People looove their mobile wallets. They fit in a smartphone (no need to carry those bulky physical wallets), provide more robust security (compared to flashing a credit card in public), and allow us to pay virtually for anything (and do so much more) from the comfort of our homes.

If you’ve identified a unique opportunity and want to create a digital wallet, you’re in the right place. In this blog, you’ll learn how to create a wallet app, some of the best practices, and what you need to win in this highly competitive niche.

Top Takeaways

- Digital wallets will rule e-commerce payments in the near future (40% by 2024), highlighting the growing importance of digital wallet mobile app development.

- To develop a mobile wallet with a sticky user experience, you must carefully consider the type of solution you want to build. The main types of e-wallets include open, closed, crypto, and mobile banking extensions.

- Mobile wallet development process involves a lot of legal formalities and implies following strict security regulations, including Payment Card Industry Data Security Standard (PCI DSS).

Table of Contents

- E-Wallet Market Overview

- Examples of the Successful Mobile Wallets

- Why To Make A Digital Wallet?

- Types of the Mobile Wallet Apps

- Must-have Features of an E-Wallet

- Technologies Used When Building a Digital Wallet

- 5 Steps to Create a Wallet App

- How Much Does It Cost to Build Your Own E-Wallet App?

- Challenges Of Building A Digital Wallet

- How To Set Up A Digital Wallet for Success?

- How Topflight Can Help

E-Wallet Market Overview

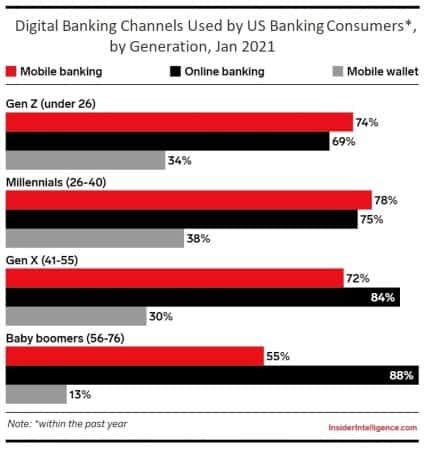

The COVID-19 pandemic made a huge impact on the mass adoption of digital wallets as with every other aspect of fintech app development. According to Finaria, the industry will grow to $2.4 trillion in 2021 (a 24% increase from 2020) and may reach $3.5 trillion by 2023.

- 32% of mobile wallet users rely on three or more digital wallets

- 40% of all US e-commerce payments will be handled via digital wallets by 2024

- 67% of retailers accept contactless payments at PoS terminals

- more than four out of 10 US smartphone users used a contactless payment system at least once in 2021

- the average annual spend per mobile wallet user is expected to grow to $2,439.68 in 2021

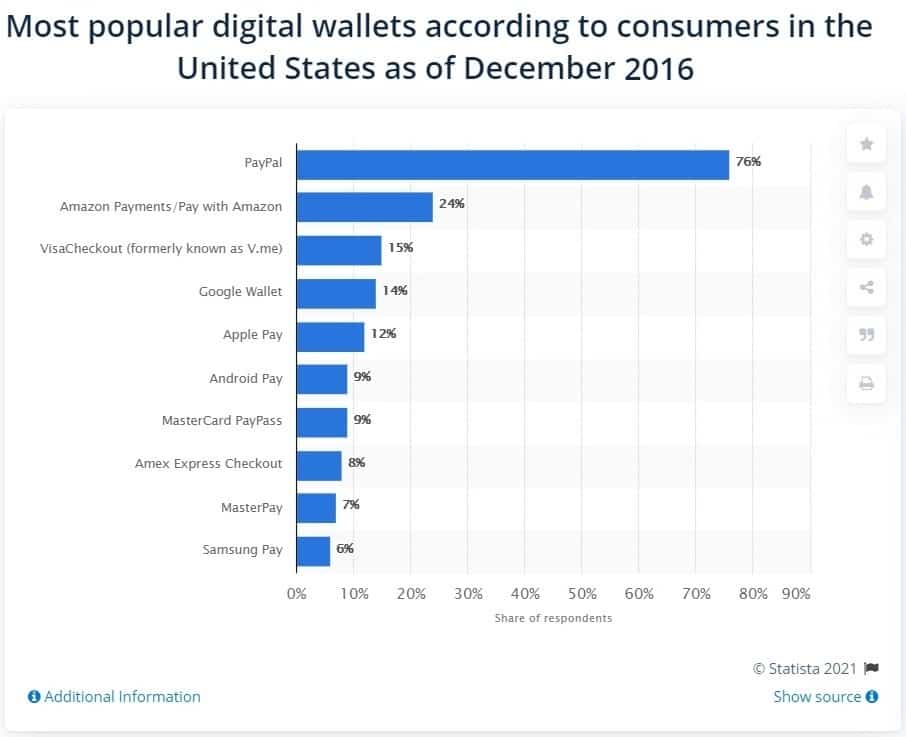

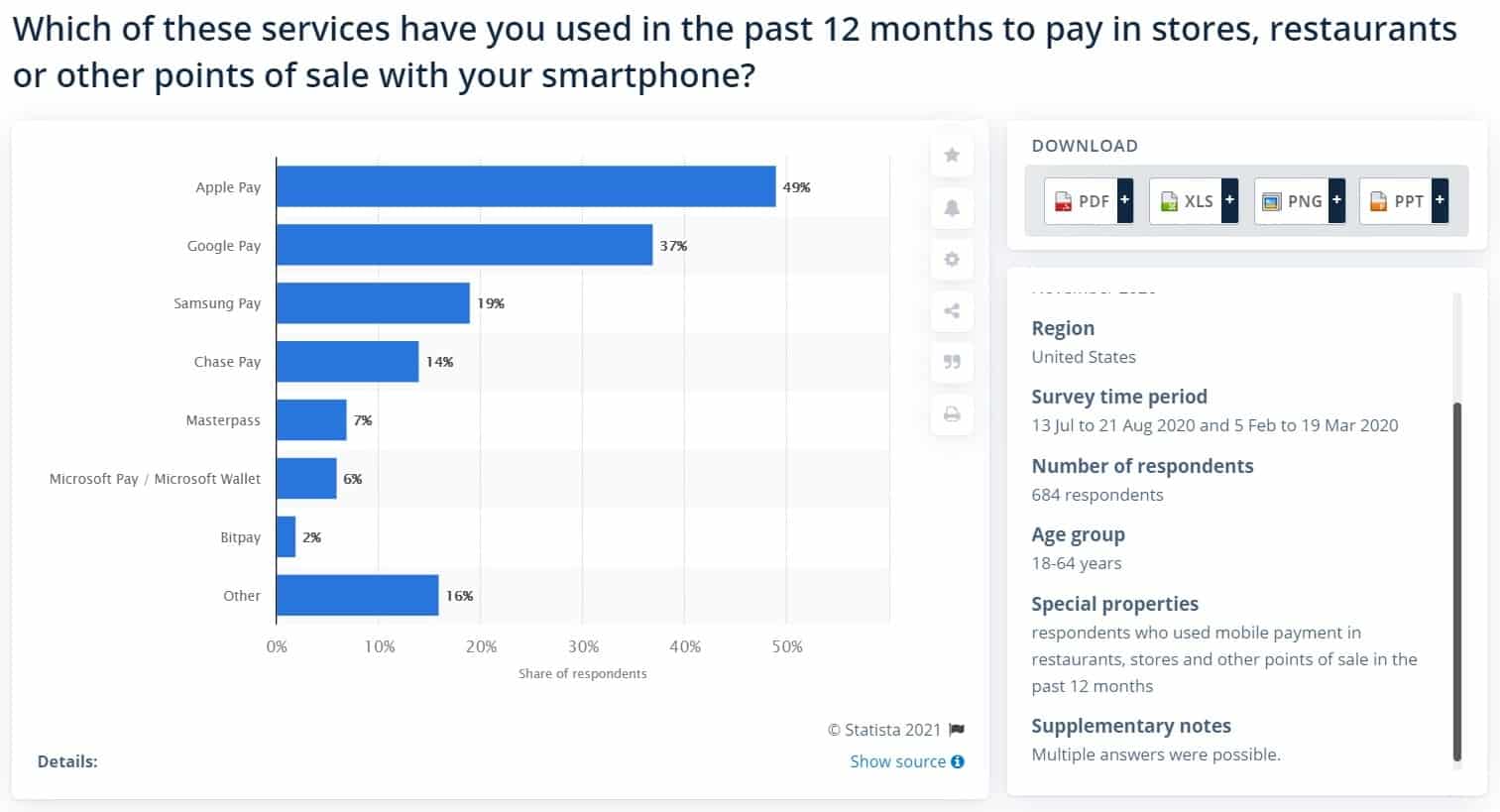

It also seems that the mobile wallets from tech giants like Apple, Google, and Samsung outperform all other competitors in the space. Compare these graphics to see what Apple Pay, Google Pay, and Samsung Pay have been able to achieve in five years:

VS.

Indeed, the competition in the digital wallet space is fierce with many contenders like Venmo, PayPal, Cash App, Walmart Pay, and Facebook Pay vying for consumers’ attention in the US. Want to make a wallet app that stands out? We’ll delve into the different types of e-wallets and examine the most successful ones in the upcoming sections. These insights will help you gauge the mobile payment market size and tailor your app to meet specific business needs.

Digital wallets, being virtual counterparts of our physical wallets, come with fewer restrictions. They offer us the flexibility to not just add the ubiquitous debit and credit cards, but also gift cards, passcards, rewards, coupons, and other cards with monetary value. This versatility is what’s driving the growing adoption of mobile wallets across the globe.

Crypto

Now, it looks like e-wallets want to go further by connecting to decentralized finance services (DeFi) and crypto. For example, Venmo allows its customers to trade the most popular cryptocurrencies, while PayPal does the same and, on top of that, supports crypto payments. The latest news (August, 2023) is that PayPal will introduce its own stablecoin in its digital wallet solution.

With this emerging trend, the question arises: How can one make an ewallet app that not only supports traditional transactions but also incorporates crypto and DeFi services? The answer lies in partnering with an experienced app development company that understands the intricacies of fintech and blockchain technologies.

Related: Smart Contract App Development: The Complete Guide

Partnerships with banks

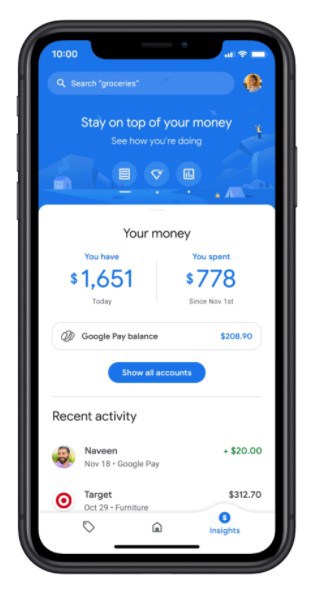

First, mobile wallets have taken down standalone e-wallets by major banks, and now they want to step back and integrate with banking services to offer more value to their customers. For example, Google is working on a GooglePlex update to its Google Pay wallet, which will provide savings and checking accounts from leading banks.

Samsung Pay has recently partnered with SoFi, a personal finance company, to provide a seamless money management platform right inside Samsung Pay. As a result of these new partnerships, customers can order credit cards right inside a wallet app and access other financial services, such as budget management or investing.

In light of these developments, are you considering building a digital wallet app that integrates diverse payment methods beyond physical cards? With global mobile wallet users projected to surpass 2.1 billion by 2023, offering such features becomes simpler if you consider piggybacking on established financial institutions’ services. Leveraging their expertise in wallet application development can significantly enhance your app’s functionality and user experience.

Related: How to Make a Mobile Banking App

Identities and virtual keys storage

Apple Pay will be rolling out support for driver licenses, virtual hotel keys, and select BMW vehicles, which they ultimately envision as a feature for storing all kinds of virtual keys. We already take our phones with us everywhere we go. So why not carry less stuff, right?

Indeed, the move towards a more digital, less cluttered lifestyle is undeniable. If you’re considering to build your own digital wallet app, it’s crucial to conduct thorough market research to understand the needs and preferences of your target audience. After all, the key to success in the digital wallet space lies in creating an easy-to-use application that not only simplifies transactions but also offers innovative features like storing virtual keys and identities.

Finance hub

I think it’s safe to say that e-wallets are gradually turning into sort of financial hubs for their owners because it’s very convenient to manage all your finances in one place. I literally envision how mobile wallets clash with mobile banking apps, and we see more exciting mergers and acquisitions.

Examples of the Successful Mobile Wallets

Before you build a wallet app, it makes sense to look at what the industry leaders are doing.

Apple Wallet

Apple Wallet is a nifty little app behind Apple Pay, which is the #1 mobile payment option in the US at the moment.

Users can add their credit and debit cards, gym passes, loyalty cards, tickets, virtual keys, and soon IDs in the app.

Apple Wallet is also the place to set up Apple Cash — an easy way to send and receive money while messaging.

Walmart Pay

Walmart is an iconic example of a closed wallet that serves more as a virtual storefront than a wallet. Customers can only use the app to buy stuff at Walmart and fuel at select gas stations. The app uses QR codes and NFC to accept payments at self-checkouts.

Taking a leaf from Walmart’s playbook, if you’re planning to create an online wallet app, remember to provide a seamless experience across different operating systems. It’s not just about making transactions simpler; it’s also about securely storing payment information and offering customers the flexibility to shop whenever, wherever they want. Isn’t it exciting to contribute to the future of retail? Effective digital wallet implementation can ensure these features are both robust and user-friendly.

Cash App

Cash App positions itself as an e-wallet/banking app. Still, since it’s not tied to any specific bank, the app offers its customers a wide range of options. Not only can they make online payments, send and receive money, but there are also such features as investing, buying crypto, and instant discounts.

Why To Make A Digital Wallet?

Before you go and create an e-wallet app, it helps to spend some time understanding the motivations behind investing in digital wallet application development so that you can make strategic decisions that drive significant business growth.

Addressing Consumer Demand

The modern consumer expects seamless, quick, and secure payment options. Digital wallets meet these expectations by providing:

- Convenience: Users can store multiple cards and payment methods in one place.

- Enhanced Security: Features like encryption and biometric verification reduce fraud risks.

- Speed: Transactions are faster compared to traditional payment methods, benefiting both consumers and merchants.

Strategic Business Advantages

For enterprises, developing a digital wallet is not just about meeting consumer needs; it also presents substantial business opportunities:

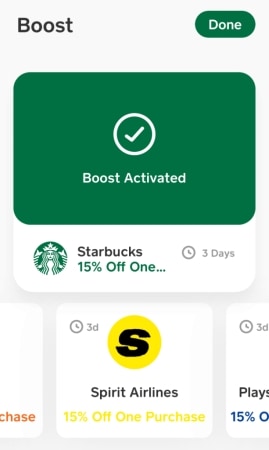

- Increased Customer Engagement: By integrating loyalty programs, reward points, and personalized offers, digital wallets can enhance user engagement and retention.

- New Revenue Streams: Offering premium features, transactional fees, and partnerships with other financial services can create additional revenue lines.

- Data Insights: Digital wallets provide valuable data on consumer behavior and spending patterns, which can be leveraged for better decision-making and targeted marketing.

Read more on enterprise mobile app development.

Staying Competitive

The fintech industry is highly competitive, and adopting innovative technologies is crucial for staying ahead. Developing a digital wallet helps businesses:

- Differentiate from Competitors: Offering unique features and superior user experience can set your app apart.

- Adapt to Market Trends: The rise of contactless payments and cryptocurrency integration necessitates a forward-thinking approach.

- Regulatory Compliance: Ensuring your digital wallet complies with relevant regulations can build trust and credibility among users.

Technological Integration

Digital wallets serve as a hub for various technologies and financial services, such as:

- Blockchain and Cryptocurrencies: Integrating these technologies can attract tech-savvy users looking for advanced financial solutions.

- IoT and Wearables: Compatibility with smartwatches and other IoT devices enhances accessibility and user convenience.

- Banking Partnerships: Collaborating with banks can expand the range of services offered, such as instant loans, investment options, and savings accounts.

Understanding the multifaceted benefits of digital wallet implementation, from enhancing customer satisfaction to opening new business avenues, is crucial for any enterprise considering this path.

By analyzing market trends, leveraging technological advancements, and focusing on user-centric features, you can create e-wallet apps that not only meet but exceed market expectations.

Types of the Mobile Wallet Apps

Not all e-wallets are created equal. If we look closely at all the apps available, we’ll soon discover that their functionality and area of application differ quite a bit. So without further ado, let’s review the most popular types of mobile wallets.

Open-loop / closed-loop mobile wallets

Also called open and closed for simplicity, these wallets differ by where you can use them. If you can pay only at certain places, the wallet is closed. Walmart, Starbucks, and 7-Eleven are perfect examples of such solutions. We can’t pay rent or Amazon Prime membership using these apps.

That’s because their purpose is to offer their customers more flexibility and perks while buying products from particular companies. A mobile wallet, in this case, serves as a virtual storefront and strengthens relationships between customers and a business.

Related: How to Build a Neobank App

As for open digital wallets, these allow you to add all sorts of cards and tie in different bank accounts, but most importantly — you get to pay for anything you want. For example, in Google Pay or Venmo, we can add any number of credit/debit cards, gift cards, etc., and use the wallet to pay for Uber rides, utility bills — well, virtually for anything.

Now, if you’re looking to set up a digital wallet app, which type should you consider – open or closed? Well, that depends on your business model and customer needs. If you’re a retailer aiming to boost loyalty and streamline the shopping experience, a closed wallet could be ideal. But remember, it limits payment options to your own services or products. On the other hand, if you aim to be a universal payment solution, an open wallet is the way to go. It allows users to store multiple account information from various card issuers and bank accounts, making it more versatile. However, it also means dealing with more regulatory issues and competition among wallet providers.

Mobile bank extensions

Today, it’s hard to imagine a mobile banking app without wallet functionality: we can fund our cards, make payments, and send money transfers using these apps. These wallets are often very robust when it comes to features, but at the same time, users can only deal with financial services offered by a particular bank.

With the rapid growth in the digital wallet market size, the line between payment apps and traditional banking is becoming increasingly blurred. If you’re looking to make a digital wallet app, it’s crucial to recognize this shift and design your product’s user interface accordingly. By transforming your digital wallet into a comprehensive finance hub, you can provide users with a one-stop solution for all their financial needs, from making payments to managing investments.

For those wondering how to open a digital wallet within such an ecosystem, ensuring seamless integration with existing banking services is key.

Related: Money Transfer & P2P Payment App Development Guide

Crypto wallets are where we can buy, hold, and transfer cryptocurrencies. That’s the first thing anyone needs to invest in (stake) or trade crypto. Most crypto wallets used to start on the web (because that’s where blockchain technologies emerged), but more and more of them are migrating to mobile — because that’s where their users spend the most time.

Related: Blockchain App Development and Crypto Wallet Development

As I’ve already mentioned, more widespread open wallets (like Venmo or Cash App) tend to integrate at least some sort of crypto interactivity to engage more users.

As the world of digital finance evolves, digital wallet development is no longer just about simple transactions to transfer money. It’s becoming a vital part of the banking and financial sector, with major institutions recognizing its potential for increased customer engagement and streamlined operations. So, as we see more traditional banks stepping into this space, could crypto-wallets be the next big thing in transforming how we interact with our money? Only time will tell.

Learn about how to set up a crypto exchange in our dedicated blog.

Must-have Features of an E-Wallet

When looking to create your own digital wallet app, you must carefully consider the features that will truly make your platform stand out in the e-wallet space. Users are increasingly demanding when it comes to their digital wallets, expecting not just secure transactions but also a wide range of additional functionalities. So, what top features should be on your radar?

Registration, sign-in, and onboarding

Like any other mobile app, your wallet first needs to seamlessly onboard new users and introduce them to its functionality in a friendly manner.

The obvious way to register a new user is via a phone number, which can also help with two-factor authentication later on as they continue using the app. However, you may also consider social authentication options like Facebook and ask for a phone number later.

Think of an easy way for users to add their card information and other details.

Biometric authentication

Creating a digital wallet app requires prioritizing user security. Biometric authentication, a method that verifies identities using unique biological characteristics, is a key feature to consider during mobile wallet app development. This technology (e.g., a fingerprint auth or FaceID) enhances security and provides a seamless user experience, making it an essential element when you build an e-wallet system.

For more detailed information on creating crypto token, check out our comprehensive guide.

Payments

Wallets store our money so we can pay for stuff. Therefore, any mobile wallet needs to provide simple ways for paying for goods and services. Besides that, you’ll need a way for users to send and receive money from each other.

Transaction history

All payments should go into an easily accessible and intuitive history of transactions. Adding search, filtering, and sorting options to this section seems like a good idea.

Multi-currency support

When planning to create a digital wallet app, incorporating multi-currency support can broaden your user base. This feature allows users to manage different currencies within the same platform, enhancing convenience and functionality. Therefore, multi-currency support is crucial during ewallet application development, making your app more versatile and user-friendly.

Budgeting tools

Budgeting may sound like it’s calling for a standalone app. At the same time, a mobile wallet could bring more value to customers by showing how they spend their money across various categories and even provide advice on optimizing their spendings.

Related: Building a Personal Finance App: Everything You Need to Know

E-commerce

Displaying products up for sale right inside a wallet app is typical of closed wallets that serve specific brands, such as 7-Eleven or Starbucks. However, you might have affiliate partnerships with multiple companies to sell products or services that your target audience loves.

Rewards

Suppose the customer can order a cashback card from inside your wallet or generate bonuses by making payments. In that case, these bonuses (or cashback) might need a dedicated screen with the balance overview, etc.

Chat

Money is a social tool. That’s why some e-wallets, e.g., Google Pay, design their wallet user experiences around the user’s relationships with people and businesses. Being able to chat and send money in one place is convenient.

Related: Building a successful chatbot in 2022

Crypto, investing, and other advanced features

Finally, leave some room in the app for unique functionality. Some of these features I’ve noticed with other digital wallets include loans, bill splitting, crypto trading, and investing.

Related: Stock Trading and Investment App Development: The Ultimate Guide

By considering these essential features during online wallet mobile app development, you can create a platform that not only meets the demands of users but also supports merchants in facilitating purchases efficiently.

Technologies Used When Building a Digital Wallet

Mobile wallet development requires both front-end and back-end technologies. The server side (aka back end) is often built with programming languages like Java, Closure, or Golang and high-throughput databases like DynamoDB, Couchbase, or Oracle.

To create a digital wallet for mobile, I’d recommend sticking with native development tools:

- Swift for iOS

- Kotlin for Android

That way, you not only ensure your mobile wallet flexibility, but you can also count on supporting new features from iOS and Android updates.

Related: Choosing the right tech stack for your business

Customers seem to favor NFC and QR code payments if you are looking for advice on what technologies to use for mobile payments.

- NFC is used for tap-and-pay features

- QR codes are used for instant payments too, but also as a means to transfer crypto to the correct address

You can also use Bluetooth for that, which would inevitably mean a lot of hustle for end users.

Related:

I’m not recommending any payment SDKs in this blog because it’s not really your choice. When integrating payment gateways, you will have to use whatever SDK or technology your financial partner is using. That means that if a bank you’re partnering with uses an SDK by MasterCard or Razor, or NMI, etc. — you’ll have to stick with it. Or else work on custom integration using your partner’s APIs.

But here’s an interesting question to ponder: What if you decide to develop a digital wallet app independently, without a financial partner? In that case, the choice of payment SDKs is entirely up to you. This freedom allows you to pick the SDK that aligns best with your specific needs and goals. It’s a challenging route, sure, but it also opens up a world of possibilities for creating a truly unique and user-centric digital wallet experience. A tempting thought, isn’t it?

Emerging Trends in Online Wallet App Development

The landscape of online wallet app development is constantly evolving, bringing new opportunities and challenges. Trends such as AI-driven security measures, blockchain integrations, and multi-currency support are shaping the future of digital wallets. By staying ahead of these trends, you can ensure your app remains competitive and meets the growing demands of users.

By leveraging the right technologies and staying informed about industry trends, you can build a robust and versatile digital wallet that not only meets but exceeds user expectations.

5 Steps to Create a Wallet App

What are the main steps you need to take to build a mobile wallet app?

Step 1: Design and prototype

The first step on your journey to develop an e-wallet app is to find out how your target audience manages money and where they have problems. You then design the screens of your wallet based on these findings and put them together into an interactive prototype.

The sole purpose of the prototype, which is a clickable version of your app implemented purely in designs, is to verify your assumptions with real users. Based on the feedback, you can update the prototype by adjusting the app screens, adding or removing specific features.

Step 2: Develop a mobile wallet

Once the prototyping is over and you have a virtual version of the wallet that customers will likely appreciate, it’s time to start building a digital wallet, i.e., putting lines of code in order.

There are quite a few things you need to consider while creating a digital wallet.

Security

Of course, security comes first. Modern smartphones and wearable devices already have pretty strong security built-in. You can extend that into your app by applying bio authentication like TouchID or FaceID on the iPhone.

Besides that, there are other best practices to protect your digital wallet:

- tokenization (using randomized tokens instead of actual credit card numbers when exchanging transactional data)

- two factor authentication (consider integration with Twilio or similar services)

- strong data encryption (both in transit and at rest)

- PCI compliance (consider VGS Mobile SDK, PaySafe, or similar tools)

From the UI/UX perspective, you should avoid displaying sensitive card details in the app in full and offer an option to hide balances and other data that customers may be checking in crowded places. Strong passwords and SSL for transferring data are also required.

Of course, you realise that’s just a tip of the iceberg, right? As we delve deeper into the realm of eWallet app development, one cannot emphasize enough the importance of robust security features. An increasingly popular and effective measure being adopted in this field is point-to-point encryption (P2PE). Why P2PE, you ask? Well, it’s one of the most secure data protection methods available today. The magic of P2PE begins the moment a user swipes their smartphone over a PoS terminal, ensuring that the transaction data remains encrypted from start to finish, providing an extra layer of security to your digital wallet. So, as you embark on your journey to create a top-notch eWallet app, remember that incorporating advanced security features like P2PE can significantly enhance the trust and confidence of your users.

When considering digital wallet mobile app development, integrating these advanced security measures will not only protect user data but also position your app as a reliable and trustworthy solution in the competitive market.

Related: The Complete UI/UX Design Guide: Building a Winning App

Open-ended architecture

Another critical aspect to keep in mind when you build your own e-wallet is an open architecture, meaning the app should be able to connect with external services and ideally provide the ground-level architecture for other developers to build on. For a development team, that means creating a lot of APIs.

This approach ensures a vibrant ecosystem around your digital wallet as it matures, and more businesses want to connect with it and use its features.

As a start, you will probably need to work with services like Plaid to connect the wallet to users’ bank accounts. You will also need to integrate with a payment gateway to process transactions. Fortunately, that’s not something you need to build from scratch, as there are plenty of payment service providers available with pluggable SDKs.

Use of third-party components

As with any other mobile app development project, you can find many plug-and-play SDKs to speed up delivery. However, due to security issues, it’s recommended that you choose such SDKs only for peripheral features, like chatting or image/QR code recognition.

The core functionality must be programmed manually to exclude even the slightest chance of having a backdoor. When embarking on virtual wallet app development, ensuring that your core features are custom-built will significantly enhance your app’s security and reliability.

Admin dashboard

You will also need a back-office app to manage users and their interactions with the mobile wallet. Consider using a template that supports customization to blaze through this mini step as you make an e-wallet app.

Step 3: Test

Testing begins during development when coders implement unit tests in code to see if various features are working as expected. During the formal testing phase, though, we need to run the whole app through functional and ux ui design testing.

Related: User Testing Tips: Steps, Tools, Best Practices

Needless to say, testing an e-wallet takes a lot of skill and expertise in mobile wallet application development, and I suggest you rely on a qualified development partner to go through this step. In addition, you can hire a cybersecurity agency to perform a security audit of your mobile wallet.

Step 4: Release

Once you’ve completed the digital wallet app development and testing steps, you’re ready to release your e-wallet. It takes jumping through a few hoops of Google Play’s and the App Store’s guidelines before your app becomes available to the public.

Plus, the server side should be switched to a live environment and connected to the app. Hopefully, downloads will start to pile up shortly after.

Step 5: Maintain

You may feel (rightfully so) like you’re going to market with a complete solution. However, having in place tools collecting app usage metrics and allowing you to further improve your wallet based on how users interact with it will be crucial to your app’s success.

Once the app is in the mobile stores, your job will be to keep it relevant by updating to support the latest OS features, ironing out rare bugs, and streamlining the user experience. By mastering how to make an e-wallet and committing to its continuous improvement, you’ll foster greater user trust and long-term success.

How Much Does It Cost to Build Your Own E-Wallet App?

E-wallet development of a minimum viable product (MVP) version of a mobile wallet will cost around $80,000, and a complete solution may end up costing $200,000 or more.

Related: How to build a Minimum Viable Product in 2021

App Development Costs: The Complete Breakdown

Remember that a huge chunk of e-wallet software development happens in the back end. That involves building APIs, a high throughput database, core logic, and many other behind-the-scenes things that a mobile wallet can’t operate without. Plus, an admin website.

Challenges Of Building A Digital Wallet

Building a digital wallet app can be an exciting venture with the potential to revolutionize the way users make an e-wallet payment. However, several challenges must be navigated to create a robust and user-friendly solution. Here are some of the key challenges:

1. Security and Compliance

- Data Security: Ensuring the security of users’ financial data is paramount. Digital wallets must implement advanced encryption methods, secure authentication processes (like biometrics), and robust fraud detection mechanisms.

- Regulatory Compliance: Adhering to various financial regulations and standards such as PCI DSS (Payment Card Industry Data Security Standard) is crucial. Compliance requirements can vary significantly across different regions and markets, adding complexity to development.

2. User Trust and Adoption

- Building Trust: Convincing users to trust your digital wallet with their sensitive financial information can be challenging. Transparent privacy policies, robust security measures, and positive user reviews are essential to build trust.

- Ease of Use: The user experience must be seamless and intuitive. Complicated onboarding processes, cumbersome authentication steps, or frequent technical issues can deter users from adopting the app.

3. Integration with Multiple Financial Systems

- Banking Partnerships: Establishing and maintaining partnerships with various banks and financial institutions can be complex and time-consuming. Each partner may have different integration requirements and compliance standards.

- Payment Gateways and Currencies: Integrating multiple payment gateways and supporting various currencies require sophisticated backend systems and thorough testing to ensure reliability and accuracy.

4. Technological Challenges

- Platform Compatibility: Developing a digital wallet that works seamlessly across different devices and operating systems (iOS, Android, etc.) requires significant resources and expertise.

- Performance and Scalability: The app must handle high transaction volumes and scale efficiently as the user base grows. Ensuring low latency and quick transaction processing is critical for user satisfaction.

5. Competitive Market

- Differentiation: The digital wallet market is highly competitive, with established players like Apple Pay, Google Pay, and PayPal dominating the space. To stand out, your app must offer unique features or superior user experience.

- Marketing and User Acquisition: Successfully marketing the app and acquiring users amidst intense competition can be challenging. Effective marketing strategies and partnerships are essential for gaining traction.

6. Maintenance and Continuous Improvement

- Ongoing Updates: Regular updates are necessary to address security vulnerabilities, improve functionality, and keep up with evolving user needs and technological advancements.

- User Feedback and Adaptation: Continuously gathering and acting on user feedback is crucial for the app’s success. Adapting to changing market trends and user expectations requires flexibility and a proactive approach.

By addressing these challenges with careful planning and execution, you can create a digital wallet that not only meets but exceeds user expectations, making the process to make an e-wallet payment seamless and secure.

Understanding how to make e-wallets involves tackling these challenges head-on with innovative solutions and a user-centric approach. This journey requires a solid strategy, partnership with experienced developers, and a commitment to continuous improvement.

How To Set Up A Digital Wallet for Success?

As digital wallets become increasingly popular, creating a seamless and welcoming experience for users is crucial for the success of your app. Here’s how you can ensure that setting up a digital wallet is as smooth and engaging as possible for your customers.

Simplify Registration and Onboarding

The first impression matters. Ensure that the process to set up an e-wallet is straightforward and user-friendly:

- Streamlined Registration: Allow users to sign up using their email, phone number, or social media accounts.

- Guided Onboarding: Provide a step-by-step guide that introduces users to the key features of your wallet. Use tooltips and pop-up tips to help users navigate through the setup process effortlessly.

- Quick Verification: Implement fast and secure methods for identity verification, such as OTP (One-Time Password) via SMS or email.

Prioritize Security Without Compromising Usability

Security is paramount, but it shouldn’t hinder the user experience. Balance both by:

- Biometric Authentication: Incorporate fingerprint or facial recognition for quick and secure access.

- Multi-Factor Authentication (MFA): Offer MFA options that enhance security while keeping the process user-friendly.

- Clear Security Information: Educate users on how their data is protected and provide tips for maintaining their account security.

Personalize the User Experience

Personalization can significantly enhance user engagement and satisfaction:

- Customizable Dashboards: Allow users to customize their dashboard with widgets that display their most-used features.

- Personal Financial Insights: Provide personalized financial insights based on their spending habits.

- Tailored Notifications: Send notifications that are relevant to users, such as transaction alerts, special offers, or budgeting tips.

Enhance the Payment Experience

Make transactions as seamless as possible:

- Multiple Payment Options: Support various payment methods, including credit/debit cards, bank transfers, and cryptocurrencies.

- QR Code Payments: Enable easy payments through QR code scanning, which is particularly useful for in-store purchases.

- Instant Transfers: Ensure that peer-to-peer transfers are instant and hassle-free.

Promote Trust Through Design and Communication

Trust is vital for the adoption of any digital wallet. Foster trust by:

- Transparent Design: Use a clean and intuitive design that makes it easy for users to find information and complete transactions.

- Help and Support: Offer accessible help and support options, such as FAQs, chatbots, and customer service.

- Regular Updates: Keep users informed about updates and new features through in-app messages or emails.

Leverage Feedback for Continuous Improvement

User feedback is a goldmine for improving your digital wallet. Encourage users to share their experiences:

- In-App Surveys: Periodically ask users to complete short surveys about their experience.

- Feedback Buttons: Integrate easy-to-access feedback buttons within the app.

- Community Forums: Create forums where users can discuss features and suggest improvements.

By focusing on these aspects, you can make the process of setting up a digital wallet not only efficient but also enjoyable for your users. Ensuring a seamless onboarding process, prioritizing security, personalizing the experience, and fostering trust will help you create an e-wallet app that stands out in the competitive market.

Remember, a positive initial experience can lead to greater user retention and satisfaction, setting the stage for long-term success.

How Topflight Can Help

Thinking of building a digital wallet application as part of your larger fintech project? Well, have you considered the advantages of using off-the-shelf solutions that can be customized to your needs? At Topflight, we’ve seen how this approach can be both smart and cost-effective.

Take a look at our Wealth case study. Here, we seamlessly integrated a white-label digital wallet while constructing an investment and wealth management app. This allows users to manage their investments and digital payments all from the convenience of their mobile devices. So why start from scratch when you can make a mobile wallet app that’s tailored to your unique requirements and still robust and secure? With Topflight, we make the complex simple.

But what if you’re looking to create a unique stand-alone crypto or traditional digital wallet? In that case, building from scratch might indeed be the best route, and guess what? We can help with that too! With our extensive fintech experience, we are more than capable of helping you build a digital wallet application from the ground up. Whether it’s crypto or traditional currencies, we’ve got you covered. So, ready to revolutionize the way people handle their finances? Let’s create something extraordinary together.

Reach out to speak with our experts if you’d like to learn more about how to create a mobile wallet app.

[This blog was originally published on Sep 01, 2021, and has been updated for more recent content]

Related Articles:

- How to Start a DAO

- How to Develop a Crypto Trading App

- Guide to Building a Fintech App

- How to Create a Loan App

- How to develop a crypto exchange

- On Demand App Development Guide

Frequently Asked Questions

How long does it take to develop a wallet app?

Around 6-8 months, depending on how many options you envision.

What technology should we pick for implementing mobile payments: QR codes, NFC, Bluetooth, or something else?

You can’t go wrong with NFC (in terms of security and ease of use). However, we recommend having QR codes as an alternative method too.

What is a good way to secure a 12-word seed phrase used for protecting a crypto wallet?

You can send the phrase via a text message or as a pdf to the user’s email. That way, the phrase never gets shown on a screen.

Can you provide an example of the innovative use of a digital wallet?

Popwallet is a cloud platform that allows merchants and other businesses to easily create digital passes and offers stored in the Apple Wallet.

Can one create an e-wallet app using React Native or Flutter for the app to work on iOS and Android?

Yes, although we recommend using native technologies to make your solution more flexible in the long run.