If there ever was a time to build a fintech app, that time is now. The market is ripe, the problems to solve are plenty, and the tools and resources are readily available.

Top Takeaways:

- Now is the perfect time to build a fintech app. Despite an overall decline in global fintech investment, which reached $51.9 billion in the first half of 2024, companies like Ramp ($150M in April 2024) and Altruist ($169M in May 2024) have recently secured significant investments, proving that fintech startups still have the potential to attract substantial funding and thrive in this dynamic environment.

- The answer to “How to develop a fintech app?” lies at the intersection of integrating with third-party financial services that provide payment, banking account info, security, and cloud services for your fintech application.

- A smart approach to fintech app development includes creating an interactive prototype that allows you to verify your assumptions with real users and invest only in coding features that make sense for the target audience. Plus, you should seriously consider AI app development approach, with all the middleware development tools available in the fintech sector.

Table of contents

2. Reasons to Develop a Fintech App

4. 8 Steps to Create a Fintech App

- Authenticate and Manage Users

- Get Secure Hosting

- Integrate Credit Score Checking

- Access Bank Account

- Setup Payment Gateway

- Implement Chat

- Add Bonus Plugins

- Consider Legal Obligations

5. Cost to Build a Fintech App

6. Our Experience in Building a Fintech App

7. It’s Time to Start a Fintech App

Fintech Industry Overview

Before we delve into the exciting world of fintech apps, let’s recap what fintech really is.

What is Fintech?

Fintech is the glamorous new-age term for anything that has to do with finance and technology: from platforms for money transferring to budgeting apps.

In fact, fintech has become so ubiquitous, I guarantee you use it more often than you know. We buy stuff using virtual cards on our smartphones, take cash from ATMs, send mobile payments, and do a lot of other things that together make up fintech.

Fintech Market

And because money is so interwoven with everything we do, as you’d expect, the fintech market covers quite a few areas of our lives:

- Wealth management

- Payments

- Lending

- Insurance

- Personal finance

- Cryptocurrency-based solutions

- Money transferring

- Trading solutions

For a comprehensive guide on how to develop a trading app, explore our detailed article on the essential steps and considerations.

- Regtec software

- Mortgage solutions

EXPLORE OUR FINTECH DEVELOPMENT SERVICES

Just like many other major markets, fintech has experienced fluctuations in investment. In the first half of 2024, global fintech investment reached $51.9 billion, showcasing the sector’s resilience despite an overall decline.

High-profile funding rounds continue to elevate the industry, with companies like Ramp and Altruist securing substantial investments. This dynamic environment indicates that fintech startups still have significant opportunities to attract capital and thrive, making it an exciting time for new ventures in the fintech space, including such fintech areas as contactless payments and branchless banking. Some say digital competition may win more than 40% of revenue from traditional banks.

Investment apps like Robinhood are also seeing an influx of new users – 24.1 million funded accounts as of May 2024.

Key Stats of Fintech Market

Diving into the numbers can give us a clear picture of where the fintech market stands and where it’s headed. Here are some key statistics that define the fintech app market in 2024:

- As of 2023, there are approximately 26,300 fintech startups worldwide.

- The global fintech market is projected to reach $37 billion by 2026.

- It’s estimated that 90% of users will make a mobile payment with their smartphone in 2024.

- Total global fintech investment declined from $62.3 billion in the second half of 2023 to $51.9 billion in the first half of 2024. While there’s been a dip, the robust investment figures indicate sustained interest.

- Payments remain the frontrunner, drawing the largest share of fintech funding globally, with $21.4 billion in the first half of 2024.

- The Americas dominated the scene, accounting for four out of five $1 billion+ fintech deals in the first half of 2024. This region continues to be a hotbed for significant fintech activity.

- Regtech was the only major fintech subsector to see an increase in investment in the first half of 2024, with $5.3 billion invested.

- The number of mobile banking users is expected to exceed 4 billion by 2026.

Major Fintech Trends to Watch in 2024 and Beyond

Based on the latest insights, here are some of the game-changing fintech trends set to make waves in 2024 and beyond:

- Embedded Finance: Imagine your favorite non-financial apps and platforms suddenly offering sleek financial services. That’s embedded finance for you. Businesses are gearing up to provide seamless financial experiences straight from their apps. Think of it as the Swiss Army knife of financial services.

- Open Banking: The evolution of open banking APIs and ecosystems continues to soar. This trend is all about secure data sharing between financial institutions and third parties, making financial services more interconnected and user-friendly. Expect your financial apps to get a whole lot smarter.

- Artificial Intelligence and Machine Learning: AI and ML aren’t just buzzwords; they’re the backbone of modern fintech. From assessing risks to detecting fraud and offering personalized services, these technologies are like having a financial advisor, detective, and personal shopper all in one app.

- Blockchain and Cryptocurrencies: Blockchain and digital currencies are no longer just for tech enthusiasts. We’re on the brink of mainstream adoption, with potential universal digital currencies becoming a reality. It’s like the future of finance is knocking on your door, and it’s bringing transparency and security with it.

- Regtech: Regulatory technology, or Regtech, is here to help financial institutions navigate the maze of regulations. Think of it as the GPS for compliance, ensuring that banks and fintechs stay on the right path without breaking a sweat.

- Buy Now Pay Later (BNPL): Flexible payment options are expanding, allowing consumers to split purchases into manageable installments. It’s like having a financial fairy godmother helping you spread out your spending.

- Enhanced Cybersecurity: With cyber threats evolving, fintech apps are stepping up their security game. From quantum-resistant encryption to multi-factor authentication, the focus is on keeping your financial data safe. It’s like having a digital fortress guarding your assets.

- Robo-Advisory Services: These digital advisors are like having a financial wizard at your fingertips, offering personalized investment advice without the hefty fees. Robo-advisors can optimize your portfolio, making smart investing accessible to everyone.

Related Article: How to Build a Robo-advisor

Before you create a fintech mobile application you should really carefully consider its category.

Types of Fintech Apps

As we’ve mentioned, financial technology is very prolific. Fintech apps fall into several major types. Let’s review the most prominent types.

Wealth and investment apps

These mobile apps let you buy stock and ETFs from the comfort of your home, sitting on a couch. They can also suggest investment options based on studying your preferences.

If you’d like to learn more, we recommend reading our article about creating an investment app.

Mobile payments

The classic payment apps, like Paypal or Venmo, were made to make and accept payments. Must-have features include history of transactions, currency conversion, etc. Apps for mobile payments grow in popularity as cross-border money transfers increase in volume.

Lending apps

Just like other types of fintech apps, lending apps allow removing a lot of manual work from lending. AI capabilities, that are often built into lending apps, ensure that the app offers optimal loan options.

Insurance apps

Insurance apps gather lots of information from customers. So having a streamlined process with clearly visualized steps and a polished UI becomes a necessity. There are also appearing interesting p2p insurance apps where users insure each other.

Related: Insurance App Development Guide

Personal finance apps

Just a few years ago, budgeting apps used to dominate the app stores. The main idea behind every personal finance app is to give the user a bigger picture of their spendings. If you’d like to learn more, check out our article on how to make a budget app.

Cryptocurrency apps

There’s a standalone class of fintech apps that stands on its own while resembling other fintech apps: investing, payments, insurance, wallets, etc. The only difference is that these apps work with cryptocurrencies. For a comprehensive fintech app, learning how to make a crypto wallet is essential to offer users a complete financial ecosystem.

Related: The Complete Guide to Smart Contract Development

Neobanks

These are swift little apps with banking features offered by non-traditional digital-only banks. These target the underbanked and target niches such as e-commerce, immigrants, freelancers, etc.

Related: How to start a Neobank

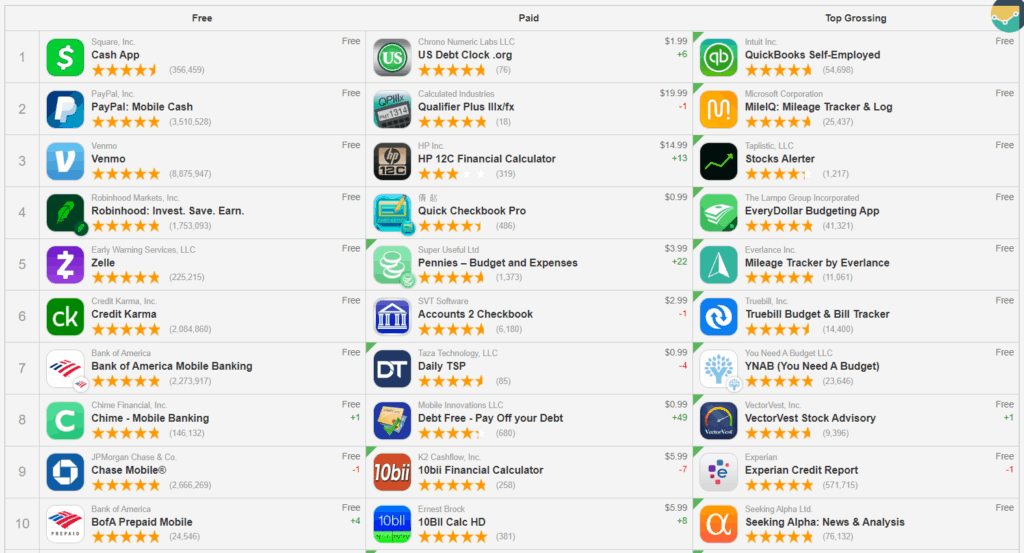

The Most Successful Fintech Apps

If we look at App Annie, Sensor Tower, or similar services looking for the most popular fintech apps, we’ll immediately notice that the finance charts are ripe with apps for mobile payments, banking, and investing.

Image credit: Sensor Tower (all rights belong to Sensor Tower Inc.)

Venmo — a popular payment app that makes it easy to split the cost of almost anything. It’s a sibling fintech app targeting millennials that are bored with the traditional PayPal app. Venmo, like all major fintech applications, works on the iPhone and Android phones.

Robinhood — an app that brought investing to the masses with zero commissions. They also added a savings account recently, which makes the app even more tempting.

Chime — is a mobile banking app that has all the features you would get from a typical banking account, plus some more, including paychecks up to 2 days early and fee-free overdraft.

Read Also How to Build a Mobile Banking App like Chime

3 Reasons to Develop a Fintech App

If there ever was a time to build a fintech app, that time is now. Let’s review these three compelling reasons why you should consider building mobile apps for fintech before we answer how to build a fintech app.

Financial illiteracy is on the rise

One would think that with the growing student loan crisis and international economic tensions, people would be more educated about managing their money. However, the reality is quite the opposite.

Recent data from WalletHub’s 2024 Financial Literacy Survey reveals that 47% of U.S. adults continue to rate their personal finance knowledge as “C” or worse, an increase of 12% since 2009. This lack of financial literacy is further highlighted by other alarming statistics:

- Generational Divide: Gen Z holds the lowest financial literacy rate at 37%, while Baby Boomers top the chart at 54%.

- Debt Dilemma: Americans are racking up credit card debt at an alarming rate, with a 4.18% increase in credit card debt since 2010.

- Financial Confidence: Over one in four Gen Zers admit to lacking confidence in their financial knowledge and skills, with 57% believing that savings accounts are the best investment option.

- Emergency Preparedness: 44% of people are not confident they can cover an unexpected expense, and over 40% don’t have the financial means to come up with $5,000 in an emergency.

The numbers are even more shocking among millennials—76% lack basic financial education, and 54% worry about repaying their student loans. Only 16% of young Americans (ages 18-26) feel optimistic about their financial future. Yet, this is the generation that will soon be in charge of our economy.

Amidst this backdrop of financial illiteracy, there’s also growing distrust in human financial managers. People, despite being under-informed, are desperate to take charge of their finances and are hungry to learn fast.

If you come up with a creative fintech app that helps ordinary people effectively take control of their finances without having to know all the financial jargon, you’d hit gold. The demand is high, and the opportunity to make a significant impact is even higher.

Mobile Phone Penetration

There are between 5 and 7 billion mobile phone users in the world by different estimates today. That is equivalent to 66.6% of the planet’s total population. Ericsson estimates that in 2025 there will be 6.6 billion mobile subscribers in the world.

Apps are everything on a smartphone and most of them require having an internet connection, so we can safely assume that a large number of these smartphone users have internet access.

Related Post: The 6 Most Important Metrics For Mobile Apps

There is a strong appetite for automation due to the availability of mobile solutions for almost everything. Going to the mall, the bank or library is not imperative anymore. We have apps for those things.

But fintech apps are still lagging behind in functionality when compared to apps for shopping, education, healthcare, and other categories. They are usually limited to managing bank accounts, online payments, transfers or making budgets. But there is so much more than can be done with a little creativity. This a gaping hole in the market.

Take home rental management, for example, a large part of it is still done offline. A fintech app solution that combines tenant screening, rent collection and other aspects of rental management could be very successful.

Open banking

Since the earliest civilizations, to access banking services, people have always had to go to the bank. But now, banks are bringing their services to the people by going digital. Open banking is the driver behind this new approach.

Today, banks understand the importance of being interconnected. By incentivizing their data, they remain relevant to their customers in this digital age. They’ve invested millions of dollars into developing APIs that enable third-party entities to create and serve value-added banking services like mobile credit score monitoring, loan processing, real-time capital management, treasury management and much more.

Thanks to open banking, you can now rapidly build and deploy complex fintech solutions without spending years on development or needing to undergo lengthy certification for you to directly manage financial data. The sky’s the limit.

For a fintech app that’s market-ready, working with a company experienced in custom mobile application development services is essential for rapid deployment.

Must-have features

When you want to make a fintech app, one of the things you worry about is how well it will be received. Make sure your application has these features before releasing it to the wild.

Security

Any fintech app must comply with security requirements protecting users’ financial information. To achieve this, a fintech developer implements blockchain, encryption, biometric and two-factor authentication, data obfuscation, and other security measures.

Payment gateway integration

The majority of fintech apps have to do with payments. To enable the payment functionality, you may choose to integrate with services like Stripe, PayPal, Zelle or work via bank APIs.

Machine learning

By now, AI has become a necessity rather than extra functionality in fintech applications. Machine learning algorithms take data from various inputs, analyze it, and provide advice.

Also Read: Machine Learning App Development Guide

Dashboards

As the saying goes, everybody loves a dashboard, aren’t they? Today, it’s hard to imagine for someone to make a fintech application without a visual representation, whether it’s spending, payments history, or stock charts.

Also read: Dashboard App Development Guide

Voice integration

Fintech apps may choose to surface their most frequently used features to customers via voice assistants: Siri, Google Assistant, and Bixby. That approach keeps customers using the app without actually opening it.

Schedule a Free Consultation

8 Steps to Create a Fintech App

In case you are wondering what the steps for custom mobile app development are, let me walk you through the steps of building a simple fintech app.

Let’s say you want to build a rental management app. Your app will enable users to check prospective tenants’ credit scores, accept leasing security deposits, place them in escrow, and manage their release at the end of a leasing contract to eligible clients. Your app also allows an easy contract renewal process for your chosen tenants.

Your value proposition is streamlining the application process for applicants and increasing ROI for landlords, the sort of win-win that fintech should be able to accomplish.

We’d need several functions to make this application:

- User authentication with encryption

- Secure hosting with multiple failover redundancy

- Credit score checking

- Access to banking data and real-time transfers to an escrow account

- A payment gateway

- Chat to communicate with users and provide support

If we were to do this the hard way, we’d have to hard-code each of these functions ourselves. It would take forever and you would spend a fortune on app development costs. Fortunately, there are APIs for each of them, which makes developing a fintech app easier.

Related: The Complete Guide to Building your MVP

The Best Framework for Mobile Apps

Step 1: Authenticate and Manage Users – Firebase

Think of this like the skeleton on which to hang the muscles and organs of your app. It is the scaffolding tool of choice for app building. It also provides secure user authentication, management, and crash reporting. Firebase integrates with a host of other Google services that create a rich user experience.

Step 2: Get Secure Hosting – Cloud Firestore

Your engine room. This is an encrypted cloud-hosted database solution for app development. It’s a Firebase product and integrates with all other Firebase products for seamless development and user experience. It has automatic scaling, is capable of high performance and simplifies the app development process.

Step 3: Integrate Credit Score Checking

Experian offers a consumer-facing API that pulls credit scores and credit reports. The credit report can also be shared online to third parties.

With ACS (American Credit Systems), you can generate full credit reports, FICO scores, public records and make credit inquiries.

The Universal Credit Services API generates credit reports from 3 credit bureaus – TransUnion, Equifax, and Experian. UCS consolidates this data into a single unified credit report file. They also support bulk requests.

Data accessible using this API includes:

- Pre-Employment Credit Reports

- 4506T IRS Tax Transcripts

- SSA89

- Social Security Number Verifications

- Criminal Searches

- Eviction Searches

- Decision-only Credit Reports

- Motor Vehicle Records

Step 4: Access Bank Account – Plaid

Plaid connects your app to bank accounts. This a major API in the fintech industry. Plaid makes many things possible that are otherwise very difficult to achieve. It’s very agile and consolidates your users’ financial data on a single platform, minimizing risk and speeding up development.

Another financial data aggregator is Yodlee, but they have fewer capabilities compared to Plaid.

Step 5: Setup Payment Gateway – Stripe

Stripe is a global payments processor. Stripe combines many payment service providers into one solution that frees you from needing to store credit card details and comply with PCI certification. It integrates with Plaid.

Step 6: Implement Chat – Chatbot

Using Natural Language Processing and machine learning, Chatbot’s API automates your customer service. Because this is powered by machine learning, you can develop it to handle more complex tasks like tenant pre-approval processing using open source libraries like python scikit.

Step 7: Add Bonus Plugins

If you want to include financial management for the landlord’s dashboard, the Intuit API has tools to show the financial health of a business. They own Quickbooks and Mint.

If data visualization is a necessary feature for your app, D3 is the framework for that. D3.js is a JavaScript library for manipulating data to create visualizations using HTML, SVG, and CSS. If you want to include enterprise resource planning, budgeting, or just looking to create a visual representation of the financial data, this is the API you will need.

Step 8: Consider Legal Obligations

Remember, we are talking about very sensitive data. This is data that hackers would love to access at your expense. So here are a few extra steps you need to take:

- Understand the legal agreements associated with accessing users’ financial data using these APIs.

- Create a data privacy and management policy.

- Secure an insurance policy so you are covered in case of a breach.

- Have a disaster recovery and business continuity plan in place.

Your responsibilities go beyond just providing a service.Your users are placing their life’s savings in your stewardship. Taking these extra steps will go a long way to enhance their trust in you as well as the reliability of your app.

Cost to Build a Fintech App

The cost of developing your app will totally depend on how many features you envision, whether you do a mobile web or mobile app, whether your app will involve blockchain development. The more integration it will require, the longer it will take to develop and the higher will be the development estimate.

At Topflight Apps, we’ve worked on fintech apps that took up to $160,000 to develop (including iOS and Android), start to finish. But we also developed nifty MVPs for $30,000. If your fintech app does not include an AI component, the biggest impact on its development budget will be one of the following or a combination of:

- Tying together all APIs integrations with the app’s business logic on the back end

- Implementing highly interactive dashboards with animations

We always suggest starting with building a prototype to verify your app concept before developing it in the flesh. Many of the features may be replaced once you have feedback from real customers who have used the prototype. And that gives you the upper hand in keeping the control over the development budget.

Related: How to avoid exorbitant app store commissions

Our Experience in Building a Fintech App

Our experience in fintech app development includes a smart budgeting app, an AI-powered loan issuing platform, investment solutions, loan tracking apps, and cryptocurrency apps.

Check out this case study on how helped create a wealth management/investing app.

With each fintech app we’ve built we take the project start to finish: from a prototype to an app uploaded to App Store and Google Play. We also develop the back end part of the app and feel comfortable working with ready designs. However, our choice is to always validate the designs before the development starts. How long it will take to develop the app will completely depend on the specific features it needs.

The process of building a successful fintech app with Topflight often includes the following steps:

- Designing wireframes — rough imagery for what the app will look like

- Putting together an interactive prototype using the wireframes

- Testing the prototype with users

- Applying user feedback to the prototype

- Designing the actual graphic UI of the app

- Putting together a high fidelity prototype using the UI

- Verifying the prototype with the user base

- Developing an app and the back end

- Testing the app

- Making the app available to the public

It’s Time to Start a Fintech App

At Topflight Apps, we turn disruptive fintech ideas from concepts to real-life products, then add rocket fuel to help these products reach millions of users. We’re app developers in NYC, LA, Miami, and if you have a fintech project and would like to discuss it with us, you can reach us here.

Related:

- How to Create a Loan App

- How to Start a DAO

- Building a Mobile Wallet for Digital Payments

- How to Make a Blockchain Payment System

- Guide to Building a Neobank

- P2P App Development Guide

- Build a Cryptocurrency Exchange

- How to Make a Banking App

- Build a Cryptocurrency Token

- Move to Earn App Development Guide

[This blog was originally published in July 2020, and has been updated for more recent data]

Frequently Asked Questions

How much does mobile application development for fintech cost?

Our mileage says the average application costs anywhere between US$40,000 to $125,000 based on the specific features it needs. Maintenance would be an additional 15-25% of the total app development cost.

How do I optimize the cost of development?

Utilize rapid prototyping, i.e., build a clickable prototype that you can share with customers for feedback. We can create a prototype in under 4 weeks.

Do you work with blockchain, smart contract, and crypto?

Yes, we have certified blockchain developers.

Do you recommend native or cross-platform app for fintech app development?

Native apps support 100% of the platform hardware and require less effort with security enhancements. So we recommend native.

Do you have real-life experience in working with Plaid APIs and similar other banking services?

Yes, we worked with Plaid, Stripe, Ficinity, and other services.

How long does it take to build a financial app?

Depending on the team composition, it may take from three to six months.