What if taking out a loan was as easy as ordering a pizza from your phone?

Today’s consumers, spoiled by the on-demand economy and burdened by pandemic-related restrictions, crave more services accessible from the comfort of their homes. That’s why developing fintech apps, especially a loan app that allows on-demand money lending is becoming a necessity for many lenders.

So if you’re planning to build a loan app, you couldn’t choose a better time. In this guide, we’ll let you in on every little detail about creating trustworthy, personalized, and overall successful lending experiences.

So if you’re planning to build a loan app, you couldn’t choose a better time. In this guide, we’ll let you in on every little detail about creating trustworthy, personalized, and overall successful lending experiences.

Top Takeaways:

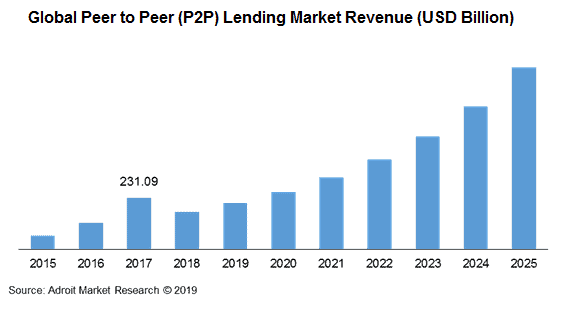

- Peer-to-peer loan lending app development is the most lucrative direction in the loan app development industry, promising more than a 2x growth by 2025.

- Before you create a loan app, consider whether you want to offer unique mobile experiences for lenders and borrowers, in which case you will need two separate apps working together.

- How to build a loan app that stands out from the crowd? The loan app development market research shows that solutions running on AI/ML and blockchain protocols, allowing to lend/borrow crypto, generate the most traction.

Read on to learn how to build a loan app.

Table of Contents:

1. Lending Apps Market in 2020

2. Why You Should Create a Loan App

4. How Money Lending App Works

5. Security and Legal Compliance

7. 7 Steps to Build a Loan App

8. How Much Does It Cost to Develop a Loan Lending Mobile App?

9. Our Experience in Loan Lending App Development

10. Time to Build Peer-to-peer Lending Apps

1. Lending Apps Market

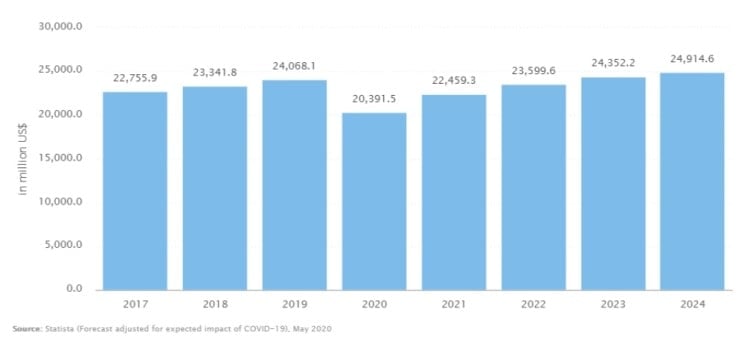

Let’s quickly review what the loan apps marketplace looks like.

Clearly, the demand is there. But how do you make sure it’s your lending app that takes a decent slice of this billion-dollar pie?

Well, first of all, it’s worth exploring what type of a loan app you can build. We’ve touched on it when talked about how to create a fintech app, but lets dive into more details.

Lending Apps by Types of Loans

First of all, loan apps differ by types of loans they can offer to borrowers. Today, we can take out loans for practically any financial situation:

- Mortgages (home loans)

- Car loans

- Student loans

- Personal

- Small business loans

It’s worth noting that personal loans are the most versatile type of loans in the consumer market.

Borrowers take out personal loans to deal with all sorts of emergencies: from car or home repairs to credit building to covering gaps in daily expenses to debt consolidation.

In contrast to personal loans, student, car, home, and business loans must be used for a specific purpose. We’ve also talk about building a loan calculator in the past.

Lending Apps by Types of Lenders

We can also differentiate lending apps by lenders. There are three types of entities that provide loans via mobile and online apps:

- Banks and other traditional financial institutions

- Credit unions

- P2P lending platforms

Banks have offered loans for a long time. It’s one of their main products. And so, many banks and other financial organizations add a mobile lending option as another feature in their mobile banking apps.

Unfortunately, such features often serve only as the starting point for consumers to initiate the loan process, and they still have to visit a bank to get a loan.

Credit unions are similar to banks; however, the borrower needs to join a union and sometimes spend some time with it to take out a loan. We’ve also discussed creating a neobank in this other blog, however that falls under a different umbrella.

P2P loans issuing companies are the real industry disruptors. These are online and mobile lending platforms that match investors with borrowers. Companies like LendingClub and Prosper saw the opportunity to take customers through the entire lending process on their smartphones and desktops.

Lending Apps by Technology Stack

Loan applications are a big part of the fintech revolution that is all about digitizing financial relationships. And as such, they take full advantage of the latest technologies:

- Blockchain and smart contracts

- Big data

- Machine learning and AI

- Chatbots

The blockchain technology powers those lending apps offering borrowers cryptocurrencies, e.g., Bitcoin, Ether, or Litecoin. Big data, coupled with AI algorithms, allows lenders to make better decisions about most appropriate interest rates and loan amounts.

And chatbots help to take the load off lenders’ front offices and personalize the experience for customers.

2. Why You Should Create a Loan App

Now that we know the demand for mobile lending products is expected to grow, let’s see what value they offer on both ends.

Benefits for customers

Loan apps exist for a number of reasons. They make customers’ lives easier by removing the need for face-to-face interaction with financial organizations. Here’s how borrowers benefit from using a loan application:

- Apply for a loan virtually from anywhere without visiting an office

- Get money to a banking account within a day

- Rest assured that your personal information is protected

- Shop for the best options available

- Quickly repay a loan from the same app

Benefits for lenders

Lenders, too, get value from making their services available online and on mobile. Since there’s no face-to-face communication with customers, lenders can cut their operating costs and focus on serving more loans.

- Reduce operating costs

- Speed up KYC procedures

- Serve more customers simultaneously

- Reach underserved markets

- Improve lending products using AI

As we can see, both borrowers and lenders have plenty of benefits when the lending process takes it to the cloud or mobile technologies.

Also read: Build a Crypto Exchange

3. Best Consumer Lending Apps

It’s worth spending time on researching your competitors before developing a loan app. That way, you can build on their weaknesses and think of unique features that will set your app apart. Without further ado, here are some best money lending apps available today.

Prosper

Headquarters: San Francisco, California.

Description: a p2p lending platform that has been on the market since 2005. Their platform connecting investors’ money with borrowers has already helped over a million individuals, lending $17B. Their online lending app automatically recommends loans based on a borrower’s profile.

Mobile presence: iOS and Android apps for investors, but none for borrowers. The latter can use their online app on desktop and mobile browsers.

Upstart

Headquarters: San Carlos, California

Description: a p2p lending platform that relies on AI for risk management. Besides the FICO score and credit history, the system takes into account such borrower’s data as their education and employment history to predict their creditworthiness.

Mobile presence: no mobile apps, accessible via mobile browsers.

LendingClub

Headquarters: San Francisco, California

Description: a p2p lending web application that has been around since 2007. LendingClub focuses on four types of loans: personal, business, auto refinancing, and medical loans. The company has served over three million customers, giving out over $50B worth of loans.

Mobile presence: iOS and Android apps for investors allowing them to control their investment portfolios. Borrowers can use the mobile version of the company’s site.

Avant

Headquarters: Chicago, Illinois

Description: Avant stands out with a separate mobile app for iOS and Android that borrowers can use to track their payment history, make payments, and get notifications about their account details. The company also offers additional options like a branded credit card.

Mobile presence: stand-alone mobile apps for both platforms and mobile web experience.

Funding Circle

Headquarters: London, UK

Description: Funding Circle is a p2p lender helping small businesses get loans by crowdfunding investments. The service stands out with lower rates but requires good personal credit and an established business for small business owners to qualify.

Mobile presence: mobile apps (iOS and Android) for investors and a mobile web experience.

4. How Money Lending App Works

An ideal loan app would take a customer through the entire borrowing process: from application to funding.

Onboarding

A customer would land on a loan app’s page in the app store following a link in an install-prompting banner. It’s a smart banner that rolls when users are browsing a site associated with a native mobile app.

Once in the app, users go through a registration process and arrive at a screen with loan options. There are a couple of variants for implementing loan options: it can be a catalog with different types of loans or a dynamic screen where users can pick various loan parameters.

After selecting a loan, users need to submit their personal details, such as:

- Education

- Residence

- Employment history, etc.

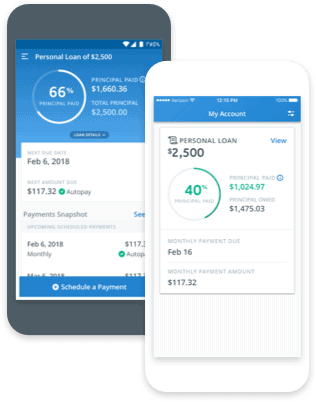

Daily Usage

The next step is to hook the loan app with your bank account details and set up auto payments. It’s necessary to enable loan repayment as due dates for interest payments start to arrive.

Now, it’s the lending app’s job to keep the user updated on their payments. The app must display upcoming and completed payments, and fire up notifications. Users should have options to adjust their payment dates and make early payments right in the app.

Some loan apps allow users to also manage other financial products they’re getting from a lending platform. For example, Avant’s loan app users can manage their company-branded credit cards:

• Schedule or cancel payments

• View transactions

• Add or remove payment methods

Working with experienced custom mobile app developers can make all the difference when creating secure loan apps.

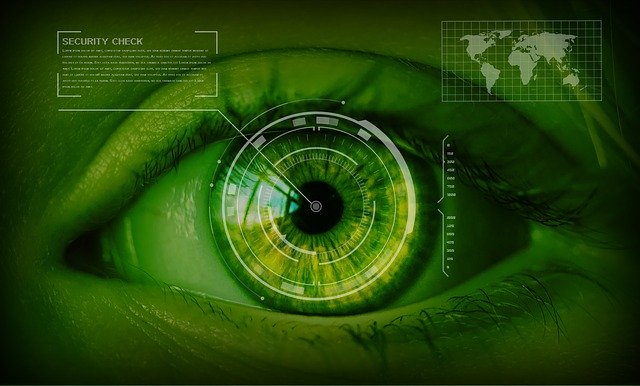

5. Security and Legal Compliance

Imagine yourself contemplating the idea of taking out a loan. What is the first thing you will consider? That’s right! Security. It’s essential in how customers choose where to borrow.

So your money lending app should carry the sense of safety and security to establish trust with users. There are several ways you can do this. Some of them are customer-facing while others remain under the hood.

Authentication

It goes without saying that a lending app must provide a secure way to authenticate users. Today, smartphones come with various means for biometric authentication, e.g., face recognition or fingerprint scanning. Use their APIs to help protect user data.

Services like Twilio or Duo can help you take authentication security even further with 2-factor authentication. An ideal scenario is when your loan app allows customers to use a strong password and falls back on a short pin or bio authentication methods for more straightforward authorization.

Encryption

Since customers will be submitting sensitive information through the app, it’s highly advisable to encrypt all data at rest and in transit, using a secure connection to servers.

Technologies that enable bank-level encryption have been on the consumer apps market for a while. So there’s no excuse to leave out such encryption in your money lending app.

Legal Compliance

Besides technical aspects, you should also take into account legal matters. Like any financial application, loan apps must adhere to regulatory compliance that may vary between states and countries.

6. Must-Have Features

To make a money lending app that will win users over, you should carefully consider its feature set. To make your life easier, let’s look at the features that a loan app must have at an MVP stage when you are probing the market, and then review some additional options.

MVP Features

An MVP lending product should provide the following functionality to users.

Registration

Users should be able to quickly register with the app using their social handles or a phone number. The less friction you create at this stage, the higher will be user adoption. Remember that you can get user data later on when they start applying for a loan.

User Profile

That’s where users can upload their personal information and edit details. A nice best practice you can apply when developing the user profile is hiding their details by default. But for the first-time use, consider adding some template info to all fields as a hint.

Loan Application Form

This feature will be the core of your application. Users will appreciate it if you break the loan application procedure into distinct steps, guiding them throughout the process, and displaying the progress.

Payments Log

Once a loan has been funded, customers will need a place to see all pending and completed payments. They should also have the remaining debt amount available at a glance.

Notifications

Push notifications will advise users on next payments. You may even add some additional logic when you notify a couple of days before the payment, on the due date, and if they missed a payment.

Related: MVP App Development Guide

Add-on Features

Payment Options

Allowing users to add and edit their bank accounts will ensure that they can start loan repayment right from the app. You can go a step further by helping your users enroll in autopay.

Loan applications can enhance their user experience by including features that help customers make a bitcoin wallet for secure loan disbursements in crypto.

Live Chat Support

Even though lending apps excel at removing the need for face-to-face communication with a clerk, your customers are still likely to request help. And live chat with your representatives can be a great way to deal with such situations.

Chatbot

When your customer service representatives are not available, a chatbot will help users resolve basic issues and explain how the app works.

Geolocation

If your product allows users to get cash via ATM, you can use geolocation to help them find the nearest spot where they can do this.

Credit Score

You may also choose to integrate your application with a credit score service. This feature will help customers to better understand their loan eligibility.

7. 7 Steps to Build a Loan App

Here we assume that you have already done some groundwork by studying your buyer personas and therefore have defined your target audience. What do you do next?

#7.1: Choose a platform

To create a money lending mobile app, you first need to decide which platforms it will support. Will it be accessible only on the web, or do you plan to make dedicated mobile apps for borrowers and investors too?

Since you’re likely to target mass consumers, it’s a good idea to consider cross-platform app development frameworks. Using multi-platform app development tools like React Native, you can expedite peer-to-peer loan lending app development.

Related Article: Swift vs React Native

#7.2: Make a list of features

At this step, you decide which features your lending app will provide and how it will differentiate from the competition.

Mobile app for borrowers

We’ve already referenced the list of must-have and add-on features above. That list can serve as a good starting point. Just make sure your app provides some unique functionality.

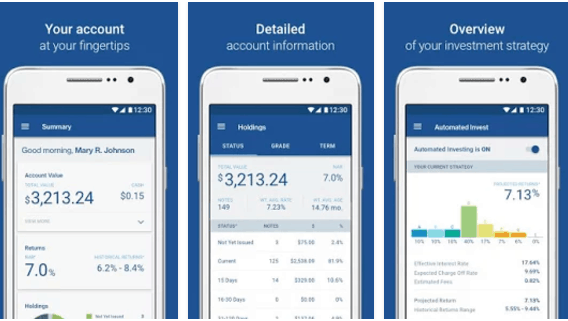

Mobile app for investors

Don’t forget that when you create a p2p lending app, there are two parts of the equation: borrowers and lenders (aka investors). The latter might need their own app to manage their investment portfolio and choose loan options they want to invest in.

Web app for back-office employees and admins

A web portal for managing loan apps is something that many entrepreneurs overlook. Remember that you will need to track requested and funded loans, payments, and manage everything else that happens in the mobile apps.

#7.3: Review available SDK/APIs and libraries

You don’t need to reinvent the wheel. There are plenty of components available on a plug-in basis. That’s why after you’ve figured out the features, you should spend some time reviewing what building blocks (in the form of SDKs, APIs, and code libraries) for your app are already available. Here are a few examples:

- Plaid for securely connecting to bank accounts

- Twilio for adding a chat and 2-factor authentication

- Facebook/Twitter/Google/Apple for quick login

By picking the right combination of these modules, you can significantly improve your time to market and, at the same time, trim the app development budget.

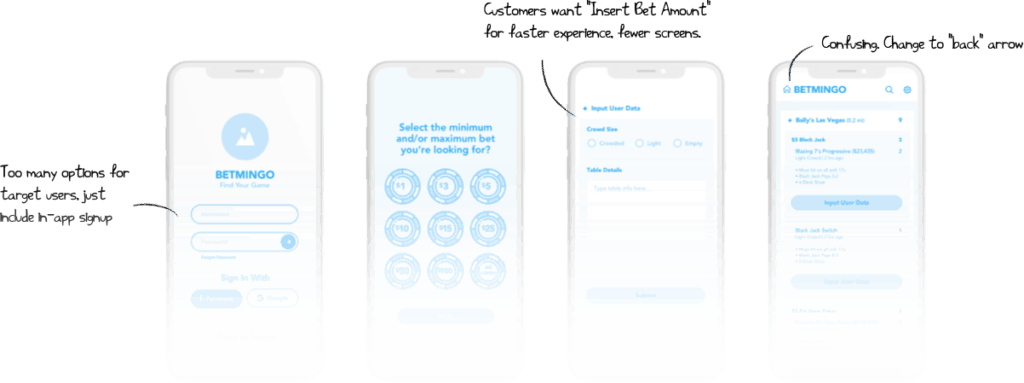

#7.4: Hone in on the UX and UI

The UX and UI of your loan app can make or break the entire business. Move from low-fidelity wireframes to high-fidelity mockups, carefully testing each screen with customers.

A clickable prototype will help you on this path to greater user experience.

#7.5: Develop an MVP

After you’ve verified the UX and UI with test users, it’s time to build an MVP version of your loan app. Bring in a qualified loan app developer to build a loan application and a web portal for administering loans.

This step is all about putting the most essential features that will help you gain traction into code.

Related: Read our guide to hire mobile app developers to help you build a winning app.

#7.6: Iterate based on user feedback

Once you have released your application and tested it with real customers in the wild, it’s time to capitalize on user feedback. Another instrument to gather insights on areas for improving your app is built-in analytics that tracks user journeys and helps you identify potential roadblocks.

#7.7: Maintain the app

Mobile operating systems keep evolving, adding new features, and presenting new opportunities to improve user experience. And so it’s critical to keep your loan app up-to-date leveraging new OS functionality to the fullest extent.

For instance, since iOS 13 (that’s been around for almost a year), your app is expected to support the Dark Mode. And moving to iOS 14, it may be useful to develop an app clip — an extension of your app that allows customers to use your loan app without even installing it.

Another idea is to implement a live widget for the home screen that shows the due date and amount for the next payment.

8. How Much Does It Cost to Develop a Loan Lending Mobile App?

From our experience, loan app development can cost somewhere between US $ 48,000 and $84,000 based on what features you want. If you did your homework and researched off-the-shelf SDKs thoroughly, your loan app’s development budget is likely to go down.

Some of the options that tend to rack up the price include:

- Machine learning

- Cryptocurrency and smart contracts

- Big data integration

Remember that you will need a full-stack loan lending app developer to implement both a mobile app and the back end: from design to actual delivery. How long it will take to develop your app will depend on a variety of factors from where in development stage you are to what features you’re looking for.

9. Our Experience in Loan Lending App Development

At Topflight Apps, we’ve worked on several lending platforms. One of them is an AI-driven application for SMB loan applications, risk assessment, and repayment. The app utilizes a custom-developed neural network to assess borrowers’ eligibility based on banking, accounting, and social media data.

Other examples of fintech apps we designed and built include a marketplace development project that lets users find financial investment consultants based on portfolios and mobile apps to analyze user spending habits and project their future expenses.

The mobile apps are also accompanied by a web portal for financial advisors who may consult customers and educate them about smart budgeting.

10. Time to Build Peer-to-Peer Lending App

Now that we’ve covered everything you need to know to custom develop your app, it’s time to get to work. We’re app developers in NYC, LA, Miami, and our team is here to help you. Let us know where in the process you are and whether you have questions around costs, design and development, or app monetization strategies, and our team of experts will walk you through all necessary steps to create a money lending app that will stand out.

Related Articles:

- How to Make a DeFi Lending Platform

- How to Create a Fintech Startup

- How to Develop a Trading and Investment App

- Create a Mobile Wallet App for Digital Payments

[This blog was originally published on 7/22/2020, but has been recently updated]

Frequently Asked Questions About How to Create a Loan App

Can I develop just the mobile app?

No, you have to build the back end to manage loans and customers. Alternatively, you could also integrate the app with an existing lending platform.

Do I need to develop a loan application as a native mobile app?

You can provide customers with mobile experience by making your lending product available via mobile web browsers. Alternatively, you could also develop a PWA lending app. Of course, native apps are capable of providing your users with outstanding experience.

Can I develop an app for an existing lending platform?

You’d have to discuss the terms with owners of such a platform. You cannot develop a loan app at your own discretion and hope that it will work with a lending platform. You’ll need access to the platform’s API to hook your app with it.

What resources do I need for money lending application development?

Ideally, a team of full-stack fintech developers: mobile developer(s), back end developer(s), a DevOps engineer, QA engineers, and a UX/UI designer. Oh, and a project manager to get the whole team rolling smoothly.

How long does it take to make a loan application?

3-4 months to get out an MVP and 6-8 months for a full-fledged system.