics: bugs found post-integration or in App Store review erase rate advantages fast.

- Coordination tax: add ceremonies, architecture office hours, and stricter acceptance criteria as the team gets farther from the domain.

Risk controls that protect budget:

- Definition of Done tied to traceable acceptance tests (not “looks good”).

- Environment parity: IaC for dev/stage/prod; nightly smoke tests against vendor sandboxes.

- Single-threaded ownership of integrations and release operations; no “everyone a little bit.”

- Change windows: plan around EHR/clearinghouse updates; pre-book re-tests.

Rule of thumb: Front-load US time where misunderstanding is most expensive, then blend as the work becomes modular and testable. Link readers to your rate tables here if you publish them.

Team Composition and Expertise Requirements

Budget tracks who does the work as much as what the work is. Staff for the current stage and compliance surface—then rebalance.

Stage-by-stage focus:

- Discovery→MVP: product lead + senior UX + solution architect; 1–2 full-stack devs; QA-in-parallel.

- Integration hardening: add an integration engineer and test automation; part-time security/DevOps.

- Scale & ops: SRE/DevOps, data/analytics, and release management; QA expands to regression matrix.

Why seniors often cost less:

- Fewer cycles lost to misreads of clinical workflows and vendor policies; cleaner acceptance tests.

- Tighter Definition of Done cuts rework during certifications and app-store reviews.

Guardrails:

- Keep single-threaded ownership for each integration.

- Maintain a living skills map (FHIR, security, observability) and fill gaps deliberately—not by headcount blob.

Hidden Costs Teams Miss

The line items below don’t look big individually—but they stack, and they show up late if you don’t plan for them.

Integration & vendor realities:

- Sandbox → prod drift (permissions, payload quirks, throttles) and mandatory vendor certifications.

- Re-testing after upgrades (EHR, payment, CometChat/video, auth) and change-window scheduling.

Security, compliance & environments:

- Audit logging (who/what/when), PHI access trails, key rotation, backup/restore drills, disaster recovery docs.

- Pen-test remediation—not just the test. Budget for fixes and verification.

- Access control reviews (clinical vs admin vs patient) and least-privilege audits.

Release & operations:

- App Store/Play compliance (privacy labels, data-use disclosures), accessibility fixes, and analytics event taxonomy that actually answers product questions.

- Monitoring/observability (APM, log retention, alert tuning) to keep on-call sane.

- Change management: internal training, rollout comms, and SOP updates.

Budget guardrails:

- Time-box a hardening sprint before launch (security + accessibility + analytics + ops).

- Treat certifications and re-tests as their own work items with dates, not “extra hours.”

- Add a 2–3 sprint contingency for post-integration polish on v1.

One-liner test: If it touches PHI, stores credentials, dials an external API, or affects an audit trail—it has a hidden cost unless you’ve already shown the evidence.

Regulatory Compliance Impact on Development Cost

When defining the scope of work for HIPAA-driven development, you should ground estimates in security best practices and the realities of designing a healthcare app.

|

Scope |

What’s included |

Cost/Time impact |

|---|---|---|

|

HIPAA baseline |

BAA, ePHI handling, audit logs, backups/DR |

+$10K–$25K, +1–2 wks — major cost factors |

|

FDA SaMD (Class I–II) |

QMS light, risk controls, validation docs |

+$25K–$80K, +3–8 wks |

|

SOC 2 Type I/II support |

Controls mapping, evidence, pen-test fixes |

+$15K–$60K, +2–6 wks |

Use these ranges to budget the HIPAA-related effort and to stay explicit when calculating the costs of the application across compliance tracks—not just features.

Integration Requirements with Medical Systems

Each new EHR/RCM/device cloud adds mapping, certification, and test cycles; read-only is cheap, write-back is not. Plan for vendor queues and environment drift to avoid rework and rising server costs.

When legacy systems are in the mix, the cost of developing a health app climbs due to adapters, data normalization, and certification cycles that don’t vanish just because FHIR exists.

- Read-only FHIR: +$8K–$20K, +1–3 wks

- Limited write-back (orders/notes): +$25K–$60K, +3–6 wks

- Multiple vendors (Epic + Athena + clearinghouse): add 30–50% overhead

As integration depth increases, SaaS and SDK fees and vendor compliance reviews often rise in parallel.

Development Timeline Effects on Budget

Time is a lever—pull it wrong and you buy rework.

Where schedule actually burns money:

- Compression: adding developers late (“mythical month”) increases coordination tax and defect rate.

- Queueing: external calendars (EHR certs, change windows) create idle time if not booked early.

- WIP creep: too many parallel tracks dilute reviews and integration quality; stabilization sprints balloon.

Controls:

- Stage gates tied to acceptance tests (not demos).

- Book vendor reviews/certs during discovery; design the plan around those dates.

- Limit WIP; merge early/merge often with contract tests at integration boundaries.

Rule of thumb: Shorten cycle time with smaller batches + stronger automation, not with emergency hiring.

User Base Size and Scalability

Start with a prototype, but size for a HIPAA-grade system from day one—capacity planning, resilience patterns, and deep observability keep scale predictable as MAUs climb.

|

Monthly active users |

Architecture moves |

Cost/Time impact |

|---|---|---|

|

≤10K |

Single region, autoscale basics |

+$0–$10K, +0–1 wk |

|

10K–100K |

Caching, queues, CDN, async jobs, scalable push notifications |

+$10K–$40K, +1–3 wks |

|

100K+ |

Multi-region, read replicas, sharding, robust observability |

+$40K–$120K, +3–6 wks |

Re-run a cost-of-goods analysis at each user tier so infra choices (compute, storage, egress, monitoring) don’t quietly erode unit economics.

Technical Complexity and Healthcare-Specific Features

Complex flows drive scope: triage logic, device data normalization, explainability, and real-time features (alerts, dashboards) increase build and QA effort. Expect +20–60% for bespoke clinical workflows, algorithm transparency, and deterministic auditability.

For any health app development project, start by estimating product features with clear acceptance criteria—whether you’re building a web or mobile healthcare application—so you can realistically develop a healthcare app without surprises. When discussing budget, be explicit about the cost of designing a healthcare app, expected app design price, healthcare website app development cost, and a healthcare app development cost breakdown by feature.

Tie costs to the stage of a product life cycle: proof of concept → MVP → market-ready product; the checkpoints to product-market fit.

One of our partners landed a $300k ARR SaaS customer, turning ROI positive within a few months after publicly releasing their healthcare platform.

Technology Stack Selection Impact on Cost

Your stack is a budget decision disguised as architecture. Pick based on evidence you’ll need to produce (auditability, latency, uptime) and the work you won’t want to redo.

What actually moves cost

- Managed vs self-hosted: fewer DevOps hours now vs higher platform premiums and migration limits later.

- Data layer choices: audit-friendly schemas, idempotency, and versioned APIs reduce downstream rework.

- Eventing & jobs: queues/retries tame clinical edge cases (and lower on-call), but add infra + test harnesses.

- Vendor lock-in: proprietary SDKs speed v1; portability and testing get pricier.

- Talent supply: niche stacks can raise rates and slow hiring; mainstream stacks speed parallel work.

Signals you chose well:

- IaC parity across dev/stage/prod; reproducible environments.

- Clear boundaries: auth/audit/logging as platform concerns; features stay thin.

- Run-rate modeled up front (compute, storage, egress, observability).

Guardrails:

- Write an “exit plan” for any critical vendor SDK.

- Treat background processing, auditing, and migrations as first-class epics—not “we’ll add later.”

Platform Choice: Native vs. Cross-Platform Cost Analysis

This isn’t “React Native saves 40%” or “native is always better.” It’s fit-for-risk.

Use cross-platform when:

- You need surface parity (iOS/Android/web) and moderate device access; shared domain/UI saves hours.

- Your risk lives in integrations and security, not in exotic device APIs.

Prefer native when:

- You rely on advanced Bluetooth/low-latency media, heavy background processing, or platform-specific health frameworks.

- Accessibility/performance budgets demand platform-idiomatic UX patterns.

Middle paths:

- Share domain logic (e.g., Kotlin Multiplatform/TypeScript libs) while keeping thin native shells for UI/OS features.

- Standardize design tokens/components so parity work doesn’t double QA.

Guardrails:

- Validate required SDKs (video, auth, analytics) on the target approach before committing.

- Keep the automated test matrix honest (real devices; store-policy checks baked into CI).

Security and Privacy Implementation Costs

|

Control |

Typical work |

Cost/Time impact |

|---|---|---|

|

Fine-grained RBAC & PHI scoping |

Role matrices, least-privilege, data tagging |

+$8K–$25K, +1–2 wks |

|

End-to-end encryption posture |

KMS/HSM, key rotation, envelope encryption |

+$10K–$30K, +1–2 wks |

|

Secure UI patterns |

Masking, consent UX, session hygiene (adds design costs) |

+$5K–$15K, +1 wk |

Healthcare app developers follow specific protocols and make use of various technologies to secure PHI, which adds scope and, therefore, cost:

- data encryption, secure connections, multifactor authentication

- hardened authentication services and least-privilege APIs

- monitoring, logging, and auditability tied to compliance needs

Even when HIPAA is out of scope, security baselines still apply to protect user data and brand trust—affecting both initial build and ongoing maintenance budgets.

Detailed Healthcare App Development Cost Analysis by Component

Budgets go sideways when everything is a single line called “development.” Break it down. It’s also the only way to argue for the ROI of healthcare app development investment—linking each dollar to measurable outcomes like faster note closure, higher care-plan adherence, lower days-in-AR, and reduced support tickets.

The same healthcare app development cost can look disciplined—or chaotic—depending on how you allocate across frontend, backend, integrations, and post-launch OPEX. Below are pragmatic ranges you can tune after discovery; think of them as planning guardrails for a HIPAA-grade MVP with 1–2 integrations.

Understanding Healthcare App Architecture Components

Think in budgetable components, not just “frontend vs backend.” For a HIPAA-grade MVP, the moving parts typically are:

- Client surfaces (web/iOS/Android) — UX, accessibility, consent flows.

- Platform & security — authN/authZ, roles, audit trails, consent, rate limits, encryption, secrets, backups/DR, observability, IaC.

- Data & jobs — PHI schemas, versioned APIs, queues/retries, idempotency.

- Integrations — EHR/RCM/video/identity/analytics; each is engineering plus vendor onboarding/certifications.

- QA & compliance — device/OS matrices, a11y, security testing, evidence capture.

- Ops — release management, monitoring, SLAs/SLOs, change-window discipline.

Directionally, healthcare budgets push a larger share into backend/security, integrations, and QA/compliance than consumer apps; UI often takes a proportionally smaller slice.

Cost Distribution Best Practices

- Align spend to risk: more dollars go where mistakes are expensive (security, integrations, release ops).

- Ring-fence platform/security: don’t cannibalize this to add “one more screen.”

- Treat integrations as projects: cap per-integration budgets and hold 10–20% contingency for sandbox→prod drift and vendor reviews.

- Keep a QA/compliance floor: plan ~10–15% of build for QA/compliance—not optional.

- Budget the steady state: reserve ~15–25% of initial build per year for maintenance/support tied to SLAs/SLOs.

Component Prioritization for MVPs

- Pick one primary workflow and get it reliable; ship parity surfaces later.

- Bias to read-only first on EHR/RCM; gate write-back behind real-world validation.

- Make audit & consent day-one features (not “post-MVP”).

- Instrument early: logs/metrics/traces and analytics taxonomy that answers product questions.

- Time-box a hardening sprint before launch (security + a11y + analytics + ops).

Frontend Development Cost for Healthcare Apps

Your client apps (web, iOS, Android) set perceived quality and compliance posture (accessibility, error states, consent flows). They’re also where scope balloons quietly—every “just one more screen” multiplies QA, localization, and edge-case handling.

Expect cost to rise with:

- Surfaces & parity: web + two native clients vs. a single cross-platform codebase.

- Workflow depth: care plans, charting, multi-role UX (patient, provider, caregiver).

- Accessibility & languages: WCAG-level polish, RTL, large-type layouts.

- Offline & performance: cached records, sync conflict resolution, list virtualisation.

Rule of thumb: allocate ~20–30% of total medical app development pricing to frontend engineering, plus 5–10% for design/system work (design tokens, component library).

Example: on a $180K MVP, $40–60K for app clients is normal; add another $10–15K if you need full web+iOS+Android at v1.

Backend Infrastructure and Security Investment

This is where HIPAA-compliant app cost becomes real: auth, audit, consent, and data stewardship. Cutting corners here is how future you inherits breach paperwork.

What you’re paying for:

- Core services: authN/authZ, roles, audit trails, consent capture, rate limits.

- Data layer & APIs: PHI models, versioned APIs, idempotency, background jobs/queues.

- Security ops: encryption at rest/in transit, key/secret management, backups/DR.

- Observability: logs/metrics/traces, alerting, error budgets (SLOs).

- Environments & IaC: reproducible dev/stage/prod; cost-controlled by design.

Rule of thumb: ~30–45% of the build goes here. Cloud run-rate at MVP scale is usually a small single-digit % of your healthcare mobile app budget, then grows with usage—not complexity.

Example: on $180K, plan $60–80K for platform + IaC + security hardening.

Healthcare System Integration Expenses

Integrations are not “just an API.” They’re engineering + vendor onboarding + certification + policy alignment.

Cost drivers you should line-item:

- EHR/clinical (FHIR/HL7/vendor REST): patient matching, read/write constraints, reconciliation, downtime handling.

- Payments/RCM: PCI scope is solvable; HIPAA scope is the tax. Add clearinghouse work for eligibility/claims/remits.

- Real-time comms: video/messaging with PHI (TURN/STUN, recording policies, consent).

- Identity & analytics: SSO/OIDC, event streams, PHI-aware dashboards.

Budgeting move: set per-integration not-to-exceed caps and add a 10–20% contingency for sandbox→prod drift and vendor reviews. Also track SaaS/SDK fees—that’s cash, not just engineering time.

Quality Assurance and Compliance Testing Costs

QA isn’t a line item—it’s a program that protects your budget after code is written.

What to plan for

- Test strategy & automation: unit/integration/contract tests at integration boundaries; regression matrix across devices/OS.

- Accessibility (WCAG): flows for large type, screen readers, contrast, focus states.

- Performance & reliability: load, offline/sync, failure-mode drills (timeouts, partial writes).

- Security testing: SAST/DAST, dependency audits, external pen-test + remediation (budget for the fixes, not just the test).

- Compliance evidence: audit-log reviews, permission matrices, privacy disclosures for stores; vendor re-tests after upgrades.

Allocation guardrail: treat QA/compliance as ~10–15% of the build (floor) and schedule a pre-launch hardening sprint; it consistently prevents overruns later.

Post-Launch Support and Maintenance Budget

Launch day shifts you from capex to digital health application investment in reliability and safety. This is where many teams underfund and pay double later.

What’s in the envelope:

- Security & compliance: patches, pen-test fixes, audit log retention, policy updates.

- Platform churn: OS/browser upgrades, device matrix, dependency deprecations.

- Vendor change tax: API version bumps, EHR upgrade windows, payer rule changes.

- Small enhancements: UX friction fixes, analytics-driven tweaks, A/B results.

Rule of thumb: reserve ~15–25% of initial build per year for maintenance/support. Tie it to SLAs (uptime, response times) and SLOs (error budgets) so you can defend the spend.

Illustrative split (MVP, ~$160–200K, 1 EHR + payments):

Frontend 25%, Backend/Security 35–40%, Integrations 15–25%, Design 5–10%, QA/Compliance/PM 10–15%. Annual maintenance 15–25% of the initial build. Not gospel—just scaffolding that turns a hand-wave into a defendable cost breakdown your stakeholders can sign.

| Component | MVP (~$160–200K) | Growth Stage (~$250–350K) | Enterprise (~$400K+) |

|---|---|---|---|

| Frontend (iOS/Android/Web) | 25% | 25–30% (multi-role UX, added UI/UX polish) | 30–35% (multi-brand, accessibility, localization) |

| Backend & Security | 35–40% | 30–40% (scalable APIs, audit trails) | 35–45% (redundancy, advanced encryption, DR) |

| Integrations | 15–25% (EHR + payments) | 20–30% (analytics, telehealth SDKs) | 25–35% (multi-EHR, RCM, data pipelines) |

| Design & QA/Compliance | 10–15% | 10–15% (design system, a11y tests) | 10–20% (multi-surface regression, FDA docs) |

| Annual Maintenance | 15–25% of initial build | 20–30% (infrastructure, SDK updates) | 25–35% (multi-region ops, scaling, SLA) |

Percentages are typical allocation ranges by maturity stage; actual values shift with integrations, compliance load, and architectural reuse.

Healthcare App Development Cost by Solution Type

Diving into the world of healthcare app development, costs hinge on estimating the development of solutions for hospitals and providers vs. patients.

Healthcare App Development Cost for Hospitals and Doctors

Applications for hospitals and doctors trend higher due to seamless integration demands. For healthcare apps tailored to hospitals and doctors, the starting cost is typically $150,000–$200,000; the crucial requirement is to integrate flawlessly with EHR/EMR systems and legacy software used by hospitals and clinics so the new tool fits the healthcare ecosystem, enhancing efficiency and patient care without disrupting workflows.

Cost to Develop a Healthcare App for Patients

For healthcare apps designed for patients, typical budgets land around $100,000–$150,000, primarily driven by whether the app touches medical systems at all. Most patient health apps need minimal or no integration with EHR systems, which keeps scope lighter than hospital/provider apps.

An exception: the cost to develop a health insurance app often aligns with provider-facing systems because of required integrations.

Strong user experience for patient apps using consumer app-like patterns in modern mobile apps helps keep builds user-friendly and contained. Deep interfaces into healthcare IT infrastructure increase healthcare website application development cost due to backend work similar to the cost of EHR implementation in provider-facing systems.

| Product type | Integration depth | Key drivers | Typical starting cost |

|---|---|---|---|

| Hospitals / Doctors apps | Deep (EHR write-back, RCM, SSO) | Certification, reconciliation, policy alignment | $150K–$200K |

| Patient apps | Minimal (often read-only or none) | Consumer-grade UX, onboarding, reminders | $100K–$150K |

| Telemedicine platforms | Medium→Deep (video, eligibility, optional EHR write-back) | Concurrency, TURN/STUN, consent & audit | MVP $100K–$150K; Full $300K–$400K+ |

| Patient portals & engagement | Read-only FHIR → Write-back | Results, payments, care plans, push reminders | $100K–$150K (read-only); higher with write-back |

| Clinical Decision Support (CDS) | Rules-based → ML/AI (SaMD possible) | Data governance, explainability, validation | Rules-based ≈ $150K–$200K; ML/AI higher |

| Practice management | Deep (clearinghouse, EDI, payer rules) | Eligibility, claims/remits, auditability | $150K–$200K+ |

Enterprise Healthcare Solutions Cost Analysis

Enterprise healthcare buys risk reduction and auditability, not features. Budgets skew toward integration depth, evidence production (security/compliance), and reliability at scale. Expect procurement, legal, and change-management to influence timelines as much as engineering. The fastest way to overrun? Treat enterprise like consumer with more tickets.

Cost concentrates where errors are expensive: multi-vendor EHR/RCM write-back, identity (SSO/SAML/SCIM), environment parity (dev/stage/prod), and release operations. Add program overhead for vendor certifications and re-tests keyed to change windows. UI polish matters, but the audit trail pays the bills.

- Tenancy model (single-tenant for large clients vs multi-tenant): isolates risk but adds infra/ops and per-client variance.

- SLAs/SLOs/on-call: higher uptime and response guarantees increase observability, redundancy, and staffing.

- Security posture (HITRUST/SOC 2, pen-tests, SBOM/CVE gates): testing is cheap; remediation and evidence aren’t.

- Data governance (retention, immutable audits, de-ID pipelines): storage + process cost grows with policy.

- EHR write-back scope: orders/notes/claims add certification effort and re-test burden.

Budget smart: stage gates tied to acceptance tests, pre-book vendor reviews, isolate integrations with contract tests, and reserve a hardening sprint before go-live. Optimize for evidence per dollar—every expensive control should produce verifiable proof.

Consumer Health App Development Pricing

D2C health apps live or die on activation, paywall conversion, and retention. Your build skews toward onboarding UX, experiment velocity (A/B tests), and analytics—plus just enough backend and privacy scaffolding to keep stores happy. If you’re not touching PHI, keep it that way early; the fastest path to a blown budget is mixing “clinical claims” with weak evidence.

|

Driver (what actually costs) |

Budget emphasis |

|---|---|

|

Onboarding & paywall experiments |

High |

|

Analytics/attribution (event taxonomy) |

High |

|

Retention stack (push, in-app messages) |

Medium–High |

|

Data sources (HealthKit/Google Fit, wearables) |

Medium |

|

Privacy/compliance (store disclosures, consent) |

Medium |

|

Support/ops (reviews, content moderation) |

Medium |

Pricing mechanics shape engineering. Subscriptions, trials, and regional prices require reconciliation logic, server-validated receipts, and feature gating. Paywall tests need stable IDs, experiment flags, and guardrails so you’re not shipping bespoke builds per variant.

- Ship the paywall + experiment framework in v1; features without tests don’t compound.

- Use managed services first (auth, push, analytics); move off only when unit economics demand.

- Privacy by design: data-minimization, clear disclosures, opt-ins; avoid PHI unless there’s ROI to justify the compliance surface.

- Plan for store policy reviews (privacy labels, data usage); bake checklist runs into CI.

- Instrument everything (cohorts, funnels, LTV/CAC proxies) so pricing changes are evidence-led.

Average Development Cost Based on the Types of Healthcare Apps

Many blogs publish approximate estimates based on the type of healthcare project (“a remote patient monitoring app costs X; a patient portal costs Y”). In reality, patient mobile app cost developed by different teams can vary widely; price tags based on the application type ignore integrations, data flows, and compliance. For health applications by categories, see our mobile health app development guide.

Related: Cost to Develop a Medical Insurance App

| Type label | Common assumption | What actually drives cost | Implication |

|---|---|---|---|

| Remote patient monitoring app | “RPM is templated.” | Device cloud, data normalization, alerts, payer rules | Range swings with integrations & compliance depth |

| Patient portal | “Simple read-only.” | Identity (SSO), FHIR mapping, messaging, payments | Write-back or payments push cost upward |

| Telemedicine | “Just video.” | TURN/STUN, consent, audit, scheduling, eligibility | Concurrency & policy add real effort |

| Medical insurance app | “Consumer-facing = cheaper.” | Payer integrations, EDI, adjudication, security | Often aligns with provider-grade complexity |

Market Context

Digital health spending is up: health-IT budget allocations and IT investments continue across the health-system as digital/AI transformation and digital transformation priorities expand. That raises expectations for ROI from digital investments and tighter control of risks in healthcare software projects for many organizations.

Benchmarks

If you’re asking, “How much does it cost to develop medical software?” directional average medical app development cost figures land well into six figures. Industry surveys note average mhealth app costs to launch can reach hundreds of thousands, with a large share of total development costs outsourced—i.e., medical app development costs are only part of the full picture, and development and operational costs must both be planned.

B2B Medical Software Development Costs

- Packaging & billing primitives (seats, orgs, roles) expand your data model and QA matrix.

- Integration mix (EHR read-only vs. write-back, RCM, SSO/SAML) shifts spend to certifications and contract tests.

- Multi-tenant vs. single-tenant changes infra cost and the customization backlog.

- Data migration/importers and report exports eat unplanned cycles.

- Customer-success tooling (admin console, impersonation, support logs) reduces churn but isn’t “free.”

B2B sells into group practices, MSOs, and digital-health vendors. Your budget concentrates on onboarding flows, self-serve org setup, role/permission management, and audit-friendly activity logs—the stuff that lowers pre-sales friction and post-sale support. Feature velocity matters, but reliability around integrations and data handling wins renewals.

To keep CAC sane, invest in demo seeds, sandbox provisioning, and out-of-the-box workflows so prospects hit value without a solutions engineer babysitting every click. Protect that speed with contract tests at each integration boundary and a stable test dataset; it’s cheaper than debugging a prospect’s environment during a live demo.

Customization is the silent budget killer. Replace “one-off tweaks” with extension points, feature flags, and templated data mappings. Then price advanced mappings and premium SLAs as productized add-ons, not bespoke projects. Finally, bake in health scoring and provisioning automation so success scales without hiring a small army.

Hybrid Healthcare Platform Pricing Models

“Hybrid” = one platform serving providers and consumers (often B2B2C). Costs skew toward tenancy, identity, and integration packs; pricing has to map cleanly to where value accrues on each side so you don’t subsidize high-touch orgs with patient growth. Keep the core modular and meter what scales: orgs, covered lives, billable events, and premium ops (SLA/on-call).

- Platform fee (per org/tenant) + PMPM for covered lives (ties to value, caps downside).

- Transactional fees for billable events (visit, claim, verified device session, eRx).

- Add-on packs: EHR/RCM/video/auth integrations, reporting, SSO/SCIM, premium SLAs.

- Marketplace/partner rev-share for third-party components (labs, payments, analytics).

- White-label/channel fees (per brand) to fund extra QA, releases, and support.

Avoid double-billing by defining a single primary meter (e.g., PMPM) and using others as guardrails or overage. Decouple a free/low-touch patient tier from provider SLAs so support load stays funded. Instrument usage from day one (contracts + analytics) and pilot with two knobs only (base + one meter) to validate unit economics before adding bundles.

Telemedicine Platform Development Costs

Telemedicine spans patient + provider surfaces and adds real-time video, virtual waiting rooms, scheduling, eligibility checks, eRx (optional), and clinical documentation—so its budget typically straddles the ranges above. How much does it cost to build a telemedicine app in 2025? As a planning anchor, MVPs that defer deep EHR write-backs land near the lower band, while enterprise builds with full integrations start in the $300K-$400K range.

-

MVP scope (video visits, scheduling, notes, basic analytics) generally maps closer to the patient-app band (as noted above, ~$100K–$150K) when you defer deep EHR write-backs.

-

Full enterprise (EHR read/write, ePrescribing, payer eligibility, device RPM, multi-clinic routing) quickly enters provider-app territory (starting $300K–$400K+) due to integrations and compliance hardening.

-

Drivers: concurrency (SFU/MCU choices), STUN/TURN spend, state-by-state telehealth rules routed into consent & audit, and incident playbooks for PHI in media streams.

Related: Medical Device Development Cost

Patient Portal and Engagement App Pricing

Patient portals and engagement apps (appointments, secure messaging, results, payments, care plans, push reminders) usually start in the $100K–$150K band when read-only EHR via FHIR is sufficient. Costs rise as you add:

- Read/write (med lists, allergies, refill requests) with idempotency + reconciliation

- Care-plan adherence, device data (Bluetooth/RPM), and multilingual accessibility

- Advanced engagement (A/B tested nudges, segmentation, in-app education) that touches analytics pipelines and PHI governance

Related: Cost of Developing a Feature-Rich Fitness App

Clinical Decision Support System Budgets

CDS budgets hinge on algorithmic complexity and regulation:

-

Rules-based CDS tied to guideline engines and discrete EHR data can remain closer to provider-app starting points.

-

ML/AI-driven CDS (risk scores, triage, imaging assist) often exceeds those baselines due to data governance, model training/validation, bias testing, explainability, and (if applicable) SaMD/FDA evidence and QMS processes.

-

Expect ongoing OPEX for model monitoring, drift detection, and periodic revalidation tied to clinical safety.

Related: How Much Does It Really Cost to Build a Chatbot

Medical Practice Management App Investment

Practice management blends scheduling, RCM, eligibility/EDI, claims, remits, and patient billing—integration-heavy work that typically starts in provider-app territory ($150K–$200K+). Cost drivers:

- Clearinghouse integrations (270/271, 837/835), prior auth workflows, payment splits (HSA/FSA)

- Multi-location & roles/permissions, granular audit trails, and payer-specific rules

- KPI dashboards (days-in-AR, denial rate) that require robust data pipelines

Why these ranges matter now: Health-IT budgets have expanded, but scrutiny has too—buyers are judging integration depth, compliance posture, and ROI timelines more harshly than ever. Anchor your scope to those realities and the healthcare app development cost bands above will stay honest.

Healthcare App Development Cost by Specialty

Specialty changes workflows, data sensitivity, and integration depth; start with your “patient vs. provider/EHR” bands and tune from there.

Snapshot by specialty (use as planning ranges)

| Specialty | Scope signal | Integrations | Privacy/consent | Typical starting cost | Typical timeline |

|---|---|---|---|---|---|

| Mental Health & Behavioral | self-guided → care delivery (therapy, billing, notes) | Optional provider/EHR | HIPAA; crisis flows; outcomes tracking | $120K–$180K (self-guided); $180K–$300K (with teletherapy) | 12–28 weeks |

| Chronic Disease Management | Devices, alerts, triage consoles | Device cloud / RPM platform; EHR write-back | HIPAA; longitudinal data | $180K–$300K+ | 16–32 weeks |

| Senior Care & Aging-in-Place | Member + family + caregiver roles | Sensors; optional medical integrations / home-health systems | HIPAA; proxy access | $120K–$220K | 14–28 weeks |

| Pediatrics | Minor + guardian access; school/clinic docs | Optional EHR / immunization registries | HIPAA; nuanced guardianship | $130K–$220K | 14–26 weeks |

| Women’s Health / FemTech | Cycle/fertility/pregnancy; education → clinical | Optional labs, eRx, EHR | sensitive data; granular consent | $120K–$200K (wellness); $180K–$320K (clinical) | 12–30 weeks |

| SUD (42 CFR Part 2) Programs | Treatment support, disclosures, exports | EHR/RCM optional; strict partitioning | HIPAA + Part 2; rigorous consent management | $180K–$280K+ | 20–36 weeks |

ROI Analysis by Medical Specialty

ROI hinges on where the value lands (revenue, cost avoidance, risk reduction) and how fast you can prove it. Read your specialty table as “which levers move quickest”: mental health apps monetize via session throughput and show-up rates; chronic care leans on readmissions and care-plan adherence; Part 2 programs trade on risk control and documentation quality. Don’t chase vanity features—optimize the metric that a payer/provider CFO already tracks.

- Mental health & behavioral: boost attended sessions per clinician hour, reduce no-shows, tighten documentation; teletherapy and outcomes tracking make ROI visible fast.

- Chronic disease: cut avoidable escalations via timely alerts; surface adherence nudges and clinician summary time saved; EHR write-back matters when crediting outcomes.

- Senior care/pediatrics: prove caregiver/guardian coordination reduces support touches and repeat work; accessibility and proxy flows drive usage.

- SUD (42 CFR Part 2): ROI centers on compliance—clean consent trails and redisclosure controls avert incidents and preserve contracts.

Close the loop with evidenceable wins in 60–90 days: one specialty KPI, one integration that credits the win (read-only is fine), and one ops metric the frontline team feels weekly (fewer calls, faster notes). Then scale features that compound that proof, not the loudest roadmap request.

Market Demand Impact on Development Pricing

- Urgency premium: when buyers need faster time-to-value, you pay for compressed schedules, pre-booked vendor reviews, and extra QA cycles.

- Integration gating: deals often hinge on specific EHR/RCM/video rails; fast-tracking certifications raises short-term spend but unblocks revenue.

- SLA pressure: higher uptime/support expectations (enterprise pilots, channel deals) push observability, redundancy, and on-call costs up.

- Scope creep by parity: crowded categories demand “table-stakes” features; parity raises QA matrices even if features look simple.

Demand doesn’t just inflate rates—it reorders the plan. Categories with clear ROI scrutiny (telemedicine, portals, RPM) reward teams that can prove outcomes quickly; budgets shift toward integrations, security/compliance evidence, and release operations that get you through procurement faster. In a tight market, buyers fund what reduces risk now, not a larger feature surface later. Anchor pricing to that reality and your ranges stay honest.

Translate demand into a pricing playbook: treat integrations and SLAs as add-on options, stage features behind one measurable KPI, and reserve a hardening sprint before go-live so reviews don’t derail timelines. Use the specialty table to set expectations by domain (e.g., chronic care vs mental health) and then tune for today’s buyer urgency rather than a generic roadmap. That alignment keeps quotes defensible when procurement asks why one line item is bigger than “just development.”

Specialty-Specific Compliance Cost Factors

Compliance isn’t a checkbox; it’s where QA, integrations, and evidence capture get real. The drivers vary by specialty and quietly reshape budgets (test matrices, consent UX, audit trails), even when feature lists look similar.

|

Specialty |

Cost-critical compliance drivers |

|---|---|

|

Mental health |

Crisis routing, outcomes documentation, privacy disclosures tuned to therapy contexts; store policy scrutiny is higher. |

|

Chronic disease |

Longitudinal PHI, device/RPM data governance, and EHR write-back to “credit” outcomes. |

|

Pediatrics |

Dual access (minor + guardian), age-based permissions, nuanced consent and data visibility. |

|

Women’s health |

Sensitive data with granular consent; labs/eRx escalate evidence and audit needs. |

|

SUD (42 CFR Part 2) |

Segmentation, redisclosure controls, and rigorous consent management beyond HIPAA. |

Two implications for scoping: first, pick the compliance track early (HIPAA baseline vs SOC 2 support vs light SaMD) and budget the program work, not just “legal.” Your own ranges already call out additive cost/time for HIPAA, SaMD Class I–II, and SOC 2 evidence—use them here instead of new numbers. Second, surface evidence production in acceptance criteria (audit logs, consent records, access trails) so specialty-driven checks ship as features, not last-minute tickets. That’s how you prevent “we passed QA but failed compliance” fire drills.

Emerging Specialties and Cost Trends

What’s “emerging” isn’t a brand-new ICD code—it’s where demand + rails + evidence finally line up. As new rails mature (SMART/Bulk FHIR, TEFCA), budgets shift from net-new UI to integrations, auditability, and release ops. Real-time care models (telemed + ambient scribing + RPM) and on-device AI move spend toward media reliability, observability, and validation, not “more screens.”

Cost patterns will increasingly reflect proof requirements (privacy, safety, outcomes) rather than feature counts. Expect short-term spikes where you fast-track certifications, e.g., payer rails modernization or video/identity stacks, with long-term savings as interoperability commoditizes bespoke interfaces. In other words: velocity up front, evidence OPEX later.

- Virtual-first subspecialties (tele-derm, remote MSK/PT): concurrency, TURN/STUN spend, and failure-mode UX push infra/QA budgets above UI.

- At-home diagnostics & lab orchestration: lab/eRx hooks expand PHI surface; granular consent and reconciliation raise compliance/QA lines.

- AI-augmented care teams (ambient scribing, triage): dev hours drop on boilerplate, but governance, bias/monitoring, and rollback lanes add durable cost.

- Value-based/pop-health programs: Bulk FHIR/TEFCA connectivity reduces bespoke interfaces yet introduces conformance/testing overhead during rollout.

Net: emerging domains don’t cheapen builds; they reallocate spend toward rails, reliability, and verifiable outcomes. Price to that reality, and your quotes stay defensible when procurement asks, “Why is the integration line so big?”

Mental Health and Behavioral App Development

- Start lean with self-guided CBT/journaling; costs rise with care delivery (notes, billing) and teletherapy.

- Add outcomes tracking, crisis routing, and optional provider/EHR continuity when clinical.

Chronic Disease Management Solutions

- Devices → normalization → alerts; an RPM platform can reduce v1, but EHR write-back pushes scope up.

- Payer rails and analytics increase rigor (governance, audit).

Senior Care and Aging-in-Place Applications

- Multi-role coordination (member, family, caregiver) with accessible UX.

- Sensors and medical integrations with home-health systems move budgets toward provider band.

Pediatric Healthcare App Considerations

- Dual access (minor + guardian), age-based permissions, nuanced privacy.

- Cost aligns to patient vs. provider scope plus extra testing around guardianship.

Women’s Health / FemTech Applications

- Sensitive data drives privacy-first UX; start as wellness apps, escalate when adding diagnostics/eRx.

- Prioritize HIPAA posture and granular consent from day one.

Substance Use Disorder (42 CFR Part 2) Programs

- Part 2 adds strict consent management, segmentation, and redisclosure controls beyond HIPAA.

- Expect extra review/QA around disclosures and exports.

Note: Ranges are planning anchors consistent with earlier bands; refine after discovery (integrations, roles, and compliance depth are the biggest levers).

Healthcare App Development Contract Models and Pricing Strategies

How do you arrive at an app development cost? You ask a few developers or agencies and compare the quotes, right? These quotes usually come in the form of:

- fixed-price proposals

- time and materials proposals

What are their pros and cons? Below we outline when each model fits best in digital health and where a hybrid makes more sense.

When Fixed-Price Works Best for Healthcare Apps

Fixed-price works when scope is locked. You sign a contract with a hard number and deadline; changes mean renegotiation. It reduces price variance for a stable scope, but punishes learning and on-the-go upgrades typical in healthcare app development projects.

Pros: clear milestones and deadlines, predictable budget, minimal coordination.

Cons: limited scope changes, no guaranteed PMF validation, maintenance slows, upgrades stall mid-flight.

Use a fixed-price estimate only when:

- short builds (≤2–3 months)

- clearly defined requirements

- ready UX/UI designs

- minimal ongoing communication.

Process note (agile vs. waterfall): fixed-price nudges waterfall—fine for well-specified utilities; risky when medical requirements and compliance insights evolve. Agile minimizes waste under uncertainty; fixed-price minimizes price variance when the scope is truly stable.

Time and Materials for Complex Medical Solutions

For healthcare applications, agile software development with the time-and-materials approach (T&M) shines when HIPAA scope, integration behavior, and clinical workflows aren’t fully known.

Pros: flexible scope, in tune with changing market conditions; faster PoC/MVP/iterations; delivery milestones adapt as you learn.

Cons: time-and-material-based app costs carry unpredictability; higher coordination.

Even with time & materials, agencies supply an estimate with a min and max cost and a budget cap before a time and materials contract. A clear estimation process maps each development phase to deliverables, with hours assigned to tasks, broken down by different app development disciplines; the percentage formula-driven estimate varies by a team’s experience.

A professional team uses T&M to reach outcomes within budgetary limitations; the wrong team burns time while the unpredictability compounds.

Hybrid Approaches in Healthcare App Development

For many medical products, a blended structure reduces risk without sacrificing learning speed:

-

Discovery Sprint (fixed) ➜ Build (T&M): lock a 2–4-week discovery to finalize specs, compliance boundaries (HIPAA scope, BAAs), and integration assumptions; then execute the build in T&M sprints.

-

Capped T&M / Not-to-Exceed: run agile with a budget cap and pre-agreed cut lines to avoid runaway spend.

-

Milestone-Based Fixed Increments: fix price for discrete, well-specified milestones (e.g., auth + audit + consent), then reassess; useful when certain modules are standardized.

-

Retainer / Managed Capacity: stable monthly squad with KPIs and SLAs; ideal for ongoing optimization and maintenance post-MVP.

-

Equity + Cash (select startups): rare, but can align incentives when budgets are tight and roadmap risk is high.

Payment structure note: whatever model you pick, pair it with clear milestones, demo-able outcomes, and acceptance criteria. That keeps pricing transparent and anchors spend to working software—critical when estimating healthcare app development cost and defending budget to stakeholders.

Milestone-Based Payment Structures

Use milestones when chunks are truly spec-able (e.g., Auth + Audit + Consent, Read-only FHIR ingest, Video visit parity). The goal is to buy predictability without forcing a full waterfall.

How to structure:

- Define demo-able outcomes and acceptance tests (contract tests at integration boundaries, WCAG checks, store-policy checklist).

- Tie dates to external calendars (EHR certifications, app-store review windows) so “done” survives real-world gates.

- Price per milestone with a change budget; defer ambiguous scope to a follow-on milestone.

Watch-outs:

- “Passing the demo” ≠ production ready; include a hardening sub-milestone (security, a11y, analytics, ops).

- Avoid over-fragmentation; milestones should reduce risk, not slice architecture into silos.

When used well, milestones are an on-ramp to agile: lock near-term scope, reassess with production evidence, and keep velocity where learning matters most.

Retainer Models for Healthcare Apps

Retainers (managed capacity) fit post-MVP growth, compliance upkeep, and integrations that evolve with vendors. You’re buying a stable squad with SLAs, not “hours in a bag.”

What good retainers include:

- Named team + monthly capacity; SLOs (lead time, change-failure rate, MTTR); release cadence.

- Quarterly objectives tied to outcomes (activation, claim pass-through, support tickets).

- On-call/incident playbooks, dependency updates, and compliance tasks scheduled, not ad-hoc.

When to avoid:

- Net-new builds with mushy scope; start with discovery/milestone work, then graduate to a retainer.

A retainer shines when you need predictable throughput and knowledge continuity while product/ops keep changing. Price it like a standing team with KPIs, not maintenance afterthoughts.

Equity-Based Development Partnerships

Equity + cash can align incentives for capital-tight teams—but only when the vendor brings domain expertise and go-to-market help, not just coding. Use sparingly.

Design it like a product:

- Vesting on deliveries, not time; tranche equity at objective gates (pilot live, first reimbursable claim, SOC 2 audit ready).

- IP & buyback: founder retains IP; include rights to buy back equity if milestones slip.

- Governance & conflicts: disclosure of other holdings in category; board-observer rights only if value is material.

When it fits:

- Pre-seed or pilot-stage products with narrow, verifiable scope and a credible path to revenue in ≤12 months.

- Not a substitute for compliance/security budgets on high-risk surfaces.

If the paper reads like a cheap T&M replacement, walk. Equity deals should reduce cash risk and increase odds of success—not just discount rate cards.

Performance-Based Pricing Options

Tie a portion of fees to measurable outcomes once telemetry is trustworthy. Great for optimization sprints; risky for net-new builds with many external dependencies.

|

Scenario |

KPI |

What you pay for |

|---|---|---|

|

Teletherapy |

Show-rate ↑ / session throughput ↑ |

Bonus on quarterly KPI lift |

|

Patient portal |

Task completion ↑ / support tickets ↓ |

Bonus on sustained improvement |

|

RCM add-on |

First-pass claim rate ↑ |

Bonus tied to verified pass-through |

Guardrails:

- Establish baselines, controls, and data access up front; define attribution rules.

- Set floor + upside (e.g., 80% base retainer, 20% performance pool).

- Lock measurement windows and exclude vendor outages/change windows from calculation.

Use performance pricing to accelerate what already works; don’t use it where success hinges on third-party calendars you don’t control.

Risk-Sharing Development Agreements

Risk-sharing blends capped T&M / not-to-exceed with incentives. If delivery beats plan, both sides benefit; if scope balloons, overruns are pre-allocated, not litigated.

Pattern:

- Base fee for planned scope + shared over/under (e.g., 70/30).

- Holdbacks tied to production readiness (security hardening, a11y, analytics) rather than demos.

- Known-unknowns list (EHR certs, vendor re-tests, store reviews) with a ring-fenced contingency.

Why it works in healthcare:

- External gates (certifications, change windows) introduce variance; sharing risk keeps pace without denial about reality.

Write it so incentives reward evidence (acceptance tests, live pilots, uptime) instead of story points. That’s how you keep partnerships healthy through the messy middle.

Healthcare App Cost Estimation Framework

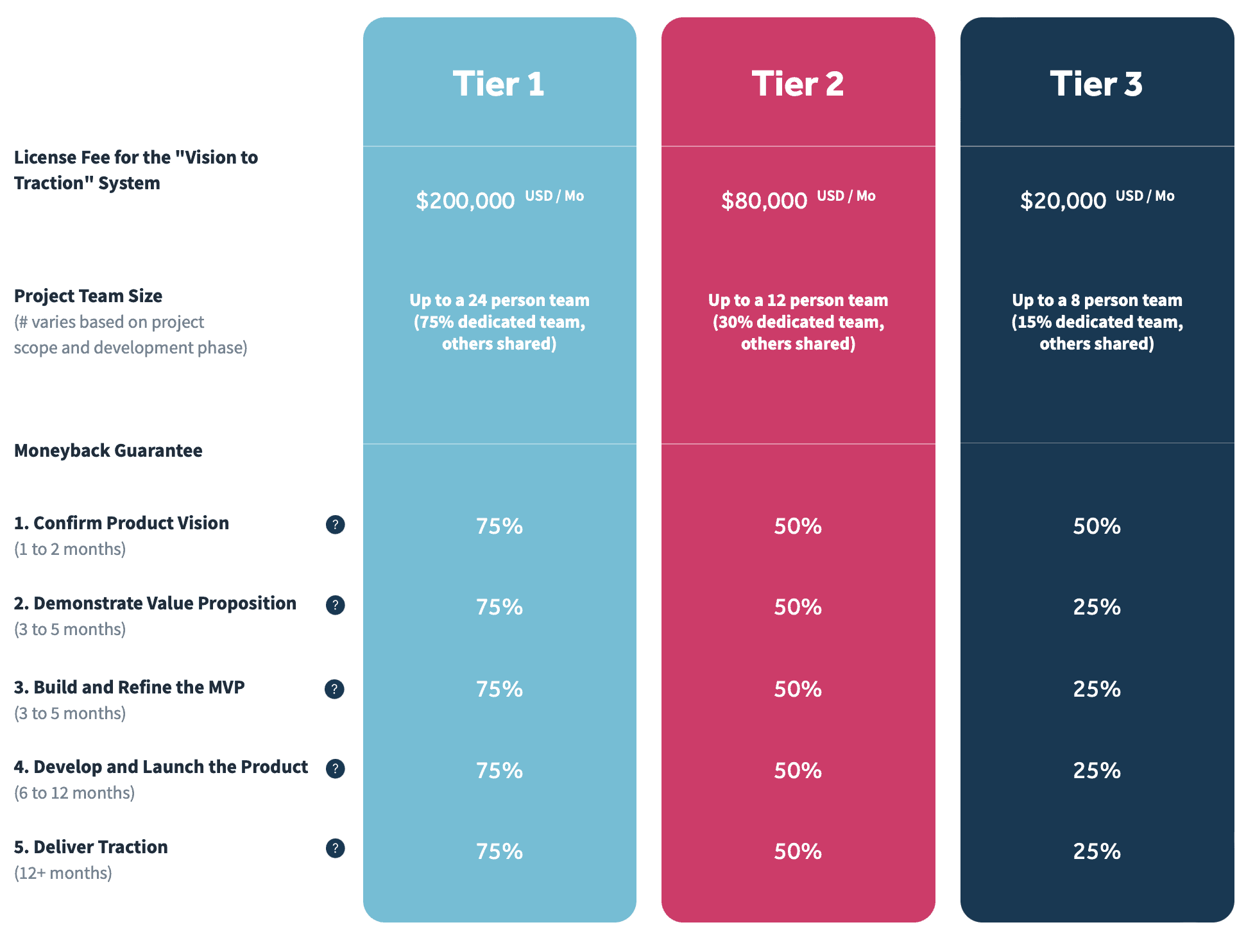

Our Vision-to-Traction System (VTS) allows you to collaborate with a tech partner who sticks with you throughout the entire process and guarantees your satisfaction. That’s a striking difference from a myriad of development shops that focus solely on the billable hour and don’t guarantee the result.

Our no-questions money-back guarantee is the first of its kind on the software development market. The MBG backs our price because we lose money if you are unsatisfied with the results. Compare that to any billable-hour deal that is out there. Our approach ensures every step aligns with secure standards, especially when working on a HIPAA compliant app development project.

Another key differentiator is how each of the five steps in the VTS provides visible results that will impress all your stakeholders. The activities we conduct at each step are based on a systematic playbook that has allowed the Topflight team to achieve consistently outstanding product outcomes for our partners:

- $200 million raised

- 50 million users reached

- Multiple acquisitions

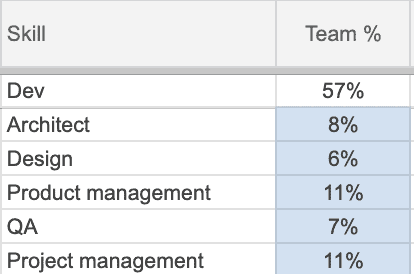

In short, Vision-to-Traction System allows you to hire a team of app development professionals who act like a super-qualified, well-organized, and coordinated team. And you don’t even have to micromanage or shuffle their full-time/part-time load: a project’s needs define that.

In terms of healthcare app development price, the VTS is very transparent:

As you can see, the VTS combines the best of fixed-price (guaranteed results) and time and materials (high flexibility). And best of all, the system has shown excellent outcomes for the healthcare industry, fintech, and other verticals.

How Vision-to-Traction System Affects Health App Development Costs

Imagine hiring a full-stack team with talent in all health app development-related disciplines: from HIPAA compliance and coding to design, QA, and DevOps. Now imagine you don’t need to worry about a full-time load; each team member comes just in time to move the project forward.

If you dig a little deeper, you’ll discover that the VTS consists of 5 steps:

- Step 1: Confirm Product Vision

- Step 2: Demonstrate the Value Proposition

- Step 3: Build and Refine

- Step 4: Product Launch

- Step 5: Deliver Traction

Each of these steps focuses on the main activities, goals, unique deliverables, and processes that spur the creation of genuine digital products.

NB: the VTS tier prices are subject to change (meaning the team may have updated the prices for tiers on the site; not that we change them during a project all of a sudden). To avoid surprises, we recommend discussing pricing structures early to ensure the proposed model aligns with your growth goals and budget trajectory.

Discovery Phase Cost Analysis

Discovery isn’t overhead; it’s the cheapest place to buy down rework. Price it as a bounded program with deliverables that directly drive your estimate—not as “a few meetings.” The goal: convert unknowns (clinical workflow, integrations, compliance) into acceptance tests and calendars you can budget against.

What you’re funding:

- Stakeholder interviews + workflow mapping (happy path, edge cases, handoffs).

- Integration scouting: vendors, sandboxes, rate limits, certification gates, change windows.

- Compliance track selection (HIPAA baseline vs SOC 2 vs light SaMD) and evidence plan.

- UX artifacts that matter (IA, key screens, copy for consent/audit-heavy flows).

- Risk register with mitigation options and a ring-fenced contingency.

Two outputs should anchor the price: (1) a scoping model (features × integrations × compliance surface) with explicit won’t-haves for v1; (2) a testable Definition of Done (contract tests at integration boundaries, WCAG checks, store-policy checklist). If discovery doesn’t produce these, you didn’t finish discovery—you ran workshops.

Budget guardrail: fund enough to prove feasibility on the riskiest thread (e.g., read-only EHR ingest + audit trail + consent copy), then size v1 from that evidence. Treat everything else as follow-on scope, not opinions.

Requirements Gathering and Cost Impact

Bad requirements don’t just blur scope—they tax your budget via rework, vendor ping-pong, and QA matrices that double overnight. Treat requirements as a cost control exercise: every line must be testable, bounded, and tied to a calendar (especially where vendors or app stores are in the loop).

What to capture (so estimates stop wobbling):

- Volumetrics & SLOs: MAU, peak concurrency, payload sizes, latency/uptime targets, error budgets.

- Access & consent model: roles/permissions, guardian/proxy rules, consent states, audit visibility.

- Integration contracts: exact endpoints, auth flow, rate limits, required certifications, change windows.

- Data definitions: PHI schema, IDs, lifecycle/retention, reconciliation rules (what wins on conflict).

- Non-functional musts: WCAG level, offline behavior, observability signals, backup/DR expectations.

Write each requirement as an acceptance test (“Given/When/Then” or a contract test) and link it to a Definition of Done. If you can’t prove it, you can’t price it.

Where cost hides:

- Ambiguous parity (“works like X”) → explodes QA matrices.

- Hand-wavy compliance (“HIPAA-ready”) → late security tickets.

- “Integrates with Y” → missing certs, sandbox→prod drift, and unbooked reviews.

Net: rigorous requirements shrink contingency and move dollars from “unknowns” to features that ship.

Prototype Development Investment

A prototype isn’t a tiny product; it’s a test rig to answer the few questions that most affect cost and timeline. Fund it to de-risk feasibility (rails), usability (workflow fit), and compliance surface—not to chase feature parity.

What to build (so money learns fast):

- One riskiest integration thread hitting a real sandbox (read-only first) with a contract test and basic rate-limit handling.

- Platform skeleton you’ll keep: auth, roles, audit log stub, env parity via IaC; UI can be disposable.

- Critical workflow slice (onboarding → one core task) with instrumentation for funnels and drop-offs.

- Failure-mode drills for the slice: offline, timeouts, partial writes; capture decisions as acceptance tests.

- Store/compliance checks (privacy labels, consent copy) to surface surprises early.

Keep PHI out, avoid vendor write-back, and skip edge features. The output isn’t “a demo”—it’s (1) a working spike you can reuse, (2) a refined estimate tied to acceptance tests, and (3) a calendar of external gates (certs, change windows, reviews).

Budget guardrail: time-box to a short phase (one or two sprints), reuse the platform skeleton, and treat everything else as follow-on scope. That’s how prototypes cut risk instead of creating throwaway code.

Full Product Development Budgeting

Budget the program, not just the backlog. Moving from prototype to product means funding features and the rails that make them durable: integrations, platform/security, QA/compliance, release ops, and post-launch obligations. Anchor dollars to outcomes + external calendars (EHR certs, store reviews, change windows), or your estimate is fiction.

Treat scope as envelopes rather than a single pot. Each envelope has its own Definition of Done and acceptance tests so trade-offs are explicit and auditable.

- Feature delivery: user-visible value slices, each releasable.

- Integrations: vendor onboarding/certifications, sandbox→prod parity, contract tests, re-test time.

- Platform & security: auth/roles, audit trail, secrets/keys, backups/DR, observability, IaC parity.

- QA/compliance: automated/regression matrix, accessibility, pen-test + remediation, store-policy checks.

- Release & ops: CI/CD, versioning, rollbacks, on-call/SLA readiness, launch playbooks.

Cashflow it with stage gates tied to acceptance evidence (not demos), and reserve a hardening sprint before go-live. Price schedule risk honestly: pre-book vendor reviews; limit parallel WIP to keep integration quality high; staff for senior ownership on the riskiest threads.

Plan the steady state up front: allocate a recurring ops/maintenance budget for dependency updates, vendor re-tests, incident response, and minor feature iterations. Scale envelopes (infra, observability, data pipelines) should only unlock when leading indicators (usage, org count, concurrency) cross your predefined thresholds.

The Influence of the Choice of the Contractor on the Formation of the Cost of the Creation of a Medical Application

It goes without saying that choosing the right technical partner plays a huge role in figuring out the cost to build a healthcare app. Two major factors come into play at this planning stage: location and type of partner.

Location

As you probably know, hiring an overseas team will lower the cost of healthcare app development. The typical range is between $30,000 and $120,000 based on the level of expertise and familiarity with HIPAA compliance and other specifics of medical apps.

However, be ready to micromanage and save a separate budget for thorough testing. The few times we dealt with the results of such teams’ work, the cost to remedy a product at least doubled from what the company had already spent to get a half-baked product.

A few other times, we let it go because the whole thing had to be rewritten from scratch.

So, the pros and cons of working with overseas developers include:

- highly volatile end results

- necessity to micromanage

- seemingly inexpensive

- language and cultural barriers

That’s not to say you’re completely safe working with US-based developers, as performance varies a lot here too. But you won’t run into cultural differences, and if you’re lucky enough, the team will have the right tech knack you need to build a decent health app.

Types of Development Partners

Regardless of their location, the typical list of partners you get to choose from includes the following:

- software development agencies

Sometimes they take on fancy names like digital product studios or digital agencies. But the bottom line is that these companies offer full-stack development and design services. Hence, they can take you from vision to a ready digital health application while completing all app development tasks with their resources.

Cost effects: usually, the cost to make a healthcare app with an agency is on the higher end.

- freelancers

Freelancers are an acceptable option as long as you agree to micromanage and have enough bandwidth to juggle a hundred balls in the air at the same time. My experience shows that founders end up hiring a dedicated project manager in-house to keep the ball rolling without losing efficiency. Even with that, we’ve had clients come up to us to finish an incomplete app, because they got bailed on by a freelancer mid-development.

Cost effects: cheaper compared to software development companies.

- hiring an in-house team

Hiring an in-house team can be prohibitively expensive compared to working with a software development shop or freelancers. Few companies, let alone startups, can afford a 7-figure payroll to hire a product team, developers, designers, QA and DevOps engineers, etc.

Cost effects: devastating unless you’re fully funded for 2 or so years to carry on.

Cost Tracking and Management Tools

Spreadsheets don’t ship code—but they do expose lies. Track cost by envelope (Features, Integrations, Platform/Security, QA/Compliance, Release/Ops), not by “task.” Tag every work item to an envelope, and tie payment gates to acceptance tests (not demos). Overlay a calendar of external gates (vendor certs, app-store reviews, change windows) so forecasts aren’t fantasy.

What to measure (keep it to five):

- Envelope variance: plan vs actual per envelope; rebaseline only with scope change.

- DORA trio for budget control: Lead Time, Change Failure Rate, MTTR—proxy for rework spend.

- Defect economics: escaped defects and rework ratio (rework hours / total); trend down before scaling team.

- Integration readiness index: contract-test pass rate, sandbox→prod parity, cert/re-test dates met.

- Compliance evidence coverage: % features with audit log, consent, access trails validated.

|

KPI |

Source of truth |

Cadence |

|---|---|---|

|

Envelope variance |

Finance tool + ticket tags |

Weekly |

|

Lead Time / CFR / MTTR |

CI/CD + incident tracker |

Weekly |

|

Escaped defects / rework % |

QA runs + issue tracker |

Per sprint |

|

Integration readiness index |

Contract tests + vendor calendar |

Weekly |

|

Evidence coverage (%) |

Test artifacts + store checklists |

Per sprint |

Bottom line: budget = evidence per dollar. If a line item can’t be proved by a test, a log, or a date, it’s not trackable—and it will blow up later.

Why Medical Apps Cost More Than Consumer Apps

It’s not “more screens.” It’s more risk, more rules, and more places to be wrong. Healthcare budgets skew higher because the work shifts from feature velocity to safety, compliance, and interoperability—the invisible half of the product.

What adds cost, concretely:

-

Compliance burden: HIPAA/BAAs, sometimes 42 CFR Part 2, retention windows, consent/redisclosure rules, attestations, and policy reviews (legal + security).

-

Auditability & data integrity: immutable audit logs, provenance, fine-grained RBAC, consent capture, and idempotent writes for clinical records.

-

Integration tax: EHR (FHIR/HL7/vendor REST), payer rails (eligibility/claims), pharmacy/eRx, device/RPM hubs—sandbox ≠ prod, version drift, and vendor certification cycles.

-

Safety-critical UX & validation: failure-mode handling (network, identity, partial writes), clinical edge cases, and structured notes that must reconcile cleanly downstream.

-

Security baseline (higher bar): threat modeling, encryption/key management, secrets rotation, backups/DR, pen-test remediation, and continuous monitoring.

-

Operational constraints: SLAs/SLOs for clinics, change-window discipline, incident playbooks, and on-call.

-

Release governance: App Store/Play compliance for health content, medical disclaimers, and internal approvals (privacy, security, legal).

-

Team mix: more QA (device/OS matrices), compliance oversight, and product/PM time to keep scope aligned with policy and integrations.

Regulatory Compliance Cost Premium

Compliance isn’t a line item; it’s a program that adds policy work, evidence capture, and re-tests on top of normal build. In healthcare, that premium shows up as BAAs and consent flows, immutable audit trails, store privacy disclosures, and certification calendars you don’t control. Net effect: compared with a similar consumer app, expect a larger slice of budget to shift from UI into backend/security, integrations, and QA/compliance.

Where the premium lands:

- Policy & evidence: consent/redisclosure rules, retention windows, attestations, internal reviews.

- Auditability: fine-grained RBAC, immutable logs, idempotent writes for clinical records.

- Governed releases: change windows, store policy checks, incident playbooks.

Planning yardsticks (use your existing ranges):

- HIPAA hardening: +$10K–$25K, +1–2 wks.

- FDA SaMD (Class I–II): +$25K–$80K, +3–8 wks.

- SOC 2 support: +$15K–$60K, +2–6 wks.

Budget move: treat compliance as its own envelope with acceptance evidence (audit-log checks, permission matrices, privacy labels, pen-test remediation verified). Price the calendar risk up front—vendor reviews and re-tests are work items with dates, not “extra hours.”

Security Requirements Cost Analysis

Security spend isn’t “nice-to-have hardening”; it’s a program that soaks both build hours and ongoing ops. The premium shows up in three buckets: design controls (RBAC, encryption posture, secrets hygiene), operational controls (monitoring, backups/DR, incident runbooks), and verification (SAST/DAST, pen-test remediation). Directionally, plan an extra +5–10% of build versus a comparable consumer app—and expect higher steady-state OPEX.

Where the money actually lands:

- Design controls (build-time): fine-grained RBAC and PHI scoping; key management/rotation; envelope encryption; secure UI patterns (masking, consent UX, session hygiene). These are feature-level tasks, not just platform toggles.

- Operational controls (run-time): logs/metrics/traces wired to SLOs, alerting, disaster-recovery drills, environment parity via IaC (dev/stage/prod). You’re funding on-call sanity, not just dashboards.

- Verification (prove it): external pen-test plus fixes and re-tests, dependency/SBOM hygiene, and periodic access-control reviews. Budget the remediation, not only the report.

Budget guardrails:

- Ring-fence a Security & Privacy envelope with acceptance evidence (audit-log checks, permission matrices, key-rotation proofs).

- Time-box a hardening sprint before go-live (a11y + analytics + ops included) and treat it as non-negotiable.

- Keep IaC parity and contract tests at integration boundaries so security doesn’t collapse under sandbox→prod drift.

Net: you’re not paying for paranoia—you’re buying evidenceable safety that survives audits, outages, and upgrades.

Integration Complexity Pricing Factors

Integrations aren’t “just an API”—they’re engineering plus vendor onboarding, certifications, and calendars you don’t control. Pricing scales with data direction (read-only vs. write-back), vendor count, and how much legacy glue (adapters/normalization) you need. Read-only is cheap; write-back into EHR/RCM is not.

Levers that move price:

- Scope & direction: Read-only FHIR typically adds a small increment; limited write-back (orders/notes) adds materially more due to validation and reconciliation.

- Certifications & reviews: Mandatory vendor certs, sandbox→prod parity checks, and app-store privacy reviews add real hours—plan them as dated work items, not “buffer.”

- Version drift & change windows: Upgrades to EHR, payments, video/auth SDKs trigger re-tests; book around change windows to avoid idle time and rework.

- Throughput & throttles: Rate limits and concurrency needs (e.g., video, RPM bursts) drive queuing/retries and test harnesses, increasing effort.

- Multi-vendor multiplier: Each additional vendor compounds mapping, testing, and ops. As a planning guardrail, multi-vendor stacks often warrant a 30–50% overhead envelope.

Budget moves:

Set per-integration not-to-exceed caps and add a 10–20% contingency for vendor reviews and sandbox→prod drift. Keep single-threaded ownership for each integration, enforce contract tests at boundaries, and reserve a hardening sprint before go-live. Treat re-tests as first-class tasks with dates.

Rule of thumb: one vendor, read-only → predictable; write-back or multiple vendors → expect calendar risk and higher QA/ops spend.

Healthcare App Cost vs Traditional Software Development

For a quick cost comparison healthcare app vs consumer app, use this side-by-side to set expectations:

|

Cost driver |

Consumer app (typical) |

Healthcare app (typical) |

Budget effect |

|---|---|---|---|

|

Compliance & governance |

App Store/Play + basic privacy |

HIPAA/BAAs, (optionally) 42 CFR Part 2, consent/redisclosure, attestations |

+10–20% scope for policy, docs, reviews |

|

Security baseline |

Auth, TLS, basic hardening |

Encryption at rest, key mgmt/rotation, secrets hygiene, IR runbooks |

+5–10% build; adds ongoing ops |

|