How to Develop a Fintech App in 2025

If there ever was a time to build a fintech app, that time is now. The market is ripe, ...

You deserve a team focused on your mission just as much as you are. Meet Topflight.

Whether you convert a legacy app or start from scratch, our fintech application development team lives for complex challenges and is trained to deliver serious fintech solutions.

You deserve a team focused on your mission just as much as you.

Whether you convert a legacy app or start from scratch, our fintech application development team is trained to deliver serious fintech solutions.

Our seasoned fintech app developers will pick the best technology stack to ensure your financial software continues growing and remains adaptable to market changes.

We apply a proprietary framework when prototyping and finalizing your app’s UX design, which guarantees engaging user experience and higher KPIs aligned with your business needs.

Customers love when favorite apps follow them on all their devices. Our banking & finance app development company builds fintech applications that work on multiple platforms.

![]()

We are committed to providing PCI compliant fintech application development services, leveraging bank-grade data security technologies and standards.

Our seasoned fintech app developers will pick the best technology stack to ensure your financial software continues growing and remains adaptable to market changes.

We apply a proprietary framework when prototyping and finalizing your app’s UX design, which guarantees engaging user experience and higher KPIs aligned with your business needs.

Customers love when favorite apps follow them on all their devices. Our banking & finance app development company builds fintech applications that work on multiple platforms.

We are committed to providing PCI compliant fintech application development services, leveraging bank-grade data security technologies and standards.

SUCCESS STORY

$125M Raised

Our fintech app development company created four platforms for Medable in 2018, laying the groundwork for its outstanding fundraising achievements. Read more here.

![]()

We’re reaching our customers in an incredibly powerful way. How we got here couldn’t have been made any easier by Topflight’s incredibly talented, communicative, and professional product development team.

Ray Arias, Owner Ara Genomics

We’re reaching our customers in an incredibly powerful way. How we got here couldn’t have been made any easier by Topflight’s incredibly talented, communicative, and professional product development team.

Ray Arias, Owner Ara Genomics

Click to learn more

![]()

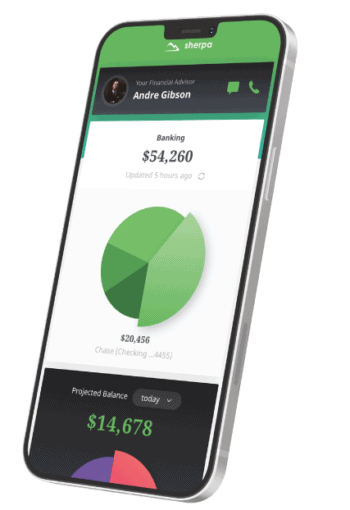

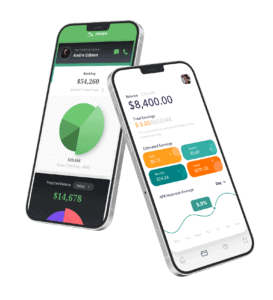

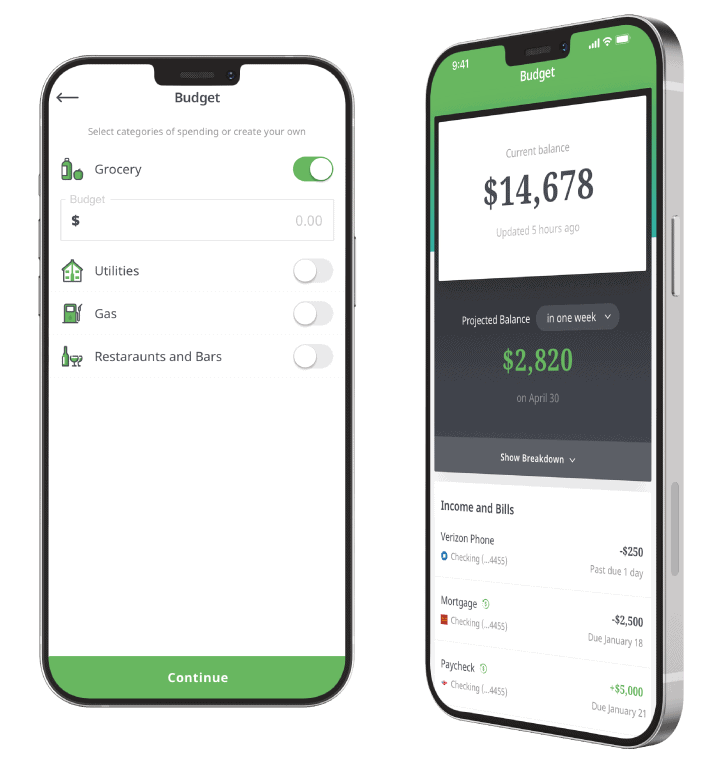

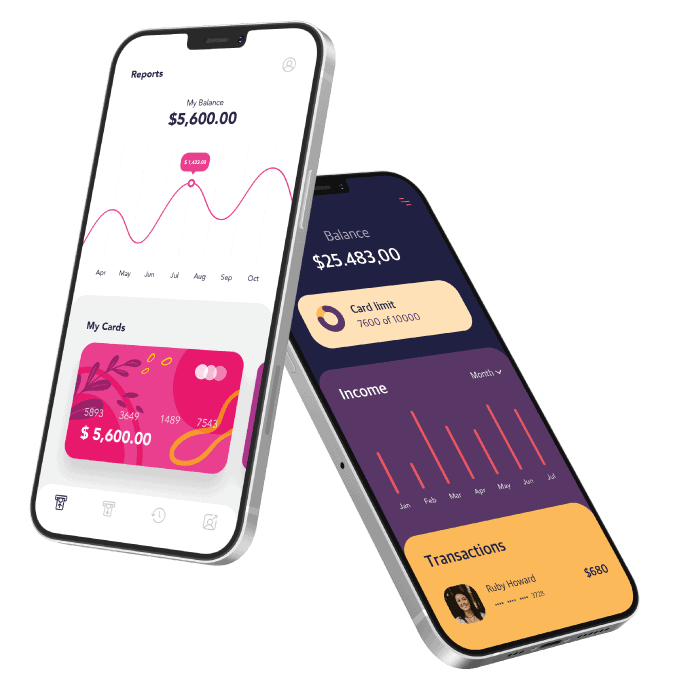

We’ve built several personal finance applications leveraging machine learning and AI. Our full-stack fintech application developers use advanced technologies like AI/ML, seamlessly delivering updates and maintaining deployed native mobile apps for the financial technology industry.

Bank-level encryption & security measures

Financial analysis algorithms

Plaid API integration

Learn how our fintech mobile app development company brought financial advisors to busy millennials in a simple, budget-monitoring solution.

With more and more consumers craving services accessible from the comfort of their homes, we understand the importance of building a loan app with a next-gen user-friendly UI/UX that allows on-demand money lending.

State-of-the-art AI lending engine

Microservices architecture

Tensorflow & Pytorch tech stack

Learn how our financial app development company built a risk-assessment engine for verifying loan applications based on banking, accounting, and social media data.

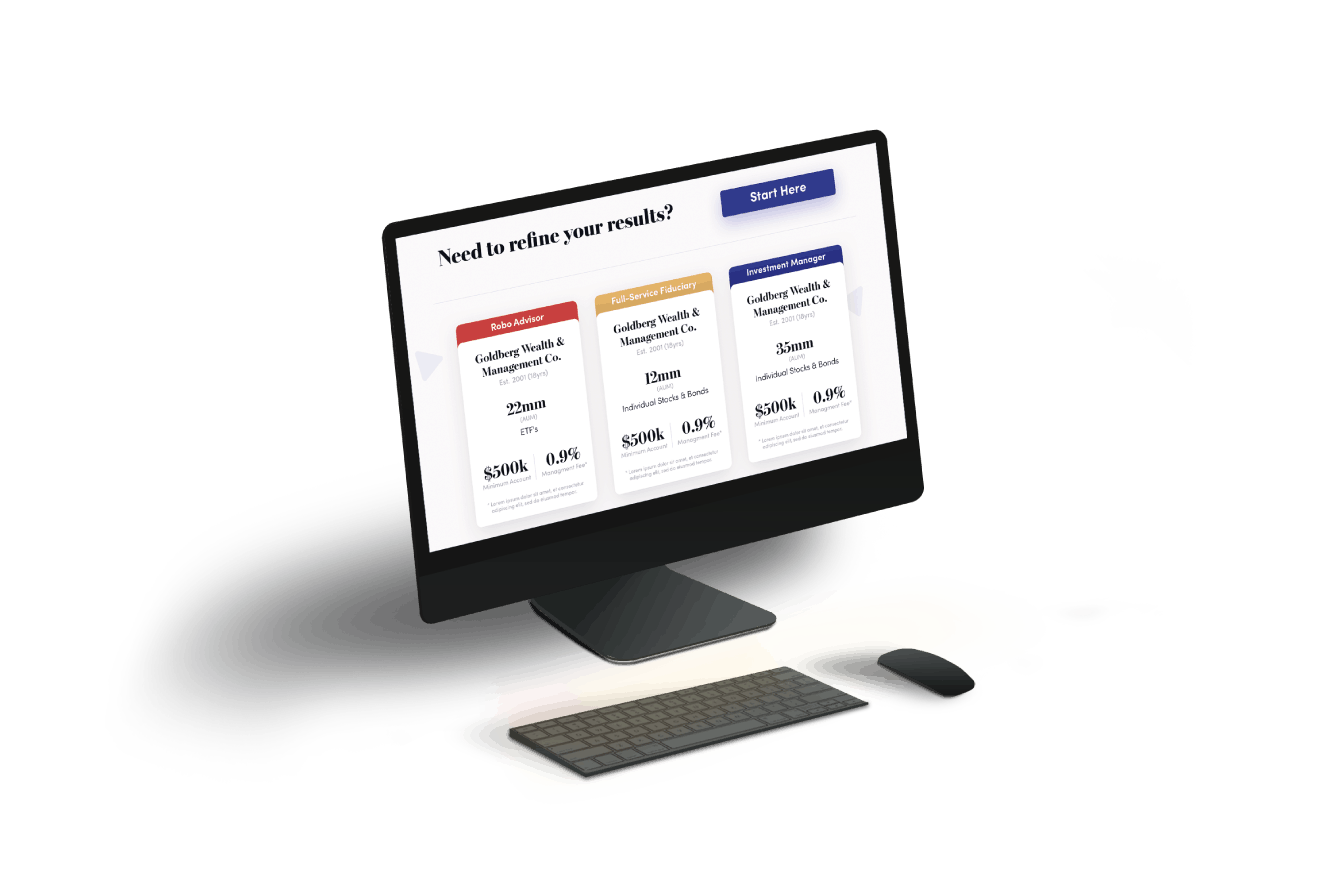

If you’re looking to create a marketplace for financial services, there’s no better time. From e-commerce to mobile payments (iOS & Android), our fintech app development firm will use the most advanced technology to create a modern, on-demand platform taking your idea to the next level.

E-payments, fin data analytics

Proprietary recommendation engine

User-centered design paradigm

Check out the marketplace Topflight’s finance app developers built to find financial investment consultants based on portfolios.

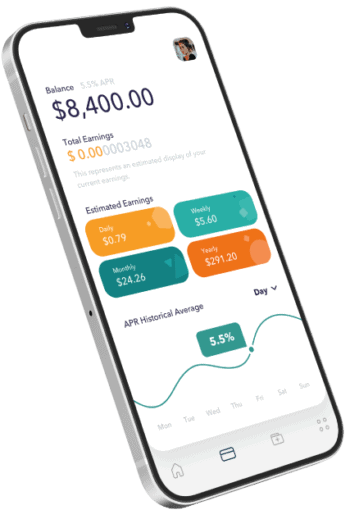

Work with our experts to bring your mobile banking application idea to life. Our financial app developers have you covered from basic features like account management, money transfers, payment scheduling to advanced options like cardless withdrawals, chat and bio authentication.

Bank and credit transactions

Mobile payments

Real-time trading, investing

Get in touch for general details about the NDA-protected projects that we can share with you or check out the case study about one of the mobile banking apps we built.

Whether you’re just getting started with trading or have been doing it for a while, it’s critical to keep live market data at your fingertips. Use our financial app development services to build top-of-the-line trading applications customized to your needs and other fintech app development solutions.

Trading bots

Brokerage data integrations

Full-scale trading capabilities

Get in touch for general details about the NDA-protected projects in this area that we can share with you.

Whether you have an idea or a fully designed crypto wallet, our experts can work with you to ensure you’re covering all the bases – from a fitting blockchain platform to protocols, digital assets, compliance, and more – to launch a successful application from blockchain, building your own crypto token, building a defi exchange to smart contract development, to building a cryptocurrency exchange.

Smart contract for the crypto fintech industry

Fiat to crypto on-ramping

Custom fintech app development services

Get in touch for general details on NDA protected fintech application development services in this area that we can share with you.

![]()

Cloud Integration

Data & Analytics

Open Banking APIs

Privacy Management

Artificial Intelligence

Blockchain

Deep Encryption

Big Data

We’ve built several personal finance applications leveraging machine learning and AI. Our full-stack fintech application developers use advanced technologies like AI/ML, seamlessly delivering updates and maintaining deployed native mobile apps for the financial technology industry.

Bank-level encryption &

security measures

Financial analysis

algorithms

Plaid API

integration

With more and more consumers craving services accessible from the comfort of their homes, we understand the importance of building a loan app with a next-gen user-friendly UI/UX that allows on-demand money lending.

State-of-the-art AI

lending engine

Microservices architecture

Tensorflow & Pytorch tech stack

If you’re looking to create a marketplace for financial services, there’s no better time. From e-commerce to mobile payments (iOS & Android), our fintech app development firm will use the most advanced technology to create a modern, on-demand platform taking your idea to the next level.

E-payments, fin data analytics

Proprietary recommendation

engine

User-centered design paradigm

Work with our experts to bring your mobile banking application idea to life. Our financial app developers have you covered from basic features like account management, money transfers, payment scheduling to advanced options like cardless withdrawals, chat and bio authentication.

Bank and credit transactions

Mobile payments

Real-time trading, investing

Whether you’re just getting started with trading or have been doing it for a while, it’s critical to keep live market data at your fingertips. Use our financial app development services to build top-of-the-line trading applications customized to your needs and other fintech app development solutions.

Trading bots

Brokerage data integrations

Full-scale trading capabilities

Whether you have an idea or a fully designed crypto wallet, our experts can work with you to ensure you’re covering all the bases – from a fitting blockchain platform to protocols, digital assets, compliance, and more – to launch a successful application from blockchain, building your own crypto token, building a defi exchange to smart contract development, to building a cryptocurrency exchange.

Smart contract for the

crypto fintech industry

Fiat to crypto on-ramping

Custom fintech app

development services

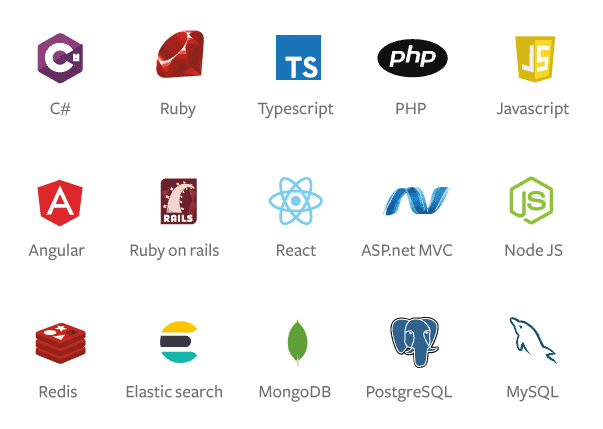

The development team working on a project uses only modern and scalable

technologies to implement mobile and web applications the way you mean it

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

To start off our fintech software development process, we brainstorm your idea and ensure the final digital product is aligned with your business goals. We then create a blueprint and specify an appropriate tech stack, APIs, code libraries, and accompanying technologies.

Our software development company prototypes rapidly to create a clickable wireframe in under 4 weeks by iterating on usability feedback. Once the UX/UI is optimized, our designers improve visuals to create an engaging web and mobile look and feel that drives conversion.

Led by a product manager, our mobile app developers code the app according to the Agile full-cycle principles: two-week sprints of writing scalable, high-quality code accounting for PCI compliance, bank-level encryption, and regular check-ins with you, unlike other development companies.

This stage includes automatic and manual testing, unit tests, security and performance testing; plus, project management. In addition, our development agency verifies things like the loading speed, responsiveness, etc. Still, security checks remain at the heart of our finance app development services.

With our fintech mobile app development services, we help you during the app submission process and supply the source code. As an option, we can help you manage the launch and maintenance of the app, keeping its features and source code up-to-date or hand over fintech development to your in-house team.

Our fintech app development team leverages the most modern and scalable technologies to integrate mobile and web finance app development solutions.

WEB

Languages

Frameworks

Databases

MOBILE

The team working on a project uses only modern and scalable technologies to implement mobile and web applications the way you mean it

Our California-based fintech mobile app development company is on standby to collaborate with you and set you up for a successful launch. Buckle Up!

If there ever was a time to build a fintech app, that time is now. The market is ripe, ...

If you want to develop a cryptocurrency exchange, the timing couldn’t be better with all the crypto craze: the ...

If you are wondering how to create a crypto token — whether to boost your DeFi app, raise money ...

Our mileage says the average application costs anywhere between US$40,000 to $125,000 based on the specific features the custom software needs.

15-25 percent of the total app development cost per year; similar to other complex software solutions maintenance.

Depending on the team composition and expertise of your development partner, it may take from four to six months to create a proof of concept or the first MVP iteration.

Utilize rapid prototyping before mobile development or web development, i.e., build a clickable prototype (UI/UX design) that you can share with customers and financial industry experts for feedback. We can create a prototype in under 4 weeks.

Yes, we have certified blockchain developers for web and mobile app development.

Native apps support 100% of the platform hardware and require less effort with security enhancements, so we recommend native. However, many financial institutions might prefer cross-platform software development services to expedite design and development of a mobile app and lay the foundation for a web app.

Yes, our software developers integrated Plaid, Stripe, Ficinity, and other services while building fintech mobile and web applications.

Privacy Policy: We hate spam and promise to keep your email address safe